Table of Contents

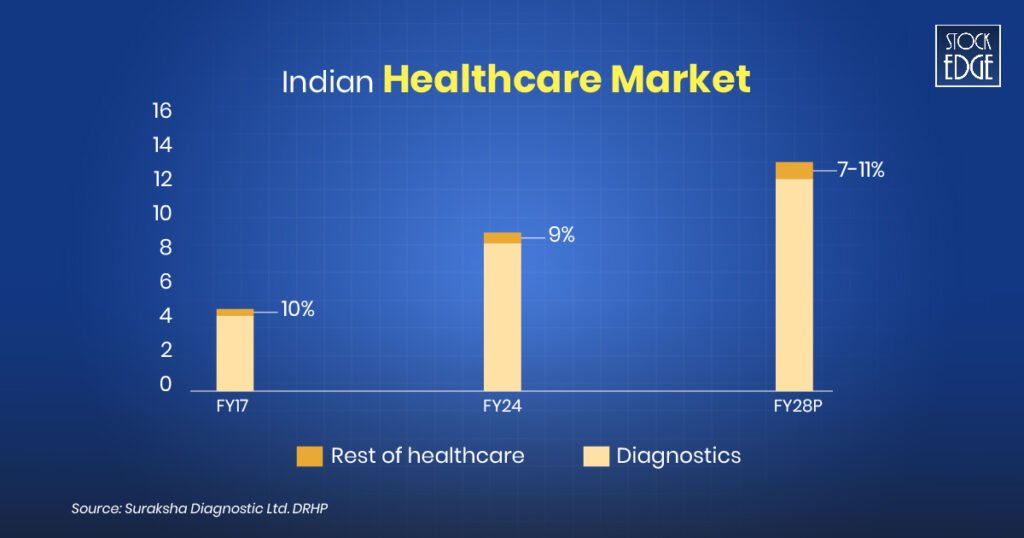

India’s fast-growing healthcare industry has become one of the leading contributors to the economy. The healthcare industry grew at 10-11% CAGR between FY17 and FY24 to ~Rs 9.5-10.5 trillion. By FY28, the industry is expected to grow to Rs 14.5-15.5 trillion, at a CAGR of 10-11%, driven by factors such as an ageing population, increased incidence of lifestyle diseases, growing healthcare awareness, technology adoption and a growing affluent middle class.

Suraksha Diagnostic Limited, a prominent player in Eastern India’s diagnostic landscape, is now stepping into the market with its Initial Public Offering (IPO).

In this blog, you will dive deep into Suraksha Diagnostic IPO details, its market position, financial performance, and the factors that make it an attractive investment.

Suraksha Diagnostic IPO is open for subscription from (19th Nov 2024) today onwards!

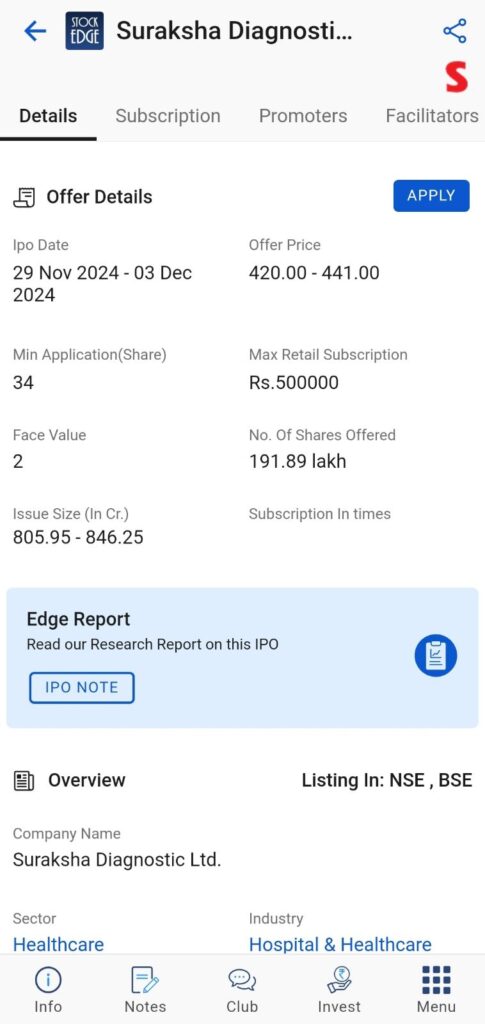

Suraksha Diagnostic IPO Details:

