Table of Contents

As India continues its push toward renewable energy, NTPC Green Energy Ltd emerges as a significant player in the sector. With its upcoming IPO, investors are curious about its financials, sector outlook, and growth prospects.

Let’s explore all key aspects of the NTPC Green Energy Ltd IPO and why it could be a game-changer for your investment portfolio.

NTPC Green Energy Ltd IPO is open for subscription from (19th Nov 2024) today onwards!

NTPC Green Energy Ltd IPO Details:

- IPO Open Date 19th November 2024, Tuesday

- IPO Close Date 22nd November 2024, Friday

- Price Band ₹102 to ₹108 per share

- Lot Size 38 shares

- Face Value ₹10 per share

- Issue Size at upper price band ₹10000 crore (Fresh Issue ₹10000 crore)

- Listing exchanges NSE, BSE

- Cut-off time for UPI mandate confirmation by 5 PM on November 22, 2024

The tentative timeline for the IPO is as follows:

- Basis of Allotment 25th November 2024, Monday

- Initiation of Refunds (if not allotted) 26th November 2024, Tuesday

- Credit of Shares to Demat (if gets allotments of shares) 26th October 2024, Tuesday

- Listing Date 27th October 2024, Wednesday

About the Company

NTPC Green Energy Ltd, incorporated in April 2022, is a wholly-owned subsidiary of NTPC Limited. Their renewable energy portfolio consists of both solar & wind power assets with a presence across multiple locations in more than six states in India. As of 30th September 2024, the portfolio consisted of 16,896 MW (megawatt), including 3,320 MW of operating projects and 13,576 MW of contracted & awarded projects.

The projects generate renewable power and feed that power into the grid, supplying a utility or off-taker with energy. For the operational projects, they enter into long-term Power Purchase Agreements or Letters of Award with an off-taker that is either a central government agency like the Solar Energy Corporation of India (SECI) or a state government agency or public utility with an average term of 25 years. As of 30th September 2024, they had 17 off-takers across 41 solar projects and 11 wind projects. Additionally, they have a capacity under pipeline of 9,175 MW, out of which 6,925 MW was solar project and 2,250 MW was wind project. Together, the portfolio and capacity under the pipeline consisted of 26,071 MW.

Sector Outlook in India

The total installed generation capacity as of March 2024 was ~442 GW, of which ~98 GW of capacity was added over FY18-FY24. The overall installed generation capacity has grown at a CAGR of 4.3% over the same period. About 11 GW of capacity has been added during FY25 as of September 2024. The installed capacity has now reached 453 GW as of September 2024. Coal and lignite-based installed power generation capacity has maintained its dominant position over the years and accounts for ~48% as of September 2024. However, renewable energy (RE) installations (including large hydroelectric projects) have reached ~201 GW capacity as of September 2024, compared with 114 GW as of March 2018, constituting about 45% of the total installed generation capacity. This growth has been led by solar power, which rapidly rose to ~91 GW from 22 GW over the same period.

Several policy initiatives and schemes support India’s renewable energy growth:

- PM Surya Ghar Muft Bijli Yojna (2024): Launched in February 2024, this scheme aims to provide 300 units of free electricity to 1 million households, with a proposed outlay of ₹75,000 crores.

- CPSU Scheme (Central Public Sector Undertaking): Phase I (2015): Promoted 1,000 MW of grid-connected solar PV projects with Viability Gap Funding (VGF). Phase II (2019): Approved 8,580 crores in funding for central and state PSUs to set up grid-connected solar PV projects. 8.2 GW of capacity has been sanctioned under this scheme.

- Annual Bidding Trajectory (2023-2028): Mandated Renewable Energy Implementation Agencies (REIAs) to issue bids for 50 GW per annum, including 10 GW of wind power. In FY24 alone, 35.51 GW of capacity was bid out by REIAs like SECI, NTPC, NHPC, and SJVN.

Financial Performance

NTPC Green Energy Ltd. has shown commendable financial performance over the years. The company’s revenue has grown consistently, supported by its operational efficiency and long-term PPAs.NTPC Green Energy Ltd’s revenue increased by 1,094.19%, and profit after tax (PAT) rose by 101.32% during FY24 over the previous financial year 2023. The company’s EBITDA margin has remained consistently high at 89%, reflecting operational efficiency. However, a dip in net profit in FY24 due to higher finance costs and project expansion is a point to consider. Despite this, the company’s growth trajectory remains strong, supported by its parent company and favourable industry dynamics.

In the highly competitive renewable energy sector, NTPC Green Energy Ltd. competes with prominent players such as Adani Green Energy and ACME Solar Holdings.

