Key Takeaways

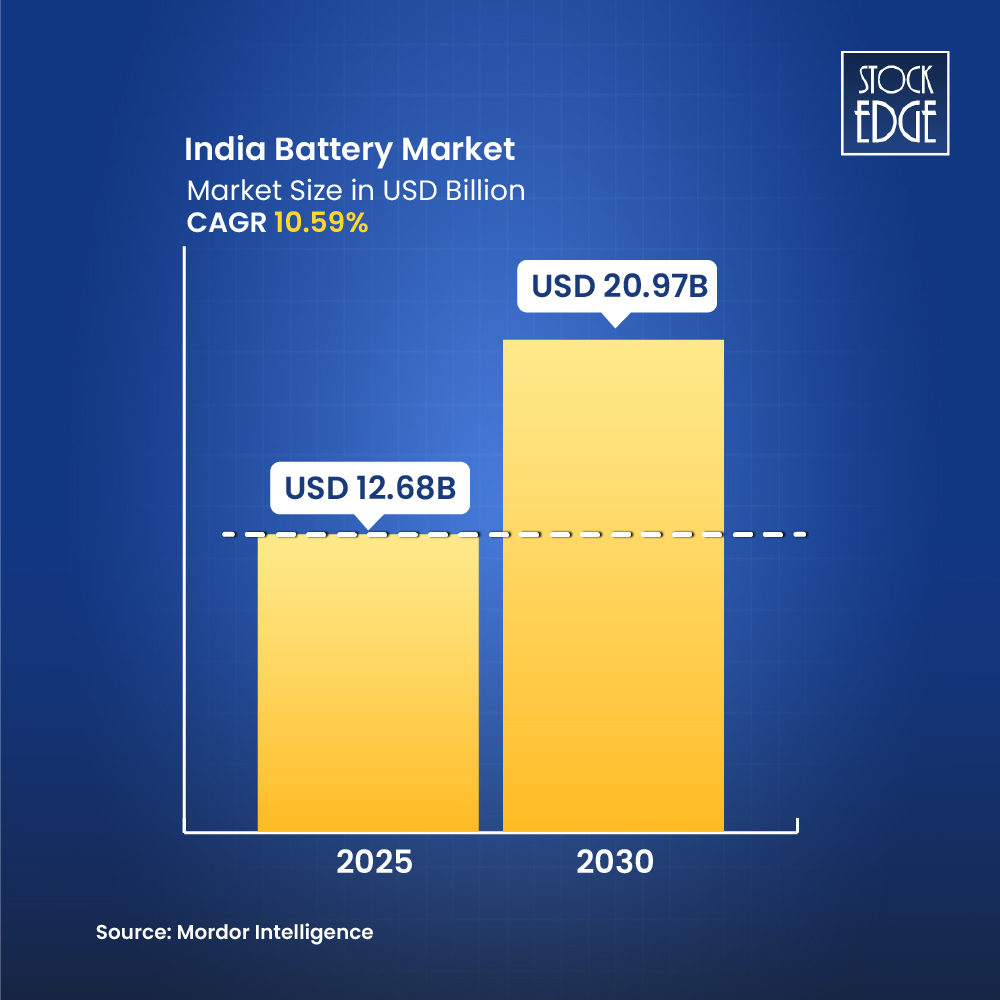

- Rapid Market Growth: The Indian battery market is projected for substantial growth, expected to rise from USD 12.68 billion in 2025 to USD 20.97 billion by 2030 at a 10.6% annual rate, driven by the increase in EVs, solar installations, and demand for smarter energy storage solutions

- Strong Drivers from Key Sectors: Batteries are central to India’s energy transition, powering EVs, storing renewable energy (solar and wind are intermittent), and enabling industrial automation and telecom networks. The growth in automotive production and renewable capacity directly fuels demand for batteries

- Robust Government Support: Government initiatives like the Make in India program, Production Linked Incentive (PLI) Scheme for advanced cells, Battery Swapping Policy, and the FAME India Scheme create a supportive framework, promoting local production and boosting demand for high-quality batteries