- IPO Open Date 29th November 2024, Friday

- IPO Close Date 3rd December 2024, Tuesday

- Price Band ₹420 to ₹441 per share

- Lot Size 34 shares

- Face Value ₹2 per share

- Issue Size at upper price band ₹846 crore (Offer for Sale ₹846 crore)

- Listing exchanges NSE, BSE

- Cut-off time for UPI mandate confirmation by 5 PM on December 03, 2024

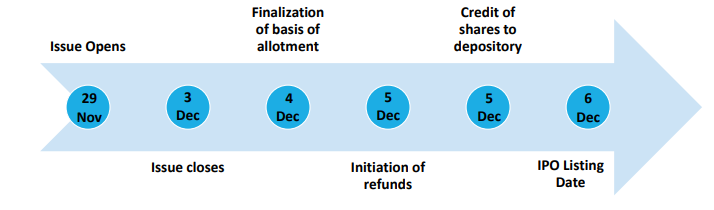

The tentative timeline for the Suraksha Diagnostic IPO is as follows:

- Basis of Allotment 04th December 2024, Wednesday

- Initiation of Refunds (if not allotted) 05th December 2024, Thursday

- Credit of Shares to Demat (if gets allotments of shares) 05th December 2024, Thursday

- Listing Date 06th December 2024, Friday

About the Company

Suraksha Diagnostic Limited is an integrated diagnostic service provider specializing in pathology and radiology testing, as well as medical consultation services. The company has established a robust operational network across key regions in India, including West Bengal, Bihar, Assam, and Meghalaya. As of June 2024, Suraksha operates a vast network of diagnostic centres and laboratories, with 13 hub centres, 11 medium-sized centres, and 23 small centres. Suraksha offers an extensive range of over 2,300 diagnostic tests, including routine pathology tests, advanced radiology procedures like MRIs and CT scans, and a growing range of medical consultations. The company operates on a hub-and-spoke model that optimizes its resources and allows for scalable growth. Approximately 94% of its revenue comes from the B2C segment, including individual patients who walk in or use home collection services.

The company’s diagnostic centres are primarily situated in the urban areas of Kolkata. Leveraging their established brand equity, they plan to expand their operations into the suburban regions of Greater Kolkata. However, the company holds a market share of ~1% in the Eastern region, which is lower than that of its competitors, indicating significant growth potential in its core geographies.

The company plans to expand its medical consultation services through polyclinic chambers at its diagnostic centres to drive revenue by cross-selling diagnostic services. This strategy aims to increase footfalls, tests per patient, and average revenue per patient. The expansion will involve adding more polyclinics to existing centres and increasing the number and specialities of affiliated doctors.

The company has reported a CAGR of ~21% in terms of non-COVID revenues between FY22-FY24. However, for FY24, this growth rate moderated to around 15% YoY, which the company expects to maintain going forward. One of the key factors behind this outlook is the post-COVID shift in consumer behaviour, where people have become more discerning about branded diagnostics. This trend has led the company to remain optimistic about sustaining or even increasing its growth rate in the future.

Sector Outlook in India

The Indian diagnostic industry, valued at ₹1323 billion in FY24, is expected to grow at a CAGR of 10-12%. They play a pivotal role in recommending essential treatments and monitoring the recovery of patients post-treatment. Overall, increased focus on preventative medicine, rising incidence of chronic and lifestyle diseases, a growing preference for evidence-based treatment, the changing nature of diseases, expansion of organised healthcare and increased use of technology in healthcare are set to drive the Indian diagnostics services industry’s growth. The Indian diagnostics industry is highly fragmented, given the high proportion of standalone centres and hospital labs occupying a smaller share of the pie. Amongst the diagnostic chains, regional dominates the sector. There has been a shift towards these chains due to their superior service quality and the absence of complex tests at standalone centres. In the diagnostic services industry, the B2C segment, which includes direct customers or patients, offers higher brand visibility and fosters repeat customer relationships. The B2B segment consists of healthcare institutions such as hospitals, doctors, and corporate bodies. However, in recent years, diagnostic chains have increasingly focused on the B2C segment due to shifting consumer preferences, technological advancements and a growing emphasis on preventive healthcare.

