Table of Contents

Winter is coming! That means vacations are around the corner for the Christmas and New Year holidays. During this season, both domestic and international travellers around the globe visit incredible India to experience the rich cultural heritage of our country. India has a vast landscape, from beautiful mountains to sunny sea beaches, which attracted nearly 1.7 billion tourists in 2023. Moreover, the figures are most likely to increase in the coming years as India is now at the global forum in travel and tourism.

So, if more tourists and travellers are visiting India, they are more likely to stay in hotels during their holidays. Therefore, hotel stocks in India can be a good attraction for investors in the market. There is a legitimate growing demand for hotels and home-stays in India. There are plenty of hotel stocks in India, which can be good investment opportunities for investors in the long term, considering the trend and growth of the overall hotel industry.

What are hotel stocks in India?

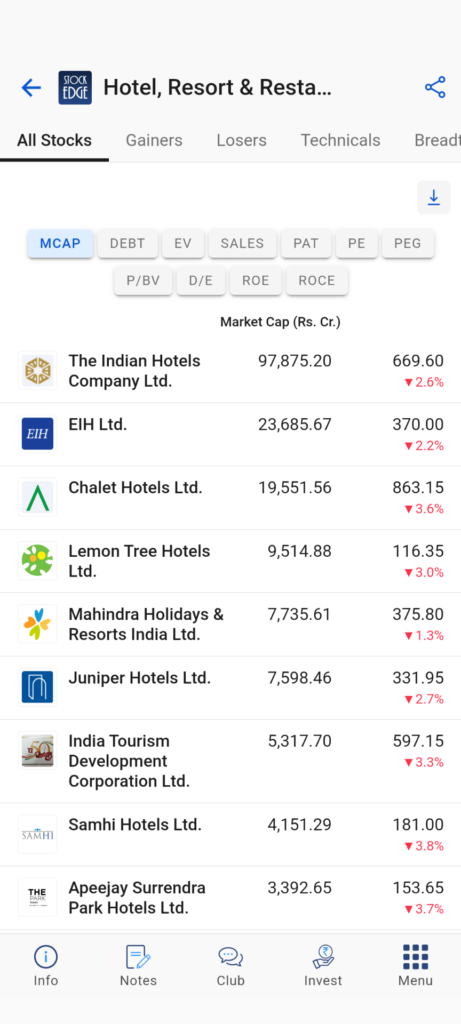

The businesses or listed companies which operate in the hospitality sector like hotels, resorts, and other accommodation are known as hotel stocks in India. At StockEdge, we have identified the list of hotel stocks in India and it has been categorized as an industry for Hotel, Resort & Restaurants.

As you can see, the list of hotel stocks in India are sorted based on market capitalization from highest to lowest. Moreover, if you wish to further analyze the different hotel stocks in India, you can compare them based on key financial figures like sales, PAT, PE ratio, ROE and ROCE of the different hotel stocks in India which are listed in the Indian stock market.

