Key Takeaways

- Banking Stocks: Banking companies dominate the Indian stock market in terms of weight and influence. Their performance often reflects broader economic health, making them crucial for investors.

- Types of Banking Stocks in India: Investors can choose between Public Sector Banks, Private Sector Banks, and Small Finance Banks. Each offers different risk-reward profiles and business models.

- Why a Good Investment: Banks benefit from rising interest rates, credit demand, and digital transformation. Their improving NPAs and strong capital positions also boost investor confidence.

- Risks Involved: Exposure to bad loans, policy shifts, and economic slowdowns can hurt performance. Regulatory pressure and competition also impact long-term returns.

- Top Picks:

- HDFC Bank

- ICICI Bank

- Bank Of Baroda

Table of Contents

Imagine a world without banks. No home loans, no savings accounts, no digital payments at your local chaiwala. Just cash under mattresses or locked away in an old steel trunk passed down from your grandparents.

This actually did happen back when our grandparents were young—money was physical, trust was local, and borrowing meant turning to family or the village moneylender, often at sky-high interest rates. Financial security was uncertain, and growing wealth was a distant dream for most households.

Banks changed all of that. They brought safety, structure, and opportunity into our financial lives. Today, whether it’s buying your first scooter, saving for a child’s education, or sending money with a single tap, banks are at the centre of it all.

That’s why banks are the backbone of any modern economy. They don’t just hold money—they keep the economy running. Banks facilitate the flow of credit, support businesses, manage risk, and promote financial inclusion. From infrastructure development to daily consumer spending, their role is everywhere.

In this blog, we will understand why banking stocks in India are an attractive investment, explore the top 3 banking stocks, and break down the key risks you should know before investing in them.

What are Banking Stocks?

Banking stocks are shares of publicly traded companies that operate in the banking and financial services. When you buy a banking stock, you are essentially purchasing a small ownership stake in a bank. Banks, like any other business, operate with the goal of making a profit — and their core product is money. Broadly, banks earn revenue through two primary avenues: commercial banking and investment banking.

- Commercial Banking: It focuses on services provided to individuals and businesses. This includes products like savings and current accounts, personal and business loans, credit lines, and more. Banks earn money by charging interest on loans and applying fees for services such as ATM withdrawals, account maintenance, and overdraft protection.

- Investment Banking: They cater to large corporations, institutions, and high-net-worth individuals. Services in this segment include advisory for mergers and acquisitions, corporate restructuring, underwriting for initial public offerings (IPOs), and wealth management. Banks earn through fees, commissions, and profit-sharing in these high-value transactions.

Types of Banking Stocks in India

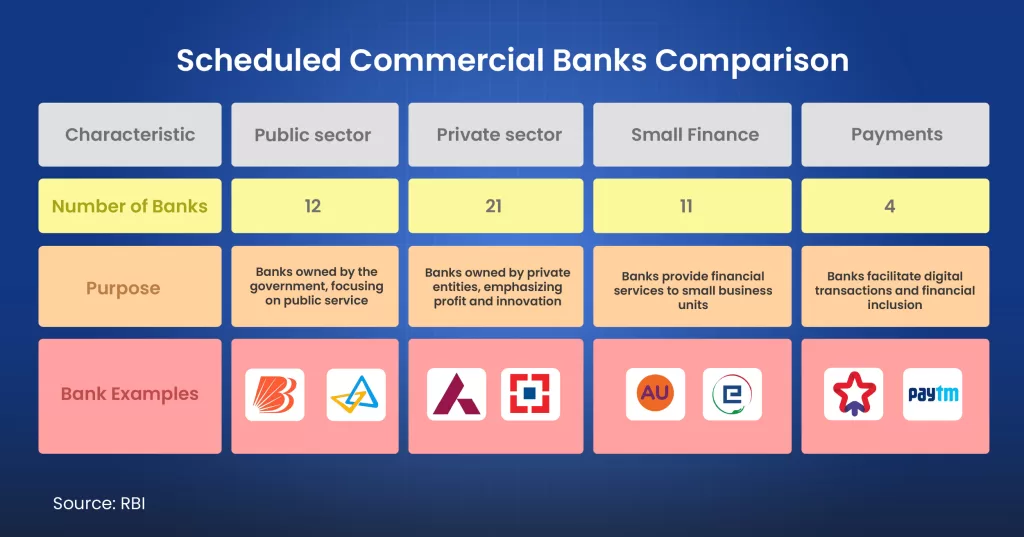

The Indian banking sector is diverse, comprising different types of banks, each with a specific focus and ownership structure:

- Public Sector Banks (PSBs): These banks are majority-owned and controlled by the Government of India. The government holds a significant stake, giving it direct influence over their operations and policies. For instance, State Bank of India (SBI), Bank of Baroda (BoB), Punjab National Bank (PNB) and many more.

