The finalization of the India-EU Free Trade Agreement on January 27, 2026, marks the arrival of what institutional desks are calling The Mother of All Deals. This landmark pact bridges two of the world’s most significant democratic economies, encompassing a population of 2 billion people and a combined market value of $24 trillion, effectively a quarter of global GDP.

Finalized after nearly 20 years of complex negotiations, the agreement signals a decisive shift toward “Strategic Autonomy” for both regions. For India, it represents a fundamental pivot from a domestic consumption-led story to a global manufacturing powerhouse. In the realm of institutional equity research, policy-led investment themes create significant early-mover advantages for those capable of decoding the secondary impacts of trade liberalization.

The India-EU FTA Investment Theme is not a transitory trading bounce; it is the most critical macro-catalyst for Indian manufacturing this decade. By removing deep-seated trade barriers, the agreement provides a clear runway for earnings visibility and structural margin expansion across high-growth sectors.

The India-EU FTA Investment Theme at a Glance: Structural Changes

The free trade agreement introduces profound structural changes to the bilateral trade relationship. At its core, the FTA ensures that tariffs are eliminated or reduced on 97.5% of Indian exports to the EU. Beyond commerce, the pact integrates digital services, professional mobility, and defense technology, establishing a long-term India-EU Economic Corridor.

From an analytical perspective, the primary driver for the India-EU FTA Investment Theme is the logic of margin expansion and capital efficiency. By removing duties that previously ranged from 12% to 26%, Indian exporters gain an immediate pricing advantage.

What India Gets from This Free Trade Agreement Deal with the EU

| Sector | Previous EU Duty | Post-FTA Duty | Key Impact |

| Textiles & Apparel | 8% to 12% | 0% | Expected to create 6–7 million jobs, $33bn current exports to see immediate boost. |

| Marine Products | Up to 26% | 0% | Zero-duty for shrimp and frozen fish; levels the playing field with Southeast Asia. |

| Gems & Jewellery | 2% to 4% | 0% | Aiming to double bilateral trade to $10 billion within 3 years. |

| Leather & Footwear | Up to 17% | 0% | Massive gain for export hubs in Kanpur, Agra, and Chennai. |

| Specialty Chemicals | Up to 12.8% | 0% | Positions India as the primary “China Plus One” alternative for EU buyers. |

Sector-Wise Opportunity Breakdown

The following sectors represent the primary beneficiaries of the trade pact, characterized by significant duty drops and improved operating leverage.

Textiles & Apparel

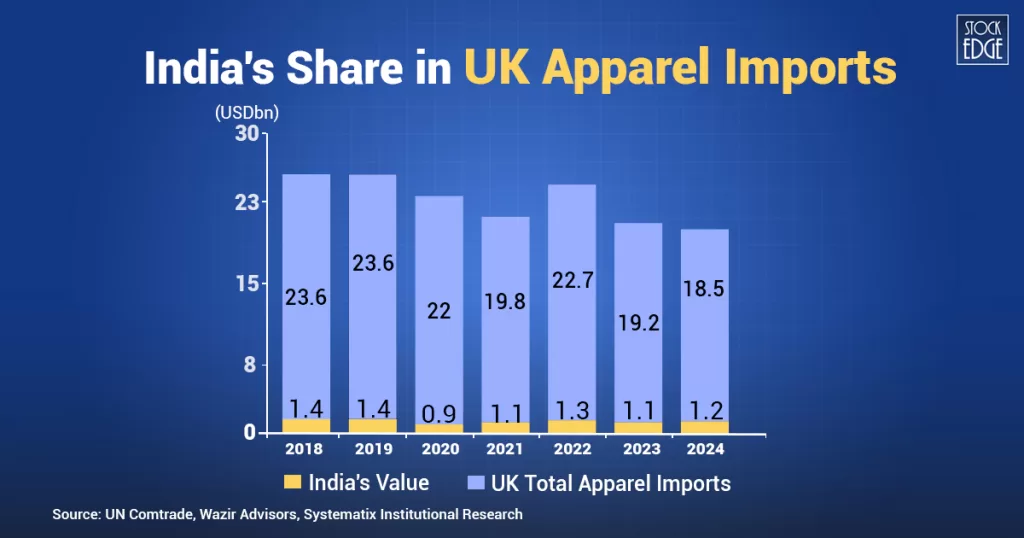

The immediate transition from a 12% duty to 0% removes a structural cost barrier, providing preferential access to the EU’s $263.5 billion import market. Indian exports are projected to double from a baseline of $7.2 billion to $15 billion by 2030.