Hotel Industry Overview

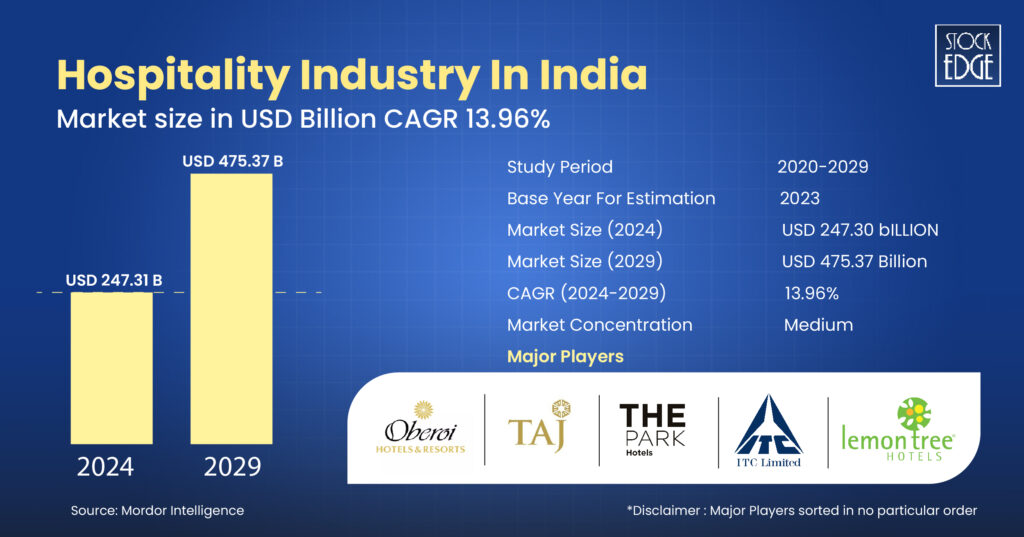

India’s hotel industry is a big contributor to its GDP and an essential element of its tourism sector. The diverse culture, rich heritage, historical landmarks, and growing urban hubs make it a popular destination for both domestic and international travellers. Thus, there is a strong demand for hospitality services like hotels, resorts, etc. As per a report by Mordor Intelligence, the hospitality industry in India has a market size of USD 247.31 billion in 2024, and it is expected to grow at a CAGR of 13.96% to reach USD 475.37 billion by 2029.

Highlights of Hotel Industry

- Diverse segment

India’s hotel market spans luxury, budget, boutique, and mid-range hotels, catering to a wide range of travelers—from high-end international tourists to budget-conscious domestic visitors.

- Domestic Tourism

The domestic travel industry is growing exponentially especially due to rise in disposable income and willingness for short staycation has triggered demand for more rooms and better amenities in the hotel industry.

- Expansion in Tier II and III Cities –

Traditionally, metro cities like Delhi, Mumbai, and Kolkata) have dominated the hotel market. However, in recent times, offbeat destinations in smaller cities have become the new travelling trend, which pushed hotels to grow rapidly in tier II and tier III cities. This expansion is due to urbanization, industrial development, and government initiatives promoting regional tourism.

Factors to consider before investing in Hotel Stocks in India

- Seasonal Demand

Do note that the hotel industry goes through several cycles throughout the year. The demand for hotels and accommodation are highly seasonal in nature and this can take a hit on the revenue and profitability of the company. Although hotels in India have the flexibility to charge more in case demand exceeds supply in certain seasons, there is a downside too, where they have to settle down at tamed prices for their rooms.

