Table of Contents

The Indian pharmaceutical industry has a dominating role in the pharmaceutical business on a global scale. Did you know that 60% of global vaccine demand is served by Indian pharma companies? India exports generic medicines to 200+ countries, with 50% of Africa’s requirement for generics, 40% of generic-demand in the USA and 25% of all medicine in the United Kingdom.

Therefore, the pharmaceutical industry should be under your radar if you’re aiming to build a strong and diversified portfolio to maximize your return in the stock market. Cipla stock can turn out to be a good investment opportunity in the long run.

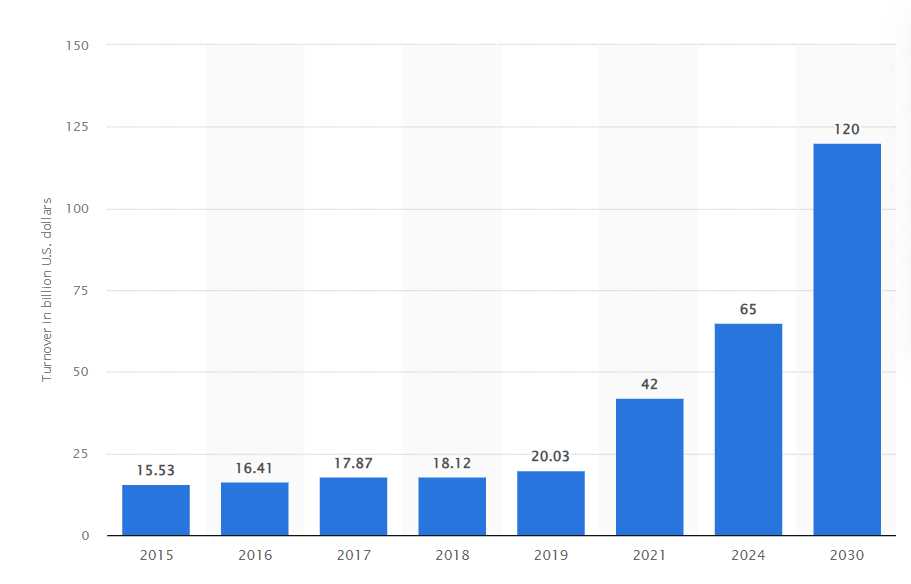

Here is a glimpse of the annual turnover of the Indian pharmaceutical market from 2015 to 2021, with expected growth till 2030 (USD billion)

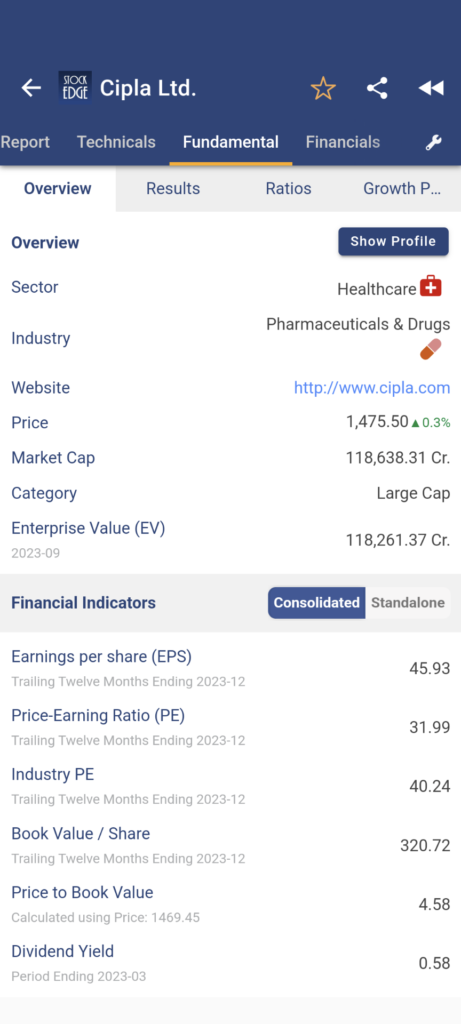

In today’s blog, we will be analyzing Cipla stock, a potentially lucrative long-term investment opportunity. The key to its potential for generating higher returns lies in its undervaluation, particularly when compared to the industry average PE.