- Private Sector Banks: These banks are professionally managed and majority-owned by private individuals or corporate entities. While they are regulated by the Reserve Bank of India (RBI), the government does not have an ownership stake. For instance, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank, IndusInd Bank and many more.

- Small Finance Banks (SFBs): It provides basic banking services like deposit-taking and lending, primarily to small business units, micro and small industries, unorganized sector entities, and low-income households. They aim to promote financial inclusion in areas where traditional banks might have a limited presence. For example, AU Small Finance Bank, Equitas Small Finance Bank, Ujjivan Small Finance Bank and many more.

- Payment Banks: They offer a limited range of banking services. They can accept demand deposits (current and savings accounts) up to a certain limit, issue ATM/debit cards, and facilitate remittances and payments. However, they are not allowed to undertake lending activities or issue credit cards. Their primary goal is to provide easy and accessible payment and remittance services. For example, Paytm Payments Bank, Airtel Payments Bank, India Post Payments Bank Limited, and Fino Payments Bank.

In essence, investing in banking stocks means betting on the health and growth of the overall economy. Their performance reflects the ups and downs of economic cycles, making them a crucial gauge of a country’s financial health.

Are Banking Stocks in India a Good Investment?

India’s banking sector has shown remarkable progress over the years, both in terms of scale and innovation. Banking is a core pillar of India’s economy, and as the economy expands, so does the role of the banking sector. In fact, according to IBEF, India is expected to become the third-largest domestic banking sector by 2050. This projected growth, combined with robust financial inclusion, digital transformation, and consistent credit demand, makes banking stocks in India a fundamentally attractive investment, especially for long-term investors.