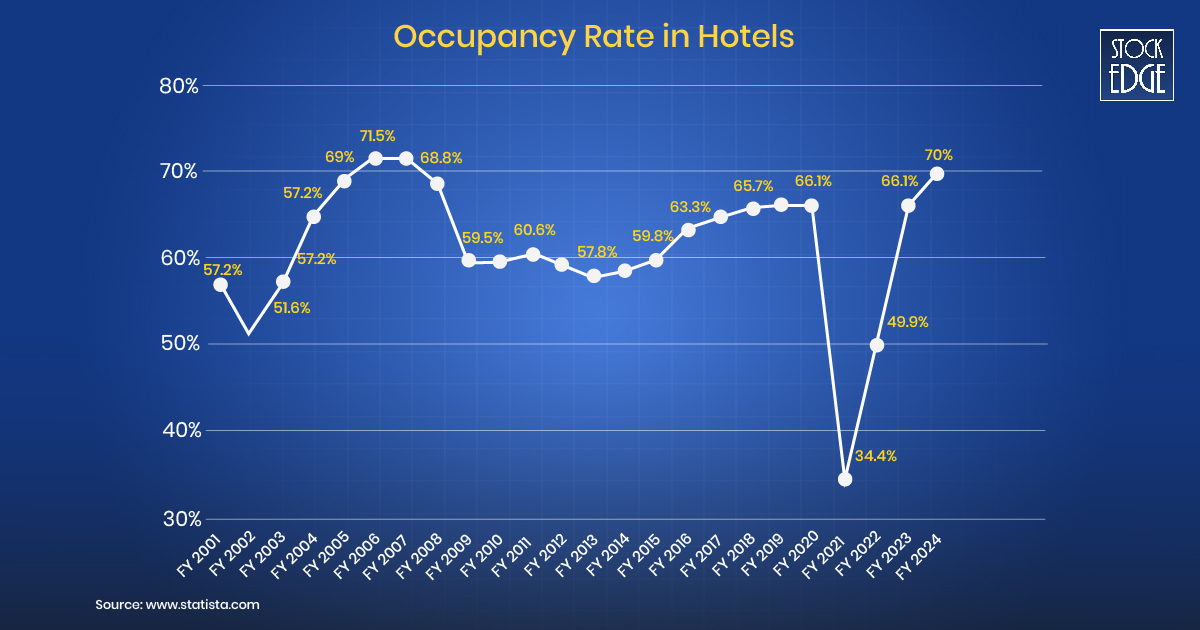

One such key indicator to measure the demand and revenue potential of best Hotel stocks in India is to keep a track of occupancy rate. It is basically the percentage of hotel rooms that are booked over a certain period. A higher rate means more rooms are filled. Here is an overview of occupancy rate in hotels in India from FY 2001 to 2023, with estimates of 2024.

Therefore, high and stable occupancy rates is generally a positive sign. Hotel stocks in India which have high occupancy rates in various seasons tend to perform better in the long run.

- Location & Diversity

For any hotel in India, a prime location is essential to attract the tourist. Hotels in major cities, tourist hubs, and business centers generally perform better, because of sustained demand throughout the year. Check if the company has properties in high-demand areas.

Additionally, portfolio diversification in hotel properties appeals to various segments of the market. Imagine a hotel company in India with a mix of budget, mid-range, and luxury hotels that can cater every segment of the market. This helps to withstand any economic shifts better.

- Brand Strength & Loyalty

An established hotel brand like ITC, Taj & Marriott usually has a loyal customer base and pricing power. These hotel brands effectively run loyalty programs and often retain customers, leading to steady occupancy rates. Identify the best hotel stocks in India, which have great brand loyalty.

- Government Policies & Regulations

Government policies affect the performance of hotel stocks in India to a large extent. First is taxation. India has the Goods and Services Tax (GST), which impacts hotel room prices, food out, and other services. They also promote domestic tourism by cutting GST rates and imposing high ones on visitors from overseas. After that comes infrastructure development (transportation and connectivity), indirectly improving the performance of hotel stocks in India and making destinations more accessible. New public transport, airports, and roads cause traveller traffic to flow toward places that could previously only be accessed by goat paths, which creates hotel demand.

- Financial Outlook

It is of great importance that you must check the company’s financial performance and health before investing in hotel stocks in India. Their financial performance can vary based on multiple factors like seasonal demand, government policies, etc. Therefore, you must track its financial performance over time in different seasonal cycles. This is a very important factor, and that is why, going forward in this blog, let’s analyze some of the stocks based on their financials that can be a good investment opportunity.

Now let’s identify top 3 hotel stocks in India which are good for investing in the long term.