The Price-to-earnings ratio is a valuable tool for assessing a stock’s value. Currently, the pharmaceutical industry’s PE stands at 40, while Cipla stock boasts a TTM PE of 32, indicating its potential value.

Using StockEdge, you can check the TTM PE of any stock and compare it with its respective industry average, as shown in the image below for Cipla stock.

Company Overview

Established in 1935 by Dr. K.A. Hamied, Cipla has emerged as a leading player in the pharmaceutical industry, known for its commitment to providing affordable healthcare solutions worldwide. Cipla is recognized for its extensive product portfolio, which encompasses a wide range of medicines, from generic drugs to innovative formulations and biotechnology products.

The company operates in the manufacturing, development, and marketing of various branded and generic formulations, as well as Active Pharmaceutical Ingredients (APIs). It maintains an extensive network of manufacturing facilities, trading activities, and other related operations both in India and international markets.

The company has a strong distribution network spanning over 180 countries, Cipla continues to make significant contributions to global healthcare by ensuring the availability of high-quality medicines at affordable prices.

Furthermore, it constitutes a segment of the Nifty 50, which serves as India’s benchmark index. For further insights into Nifty 50 stocks, refer to articles such as “All About NIFTY50,” “Components of NIFTY50,” and “How to Invest in it.”

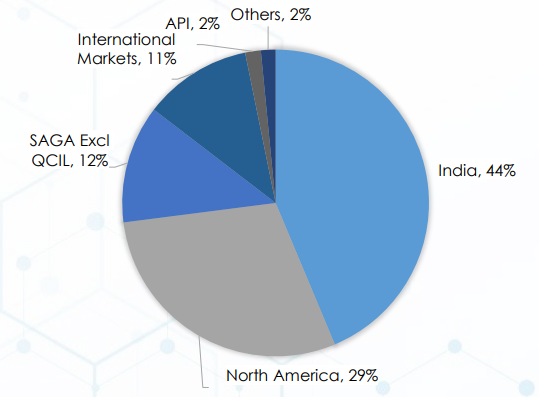

Revenue Mix

During Q3 FY24, Revenue Break-up was India-44%, North America-29%, SAIGA-12%, International Markets-11%, API-2% and Others-2%. (see the chart below)

Financial Highlight of Cipla stock

In the last 5 years the company’s revenue grew at 8% CAGR and Net Profit grew at 15% CAGR. To view the yearly change of revenue and net profit of Cipla stock, you can head to the profit and loss statement of the company from StockEdge.

As you can see in the above image, a bar chart represents Cipla’s annual revenue YoY. The growth in net sales has been astonishing for the company.

During FY23, the company posted an ROE of 13% and an ROCE of 18%. You can analyze the return ratios of Cipla stock directly from StockEdge itself.

The company has reduced its debt substantially over the years and now has a decent interest coverage ratio.

During FY23, Revenue increased by 5% on a YoY basis. Excluding the Covid-related segment, the Revenue grew by 11% YoY. Net Profit increased by 11% on YoY, and the margin was marginally higher. R&D expenditure was higher by 12% during FY23 than last year.

Company has reported 15% YoY Revenue growth in 9M FY24 driven by strong momentum in the core business across key markets, particularly in India, and effective execution of a differentiated portfolio in the US market, coupled with easing cost inflation pressures. EBITDA growth was 29% YoY with EBITDA margin increasing by 272bps. Net Profit grew by 40% YoY for 9M FY24.