1. Robust Credit and Deposit Growth

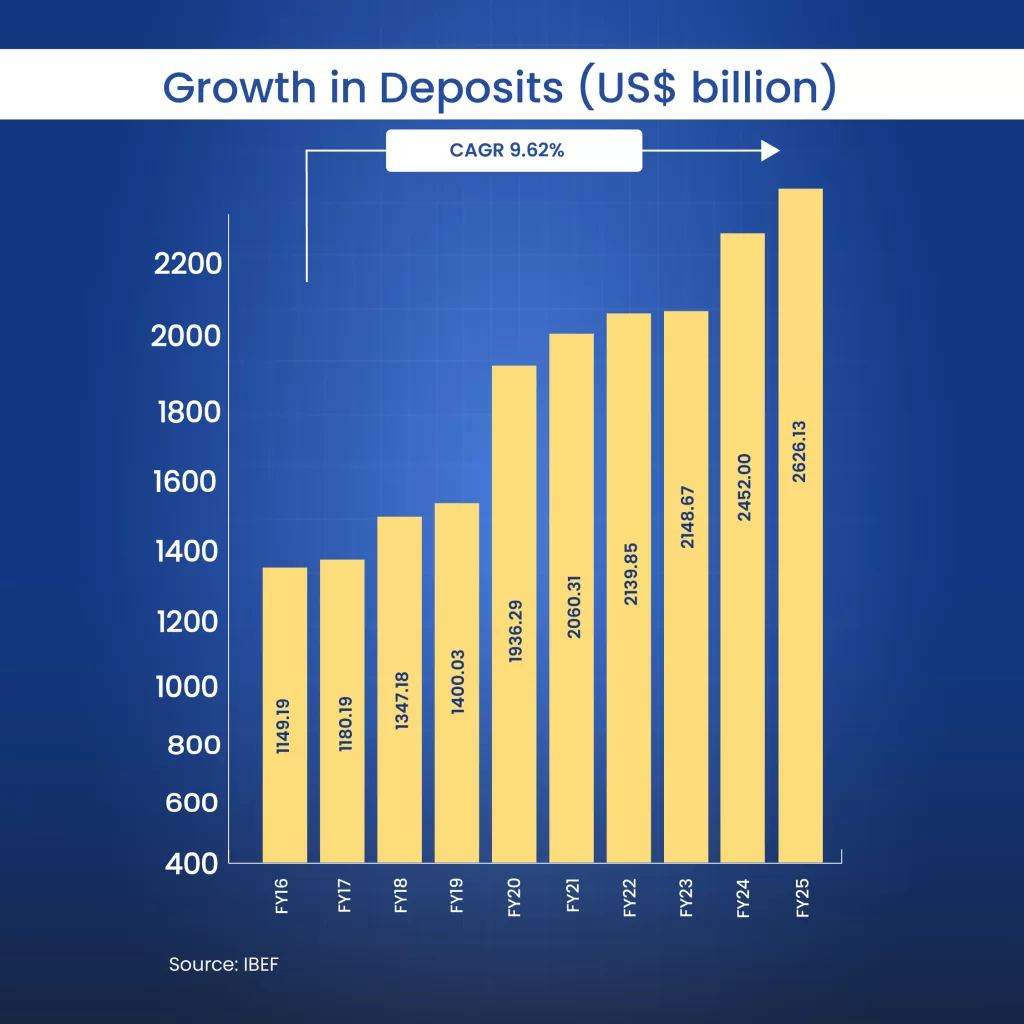

The Indian banking sector has consistently demonstrated healthy growth in credit and deposits. As of January 10, 2025, total bank credit stood at ₹182.55 lakh crore (approximately US$ 2.09 trillion), reflecting an impressive 11.47% year-on-year growth.

On the other hand, bank deposits increased by 10.83% to ₹221.50 lakh crore (approximately US$ 2.56 trillion). This sustained expansion underscores growing economic activity, rising consumption, and increased public trust in the formal banking system—key drivers of long-term growth in banking stocks.

2. Financial Inclusion Expanding Customer Base

India’s efforts toward financial inclusion have significantly increased the customer base for banks. Over 52 crore Jan Dhan accounts have been opened under government initiatives, with total deposits exceeding ₹2.38 lakh crore (US$ 27.56 billion). Moreover, 100% of new bank accounts in rural India are now being opened digitally. This penetration into previously underbanked areas creates new long-term growth opportunities for Indian banks.

3. Digital Adoption and Fintech Integration

Digital transformation is a major catalyst for the banking industry. In December 2024 alone, UPI transactions hit a record 16.73 billion, valued at ₹23.25 lakh crore (US$ 271.96 billion). The digital lending market, worth ₹30.32 lakh crore in 2023, is projected to reach ₹62.37 lakh crore (US$ 720 billion) by 2030. Banks that are investing in AI, paperless onboarding, UPI, and mobile apps—like HDFC Bank, ICICI Bank, and Axis Bank—are best positioned to lead this digital disruption and scale profitably.