Top 3 Hotel Stocks In India

1. The Indian Hotels Company Ltd.

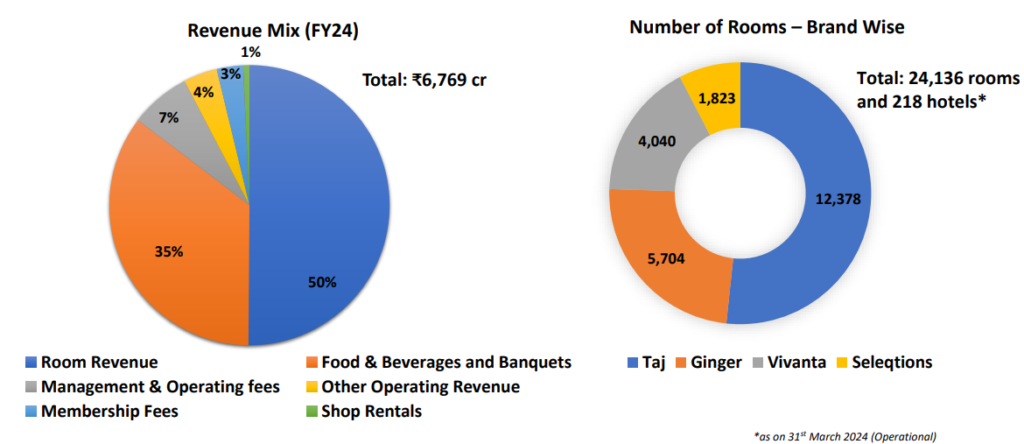

Did you know that the Indian Hotels Company is a TATA group of stocks? Yes, incorporated by the founder of the Tata Group, Jamsetji Tata, it opened its first hotel – The Taj Mahal Palace, in Bombay in 1903. Today, it is South Asia’s largest hospitality-focused enterprise with true Indian origins. Some of the largest hotel brands under (IHCL) are Taj, Vivanta, Seleqtions and Ginger Hotels. As of 31st March 2024, it has 218 hotels with a capacity of 24,136 rooms. Here is an overview of the revenue mix as of FY 24:

Now, let’s have a look at the company’s financial performance in the recent quarter of Q2 FY25. The company reported a 27% YoY jump in its revenue from operations, which stands at ₹1826 crores. The Net profit for Q2 FY 25 was ₹573 crore, which is approximately 258% increase YoY.

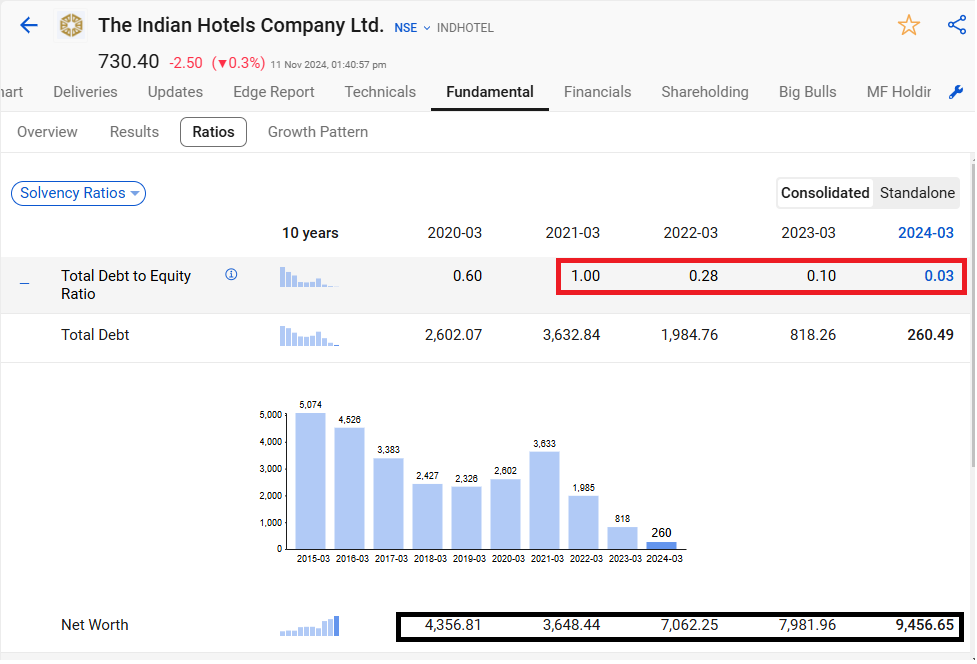

Also, the company has managed to reduce its debt and increase its net worth over the last few years. Its current debt-to-equity ratio is just 0.03, down from its peak of 1 in FY 2021 as you compare using StockEdge:

In the upcoming quarter, the company’s main focus could remain in brand evolution and strengthening of competitive advantages with prudent capital allocation to strategic opportunities along with focus on new business. The company targets to open ~25 new hotels in FY25 and 30 hotels in FY26 and with CAPEX guidance of 4%-5% of the revenue going forward.

