Table of Contents

Introduction

Diwali is one of the most anticipated festivals in India often known as the festival of lights.

It represents the victory of light over darkness and the triumph of good over evil, celebrated by grand festivities, family reunions, and the exchange of gifts.

The Diwali celebration spans five days and is closely associated with Lakshmi Pujan, during which we seek the eternal blessings of Goddess Lakshmi. It presents a prime opportunity for investors to buy gold, invest in property, or explore other avenues like mutual funds.

While we strive to draw Goddess Lakshmi (wealth) closer to us, are we truly doing enough to safeguard and grow the wealth we already possess?

Your financial journey could be as bright as the Diwali celebrations if you invest in mutual funds.

In this blog, we will learn more about the significance of Diwali Muhurat trading and the Top 5 Mutual Funds for SIP investments for a 5-year investment horizon.

Importance of Diwali Muhurat Trading

First, let’s discuss the definition of Muhurat trading. The term “Muhurat” refers to a fortunate moment. According to Hindu tradition, Muhurat is a period of favourable planet alignment that guarantees success.

In India, muhurat trading is a custom that many traders adhere to. When it comes to investing in shares on Diwali, this one hour is deemed fortunate. Every year, the stock exchange sets the timing for Muhurat trading. In Diwali 2024, Muhurat trading will take place on 1st November from 6:00 PM to 7:00 PM.

People who trade during this hour are said to have a higher probability of becoming wealthy and prosperous all year long. The majority of people prefer to purchase stocks as a symbol of Goddess Lakshmi during this time, which usually occurs on the evening of Diwali. This is exclusive only to the Indian stock markets.

A preferred investment choice in recent years has been the rise of Mutual Funds.

Mutual funds have become a popular and accessible way for people to invest their money in a wide range of products, such as shares, bonds, gold, silver and other securities. It provides the ease to invest in a basket of stocks that is well diversified, affordable and professionally managed by experienced fund managers. Here are he Top 5 mutual funds for SIP in November 2024.