- Gokaldas Exports: India’s largest apparel exporter. Its strategic acquisitions of Atraco Group and Matrix allow it to compete on price while capturing high-value knitwear margins. It is redirecting 2026-27 capex toward European expansion.

- KPR Mill: A vertically integrated giant with 25% revenue exposure to Europe. Its new Odisha facility targets 250+ million units by 2027. Investment in Vortex Spinning and automated processing is expected to reduce labor costs by 15%, widening margins.

- Welspun Living: A leader in home textiles poised to displace competition from Turkey/Pakistan. Its vertically integrated model is designed to meet strict European ESG and sustainability standards.

- PDS Ltd: Operates a global fashion infrastructure platform. Management is targeting a revenue doubling to $4–5 billion over four years, supported by slashed working capital days (from 17 to 7 days).

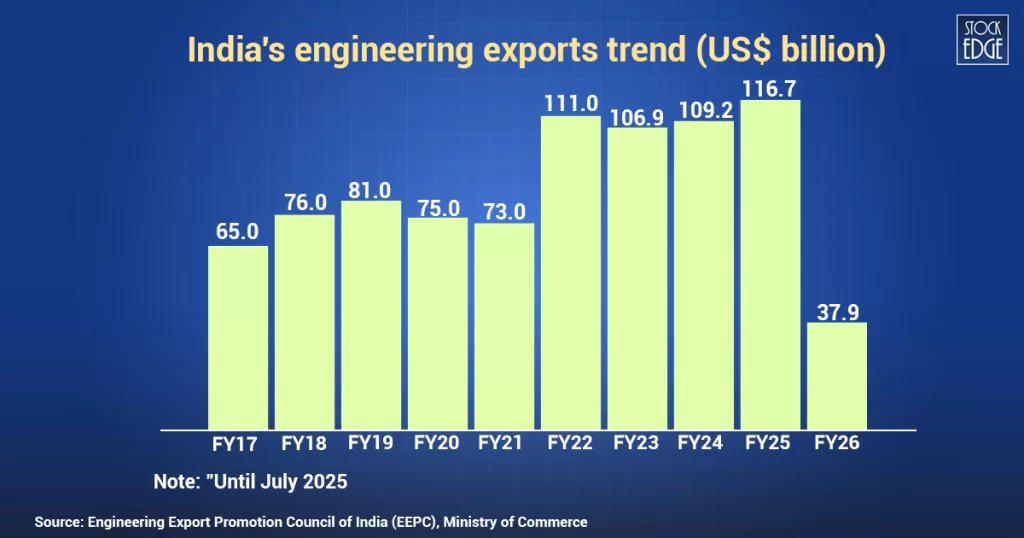

Engineering & High-Tech Goods

The FTA provides immediate duty removal on 79.1% of tariff lines, lifting projected engineering exports from $16.6 billion to $25 billion within 24 months.

The agreement covers 100% of value-added minerals (Aluminum, Copper, Zinc), positioning India as the primary supplier for the EU’s energy transition.

- Samvardhana Motherson International Ltd: Samvardhana Motherson International (SAMIL) is one of the world’s largest automotive component manufacturers. With a strong presence in the automotive industry, the company expects the FTA to open up new opportunities for growth and supply chain integration. Despite current challenges in the global CV production, the company remains optimistic about the prospects.