- Compelling Investment Opportunity: Battery stocks are becoming a significant deal as India shifts towards cleaner energy2. The sector is experiencing strong, policy-driven, and long-term tailwinds, making battery stocks a compelling addition to a forward-looking equity portfolio as companies like Exide Industries Ltd. and Amara Raja Energy & Mobility Ltd. position themselves to capitalize on future growth

Back in 2020, while most of us were focused on staying safe indoors, something interesting was quietly taking shape in the background. Solar rooftops were powering homes, wind turbines were generating clean electricity, and more electric vehicles began rolling out on Indian roads than ever before.

Fast forward to 2025, and we’re now witnessing a full-blown energy transition. India is actively shifting towards cleaner, smarter, and more sustainable power sources. And right at the centre of this change?

Batteries!

Batteries are no longer just a backup solution for your inverter. Today, they’re powering electric scooters, storing energy from solar panels, and helping industries run without interruption. As this shift continues, a new wave of investment opportunities is emerging especially in battery stocks in India.

In this blog, we’ll break down what battery stocks really are, why they’re becoming a big deal, and explore two standout companies leading this charge.

Table of Contents

What are Battery Stocks?

At the simplest level, battery stocks in India are shares of companies involved in designing, manufacturing, and supplying batteries across different technologies and industries. These batteries power everything from cars and motorcycles to electric vehicles (EVs), solar panels, telecom networks, and industrial backup systems. Key battery stocks in India are Exide Industries Ltd., Amara Raja Energy & Mobility Ltd., HBL Power Systems Ltd., Waaree Technologies Ltd., and many more.

In summary, battery stocks in India encompass various technologies and are vital for key sectors from transportation and clean energy to telecommunications and infrastructure. As the nation advances its electrification of mobility and enhances renewable energy usage, these companies are gaining importance not only as suppliers but also as long-term investment options. To explore battery stocks in India, visit our StockEdge.

Why Invest in Battery Stocks?

1. The Market Is Growing—Fast

The Indian battery market is poised for significant growth, expected to surge from USD 12.68 billion in 2025 to USD 20.97 billion by 2030, according to industry data. This robust 10.6% annual growth rate is driven by the increasing number of EVs on the road, the rising trend of solar installations, and the growing demand for smarter energy storage solutions.

