Table of Contents

The company, which we know today as LTIMindtree, was two separate companies- L&T Infotech and Mindtree Ltd., both from the IT sector. Today, LTIMindtree is a global technology consulting and digital solutions company. Should you invest in LTIMindtree share?

In 2019, L&T acquired a 60% stake in Mindtree despite opposition from Mindtree’s founder and the board. This can be considered India’s first hostile takeover in the IT industry, as the promoters of Mindtree were not in a position to raise the finances. Later, in 2022, L&T decided to merge Mindtree and L&T Infotech (LTI) into a new entity, LTIMindtree.

In the meanwhile, shareholders of Mindtree will receive 73 shares of LTI in exchange for 100 shares of Mindtree. The integration of LTI and Mindtree has been completed and the companies have started operating under a unified system and processes from 1 April 2023.

A Larsen & Toubro Group company (holds 74% stake in the merged entity) combines the industry-acclaimed strengths of erstwhile Larsen and Toubro Infotech and Mindtree.

LTIMindtree shares have given a return of only 14% in the past 1 year. But with a recent change in management Ms. Shuchi Sarkar was appointed as the Chief Marketing Officer of the company on January 8, 2024. Can it deliver expected return for its shareholders or not?

In this blog, let’s analyze the fundamentals of LTIMindtree shares.

Company Overview

LTIMindtree is a technology consulting and services company that was created after the merger of Larsen & Toubro Infotech (LTI) and Mindtree. Specializing in digital transformation and innovation, LTIMindtree utilizes its expertise in cloud computing, data analytics, AI, and IoT to assist clients in overcoming complex business challenges and fostering growth. The company has a diverse clientele across various industries, and it provides customized end-to-end solutions tailored to meet specific requirements. Committed to excellence through collaboration and customer-centric approaches, LTIMindtree holds a prominent position in the competitive IT services industry landscape.

Moreover, it forms a component of the Nifty 50, which serves as India’s benchmark index. For further insights into Nifty 50 stocks, refer to articles such as “All About NIFTY50,” “Components of NIFTY50,” and “How to Invest in it.”

Financial Highlights of LTIMindtree shares

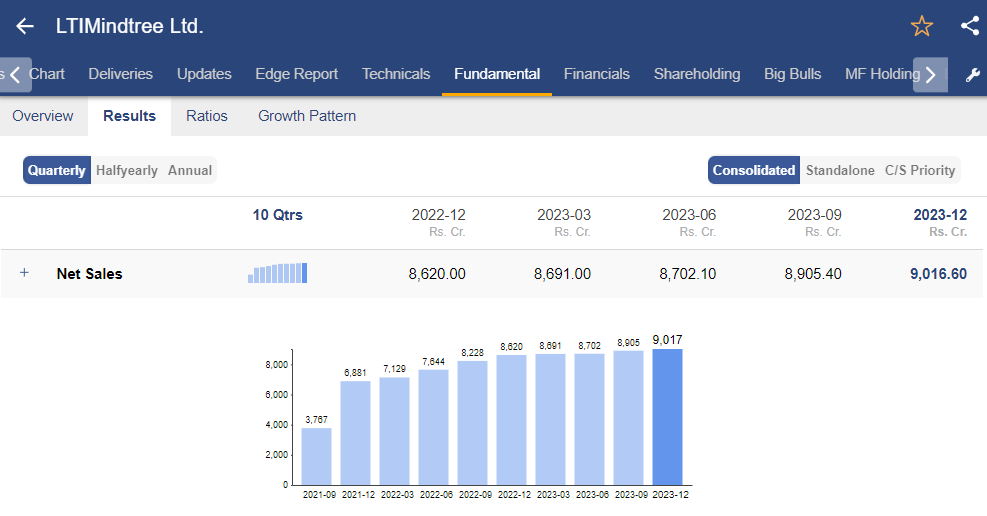

In the latest quarter, revenue or net sales increased by 4.6% YoY while net profit jumped 16.9% YoY. Despite higher than expected seasonal impact, the company reported robust results due to a strong order inflow.

You can view the quarterly financial statement of LTIMindtree from StockEdge.

Despite higher than expected seasonal impact, the company reported robust results due to a strong order inflow.