Adani Green Energy leads in revenue generation at ₹9,220 crore. NTPC Green Energy follows with ₹1,963 crore, while ACME Solar lags behind at ₹1,319 crore. However, NTPC Green Energy has shown superior operational efficiency with the highest EBITDA margin of 89.0%, outpacing ACME Solar (82.6%) and Adani Green Energy (79.1%). NTPC Green Energy Ltd also excels in profitability with a PAT margin of 17.6%, higher than Adani Green Energy’s 10.5%.

Objectives of the Issue

NTPC Green Energy Ltd IPO is expected to raise a total of ₹10,000 crores, entirely through a fresh issue of shares. The IPO proceeds will be used for the following purposes:

- Debt Repayment/Prepayment: ₹7,500 crores will be allocated to reduce the debt burden of its subsidiary, NTPC Renewable Energy Ltd.

- General Corporate Purposes: Enhancing operational efficiency and strengthening the financial position.

This strategic use of funds will improve the company’s financial health and support its expansion plans.

Risk Factors

Like any investment, NTPC Green Energy Ltd comes with its own set of risks.

- Revenue Concentration: A significant portion of revenue comes from a few key off-takers, with ~50% from Telangana Discoms.

- Geographical Concentration: With over 61.7% of its projects located in Rajasthan, the company is exposed to regional risks.

- Dependence on Imports: About 18% of its components are sourced from China, making it vulnerable to geopolitical tensions.

- Seasonal Fluctuations: Solar projects are affected by weather conditions, leading to seasonal variability in energy output.

Investors should carefully evaluate these risks before subscribing.

Should you subscribe to NTPC Green Energy Ltd IPO?

The company is investing in hydrogen, green chemical and battery storage capabilities and solutions as well as associated technologies. Their current initiatives include:

- Developing battery storage and round-the-clock renewable energy projects

- Developing a green hydrogen hub at Pudimadaka

- Finalizing a tie-up for electrolysers

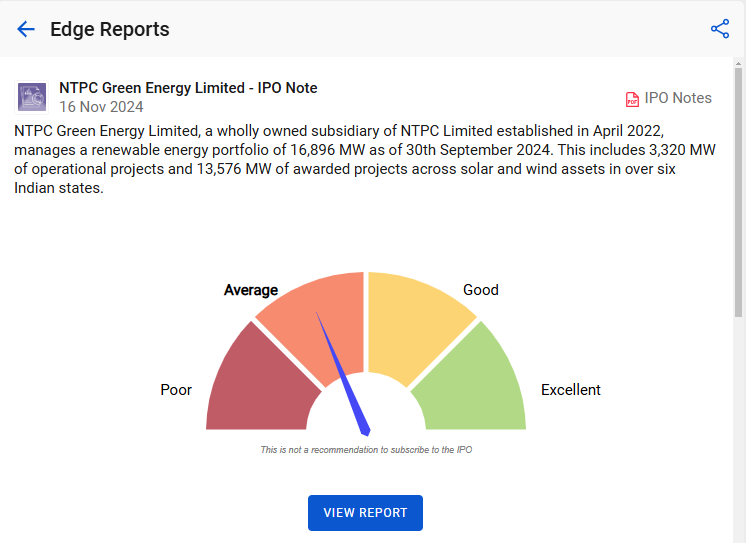

NTPC is the leading renewable power-generating public sector enterprise with a presence in both solar and wind energy generation. It operates in a highly competitive and highly regulated industry. The company boasts a robust pipeline, which might require additional funding. It is richly valued. However, due to strong parentage and tailwinds in the renewable sector, the company is poised for growth. Further, they are in the process of installing Battery Energy Storage at an NTPC thermal plant to smooth the flexibilization on a pilot basis. Before you invest in NTPC Green Energy Ltd. IPO, make sure you understand the potential risks and rewards. In this blog post, we have provided a full review of both the benefits and possible drawbacks of participating in the NTPC Green Energy Ltd IPO. StockEdge’s panel of experts rated NTPC Green Energy Ltd IPO as Average. Furthermore, we’ve created a complete IPO Note that delves deep into the company’s financial situation and SWOT analysis, providing you with a more in-depth understanding of the company’s prospects. You can read our blog’s top 5 upcoming IPOs in India, where you get more insights about NTPC Green Energy Ltd IPO.

StockEdge has a different section on IPO under the Explore tab, where you can see the list of upcoming IPOs, ongoing and recently listed IPOs.

Join StockEdge Club, where our team of research analysts will be dedicated to solving your query related to investments, trading or IPOs.

Happy investing!