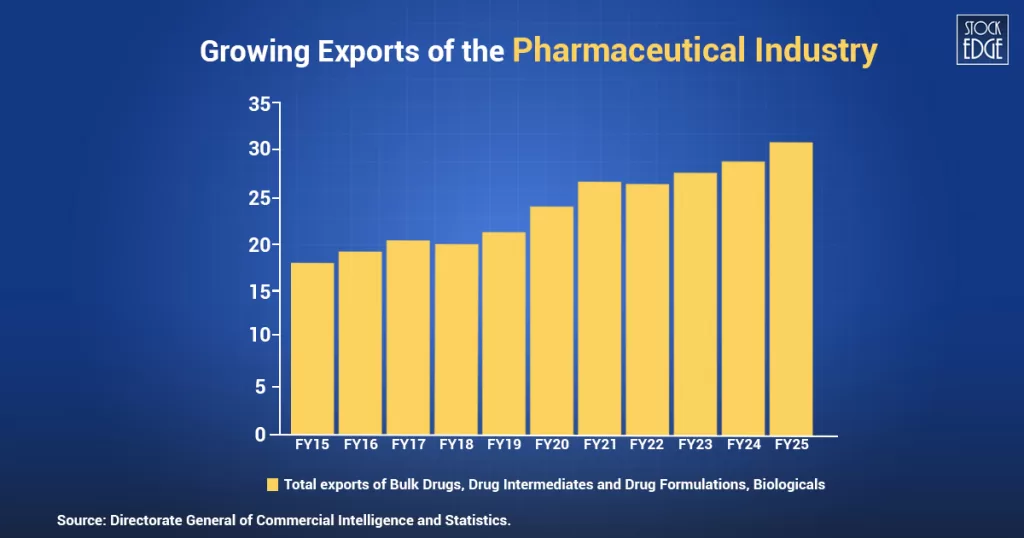

Pharmaceuticals & Chemicals

The removal of 11% medicine tariffs and 97.5% of chemical duties provides an instant competitive edge and simplified market authorization for biosimilars.

Zero-duty access to high-end European Active Pharmaceutical Ingredients (APIs) and specialty chemicals, lowering domestic production costs.

- Laurus Labs: Transitioning to a CDMO powerhouse with the Synthesis segment expected to contribute >50% of revenue by 2030. It is a direct beneficiary of the ₹10,000 Cr Biopharma Shakti scheme.

- Gland Pharma: The world’s largest injectable CDMO with a 25% Adj. EBITDA margin. Its Cenexi (France) acquisition makes it a deeply integrated European player. It is expanding pen/cartridge capacity to 140 million units to meet diabetes drug demand.

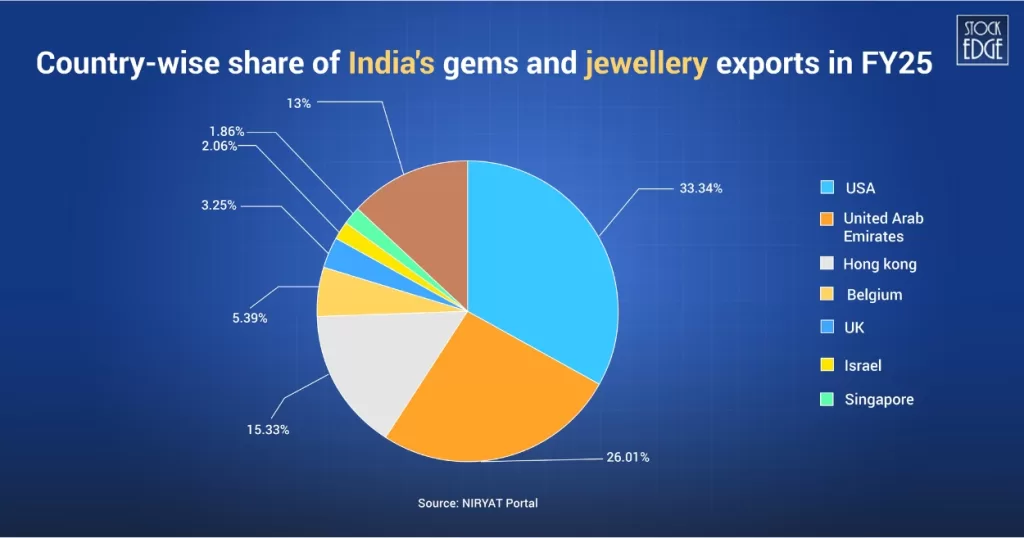

Gems & Jewellery

The India-EU FTA Investment Theme brings a structural shift for the gems and jewellery sector, with import duties on all jewellery categories reduced from 4% to 0%, effectively removing the primary cost barrier for Indian exporters in the European luxury market.

The agreement secures zero-duty access across 100% of trade value, covering diamonds, gold ornaments, silver jewellery, and lab-grown diamonds. This preferential access strategically positions India to potentially double bilateral trade to $10 billion within three years, leveraging the EU’s $79 billion jewellery import demand.

- Goldiam International: Lab-grown diamonds (LGDs) account for 90.5% of export revenue. Strategic “US origin casting” models minimize net tariff impacts while backward integration through Eco-Friendly Diamonds LLP secures raw materials.

