Key Takeaways

- What is Nifty Next 50: It includes companies ranked 51st to 100th by market capitalization, just below the Nifty 50.

- Growth Potential: Acts as a feeder index to Nifty 50 with emerging large-cap companies showing strong long-term growth prospects.

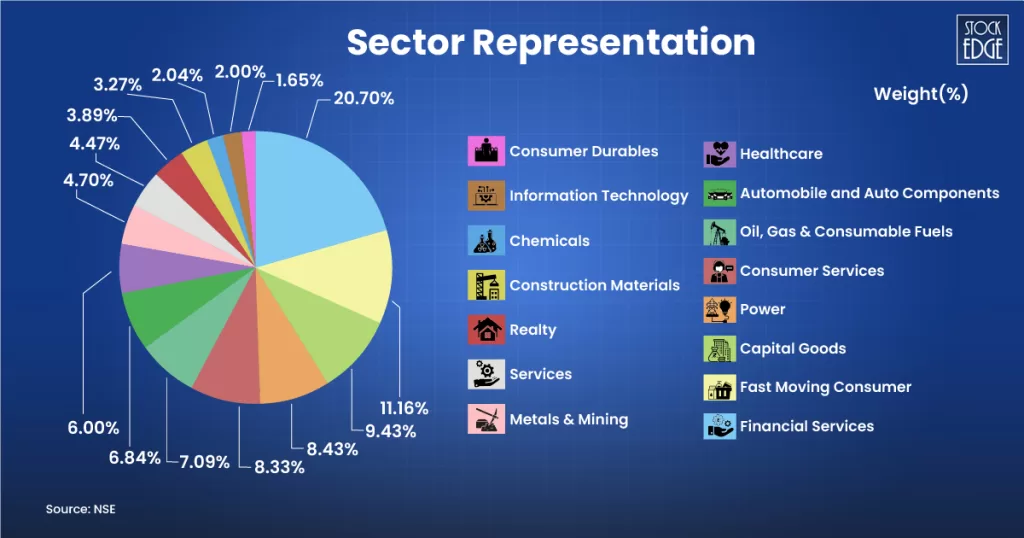

- Sectoral Diversification: Covers a wide range of industries including pharma, FMCG, finance, and industrials.

- Constituent Examples: Includes stocks like HAL, Varun Beverages, ICICI Lombard, and Adani Wilmar.

- Comparison with Nifty 50: More volatile than Nifty 50 but may offer higher returns over time.

- Investment Benefits: Offers diversification, future market leaders, and easy access via index funds and ETFs.

Table of Contents

What do Adani Enterprises Ltd, Dr. Reddy’s Laboratories Ltd, and Tata Consumer Products Ltd stocks have in common?