2. The EV Boom Is Just Getting Started

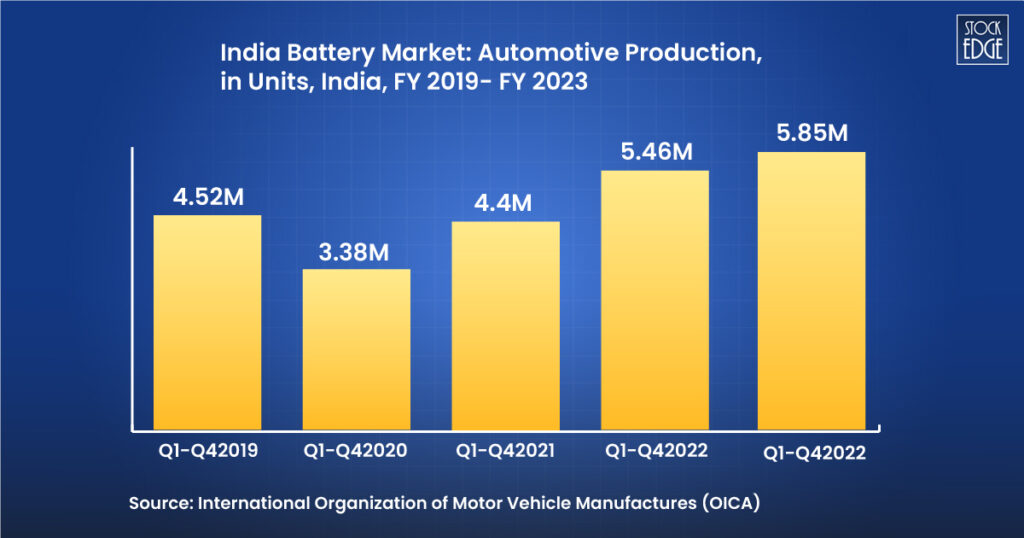

According to data from the International Organization of Motor Vehicle Manufacturers (OICA), automotive production in India has shown a strong upward trend over the past five years. After a dip to 3.38 million units in FY 2020 due to the pandemic, production rebounded sharply, rising to 4.4 million units in FY 2021, 5.46 million in FY 2022, and reaching 5.85 million units in FY 2023. This steady growth in vehicle manufacturing is directly linked to higher demand for automotive batteries, as every new vehicle, whether conventional or electric, requires a battery.

As India continues to scale up electric vehicle production alongside traditional models, the demand for both lead-acid and lithium-ion batteries is expected to rise significantly. This trend further strengthens the investment case for battery stocks in India, particularly for companies like Exide Industries and Amara Raja Energy & Mobility, which are strategically aligned with the auto OEM segment and are expanding into advanced battery technologies.

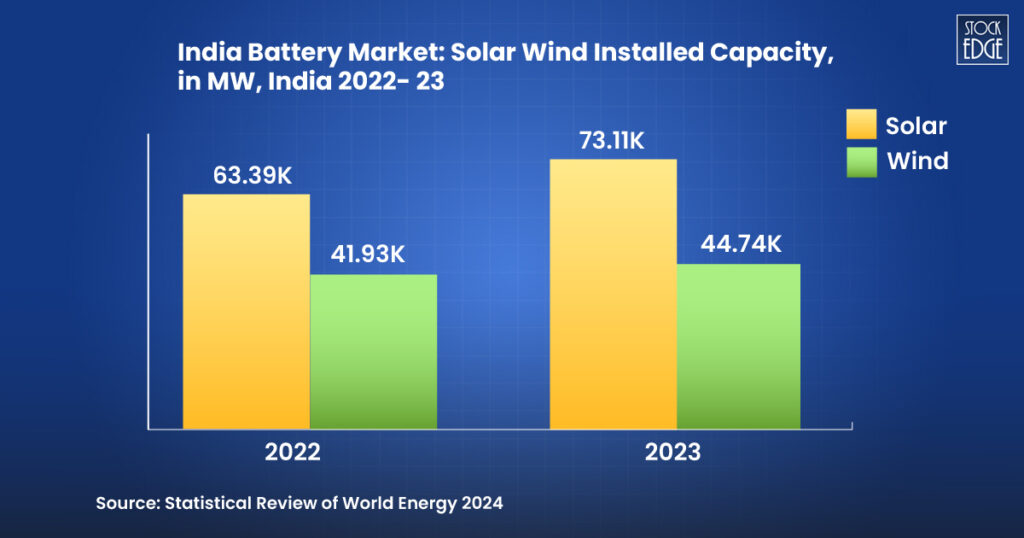

3. Renewable Energy Needs Storage

India’s renewable energy sector is expanding at a rapid pace, and this is creating significant opportunities for battery storage solutions. According to the Statistical Review of World Energy 2024, the country’s installed solar power capacity increased from 63,390 MW in 2022 to 73,110 MW in 2023, marking a growth rate of over 15% year-on-year. Similarly, wind power capacity rose from 41,930 MW to 44,740 MW during the same period. This consistent rise in renewable capacity highlights India’s commitment to clean energy, but it also brings new challenges namely, how to store and distribute power efficiently.

Since both solar and wind energy are intermittent by nature, the growing reliance on these sources significantly boosts demand for large-scale energy storage systems. This trend directly supports the growth of the battery industry and strengthens the long-term potential of battery stocks in India, especially those companies focused on energy storage technologies for renewable integration. To know more about the renewable energy sector, read our blog Top Renewable Energy Stocks in India.

