Key Takeaways

- Jio BlackRock: A 50:50 joint venture between Jio Financial Services and BlackRock to offer mutual funds in India with a digital-first, low-cost approach.

- Vision & Mission: Aims to make mutual fund investing more accessible, affordable, and trusted among everyday Indian savers, especially in smaller towns.

- Strategic Strength: Combines Jio’s wide digital reach with BlackRock’s global investment expertise and advanced tech platform Aladdin.

- Product Focus: Started with low-risk debt funds like liquid, overnight, and money market funds to attract first-time investors. Offers direct plans with no commission or expense ratio, making it cost-effective for retail investors.

- Challenges Ahead: Needs to overcome low financial literacy, investor trust issues, regulatory hurdles, and strong competition from existing AMCs and fintechs.

- Potential Impact: If executed well, it could change how millions of Indians invest, bridging the gap between saving and investing.

Table of Contents

What is Jio BlackRock?

Jio BlackRock is a mutual fund company established as an equally owned joint venture between Jio Financial Services Limited (JFSL), a financial services arm of Reliance Industries, and BlackRock Inc., a global investment management corporation with over $11.58 trillion in assets under management (AUM) as of March 31, 2025.

The partnership strategically merges Jio’s colossal digital reach and nuanced understanding of the Indian consumer base with BlackRock’s unparalleled global investment expertise and cutting-edge technology, notably its proprietary Aladdin platform for sophisticated investment analytics and risk management.

How was Jio BlackRock Formed?

Before we look forward, it’s important to look back.

BlackRock’s First Foray (2008–2018)

BlackRock entered India in 2008 through a joint venture with DSP Group, forming DSP BlackRock Mutual Fund. It quickly gained prominence, but by 2018, BlackRock exited the JV by selling its 40% stake, leading to the fund house being rebranded as DSP Mutual Fund.

The Comeback via Jio BlackRock (2023–Present)

In July 2023, BlackRock re-entered India by partnering with Jio Financial Services, creating a 50:50 joint venture – Jio BlackRock. With an initial commitment of $150 million each, the aim is to blend Jio’s digital infrastructure with BlackRock’s $9.4 trillion global asset management expertise. Larry Fink (Chairman of BlackRock) described this joint venture as a “major step” in expanding the company’s global presence. It is also an opportunity to tap into India’s investment potential.

Regulatory Approval and Leadership

In May 2025, SEBI approved Jio BlackRock to operate as a mutual fund, paving the way for innovative, data-driven investment products. Sid Swaminathan, a BlackRock veteran who previously managed $1.25 trillion in assets, was appointed CEO to lead the JV’s India operations, combining global insight with local execution.

The Accessibility Gap in Indian Mutual Fund Investing (Targeting the Masses)

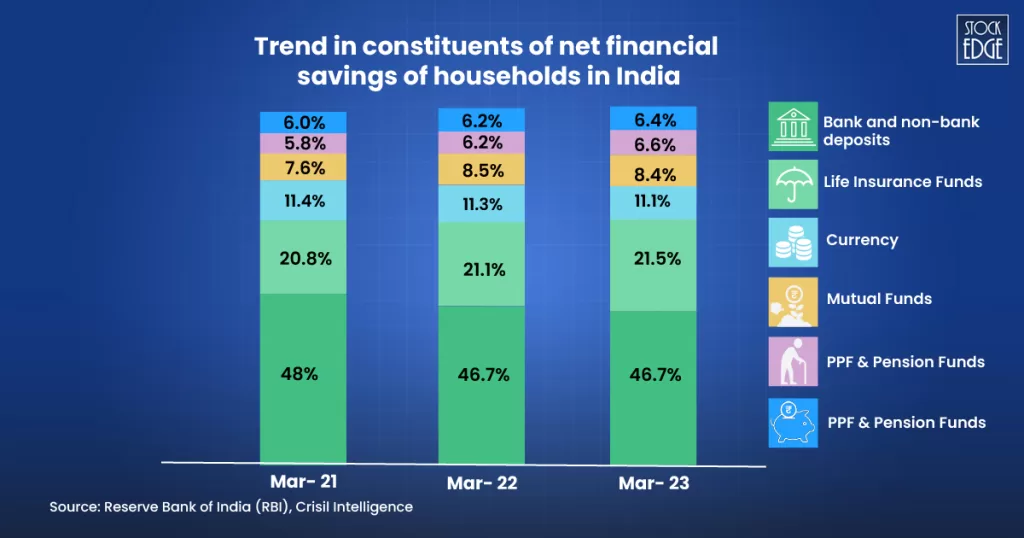

While mutual funds have grown in popularity among urban investors, they still account for a small proportion of total family savings in India, suggesting a considerable accessibility gap. According to RBI and CRISIL data, mutual funds accounted for only 7.6% of net financial household savings in FY 2020-21, 8.5% in FY 2021-22, and 8.4% in FY 2022–23.

Meanwhile, more than 46% of household savings consistently went into bank and non-bank deposits during those years. This shows that mutual funds have yet to become a popular investing option among the majority of Indian consumers.