Top 5 Mutual Funds for SIP this Diwali 2024

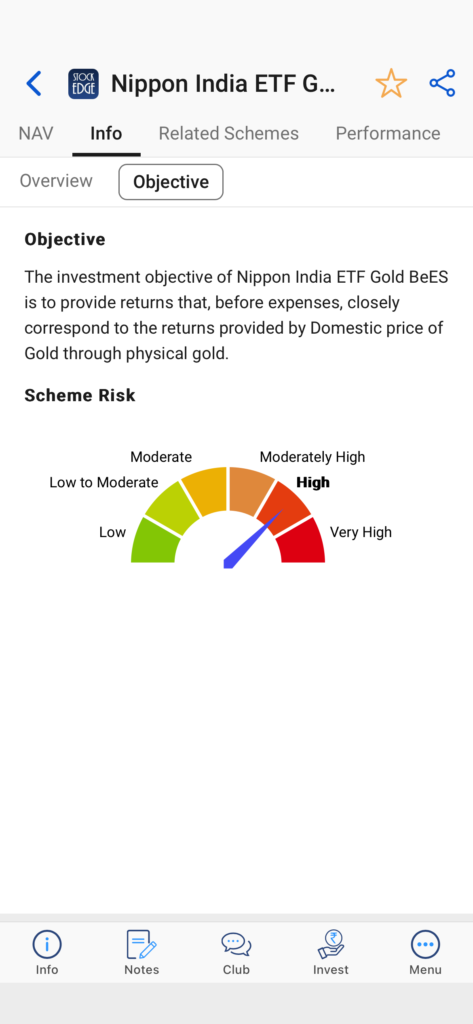

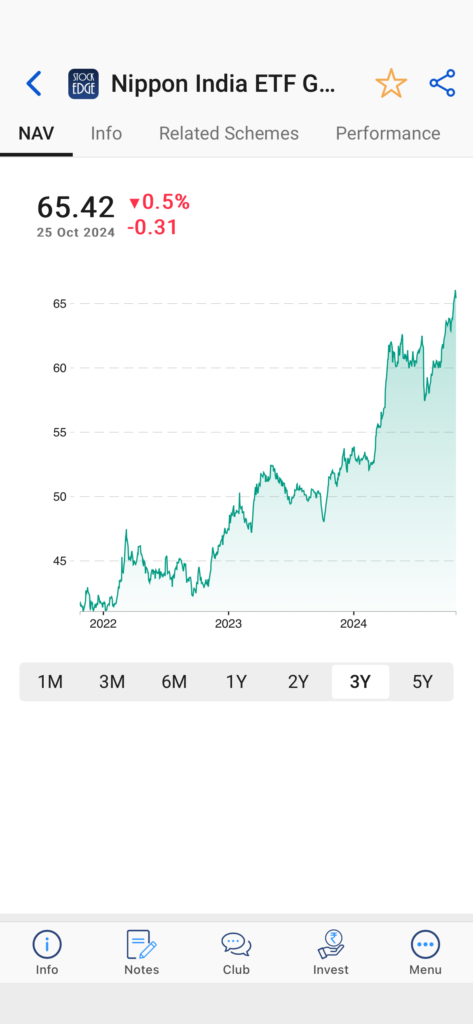

1. Nippon India ETF Gold BeES

Nippon India ETF Gold BeES is an exchange-traded fund that tracks the Domestic price of the Gold Index in India. It was launched in March 2007 and has a total asset base of ₹13,725 crore (as of 30 September 2024). This ETF charges an expense of 0.79% and has no exit load charges. Historically, Nippon India Gold ETF has delivered CAGR returns of 13.85% on an annual basis. This ETF has the highest trading volume when compared to all other Gold ETFs.