- Titan Company: Secured duty-free access for over 99% of exports to the EU. Management targets $2 billion in watch sales by FY30, scaling the Tanishq and Zoya brands globally.

Agriculture & Marine

Tariffs on shrimp were slashed from 26% to 0%, opening a $53.6 billion seafood market. Immediate preferential access for Tea, Coffee, and Spices, neutralizing costs and boosting margins for Indian rural exporters. Even India’s agriculture exports have shown a strong upward trend, rising from around $33.3 billion in FY17 to over $51 billion in FY25.

Critical exclusions for Dairy, Cereals, and Poultry protect domestic farmers while pursuing export-led growth in other categories.

- Apex Frozen Foods: Doubling Ready-to-Eat (RTE) capacity to 10,000 MTPA. The company maintains an extremely low Net Debt-to-Equity of 0.05x, allowing for aggressive, non-dilutive growth.

Investment Framework: Identifying EU FTA Beneficiaries

To effectively participate in the EU-India FTA Investment Theme, investors must move beyond headlines and apply a structured, data-driven framework.

Policy announcements create excitement but only companies with the right operating leverage, export exposure, and execution capabilities can truly convert tariff advantages into sustained profit growth.

A disciplined framework should include the following parameters:

- Select companies with meaningful EU revenue exposure and export contribution exceeding 25% of total sales.

- Focus on sectors where tariff reductions materially improve cost competitiveness and margin potential.

- Evaluate capacity expansion plans and operational readiness to meet increased European demand.

- Prefer businesses with strong balance sheets, low leverage, and ROCE above 15%.

- Assess compliance strength with EU regulatory, ESG, and quality standards.

- Track management commentary, strategic positioning, and evidence of institutional participation.

It is important to recognize that not every export-oriented company will benefit equally. The real opportunity lies where tariff elimination aligns with operational preparedness and competitive strength.

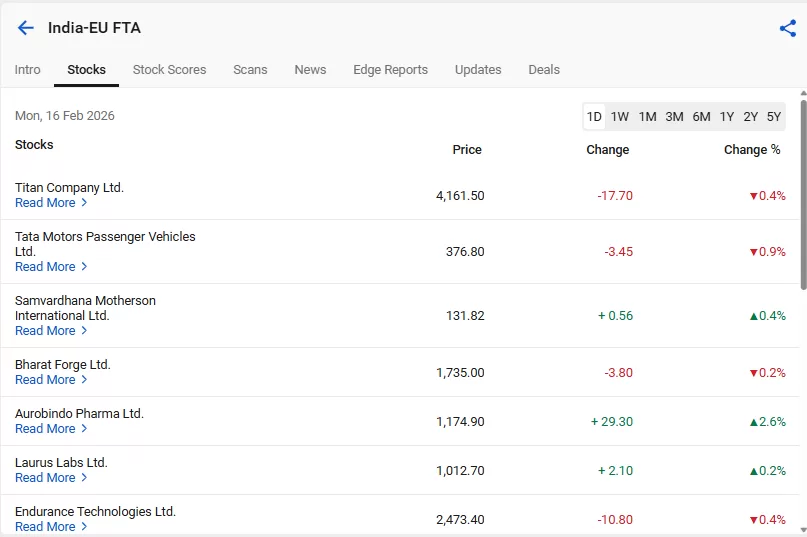

For a deeper and more structured analysis of companies positioned to benefit from this development, investors can explore the newly launched India-EU FTA Theme on StockEdge. The theme provides curated beneficiaries, sector-wise breakdowns, and data-backed screening tools to help investors evaluate opportunities with clarity and discipline.

Read: How US Tariffs Are Affecting The Indian Stock Market In 2026

Frequently Asked Questions (FAQs)

1. When will the India-EU FTA come into effect?

The Free Trade Agreement was finalized on January 27, 2026, and will come into force after formal ratification by India and the European Union. Implementation is expected in phases, with tariff reductions rolling out progressively.

2. How can investors benefit from the EU FTA theme?

Investors can benefit by focusing on export-driven sectors where tariff elimination improves competitiveness and margins, such as textiles, pharmaceuticals, engineering goods, marine products, and auto components.

3. How can investors identify EU FTA beneficiary stocks?

Look for companies with meaningful EU revenue exposure, export intensity above 25%, strong return ratios, low leverage, and capacity expansion aligned with European demand.