4. Government Support Is Strong

The Indian government’s Make in India initiative significantly impacts the battery industry by encouraging local production of high-quality batteries to decrease import reliance and enhance self-reliance. The focus is on research and development to create cost-effective and sustainable technologies for both domestic and global markets. The Production Linked Incentive (PLI) Scheme supports this, offering financial rewards based on actual production. According to the PIB, Companies like Reliance New Energy Limited, Ola Electric Mobility Private Limited, and Rajesh Exports Limited (they have signed agreements and are setting up a 5 GWh lithium-ion cell factory in Karnataka) will benefit from India’s ₹ 18,100 crore program, with expectations to establish around 95 GWh of battery manufacturing capacity.

Another innovative step is the government’s Battery Swapping Policy, which addresses both cost and convenience challenges for EV users. By promoting standardized and interoperable battery swapping systems, the policy not only simplifies the user experience but also creates new business models for manufacturers. This shift is particularly helpful for two- and three-wheeler EV adoption, where affordability is key.

Finally, the FAME India Scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) continues to play a vital role in boosting EV demand. By offering upfront incentives on electric vehicles, the scheme directly increases the need for high-quality, reliable batteries. Together, these policies form a comprehensive framework that supports the long-term growth of the battery sector, making battery stocks in India even more attractive for investors looking to align with the country’s clean-tech future.

Now, let’s explore the best battery stocks in India and understand its business, financials and growth potential

Best Battery Stocks in India

Here are two top gainers companies that clearly stand out in 2025, both in terms of business strategy and long-term potential.

Exide Industries Ltd.

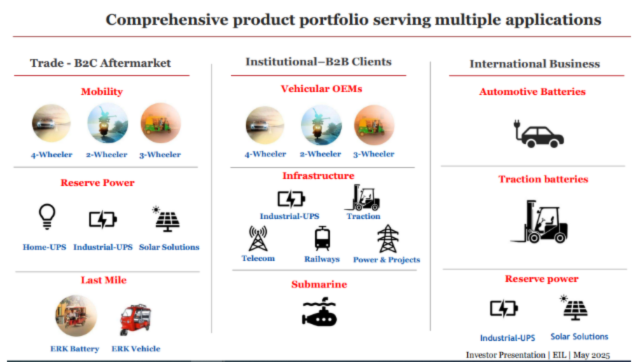

Exide Industries Limited offers a diversified product portfolio with batteries ranging from 2.5Ah to 20,200Ah. Their business is structured across three key verticals: Trade (B2C Aftermarket), Institutional (B2B Clients), and International Business. They also have a significant new business focus on Green Technology Solutions, specifically Lithium-ion cells & batteries. Here are the comprehensive product portfolio of Exide Industries.

The company boasts 5 global strategic technical collaborations with partners like Moura Batteries, SVOLT Energy Technology Co. Ltd, East Penn Manufacturing, Advanced Battery Concepts, and Furukawa Battery Company.

Financial Performance

In Q4 FY25, the company recorded a modest sales growth of ~4% YoY along with a stronger sequential growth of ~8%, driven by a solid performance across 75% of its business. During the quarter, EBITDA (standalone) stood at ₹467 crore, a de-growth of 10% YoY, led by high input costs and write-offs. The sharp rise in antimony prices over the past 6 months has significantly put pressure on margins. As of 31st March 2025, the company continued to remain a net debt-free company.

Why does it stand out?

Exide Industries Limited stands out for several reasons:

- Manufacturing Prowess and Strategic Locations: Operates 10 strategically located manufacturing plants and is the only battery manufacturer in India to have 3 large lead recycling plants. Proximity to clients drives agility and efficiency.

- Strong R&D and Technical Collaborations: Established an R&D centre in Kolkata in 1976, and has 5 global strategic technical collaborations, leading to the development of advanced products like high efficiency AGM batteries, FTPG batteries for data centers, and adoption of AGM/T-Gel batteries for BESS. They have a multi-year technical collaboration with SVOLT Technology Solutions Ltd. for Li-ion cell technology.

