Table of Contents

Key Takeaways

- Expanding Telecom Market: With over 1.19 billion subscribers, India is the 2nd largest telecom market globally, and growing year-on-year.

- High Growth in 5G: By FY25, it’s projected that 25-26% of users will adopt 5G, opening up opportunities in sectors like healthcare, agriculture, and automation.

- Rising Data and Smartphone Usage: A surge in smartphone shipments and internet users is fueling data consumption, directly benefiting telecom operators.

- Government Support: Initiatives like 100% FDI, deferred spectrum payments, and longer validity are improving industry viability.

- Top Picks:

- Bharti Airtel Ltd.

- Indus Towers Ltd.

- RailTel Corporation of India Ltd.

If you are a millennial, you remember the struggle of waiting in line at an STD booth just to make a phone call. Holding onto coins, carefully choosing what to say because every second was so expensive!

If you belong to this generation, you might admire those iconic red telephone boxes in London and wonder about their charm in connecting people.

But just think about it: we can get restless if a message on WhatsApp takes more than two seconds to deliver, so how can we patiently wait for hours to make a single call? Today, we have gone from rationing our words on expensive calls to unlimited WhatsApp chats, HD video streaming, and AI-powered virtual assistants, all at our fingertips.

This significant change is not only a sign of innovation but also a narrative driven by the telecommunications sector. The telecommunications industry is indeed at the heart of modern technology, acting as the backbone for connecting people, businesses, and devices, enabling everything from basic communication to complex digital services and innovations like 5G, IoT, and AI.

In this blog, we will explore why telecom stocks hold immense potential, discuss what factors you should consider before investing in telecom stocks, and examine the key players in this sector.

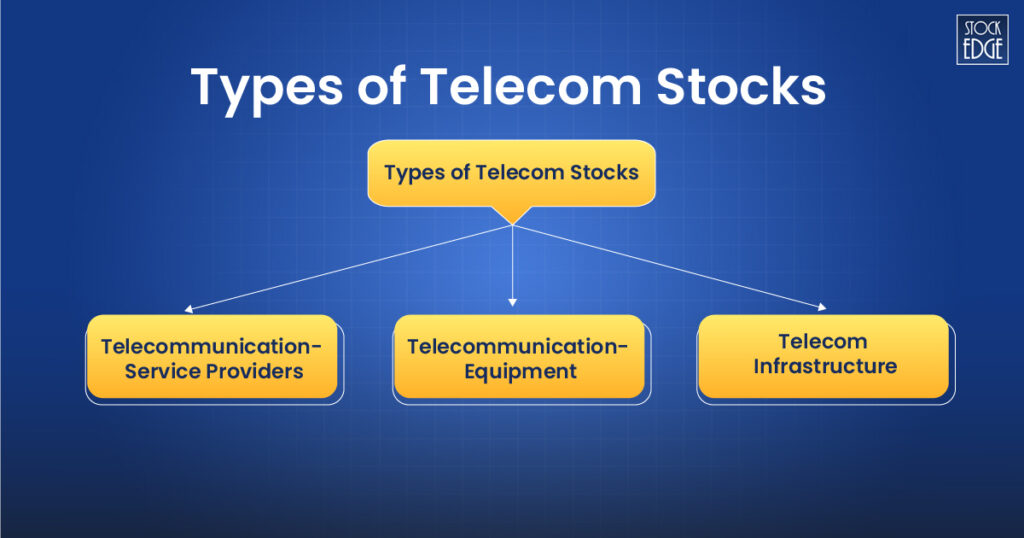

What are telecom stocks?

Telecom stocks represent companies that enable communication, whether through voice calls, internet services, messaging, or digital infrastructure. It consists of three key segments:

- Telecommunication – Service Providers

These are the companies that deliver mobile and broadband services to consumers and businesses. They handle everything from network connectivity to data plans and OTT bundles. They include Airtel, Jio (Reliance Industries), Vodafone Idea, and many more.

- Telecommunication – Equipment

These companies manufacture and supply the hardware and technology that telecom networks rely on, such as routers, switches, fiber optics, and 5G equipment. They include Tejas Networks, HFCL, and many more.

- Telecom Infrastructure

This segment consists of companies that build and maintain physical assets like mobile towers, optical fiber networks, and other supporting infrastructure. These assets are often leased to service providers. Companies in this segment include Indus Towers, Railtel, and many more.

If you’re looking to dive deeper into telecom stocks, view real-time market data, or analyze sector-wise performance, visit the Telecom Sector.