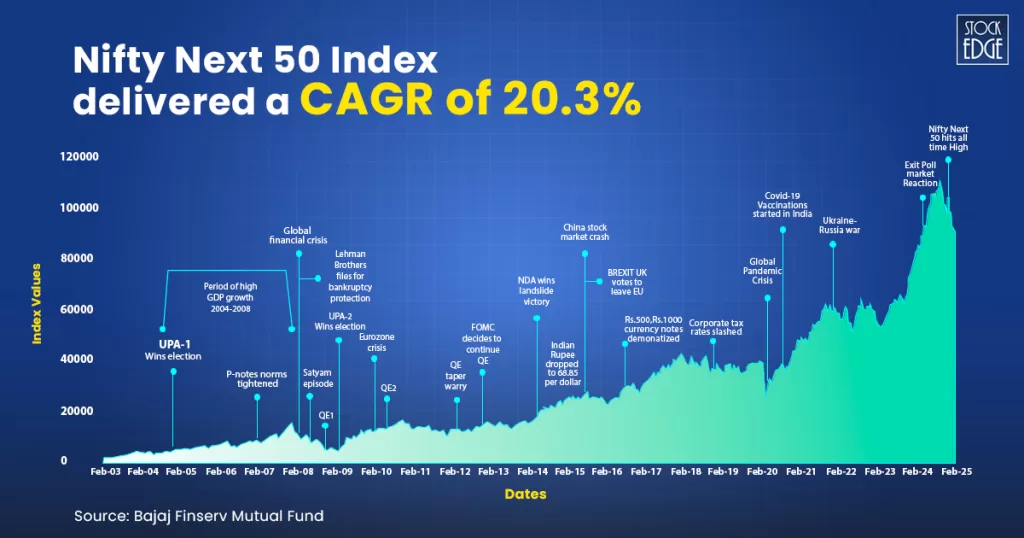

They all began their journey to the top from the Nifty Next 50, often referred to as the proving ground for India’s future market leaders. In the past 15 years, 44 companies have made the leap from the Nifty Next 50 to the prestigious Nifty 50, including three in 2024 alone. The message is clear: this index doesn’t just track performance — it predicts leadership. For investors with vision, the Nifty Next 50 isn’t just a list of stocks — it’s a launchpad for tomorrow’s blue chips and a front-row seat to India’s economic evolution.

What is Nifty Next 50?

The Nifty Next 50 is a benchmark index comprising the 50 largest companies, ranked 51–100 by free-float market capitalisation, within the Nifty 100, excluding the Nifty 50 constituents. The Nifty Next 50 is a stock market index introduced by NSE (National Stock Exchange) to track the performance of the next 50 most liquid and large-cap stocks after the Nifty 50. In simple terms, it represents India’s potential future blue-chip companies — firms that may graduate to the Nifty 50 index over time.

What are the Nifty Next 50 companies?

The index comprises 50 high-potential large-cap firms, positioned just below the top-tier Nifty 50. These are typically more liquid and often available in NSE’s F&O segment. The Nifty Next 50 Index represents about 11.50% of the free float market capitalization of the stocks listed on NSE as on March 28, 2025. These companies span 15 sectors, including defence, chemicals, capital goods, and consumer services, some of which are underrepresented in the Nifty 50. Here are the list:

Nifty Next 50 vs Nifty 50

While both indices represent large-cap Indian companies, they cater to different investment objectives due to their distinct characteristics:

| Feature | Nifty 50 | Nifty Next 50 |

| Companies | The top 50 largest and most liquid companies. | Next 50 largest and most liquid companies (51-100). |

| Market Cap | Represents the largest companies. | Represents companies just below the top 50, often with high growth potential. |

| Nature of Companies | Established large-cap leaders | Emerging large-cap contenders |

| Volatility | Generally lower volatility, more stable. | Higher volatility due to growth-oriented companies. |

| Returns | Offers consistent, moderate returns. | Potential for higher returns, especially in bullish markets. |

| Risk Profile | Suitable for lower-risk investors. | Suitable for investors with a slightly higher risk appetite. |

| Maturity | Established, mature “blue-chip” companies. | Growing companies with potential to become blue-chips. |

| Market Cycles | Tends to perform better during market slowdowns due to the resilience of large-cap stocks. | Performs well in bullish stock market phases. |

To know more about the Nifty 50, read our blog All About NIFTY50, Components of NIFTY50, and How to Invest in it.

Benefits of Investing in Nifty Next 50

Investing in the Nifty Next 50 index is more than just betting on emerging companies. It’s a strategic choice for investors seeking to capture superior long-term returns, identify future market leaders, and achieve sectoral diversification. Here are the key reasons why the Nifty Next 50 deserves a spot in your portfolio:

High Growth Potential: The companies in the Nifty Next 50 are often in a growth phase, seeking to expand their market share and operations. This can result in higher returns for investors compared to more established companies.

Diversification Beyond Top 50: It provides a crucial diversification layer beyond the Nifty 50, reducing concentration risk in just the absolute largest companies. You gain exposure to a broader segment of the large-cap market.