4.Attractive Valuations and Profitability Metrics

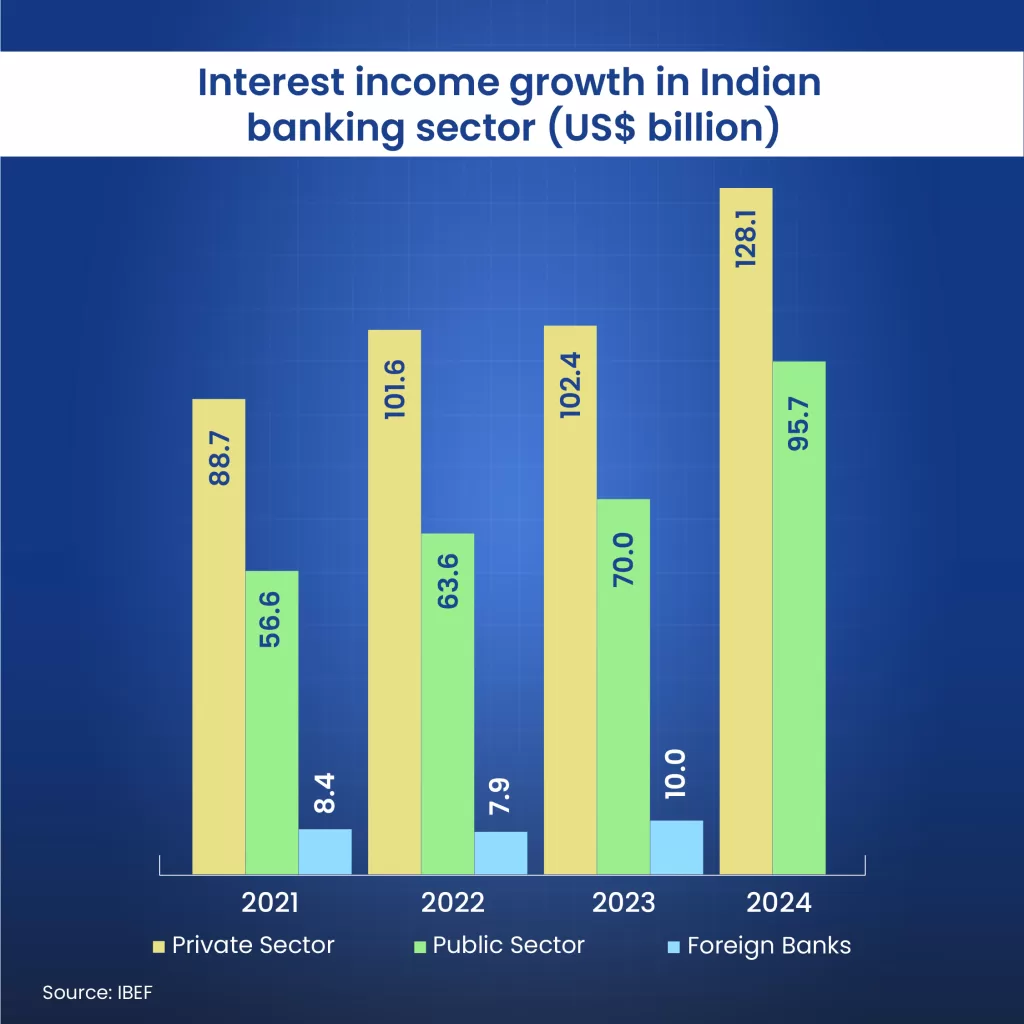

India’s top banks demonstrate strong profitability. In FY24:

- Public Sector Banks earned ₹11.09 lakh crore (US$ 128.1 billion) in interest income.

- Private Sector Banks posted ₹8.29 lakh crore (US$ 95.7 billion).

Strong banks, such as ICICI Bank, HDFC Bank, and Kotak Mahindra Bank, maintain Net Interest Margins (NIMs) between 4% and 4.6%, return on equity (ROE) rates over 17%, and current account savings account (CASA) ratios above 40%—all indicators of operational excellence and financial strength.

You can track the performance of banking stocks in India through the Bank Nifty index, which represents the top banking companies listed on the NSE. To know more about the Bank Nifty, read our blog, Everything You Need to Know about Bank Nifty.

What are the risks investing in banking stocks in India?

Now, let’s look at the key risks to consider when investing in banking stocks in India.

1. Credit Risk

One of the biggest risks in banking stocks is credit risk, which arises when borrowers fail to repay their loans. If a bank has a high number of defaulting customers, it must write off these loans as losses. This impacts profitability and investor confidence. A bank with poor credit appraisal or overexposure to risky sectors is more vulnerable to this risk.

2. Interest Rate Risk

Banks earn money from the difference between the interest they charge on loans and what they pay on deposits. This difference is sensitive to changes in interest rates. If interest rates change too quickly, especially in a rising rate scenario, banks may struggle to adjust their lending and deposit rates effectively. This can hurt their margins and earnings.

3. Economic Slowdown

Banking stocks are closely tied to the economy. When the economy slows down, businesses and individuals borrow less, and the risk of loan defaults increases. This leads to lower credit growth and higher provisions for bad loans. In such periods, banking stocks tend to underperform the broader market.

4. Regulatory Risk

Banks operate in a highly regulated environment. The central bank and government often introduce new policies that impact how banks function, whether it’s about lending limits, capital adequacy, or liquidity. Sudden or strict regulatory changes can reduce profitability or restrict growth opportunities for banks.

What are the 3 best banking stocks to buy in India?

HDFC Bank

As the largest private sector bank, HDFC Bank has a total business (loans and deposits) of around Rs 50.8 lakh crore. The Reserve Bank of India (RBI) has classified HDFC Bank as a domestic systemically important bank (D-SIB), highlighting its significance in India’s banking sector. The bank offers a range of services, including commercial and investment banking on the wholesale side and retail banking through branches.