Now, let’s explore why telecom stocks are becoming more promising!

Why should you invest in telecom stocks?

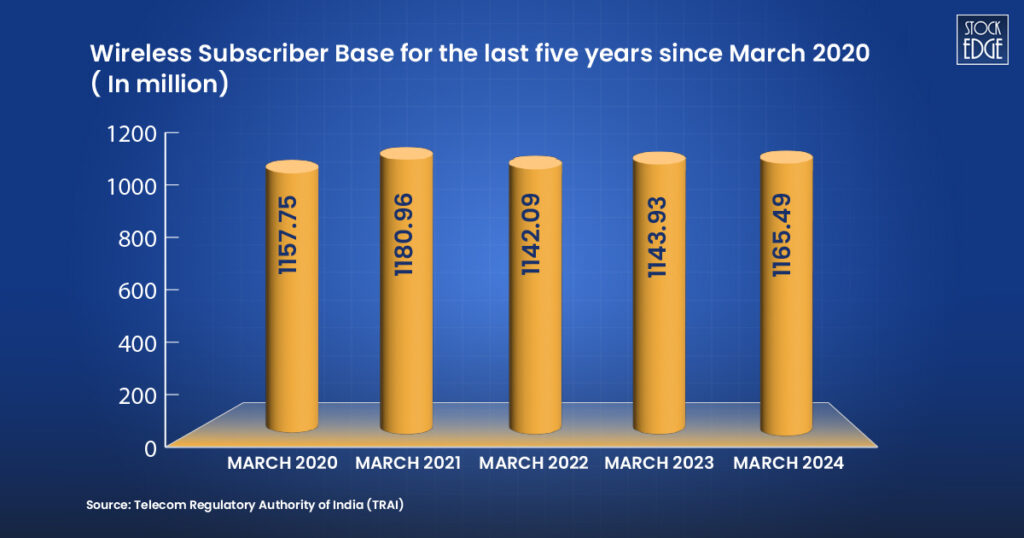

Today, telecom stocks have become an integral part of daily life, supporting not just individuals and businesses but also the broader digital economy, government infrastructure, and emerging technologies. According to the Telecom Regulatory Authority of India (TRAI), India ranks as the second largest telecommunications market, with a total telephone subscriber base amounting to 1199.28 million as of 31st March 2024. The wireless subscriber base was 1165.49 million at the end of 31st March 2024 in comparison to the subscriber base of 1143.93 million as of 31st March 2023, registering an increase of 21.56 million subscribers during the financial year 2023-24.

We all know that the telecom sector is highly competitive and capital intensive. To survive in this sector, companies need to focus on innovation, cost efficiency, strong customer relationships, and strategic partnerships. Now, let’s explore what drives this sector and why you should consider investing in telecom stocks.

- Evolution of 5G Network

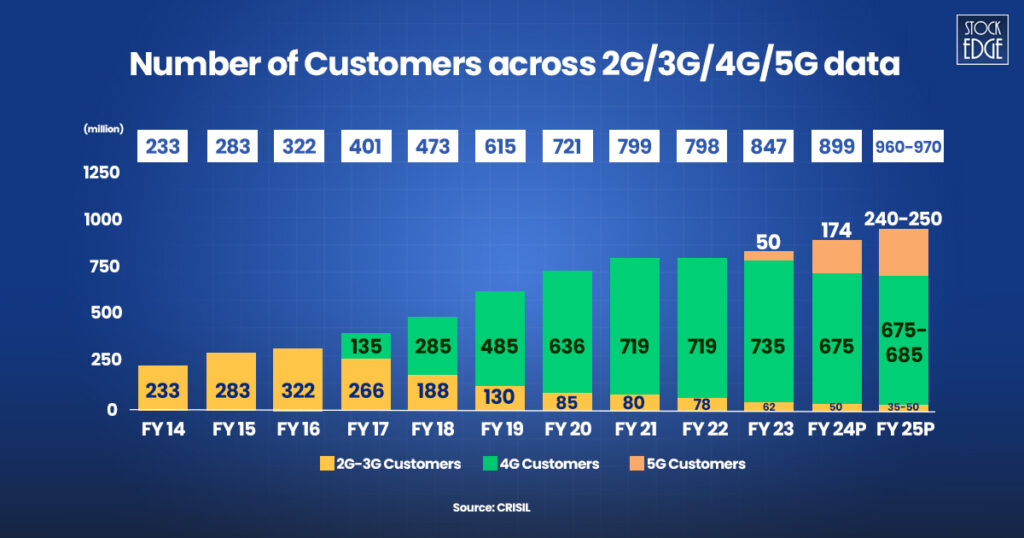

In Fiscal 2025, CRISIL MI&A projects approximately 70% of total users to be on 4G and approximately 25% -26% to be 5G enabled, primarily in urban markets, surpassing 240-250 million users. The future of telecom stocks looks promising with the evolution of 5G mobile technology. With the rollout of 5G services in the country, opportunities for applications in various sectors of the economy, such as agriculture, transportation, healthcare, and industrial automation, have significantly expanded.