Exposure to Future Blue-Chips: Many companies in this index have the potential to grow into Nifty 50 constituents in the future. Investing in the Nifty Next 50 allows you to participate in this upward journey.

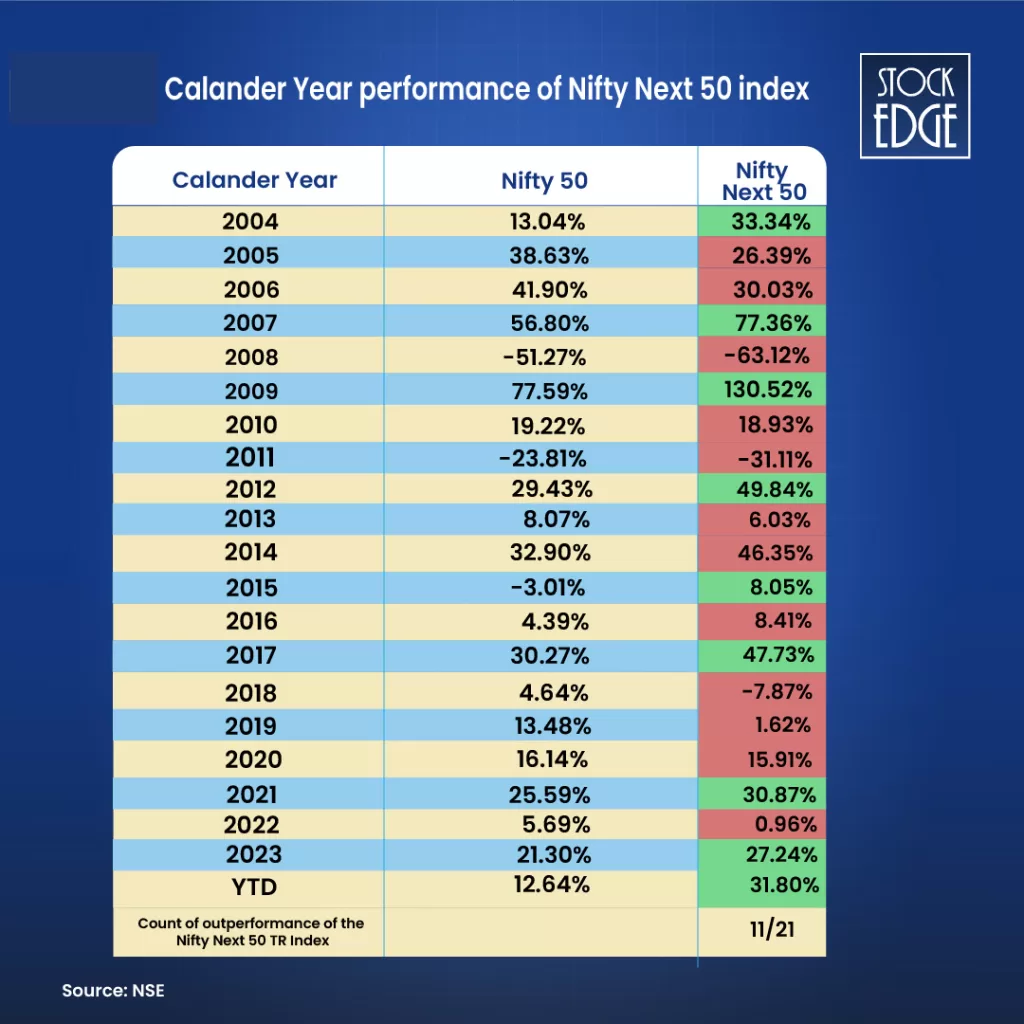

Outperformance in Bullish Markets: Historically, the Nifty Next 50 has shown a tendency to outperform the Nifty 50 during strong bull runs, as growth stocks tend to thrive in such environments. Over the previous 21 calendar years, the Nifty Next 50 TR Index delivered positive returns in 18 calendar years. When compared to Nifty 50 TR, the Nifty Next 50 TR has outperformed it in 11 out of 21 calendar years.