In spite of being a regulated, tax-efficient, and market-linked product, mutual funds face several challenges that prevent widespread adoption:

1. Low Financial Awareness

Many Indians still equate mutual funds with the stock market and view them as risky. The lack of structured financial education leads people to stick with what they know – fixed deposits, LICs, or gold.

2. Lack of Trust

A major hurdle in making mutual funds truly accessible to everyone has been the lack of investor awareness, especially beyond big cities. In Tier-2 and Tier-3 areas, low financial literacy and a strong preference for familiar, seemingly safer options like fixed deposits, PPFs, and gold have held back wider adoption. The complicated nature of mutual fund categories, risk-return trade-offs, and newer product types often confuses first-time or less-informed investors, leading to fewer people actually investing in them.

3. Accessibility & Digital Divide

While fintech has made investing easier for urban users, millions of Indians still don’t have access to smartphones, reliable internet, or user-friendly platforms in regional languages.

4. Preference for Guaranteed Returns

Most Indians prefer guaranteed capital protection over market-linked returns. Mutual funds, with their inherent market risks, often get overlooked in favour of FDs or LIC plans, even if the returns are lower.

What is Jio BlackRock’s Business Strategy on Bridging this Gap?

Jio BlackRock’s business strategy is primarily built around a digital-first, low-cost approach to asset management, aiming to make mutual funds more accessible to a broader base of Indian investors. Let’s deep dive into the key highlights of their approach:

1. Digital-First, Mobile-Led Distribution:

At the heart of Jio BlackRock’s strategy is a fully digital mutual fund platform that aims to reach every corner of India through smartphones. By using Jio’s telecom and digital services like JioFiber, JioMart, and MyJio, the platform aims to make investing as simple as recharging a mobile phone. It removes the need for physical branches or middlemen, which helps lower distribution costs.

2. Product Offerings:

The company has begun its offerings with debt funds, which are generally regarded as lower-risk investments and suitable for novice investors. So far, it has introduced:

3. Direct-to-Consumer Model with Disruptive Pricing:

It offers a direct plan with zero brokerage, no commission, and no expense ratio. This aggressive approach is designed to make investing more affordable and encourage more people to start investing.

4. Integration of BlackRock’s Aladdin Platform:

Jio BlackRock integrates BlackRock’s Aladdin platform, a powerful, institutional-grade risk management and portfolio management tool. This brings advanced technology and sophisticated analytical capabilities typically reserved for large institutional investors to individual retail investors in India.

By combining zero-cost entry, advanced technology, and Jio’s unparalleled digital reach, Jio BlackRock aims to create a distinct and highly competitive position in India’s asset management market, potentially revolutionizing how mutual funds are accessed and perceived by the masses.

What Challenges Could Jio BlackRock Face in Its Mission?

Although Jio BlackRock provides promising benefits, it still faces obstacles in its aim to transform mutual fund investing in India.

1. Investor Trust and Financial Behavior

The biggest obstacle may not be infrastructure but mindset. A large section of Indian households still prefers guaranteed-return instruments such as fixed deposits, LIC policies, or post office schemes.

2. Low Financial Literacy and Limited Awareness

Despite growing digital penetration, financial literacy in India remains low, particularly in rural and semi-urban areas. Many potential investors do not fully understand concepts like NAV, SIP, risk profiling, or even basic fund types. Even the most app or low-cost fund will struggle to gain traction unless backed by targeted financial education efforts tailored to regional and cultural contexts.

3. Competition from Established AMCs and Fintechs

India’s mutual fund space is already crowded, with over 40+ asset management companies (AMCs) and multiple fintech platforms offering user-friendly investing experiences. Brands like Zerodha, Groww, Paytm Money, and PhonePe are already trusted digital names in this space. Gaining user trust and loyalty will require Jio BlackRock to go beyond pricing and technology – it must consistently deliver value, performance, and service.

4. Regulatory and Compliance Requirements

As a SEBI-regulated entity, Jio BlackRock must adhere to stringent compliance, disclosure, and investor protection norms. While digital onboarding may reduce friction, it still needs to ensure full KYC compliance, risk disclosures, data privacy, and grievance redressal systems – all of which become more complex when targeting millions of first-time investors.

Will It Truly Change the Game?

By combining Jio’s deep digital reach with BlackRock’s global experience in managing money, the partnership is uniquely placed to solve long-standing problems in retail investing.

Its focus on mobile-first access, zero-cost investing, simple products, and financial inclusion tackles the very reasons why mutual funds haven’t yet become a common choice for most Indians. Unlike traditional players, Jio BlackRock seems to be building a platform for the everyday saver – not just for those who already understand the markets.

However, whether it will truly “change the game” depends on several factors:

- Execution at scale: Can Jio BlackRock maintain operational efficiency and service quality while onboarding millions of new investors?

- Investor trust: Will new-to-market investors stay invested long enough to experience the long-term benefits of mutual funds?

- Competitive differentiation: Can it continuously innovate and stay ahead in an already saturated digital investing space?

If Jio BlackRock manages to align its technology, pricing, and messaging with the needs and mindset of India’s growing base of retail investors, it could play a major role in advancing financial inclusion. More than just offering mutual funds, it has the potential to influence how a new generation of Indians think about saving and investing.