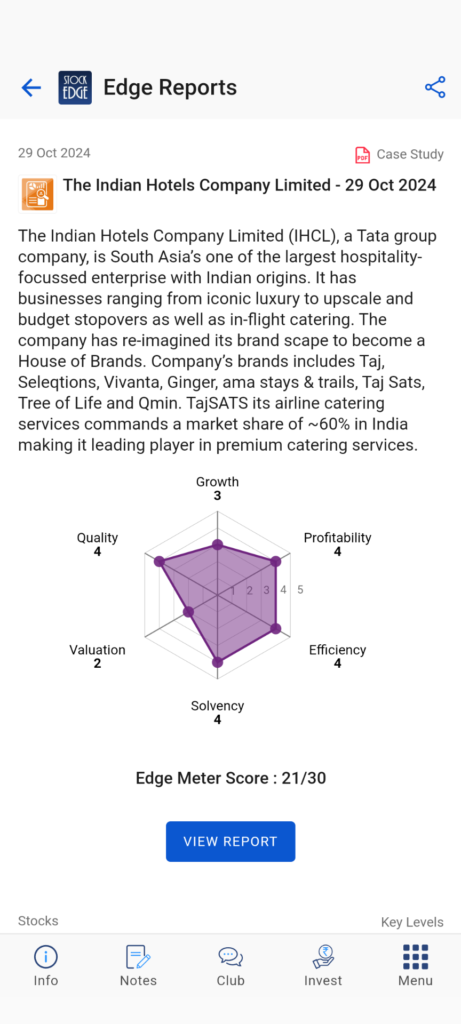

To know further details of the company’s financials and its performance, you can read our case study on The Indian Hotels Company Ltd. where our team of analysts prepared a detailed report on the company based on six major parameters which are growth, profitability, valuations, efficiency, quality and solvency. You can view the report here.

2. EIH Ltd.

Although the name EIH Ltd. may be unfamiliar to some, it operates two famous chains of luxury hotel brands, namely ‘The Oberoi Hotels’ and ‘Trident’ Back in 1949, the company was promoted and incorporated by Rai Bahadur Mohan Singh Oberoi. Today, the company owns and operates 29 hotels and 1 cruise line across the globe. (as per FY24) In addition to this, the company is also engaged in flight catering, airport restaurants, project management and corporate air charters.