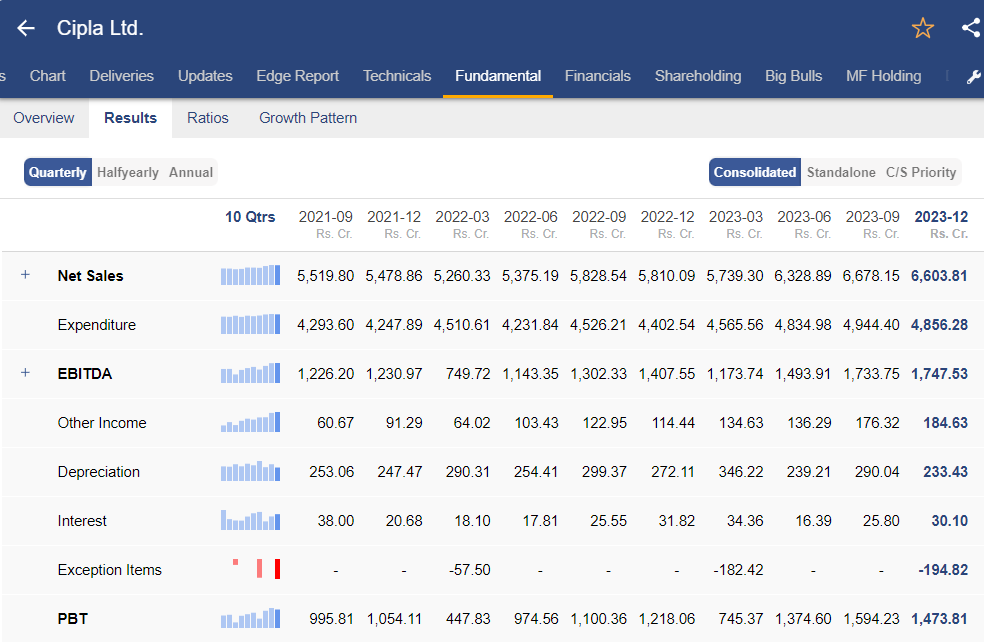

You can also check the company’s quarterly financials using StockEdge, as shown in the image below for Cipla stock.

However, the quarter also witnessed challenges, including an exceptional loss of approximately ₹195 crore due to the impairment of intangible assets related to the discontinuation of the development and commercialization of Pulmazole. This setback underscores the hurdles the company faces in its R&D and product development endeavors.

SWOT analysis of Cipla stock

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions

Strength

Cipla is one of the leading pharmaceutical companies with a substantial market share. The company holds a substantial market share in chronic medication. In India, the market share in the Respiratory segment is 22.6%, in the Urology segment is ~14.4%, and in Cardiology, the market share is ~5.3%. In the North American market, the company’s market share for the products Albuterol & Arformoterol is ~17.6% and ~38.5%, respectively. The company’s market share in the South African market segment stood at ~7.7%.

Weakness

During the recent quarter, API and International markets revenue declined. Profit growth was impacted owing to increased expenditure.

Opportunity

The company will be looking forward to maintaining growth momentum in large branded and non-branded generic franchises in India and South Africa. In Europe & Emerging markets, branded and generic DTMs are expected to witness an increasing scale of business through organic and inorganic ways. Management will be expanding its lung portfolio leadership globally, and key launches will be prioritized for complex generics in the US. Regulatory compliance and digital transformation are two other goals that management will be looking at. The company is expecting a strong pipeline from peptide franchises in North America going forward.

Cipla aims to launch 4 peptides, a class of innovative drugs, by FY25. Alongside the peptide launches, the company also plans to file applications for approval of a couple of other products within the next 12 months. These filings and launches demonstrate Cipla’s commitment to innovation and expansion of its product portfolio.

Threat

- The company has a good market share, but the peer pressure in the industry is very high across the geographies.

- Pricing risk on medicines brought under pricing control by the government.

- Regulatory issues related to USFDA prevail in the pharma sector shares

- Inflationary costs of raw materials may reduce the margins.

The Bottom Line

The company’s past performance and current market share across geographies are pretty impressive for long-term investment.

The potential entry of Blackstone into Cipla, a leading pharmaceutical company in India, has generated considerable speculation regarding the company’s future direction and the broader implications for the industry. Blackstone’s non-binding bid to acquire a significant promoter stake has raised questions about Cipla’s ownership and strategic trajectory. This development has triggered discussions about the potential departure of the founding Hamied family and the transformative impact of a private equity-led buyout on India’s pharmaceutical market.

The introduction of Blackstone into Cipla’s ownership structure may lead to changes in leadership, decision-making processes, and a focus on enhancing profitability and overall value. These developments are being closely observed due to their potential socio-economic significance, affecting Cipla’s legacy, its role in providing affordable healthcare, and its broader influence in India’s socio-economic landscape, although the precise outcome remains uncertain.

Apart from investing in Cipla stock, you may invest in another such pharma stock, read; Unlocking Potential: Divis Laboratories Stock Analysis

Happy Investing!