- Financial Strength: It is a debt-free company with healthy return ratios and a track record of consistent financial performance and positive cash flow generation.

- Leadership in New Technology: Exide is ahead of the curve in its lithium-ion battery foray. They are establishing one of India’s significant Li-ion cell manufacturing facilities with world-class technology partners (SVOLT) and aim to be a leading Li-ion cell manufacturer offering an end-to-end solution.

In summary, Exide Industries Limited is a long-standing player with a strong operational and financial foundation, strategically investing in new growth areas like Lithium-ion technology, positioning itself well to capitalize on future market opportunities while maintaining its established businesses. The company incorporates sustainability into its strategy, with initiatives like using 20% renewable energy in FY25, recycling 75% lead and 17% plastics, using EVs and LNG trucks for logistics, and implementing strong governance practices. To know more about this company in more details, read our concall analysis.

Amara Raja Energy & Mobility Ltd.

Amara Raja Energy & Mobility Ltd. operates primarily in two segments: Lead Acid Batteries (LAB) and the New Energy Business (NEB).

- Lead Acid Batteries (LAB): The company is one of the largest manufacturers of lead-acid batteries in India. This segment serves both Automotive and Industrial applications.

- New Energy Business (NEB): Forayed into this segment in 2022. This business focuses on Li Cell and Pack Manufacturing, EV Charging Products, and Energy Storage Solutions. They have also completed the acquisition of Amara Raja Power Systems Limited (ARPSL) to strengthen charging solutions offerings.

Financial Performance

On a standalone basis, revenue was up by ~13% YoY at ₹3,131 crore. After the adjustment for the subsidiary’s revenue in Q1 FY24, it increased by ~15%. The growth was driven by volume in the automotive segment, both domestic and international. On the basis of segment, revenue split stood at: LAB (lead acid battery) at ~₹3,137 crore and new energy business ~₹126 crore.

On a YoY basis, EBITDA margin increased by approximately 26 basis points to 13.4% due to higher realizations. Sequentially, it decreased by about 71 basis points, impacted by higher material costs.

Why does it stand out?

Amara Raja Energy & Mobility Limited distinguishes itself through several key factors:

- Segment Leadership & Innovation: The company is a pioneer and market leader in key segments like Telecom VRLA batteries and is the largest exporter in certain categories. It was also the first to introduce specific technologies like AGM batteries for 2W and VRLA batteries in India.

- Strong Financial Standing: Characterized by minimal debt and an AA+ Credit Rating, demonstrating financial discipline and stability.

- Strategic Pivot to New Energy: The bold and substantial investment of INR 9,500 crores into the New Energy Business and the planned 16 GWH Giga Corridor showcases a forward-looking strategy to transition beyond traditional lead-acid technology and capture future growth in the electric mobility and energy storage markets.

- Brands and Network: Possesses strong, well-recognized brands like ‘Amaron’ and a vast distribution network.

In essence, ARE&M stands out due to its established leadership and financial strength in the traditional battery market, combined with an aggressive, well-funded strategic expansion into the burgeoning New Energy sector, underpinned by a strong focus on sustainability. To know more about its growth potential, read our concall analysis.

The Bottomline

India’s energy landscape is undergoing a significant transformation, and batteries are at the heart of this transition. The electrification of mobility, expansion of solar and wind power, and growth in industrial automation all necessitate robust and scalable battery solutions, making battery stocks a compelling addition to a forward-looking equity portfolio.

India is likely to be a key investment hotspot for battery businesses in the next few years due to government policy incentives for the manufacturing industry. The two-wheeler segment leads the automotive market due to a growing middle class and a young population.

In short, the tailwinds are strong, policy-driven, and long-term in nature, which makes battery stocks a compelling addition to a forward-looking equity portfolio.

Happy Investing!