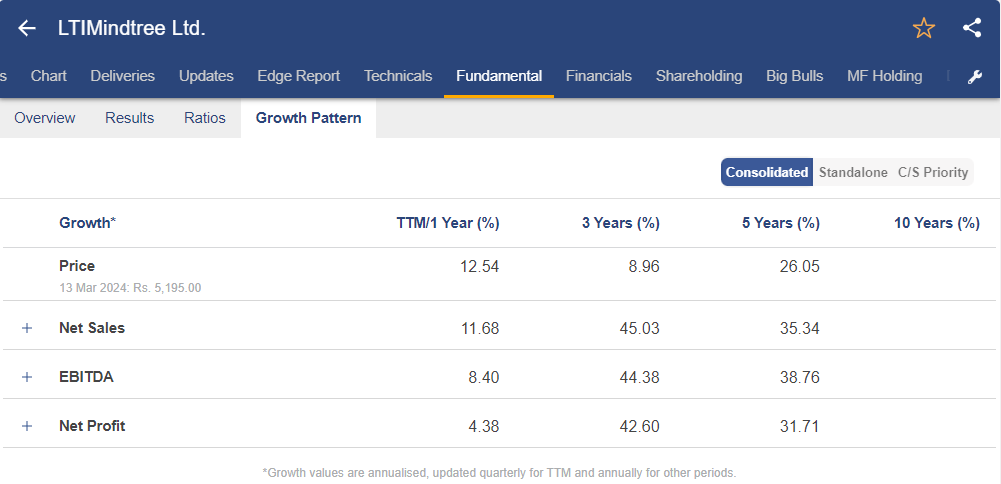

However in the past 5 years, the net sales of the company jumped by an impressive 35.34%, while EBITDA and net profit increased by 38.76% and 31.71% respectively.

The overall growth of the company was no doubt impressive. It is of utmost importance that the company should continue to grow, therefore the growth pattern of each company tells a different story which reflects in this share price.

Using StockEdge, you can view the overall growth pattern of any stock over several years as shown in the below image in case of LTIMindtree shares.

As you can see, the above image displays the growth pattern of LTIMindtree shares.

The EBIT margin in the Q3 FY24 decreased by 60 basis points compared to the previous quarter. Factors such as increased furloughs, fewer working days, and seasonal softness contributed to a margin decline of around 200 basis points. However, this was partially mitigated by an 80 basis point improvement in SG&A costs and a 60 basis point gain from operational efficiencies.

You can view the EBIT margins of LTIMindtree shares from StockEdge, as shown in the image below:

Financial Updates for Q3 FY24:

- The return on equity (RoE) in Q3 FY24 was 26.6%, marginally down from 26.9% in Q2 FY24.

- The operating cash flow to PAT ratio stood at 155.7% in Q3 FY24 v/s 92.1% in Q2 FY24 due to stronger collections.

- The total order inflow during Q3 FY24 was $1.5 billion, up by 21% YoY.

- High attrition rates can be a concern for IT companies as they can lead to increased recruitment costs, loss of expertise and knowledge, decreased productivity, and potentially negative impacts on company morale and culture. As per a survey by Deloitte, there is a 15.5% average attrition rate in 2023, whereas LTIMindtree has a 14.2% attrition rate as of Q3FY24.

SWOT analysis of LTIMindtree shares:

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strengths

Post-merger, it has become the fifth largest IT company in India on a market capitalization basis. This is likely to scale up its client base, complement product offerings and aid in the diversification of geographies, verticals and customers. Thus leading to an improved overall business risk profile. The combined entity is also likely to benefit from a larger balance sheet size. As of 31st December 2023, the total number of active clients for the quarter stood at 739. Thus ensuring steady revenue visibility.

Weaknesses

North America contributed 71.9% to the revenue in FY23. Any regulatory changes in the region could have bearing on the operations.

Opportunities

The company guided for double-digit revenue growth in FY24. It is looking to achieve EBIT of 17%-18% going forward but expects the recovery in the margins to be gradual.

The complementary, vertical presence is one of the key long-term benefits for the combined entity. The merger is likely to provide significant synergies in regard to scaling its revenue, cost & operational efficiencies. The enhanced scale will create cross-sell and up-sell opportunities. It will also provide a competitive advantage while participating in large deals.The increase in scalability is also likely to help the merged company to have the ability to bid for larger deals. It will have good cross-sell and up-sell opportunities, with a base of over 700 clients.The overall deal pipeline is ~ $4.6 billion, and it’s about 30% up from the same time last year.

In Q3 FY24, it recorded a $1.5 billion order book, which is on the back of the deal wins. Thus providing revenue visibility. It has made significant investment and progress in Generative AI, launching its Gen AI platform.

Threats

Demand environment continues to remain volatile on the back of high inflation and geopolitical issues, especially in markets like the US and Europe. This is likely to have some impact on client spending in FY24. Rupee appreciation or/and adverse cross-currency movements.

The Bottom Line

The merged entities are likely to witness synergistic benefits arising out of diversified portfolio, presence of complementary verticals, access to larger deals and larger scale of operations. This is not only going to lead to improved topline growth but is also likely to aid in margin expansion in the long run.

However, there is softness being witnessed in the discretionary demand in the IT industry. This indicates weak volumes and may lead to muted growth. Also, companies may resort to subcontractor substitution and thinning of the bench to improve their margin performance.

This muted demand environment especially in its largest vertical, BFSI, which continues due to face delay in decision making, could make it difficult for the company to achieve its revenue and EBIT guidance. Thus, it remains monitorable.

Attrition is witnessing a decline. For Q3 FY24, it was 14.2% vs. 22.3% in Q3 FY23 and 15.2% in Q2 FY24. However, the trend remains monitorable.

We maintain a cautiously positive outlook on the company over the medium term. While maintaining a positive stance for the long term.

Apart from LTIMindtree share, there are other opportunities for investment in the Indian IT sector companies. One such stock that may turn out to be a valuable investment opportunity. Find out in this blog; TCS Stock Analysis: Is it a Good Investment in 2024?

Happy Investing!