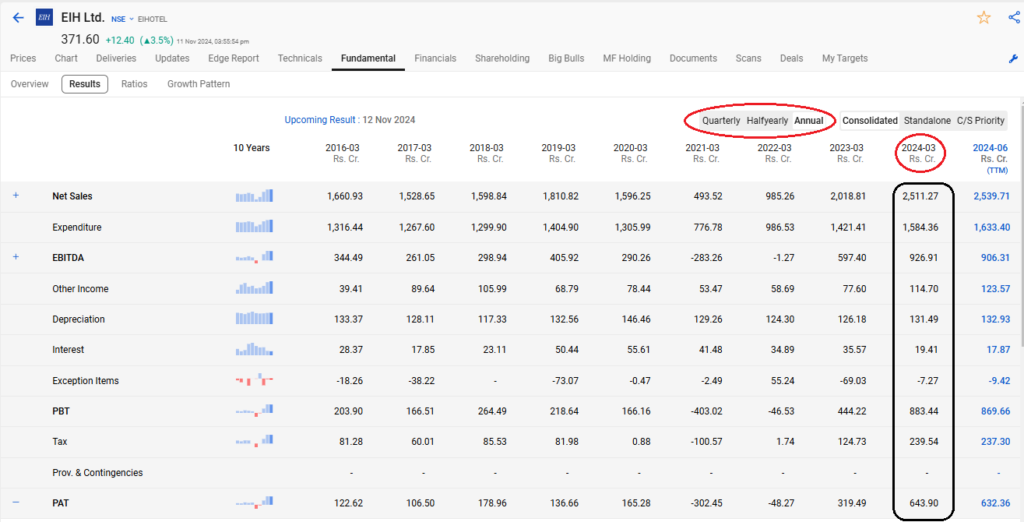

Now, let’s look at the company’s financial performance in FY 24. The company registered a turnover of ₹2,511.27 crore – registering a yearly growth of 24.39%. EBITDA for the period ended at ₹926.91 crore – registering a growth of 55.16% YoY. Profits stood at ₹643.90 crore – registering a growth of 101.54% YoY. You can analyze the company’s profit and loss statement using StockEdge, where you can view annual, quarterly and half-yearly results as well.

In terms of business highlights, the YoY occupancy rates and ARR for Trident Metro, Oberoi Metro, and other properties saw modest growth, while Oberoi Leisure and Trident Leisure reported declines. The occupancy rates during April, May, and June 2024 were 76%, 66%, and 69%, respectively.

The company remains optimistic about its future prospects, buoyed by anticipated growth in domestic tourism and corporate travel segments. However, as of the recent quarterly results announcement for Q2 FY25, the company gave a stellar performance with consolidated net sales growth by 13% YoY at ₹623 Crore and net profit climbed to ₹133 Crore marking 41% YoY growth. Therefore in the long term the company can be expected to be poised for high growth given its current financial performance and the overall travel and tourism sector growth in India.

3. Lemon Tree Hotels Ltd.

Lemon Tree Hotels is engaged in the business of developing, owning, acquiring, operating, managing, renovating and promoting hotels, motels, resorts, restaurants, etc. It is India’s largest hotel chain in the mid-priced segment having locations across metro regions, including the NCR, Bengaluru, Hyderabad, Mumbai, Kolkata and Chennai, as well as tier I and tier II cities such as Pune, Ahmedabad, Chandigarh, Jaipur, Indore, Aurangabad, Udaipur, Visakhapatnam, Kochi, Ludhiana, Thiruvananthapuram and Vijayawada.

Now, let’s look at financial performance in FY 24. The revenue for the year ended at INR 1071.12 crores, which witnessed a growth of 22.4% YoY. EBITDA for the year ended was INR 523.24 crores, which saw a growth of 16.91% YoY. EBITDA margins were recorded at 48.8%, which witnessed a decline of 230 bps YoY. PAT was at INR 181 crores, which saw a growth of 29.61% YoY. PAT margins stood at 13.86%, which saw a growth of 77 bps YoY.

At INR 293.8 crore, the cash profit for FY24 was up 24% YoY, signifying good operational cash flow and strong company financial health. Nonetheless, the company’s debt was INR 1,889.1 crore at the end of FY24, 8% higher compared to FY23. In addition, the debt-to-EBITDA ratio, which is an important credit metric, has improved from 3.83x to 3.57x due to the company’s own strategic investments and revenue growth.

In the end, Lemon Tree Hotels Limited reported staggering growth and solid financial performance in FY24, with significant improvements in key operational indicators. The company’s strategic expansion, which includes both owned and managed/franchised properties, as well as targeted restorations and enhancements, sets it up for future success.

The Bottom Line

Investing in Indian hotel stocks has long-term potential as the country’s tourism is growing, urbanization is happening, and the middle class is expanding. With domestic travel increasing and international visitors growing steadily, the hospitality industry is poised to grow. Government initiatives to boost tourism infrastructure and policy support for FDI will make it easier for hotel chains to expand. You may even check out one of our previous blog on Top 6 Tourism Stocks in India

Also, with digitalization and the shift towards branded hotels, Indian hospitality companies are getting more efficient and reaching more customers, which will lead to better profitability. While short-term volatility will come due to economic cycles and global events, the long-term outlook is strong, so Indian hotel stocks are a good choice for investors looking to invest in one of the fastest-growing economies and its tourism landscape.

Happy Investing!