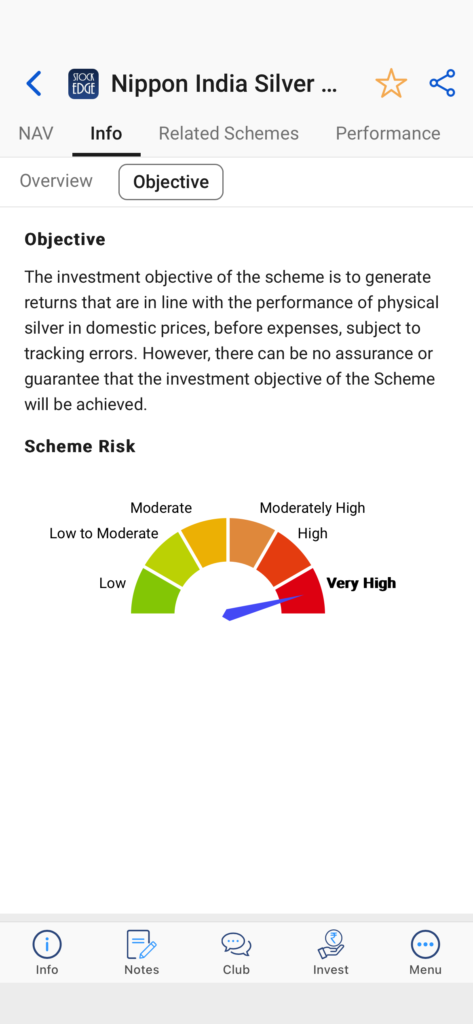

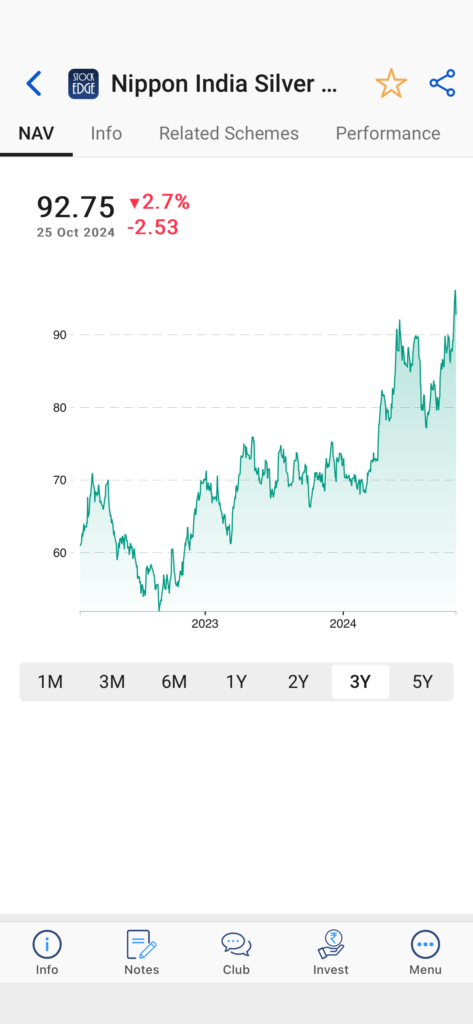

2. Nippon India Silver Bees ETF

Nippon India Silver Bees ETF is an exchange-traded fund that tracks the Domestic price of Silver Index. This ETF was launched in Feb 2022 and has a total asset base of ₹4,477 crore (as of 30 September 2024). This ETF charges an expense of 0.56% and has no exit load charges. Looking at the past returns, the fund has delivered annualized returns of 28.10%. It has good trading volumes in the stock exchanges.

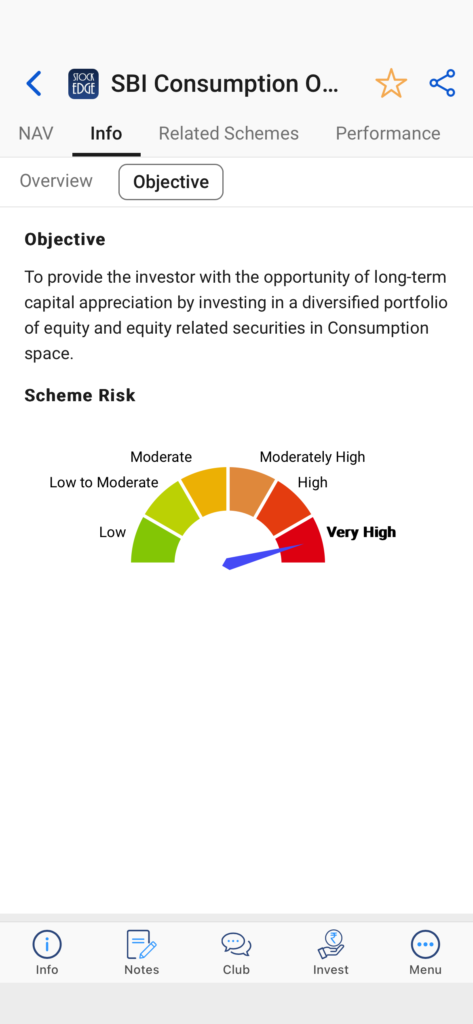

3. SBI Consumption Opportunities Fund

SBI Consumption Opportunities Fund is an open-ended equity scheme following the consumption theme, which was launched in January 2007. The scheme’s main goal is to provide long-term growth prospects and capital appreciation by investing in a portfolio of consumption-focused businesses. The scheme follows the Nifty Consumption TRI Index as its benchmark index.

As of 30th September ‘24, the Fund has an AUM of ₹3101 crore, which is one of the leading funds in the category. It charges an expense of 0.90% and an exit load of 0.1% for redemption made within 30 days.

