Key Takeaways

- Why Bank Nifty Matters:Bank Nifty tracks the performance of the top 12‑15 banking stocks listed on NSE, serving as a barometer of India’s financial health.

- Eligibility & Constitution Criteria:Candidates must be from the banking sector, trade actively in Futures & Options, and have solid free‑float market cap and liquidity.

- How Bank Nifty is Rebalanced: The index is weighted by free‑float market capitalisation. Every six months, typically June and December, constituent weights are adjusted based on rising or falling liquidity and market cap, keeping the index aligned with current fundamentals.

- Offers Diversified Bank Specific Exposure: By investing in Bank Nifty, you gain exposure to a cross-section of India’s banking sector from public giants to strong private players without the need to pick individual stocks.

Table of Contents

What is Bank Nifty?

The Bank Nifty, officially known as the Nifty Bank Index, is a sectoral index managed by the National Stock Exchange (NSE). It comprises 12 of the most liquid and large-cap banking stocks listed on the NSE. Introduced in 2003, it provides a benchmark for the performance of Indian banking companies, including both public and private sector banks.

The Bank Nifty is widely used for benchmarking portfolios, sectoral analysis, and trading via derivatives such as futures and options. It provides global investors with a clear view of India’s banking sector’s financial health by reflecting the overall performance, whether positive or negative, of banking stocks, serving as a reliable indicator of how these banks are likely to perform in the stock market.

Composition of Bank Nifty

The composition of the Bank Nifty is periodically revised based on predefined criteria, including liquidity, free-float market capitalisation, and sector representation.

List of Bank Nifty Companies and their Weightage as of 30th May 2025

View the list of Bank Nifty Companies and their latest price

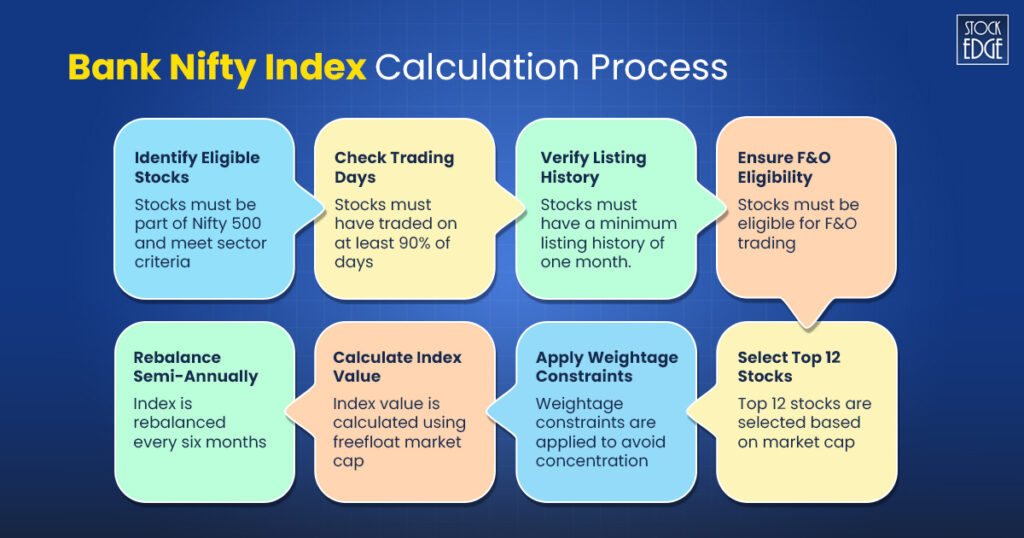

How is Bank Nifty Calculated?

The Bank Nifty index is computed using the free-float market capitalisation methodology. This means only the shares readily available for trading in the market are considered, excluding promoter holdings and other locked-in shares.

Calculation Formula:

Bank Nifty Value = (Current Free Float Market Cap of Index / Base Market Cap) × Base Index Value

Eligibility Criteria for Selection of Constituent Stocks:

A strict set of eligibility guidelines governs the Bank Nifty Index to ensure it includes only the most relevant, liquid, and investable banking stocks in India. The selection criteria are as follows:

- Companies must be part of the Nifty 500 index. If fewer than 10 eligible banking stocks are available in the Nifty 500, the remaining stocks are selected from the top 800 companies based on:

- Average daily turnover, and

- Average daily full market capitalisation over the previous six months.

- Companies must belong to the Banking sector as classified by NSE.

- Stocks must have traded on at least 90% of trading days in the preceding six months to ensure high liquidity.

- The company must have a minimum listing history of one month as of the index review cutoff date (January 31 or July 31).

- Only stocks that are eligible for trading in the Futures & Options (F&O) segment are considered for inclusion.

- The top 12 companies are selected based on their free-float market capitalisation among the eligible banking stocks.

- Weightage constraints are applied to avoid over-concentration:

- No single stock can have a weight exceeding 33%.

- The combined weight of the top 3 stocks must not exceed 62% of the index.

- The Bank Nifty index is rebalanced semi-annually, with reviews conducted in January and July, using six months of historical data.

Benefits of Investing in Bank Nifty

The Bank Nifty Index offers a range of strategic benefits, making it one of the most valuable tools for both investors and traders in India’s equity markets. By capturing the performance of the most influential banks in the country, the index provides not only exposure to the sector but also opportunities for tactical trading, benchmarking, and portfolio diversification. Here’s a closer look at the key advantages of investing in or trading Bank Nifty:

1. Diversification and Sectoral Exposure

The Bank Nifty comprises a mix of leading private and public sector banks, offering a broad exposure to the Indian banking industry. Investors gain access to multiple banks through a single instrument, thereby helping to diversify risk. This diversification protects against the underperformance of any one particular bank.