- Rising Data Consumption

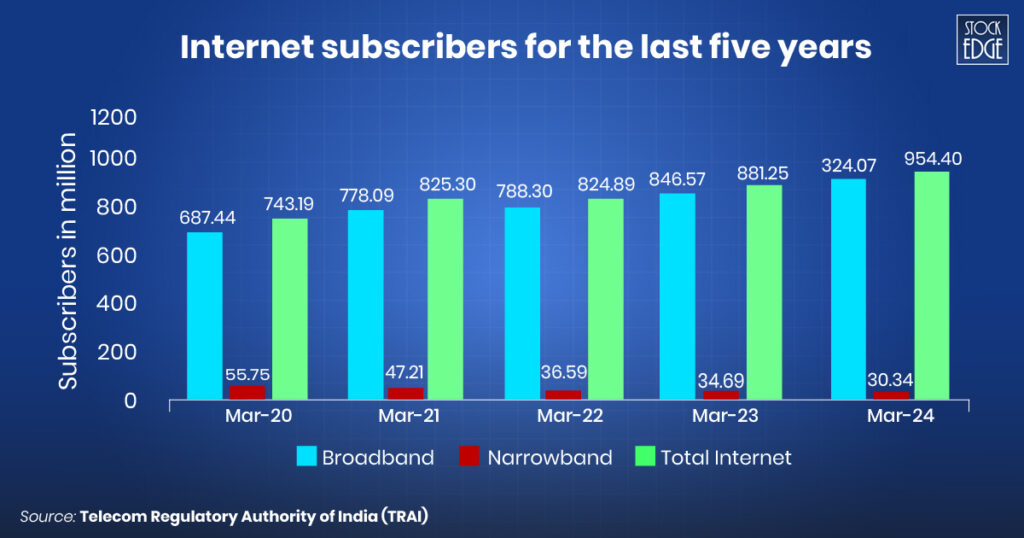

As smartphones become more prevalent, 5G technology is deployed, and digital services like video streaming, remote work, and online education gain popularity, data usage is surging, which in turn boosts revenues for telecommunications operators. As of March 31, 2024, the country’s Internet subscriber base has seen an 8.30% increase compared to March 2023.

Increasing demand for smartphones

According to the International Data Corporation’s (IDC) Worldwide Quarterly Mobile Phone Tracker, India’s smartphone market shipped 146 million smartphones in 2023. The rising demand for smartphones, particularly those with advanced features and 5G capabilities, is driving significant growth in the telecom industry, fueling internet usage and the development of new technologies like AI and IoT. The availability of low-cost smartphones has significantly boosted the telecom sector’s growth.

- Government Reforms and Initiatives

The Indian government has introduced significant reforms to support the telecom sector. These include a 4-year break on AGR and spectrum payments, 100% FDI through the automatic route, longer spectrum validity (30 years), reduced interest rates, and no penalties on dues. These steps help telecom companies reduce debt, attract investment, and focus on growth, especially in 5G.

Factors to Consider Before Investing in Telecom Stocks in India

Now let’s look at what factors should be taken into consideration before investing in telecom stocks:

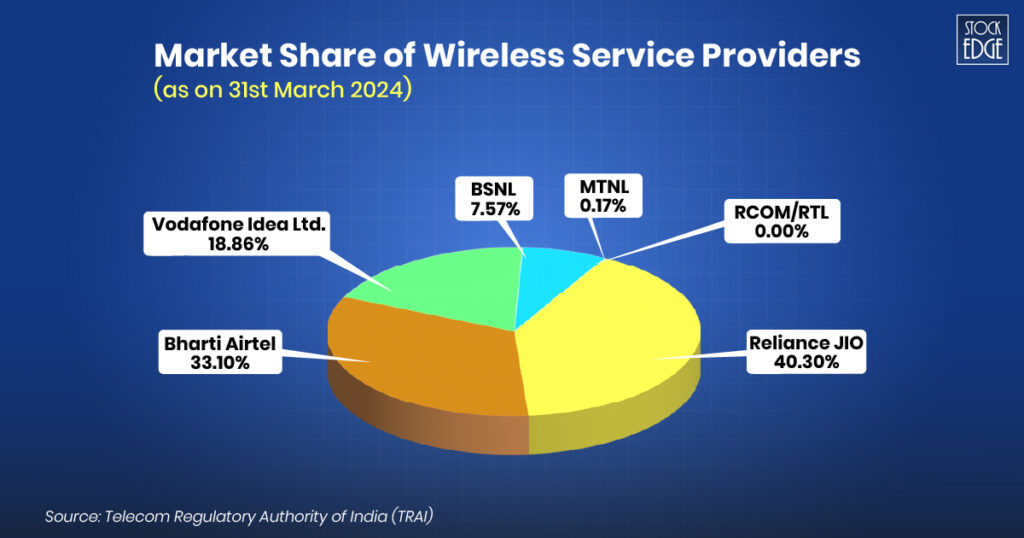

Market Share

Market share refers to the percentage of total sales or customers that a company has within its industry or market. It is an indicator of a company’s competitiveness and dominance in the market. Reliance Jio Infocomm Ltd led the wireless services market with 469.73 million subscribers, followed by Bharti Airtel (385.76 million), Vodafone Idea (219.82 million), BSNL (88.25 million), and MTNL (1.93 million), respectively.

ARPU (Average Revenue Per User)

ARPU measures the average revenue generated per user or unit. If a mobile network provider’s ARPU is Rs. 300, it means that, on average, each customer generates Rs. 300 in revenue for the company per month. ARPU is commonly used in industries like telecommunications, media, and technology to assess a company’s revenue efficiency.

| Company | ARPU (As on FY24) |

| Reliance Jio | ₹203.3 |

| Bharti Airtel | ₹245 |

| Vodafone Idea | ₹156 |

As on Q3FY2025

Source: Annual Reports

EBITDA Margin

EBITDA margin measures a company’s operating profitability as a percentage of its total revenue. A high EBITDA margin indicates that a company generates a larger portion of its revenue as profit after covering operating expenses, suggesting better operational efficiency and a stronger financial position.

| Company | EBITDA Margin (As on FY24) |

| Indus Tower | 56.10% |

| Bharti Airtel | 53.16% |

| Vodafone Idea | 40.42% |

| Railtel Corporation Of India Ltd. | 20.49% |

Source: StockEdge

Capex Productivity

Capex productivity tells you how much return the company is getting from their capital expenditure. High capital expenditure (CapEx) productivity generally means a company is efficiently using its investments in long-term assets (like buildings, machinery, and equipment) to generate revenue and improve operations, leading to increased output and profitability.

| Company | CAPEX Productivity (As on FY24) |

| Indus Tower | 27.9% |

| Bharti Airtel | 55.25% |

Source: StockEdge

Best Telecom Stocks in India

Bharti Airtel Ltd

Bharti Airtel Ltd is one of the world’s leading providers of telecommunication services, with a presence in 18 countries, including India, Sri Lanka, and 14 countries in Africa. The Company is India’s largest integrated communications solutions provider and the second largest mobile operator in Africa. The revenue mix in Q3 FY25 was: Mobile (India) 56%, Non-Mobile (India) 14%, Africa 23% and Indus Tower 7%.

As of December 31, 2024, the company has approximately 35.7 crore customers in India, up from 34.6 crore as of December 31, 2023. The average revenue per user (ARPU) for the quarter was ₹245, an increase from ₹208 in Q3 FY24. This growth was fueled by upgrades from prepaid to postpaid plans, enhanced data monetization, a rise in international roaming, and better earnings attributed to premiumization (the transition from feature phones to smartphones).

To know more about the company’s financial performance, check out our Edge Reports.

Indus Towers Ltd.

Indus Towers Limited operates in establishing, managing, and maintaining wireless communication towers. It offers wireless telecom service providers access to these towers on a shared basis through long-term contracts. The company boasts over 2,11,775 towers and 3,60,679 co-locations, with a nationwide reach across all 22 telecom circles. Bharti Airtel and VIL are its major clients, responsible for 80-85% of the total revenue in FY23.