Conclusion

The Nifty Next 50 is more than a stepping stone to the Nifty 50. It’s a growth-driven index representing India’s upcoming economic wave. With strong long-term returns, exposure to emerging sectors, and a history of nurturing future blue-chip firms, it offers a strategic edge for investors seeking sustainable wealth. For those prepared for short-term volatility and thinking long-term, it’s not just a good investment—it’s a valuable tool.

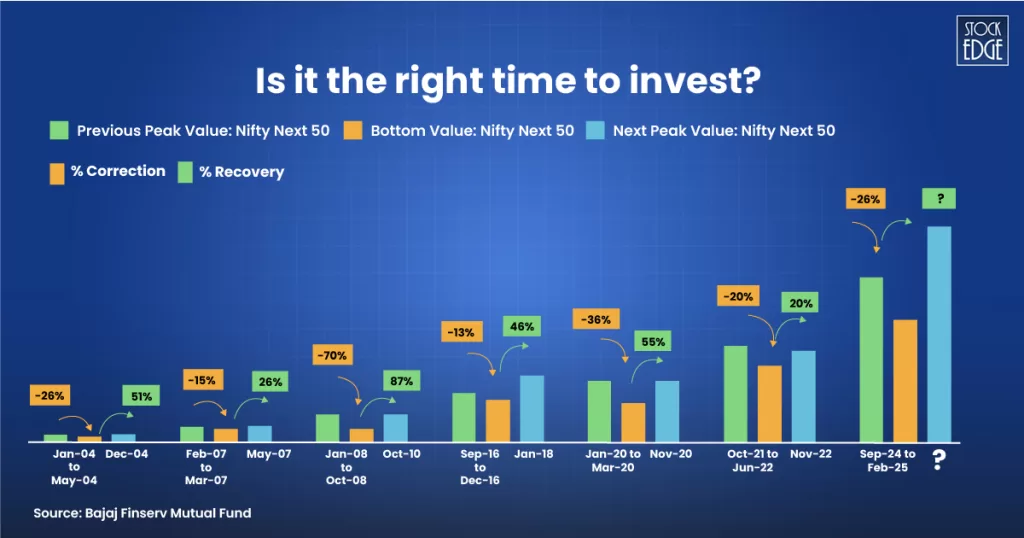

Now, the question arises: Is it the correct time to invest?

The historical performance of the Nifty Next 50 shows that every major correction has been followed by a strong recovery. During the 2008 global financial crisis, the index went down by 70% but rebounded by 87%. Similar trends were seen in 2020 and 2022. These highlight a crucial insight for investors that downturns often present the best long-term entry opportunities.

Frequently Asked Questions

When did Nifty Next 50 start?

The Nifty Next 50 index was officially launched on January 1, 1997. But to track its performance from an earlier point in time, the NSE chose a base date of November 3, 1996. On that base date, the index was given a starting value of 1000, and the total market value (or market capitalisation) of all the companies in the index at that time was about ₹0.43 trillion (or ₹43,000 crore).

Where can I get the live Nifty Next 50 chart?

You can easily track the live Nifty Next 50 chart on trusted platforms like the NSE India official website and StockEdge.

Is Nifty Next 50 a good investment?

Yes, Nifty Next 50 can be a great investment option, particularly for long-term investors looking for higher growth potential. It comprises large-cap companies that are just below the top 50, often considered future blue-chip stocks. Historically, the Nifty Next 50 has delivered better long-term returns than the Nifty 50, as its exposure to emerging industry leaders across diverse sectors, including defence, retail, insurance, and infrastructure. While it may be more volatile in the short term, this index offers an excellent opportunity to invest in companies that are on the path to becoming tomorrow’s market giants.