It allows participation in the overall growth trajectory of the banking sector, which is closely tied to economic expansion, credit cycles, and digital financial inclusion.

2. High Liquidity and Efficient Trading

Bank Nifty is composed of highly liquid banking stocks, all of which are part of the Futures and Options (F&O) segment. The index enjoys deep liquidity, both in its underlying stocks and in its derivative instruments.

Liquidity plays a crucial role in a trader’s success, especially for those involved in intraday and derivatives trading. High liquidity ensures that buy and sell orders are executed quickly, with minimal slippage and tighter bid-ask spreads, which in turn reduces trading costs and improves price efficiency. This allows traders to enter and exit positions seamlessly, even in large volumes.

The Bank Nifty index, comprising the most actively traded banking stocks like HDFC Bank, ICICI Bank, and SBI, offers this high level of liquidity. All its constituents are part of the Futures and Options (F&O) segment, which further enhances market depth and ensures smooth and efficient trading for market participants.

3. Volatility and Intraday Trading Potential

Bank Nifty, known for its high volatility, is widely followed by intraday and swing traders. The index often shows sharper price movements compared to the Nifty 50, due to the banking sector’s sensitivity to economic and policy developments. This volatility creates numerous trading opportunities, as it allows traders to capitalize on short-term price swings. The frequent fluctuations enable quick profit-making as well as strategic entry and exit positioning.

Volatility presents ample trading opportunities, particularly around key events such as Reserve Bank of India (RBI) policy announcements, bank earnings, or the release of macroeconomic data.

4. Access to Leverage through Derivatives

The Bank Nifty facilitates active trading through futures and options, allowing for exposure to larger positions with relatively lower capital requirements. While leverage amplifies potential returns, it also increases risk, making it suitable for experienced and disciplined traders who can manage it effectively.

5. Benchmark for Sectoral Performance

Bank Nifty is the standard benchmark for evaluating the performance of mutual funds, ETFs, and portfolio strategies focused on the banking sector.

Fund managers compare their returns to Bank Nifty to measure alpha (outperformance). Analysts and investors use the index to track the health and momentum of the Indian banking space. It provides a transparent, rules-based reference point for monitoring investment performance.

6. Hedging and Speculative Utility

Bank Nifty derivatives are actively used for risk management and speculation. Traders and institutions use options contracts to hedge long-term equity exposure or open positions. The availability of weekly and monthly expiries offers flexibility in structuring short- and medium-term hedging strategies.

The same instruments are also leveraged by speculators betting on market direction, shifts in volatility, or macroeconomic outcomes.

7. Sectoral Breadth and Macro Sensitivity

It comprises both private sector innovators (e.g., HDFC Bank, ICICI Bank) and public sector institutions (e.g., SBI), thereby creating a balanced sectoral profile. The index responds to key economic indicators, including interest rate changes, inflation data, and monetary policy, making it a strong proxy for broader economic sentiment.

Bank Nifty vs. Nifty 50

After understanding all about Bank Nifty. Now, let’s check out how it differs from the Nifty 50.

| Basis | Nifty | Bank Nifty |

| Meaning | Nifty is a group comprising the top 50 companies from various sectors in India’s stock market. | Bank Nifty is a group of the top 12 banks listed on India’s stock market. |

| Composition | Nifty includes companies from various industries, such as technology, healthcare, and manufacturing. | The Bank Nifty is a sectoral index that only includes banks, focusing solely on the banking sector. |

| Diversification | Nifty spreads risk because it encompasses a diverse range of companies. | Bank Nifty doesn’t spread out risk because it’s only banks. |

| Benchmark Index | The Nifty reflects the overall performance of the entire stock market. | The Bank Nifty indicates the performance of banks. |

| Volatility | Nifty doesn’t change too quickly because it comprises a large number of different companies. | The Bank Nifty can experience significant changes because it is primarily composed of bank stocks. |

To know about Nifty 50, read our blog All About NIFTY50, Components of NIFTY50, and How to Invest in it.

Conclusion

For serious market participants, Nifty Bank is more than just an index—it’s a strategy in itself. Whether you want to trade on momentum, hedge portfolio risk, or invest in India’s financial backbone, Bank Nifty offers precision, liquidity, and performance.

However, with high rewards come high risks. Its volatility, driven by interest rate cycles, credit growth, and regulatory actions, demands diligent monitoring. Yet for the informed trader or investor, Bank Nifty remains an unmatched tool in India’s financial markets.

Frequently Asked Questions

What is Bank Nifty expiry?

Nifty Bank futures or options contracts expire on the last Thursday of the expiry period. If last Thursday is a trading holiday, the contracts expire on the previous trading day.

What is Bank Nifty future?

A futures contract is traded on an Exchange. Nifty Bank futures Contract would be based on the BANK NIFTY index. The NSE defines the characteristics of the futures contract, including the underlying index, market lot, and maturity date of the contract. Futures contracts are available for trading from the introduction date to the expiry date.

How many Banks are included in Bank Nifty?

The Nifty Bank index comprises a maximum of 12 stocks. It is selected based on free-float market capitalisation, liquidity, F&O eligibility and many other factors.