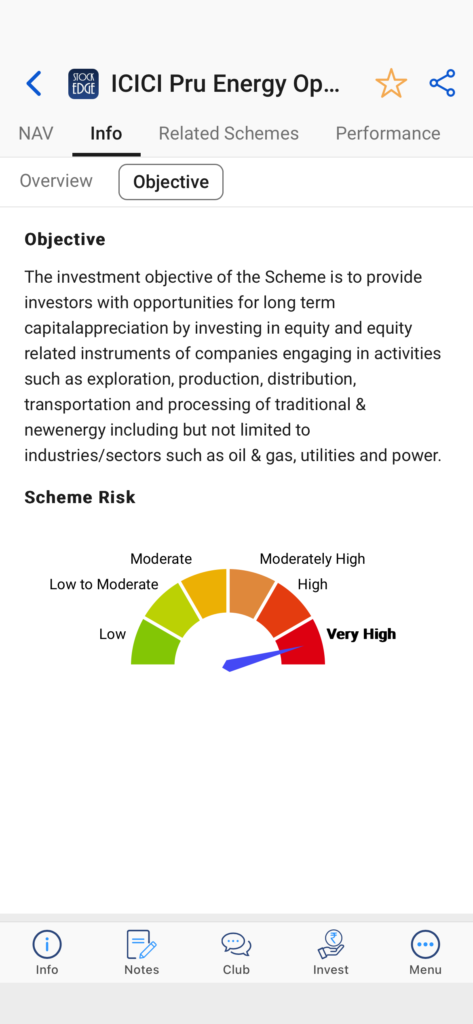

4. ICICI Energy Opportunities Fund

ICICI Energy Opportunities Fund is an open-ended equity scheme mainly investing in companies that are engaged in activities such as exploration, production, distribution, transportation and processing of traditional & new energy including industries/sectors such as oil & gas, utilities and power. The scheme follows the Nifty Energy TRI Index as its benchmark index.

As of 30th September ‘24, the scheme has a robust AUM of 10,494 crore. Fund charges expense of 0.43% and an exit load of 1% if redeemed within 3 months from the date of purchase.

5. HDFC Long Duration Debt Fund NIFTY Long Duration Debt Index A-III

Within the debt mutual funds, the preference remains tilted towards long-duration mutual funds and G-Sec, mainly because of the interest rate cut expectation by the RBI. Major economies like China, the US and the ECB have reduced interest rates from 25bps up to 50 bps.

Read Why Investors Should Consider Investing in Debt Mutual Funds in 2024.

HDFC Long Duration Debt Fund is an open-ended debt scheme investing in sovereign bonds that have an average maturity of above 7 years. The fund has an AUM of 4,866 crore and charges an expense of 0.25%, as of 30 Sept ‘24. It has an average maturity of 30 years and a Macaulay duration of 12.67 years. The expected yield to maturity of the scheme is at 7.01%. Historically the fund has delivered returns of 13.91% in the last 1 year, however, there is no guarantee that the fund will generate similar returns. Hence investors can consider investing in long-duration debt funds to take advantage of falling interest rate cycles.

Shortlisting criteria by StockEdge

StockEdge has shortlisted the above mutual funds based on the parameters mentioned below:

AUM Size: For Equity funds and ETFs, the threshold asset size is above ₹2000 crore.

Total Expense Ratio: The expense ratio should be less than 1% for Equity funds and less than 0.50% for Debt funds.

Tracking Error: For ETFs, tracking error should be less than 1% and Exchange trading value should be higher than 2 crore daily.

Fund History: For Equity funds, more than 5 years should be completed in the market. (except ICICI Energy Opportunities Fund was launched in 2024)

The Bottom Line

The festival of lights, Diwali, brings happiness and positivity, creating a chance to improve your financial future through mutual fund investments.

Diwali is an excellent occasion to begin investing in mutual funds, as it symbolizes new beginnings and financial planning.

This Diwali, illuminate not just your home but also your financial future by making wise, deliberate choices with your bonus.

Establish clear financial objectives, whether for the long term or short term and invest in mutual funds this Diwali that corresponds with these goals. Think about initiating a Systematic Investment Plan (SIP) for consistent, regular investing, or consider making a lump sum investment to capitalize on market opportunities.

Happy investing and a very Happy Diwali!