Now let’s look at the Suraksha Diagnostic IPO

Financial Highlights

Despite challenges posed by the post-COVID shift in healthcare demand, Suraksha Diagnostic has maintained steady growth. The FY24 revenue was ₹219 crore, reflecting a 15% year-over-year increase. The EBITDA margin also improved to 32% in FY24 from 23.1% in FY23, signifying operational efficiency. Approximately 94% of the revenue stems from the high-margin B2C segment. The Indian diagnostic services market is highly fragmented, with standalone centres and hospital labs comprising a large portion of the sector. However, diagnostic chains like Suraksha are increasingly gaining market share due to their higher service quality and more advanced testing capabilities. Suraksha Diagnostic IPO competes with other key players like Dr Lal PathLabs Ltd., Metropolis Healthcare Ltd., Thyrocare Technologies Ltd., and Vijaya Diagnostic Centre Ltd., which have a national presence. At the same time, Suraksha is focused on dominating the Eastern market.

Suraksha’s focus is regionally concentrated, with its revenue driven mainly by operations in West Bengal and surrounding regions. At the same time, Dr Lal PathLabs and Metropolis Healthcare operate on a pan-India scale with international footprints. Suraksha’s revenue per patient stands out at ₹1,922 and holds a modest 1.2% market share in its region, which indicates significant growth potential in a market that is expected to grow at a CAGR of 10%-12%. The company’s competitive edge lies in its strong brand presence, extensive operational network, and comprehensive test offerings.

To know more about Suraksha Diagnostic IPO’s financial performance and SWOT Analysis, check out our Edge Report.

Objectives of the Issue

The objectives of Suraksha Diagnostics IPO are to provide an exit opportunity for existing shareholders through an ₹846 crore Offer for Sale (OFS), enhance brand visibility and market credibility, and support future growth plans indirectly by improving fundraising capabilities post-listing. The IPO also aims to attract and retain top talent through equity-linked incentives, aligning with the company’s expansion strategy in the diagnostic healthcare market.

Now let’s look at the risk factors of Suraksha Diagnostic IPO

Risk Factors

While the prospects are promising, investors should be aware of certain risks. Below are the Suraksha Diagnostic IPO risk factors:

- Geographical concentration: West Bengal accounts for about 95% of revenue, suggesting problems if the region slows down.

- High Valuation: With a price-to-earnings (P/E) ratio of 99.3x, the valuation is greater than peers.

- Dependence on third parties: The reliance on external vendors for equipment and reagents increases operational risk.

Should you subscribe to Suraksha Diagnostic IPO?

Investment Considerations

Currently, the company operates 49 diagnostic centres, with plans to expand this number to ~100 over the next three years. Their primary focus will be on West Bengal (with ~80% of the planned centres), where there are still several districts left to be covered, while also reaching out to the rural population through their channel network. Suraksha Diagnostic IPO provides a unique opportunity to get involved in the Eastern India healthcare sector’s growth story. With a strong diagnostics foundation and ambitious expansion goals, the company is well-positioned to benefit from the industry’s changing dynamics. However, this investment, like all others, carries certain dangers. Before making a selection, conduct a thorough review of the financials, industry trends, and peer benchmarks.

In this blog post, we’ve reviewed the benefits and potential drawbacks of investing in the Suraksha Diagnostics IPO. StockEdge’s panel of experts has rated the IPO as Average, providing a balanced perspective for investors. Additionally, we’ve compiled a comprehensive IPO Note featuring an in-depth analysis of the Suraksha Diagnostic IPO’s financials and a detailed SWOT analysis to give you a clearer picture of its prospects.

For more insights, check out our blog on the Top 5 Upcoming IPOs in India.

Don’t forget to explore the IPO section under the StockEdge Explore tab, where you’ll find a curated list of upcoming IPOs, as well as ongoing and recently listed IPOs.

Are you looking for personalized investment advice?

Join the StockEdge Club, where our expert research analysts are ready to address all your queries related to IPOs, trading, and investments.

Happy investing!