After the merger, key subsidiaries of HDFC Bank include HDFC Securities, HDB Financial Services, HDFC Asset Management Co. Ltd, HDFC ERGO General Insurance, HDFC Capital Advisors, and HDFC Life Insurance Co. Ltd. In the asset management and life insurance sectors, the company’s subsidiaries are among the top players. HDFC Bank is one of the country’s top-performing banks, with a strong presence in the retail segment and excellent asset quality.

Financials

For Q4 FY25, HDFC Bank reported a Net Interest Income (NII) of ₹39,793.1 crore, marking an 11.3% year-on-year growth, and a Net Profit of ₹19,284.6 crore, up 7.1% year-on-year. Its Net Interest Margin (NIM) improved to 3.70% in Q4 FY25, from 3.62% in Q3 FY25. The bank maintains robust asset quality with Gross Non-Performing Assets (GNPA) at 1.33% and Net Non-Performing Assets (NNPA) at 0.43% as of March 2025. Its Capital Adequacy Ratio (CRAR) remained strong at 19.6%.

Why it stand out?

HDFC Bank stands out due to its dominant market leadership as India’s largest private sector bank and its strategic merger with HDFC Ltd, which provides synergistic benefits like reduced costs and enhanced cross-selling, particularly in the home loan segment. Management anticipates a long-term ROA of 1.9-2.1%. Credit growth is expected to align with industry levels in FY26. The C/D ratio is projected to fall below 90% by FY27. To know more in detail, you can check out Edge reports.

ICICI Bank

ICICI Bank is the second-largest private sector bank in India, with a loan book size of Rs 13.1 lakh crore. The bank has pan India presence with 6742 branches. ICICI Bank has its feet in various other financial services segments like life insurance, general insurance, broking, etc, via its subsidiaries and has a meaningful presence in each of these business lines.

ICICI Bank’s strong brand positioning across retail, business banking, and corporate banking segments, with a pan-India presence, makes it an attractive and robust business. Looking ahead, we believe optimism in the economy, supported by resumption of economic activity and continued growth in digitization and the bank’s extensive franchise, high-quality digital platforms, prudent risk management practices, make the bank well placed to capture opportunities that will arise in the near to medium term.

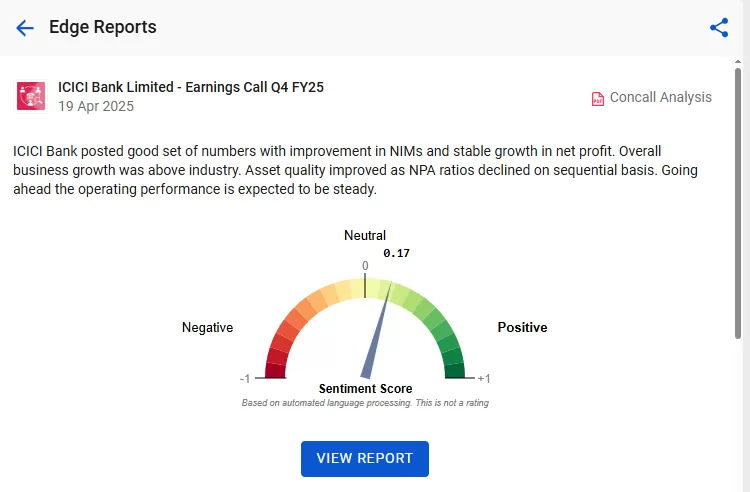

Financials

ICICI Bank posted a good set of numbers, with improvements in NIMs and stable growth in net profit. Overall business growth exceeded industry standards. Asset quality improved as NPA ratios declined on a sequential basis. Looking ahead, operating performance is expected to be steady. The bank registered a remarkable 18.0% year-on-year growth in Profit after tax, standing at ₹ 126.30 billion. Loan growth was equally impressive, with domestic loans rising 13.9% year-on-year, and the business banking portfolio witnessing a notable 33.7% year-on-year increase.

Why it stand out?