In the quarter, EBITDA reached ₹7,000 crore, reflecting a 93% increase year over year and a 43% rise quarter over quarter. The EBITDA margin improved by 427 basis points compared to the previous year and by 270 basis points sequentially. In Q3 FY25, the revenue mix from operations consisted of approximately 64% in sharing revenue and 36% from energy reimbursements. For the first nine months of FY25, it was around 63% and 37%, respectively. Core revenue from rentals increased by 7.5% year over year, totaling ₹4,820 crore, supported by additions in co-location and towers.

Check out our Edge Report to know more about their business segment and industry analysis.

Railtel Corporation Of India Limited

RailTel Corporation, a “Navratna” public sector undertaking, is one of the country’s major neutral telecom infrastructure providers, with a Pan-India optical fiber network. RailTel’s network currently serves over 6,000 stations throughout the country, including all major commercial hubs.

The company provides various types of telecommunication services such as dark fiber, tower colocation, leased line, internet bandwidth, VPN, retail broadband services, data center services, managed data services, etc. The segment revenue grew by 21% between FY22 and FY24.

In Q3 FY25, revenue from telecom services was ~₹338 crore, while revenue from project work services stood at ~₹430 crore. The revenue mix of telecom services during the quarter was: National Long-Distance (NLD) ~₹150 crore, Internet Service Provider (ISP) ~₹111 crore and Infrastructure Provider (IP) ~₹75 crore.

To know more about the company’s financial performance, check out our Edge Reports.

The Bottomline

In FY24, the telecom sector’s gross revenue stood at Rs. 2.4 lakh crore (US$29.00 billion). Over the next five years, increased mobile phone penetration and lower data prices will result in 500 million new Internet users in India, offering opportunities for new businesses.

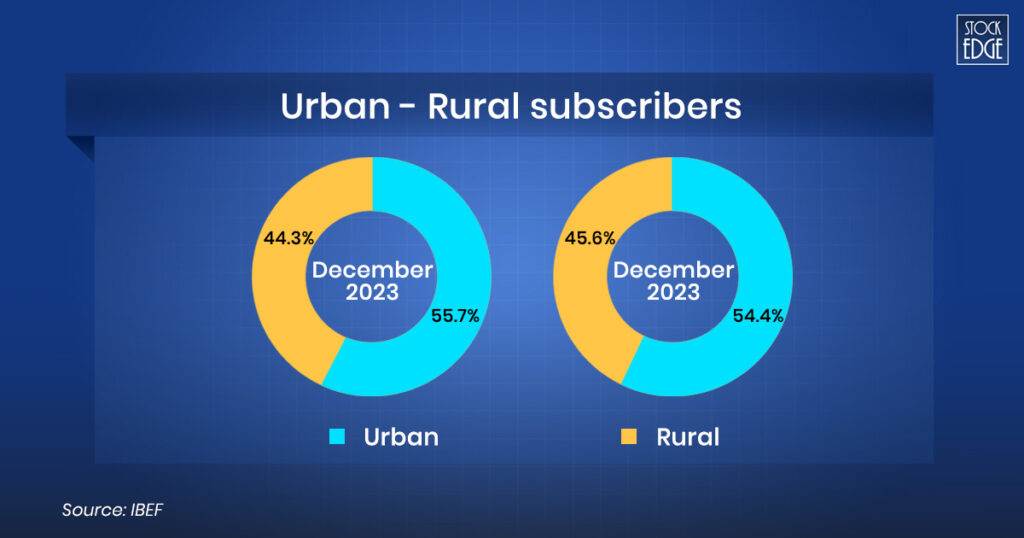

In the Union Budget for the fiscal year 2024-25, the Department of Telecommunications and Information Technology was allocated ₹ 116,342 crore (approximately US$ 13.98 billion). The share of the rural segment in India’s telecommunications market has increased steadily. The tele-density of rural subscribers also reached 59.59% as of May 2024. To boost the cash economy, the Indian government declared that it would provide free Wi-Fi to more than 1,000 gram panchayats.

Despite their potential, telecom stocks remain highly competitive and capital-intensive. A tightly regulated environment, substantial capital requirements, and the dominance of a few consolidated players pose significant entry barriers for new participants, making them highly volatile.

If you look at their momentum score, you will see that as of 07th April 2025, most of the telecom stocks, including Bharti Airtel, Indus Towers Ltd, and Bharti Hexacom, are bullish. This suggests strong and sustained upward price trends. Momentum scores help traders gauge the strength and direction of a stock’s price movement over different timeframes—one month, three months, and six months, depending on your trading/investing style.

Visit our blog to gain a deeper understanding of the Momentum Score!

Happy Investing!