ICICI Bank maintains a highly diversified and granular loan book, with retail loans comprising 52.4% of total loans, and lending practices emphasizing cashflow assessment and conservative loan-to-value ratios, particularly in mortgages. Furthermore, ICICI Bank leverages significant digital transformation, implementing solutions like ‘iLens’ for end-to-end retail lending and ‘InstaBIZ’ for business banking, streamlining operations and enhancing customer experience. To know more in detail, you can check out Edge reports.

Bank Of Baroda

Bank of Baroda is engaged in providing various services, such as personal banking, corporate banking, international banking, small and medium enterprise (SME) banking, rural banking, non-resident Indian (NRI) services and treasury services. The bank is among India’s top five banks by asset size and total deposits with a 6% market share as of FY24.

Financials

For Q4 FY25, the net loan growth rate was 13.5% year-on-year and 5.1% quarter-on-quarter, with the total loan book reaching ₹12 lakh crore. The retail portfolio grew by 19.4% year-on-year, while Agri and MSME segment loans saw an increase of 14.2% each. Corporate credit also rose by 8.6% year-on-year and 6.4% quarter-on-quarter. However, net interest income (standalone) declined by 6.6% year-on-year and 3.5% quarter-on-quarter, mainly due to margin contraction. Net interest margins (NIM) dropped by 41 basis points year-on-year and 8 basis points quarter-on-quarter to 2.86%. The decrease in NIM was largely driven by the central bank’s repo-rate cuts.

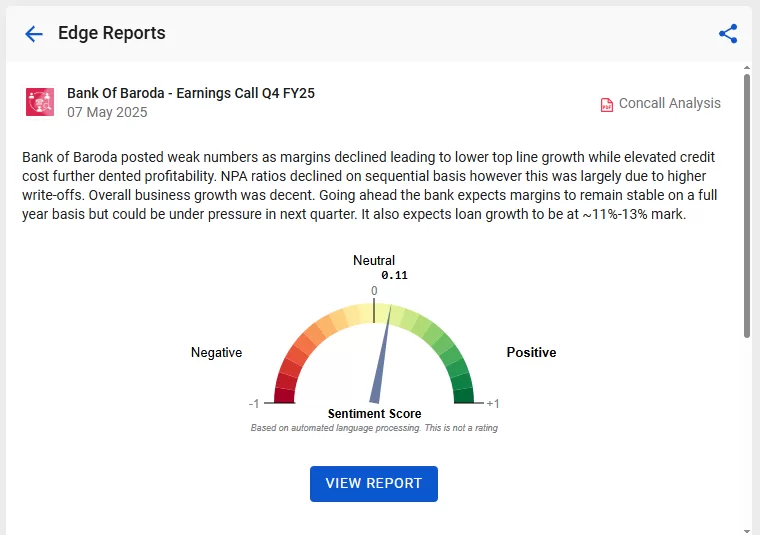

Why it stand out?

The bank expects loan growth of 11%-13%, while deposits are projected to increase within the range of 9%-11% for FY26. NIMs may face pressure in the coming quarter; however, on a full-year basis, management anticipates NIMs to remain stable year-over-year. To know more in details, you can check out Edge reports.

Bottomline

Banking stocks in India are more than just a sectoral play—they serve as a direct proxy for the country’s economic growth. With consistent credit expansion, rising digital adoption, and a widening base of financially included customers, the sector is built on strong fundamentals. While risks such as NPAs and regulatory changes exist, leading banks with robust asset quality, strong profitability, and a digital first approach are well positioned to deliver steady, long term returns. For investors looking for a balance of growth, stability, and dividend income, banking stocks in India, especially among the top gainers, remain a compelling choice in 2025 and beyond.

Frequent Asked Questions(FAQ)

Why buy banking stocks in India?

Banking stocksin India play a crucial role in any investor’s portfolio because they are directly linked to the overall growth of the economy. As businesses expand and consumers spend more, the demand for credit increases, which benefits banks through higher loan disbursements and interest income.

Another compelling reason to invest in banking stocks is the rapid digital transformation occurring across the sector. With the growing use of online banking, mobile apps, and fintech partnerships, banks are becoming more efficient, reducing costs, and scaling faster than ever before. This technology-driven growth supports better margins and long-term profitability.

What are the advantages of investing in bank stocks?

Banks power economic growth—when the economy expands, demand for credit rises, boosting bank earnings and stock performance. With growing digital adoption, financial inclusion, retail lending, and infrastructure investments, banks are well-positioned for long-term growth, making them an attractive investment opportunity.