Key Takeaways

- Quick pattern discovery: StockEdge Candlestick Scans instantly identify stocks forming important candlestick patterns, removing the need to manually scan hundreds of charts.

- Clear pattern-based categorisation: Candlestick scans are neatly organised into Bullish, Bearish, Neutral, Reversal, and Continuation categories, making it easy to match scans with your trading strategy.

- Market psychology made visible: Each candlestick pattern reflects buyer strength, seller pressure, or market indecision, helping traders better understand price action.

- Data-backed end-of-day signals: All candlestick scans are generated using actual end-of-day market data, ensuring consistent and reliable pattern identification.

- Best used with confirmations: Candlestick scans work most effectively when combined with volume, trend direction, indicators, and support-resistance levels for more confident trades.

Candlestick patterns have been at the heart of price-action trading for decades. They help traders decode market psychology, identify reversals, and spot high-probability setups. But manually scanning hundreds of charts for these patterns daily is difficult.

This is where StockEdge Candlestick Scans become game changers. They convert complex chart reading into ready-to-use trading insights by scanning the entire market and highlighting stocks that triggered important patterns based on actual end-of-day market data.

In this blog, we will discuss these candlestick scans and how to use them

What Are Candlestick Scans in StockEdge?

StockEdge Candlestick Scans are pre-built screeners that identify bullish, bearish, or neutral candlestick patterns across all NSE stocks. These scans use end-of-day market data to detect patterns.

Instead of going through 500+ charts manually, StockEdge highlights the exact stocks where the pattern has appeared, helping you quickly shortlist potential trade setups.

Why Traders Use Candlestick Scans?

Candlestick scans help traders quickly identify meaningful price patterns without manually inspecting hundreds of charts. Here’s why they’re widely used:

1. Quick Identification of Trading Opportunities

Instead of reviewing every stock or asset individually, scans instantly highlight those forming important candlestick patterns. This saves time and helps traders focus only on potential trade setups.

2. Spotting Market Reversal Signals

Many candlestick patterns indicate a trend reversal. Scans allow traders to detect these patterns the moment they form.

- Bullish reversals (Hammer, Morning Star, Bullish Engulfing) indicate that buyers are taking control after a downtrend.

- Bearish reversals (Hanging Man, Evening Star, Bearish Engulfing) suggest sellers are dominating after an uptrend.

3. Finding Trend Continuation Patterns

Scans can also identify continuation patterns that signal a pause before the trend resumes (like Rising Three Methods). This helps traders confidently enter or add to positions.

4. Understanding Market Sentiment

Candlesticks reflect trader psychology, fear, greed, and indecision. Scans flag patterns that reveal this sentiment:

- Bullish candlesticks suggest strong buying interest

- Bearish candlesticks indicate strong selling pressure

- Neutral candlesticks show indecisiveness in the market.

5. Strengthening Trade Confirmation

Candlestick scans can be combined with technical indicators (RSI, Moving Averages, MACD). When a pattern aligns with indicator signals, the trade setup becomes more reliable.

Candlestick scans streamline technical analysis, help traders uncover high-quality setups faster, and provide deeper insight into price action and market psychology, something manual chart-checking simply can’t match.

How to Use Candlestick Scans in StockEdge?

Now, let’s understand how to use candlestick scans in StockEdge

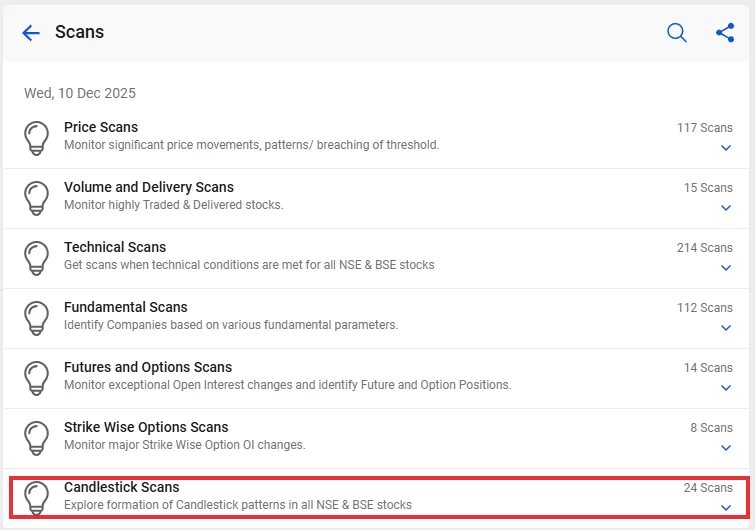

1. Go to Scan Section

Jump straight to: web.stockedge.com/scan-groups

Once you’re there, explore the list of scan categories and click on Candlestick Scans.

2. Pick the Pattern You Want to Track

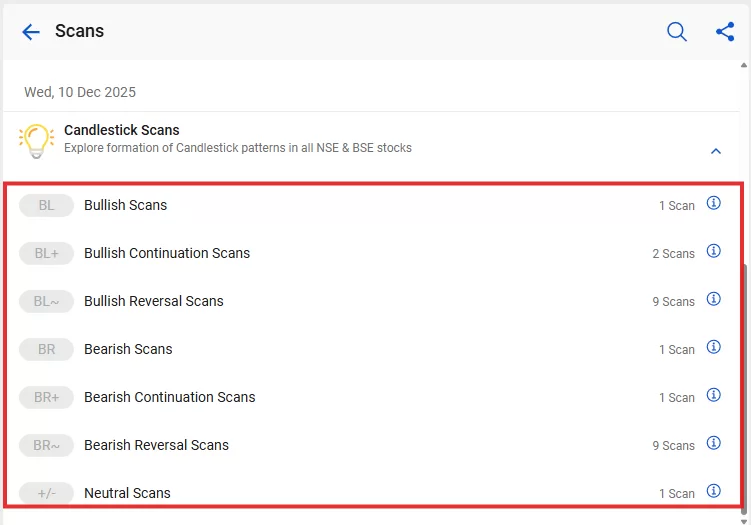

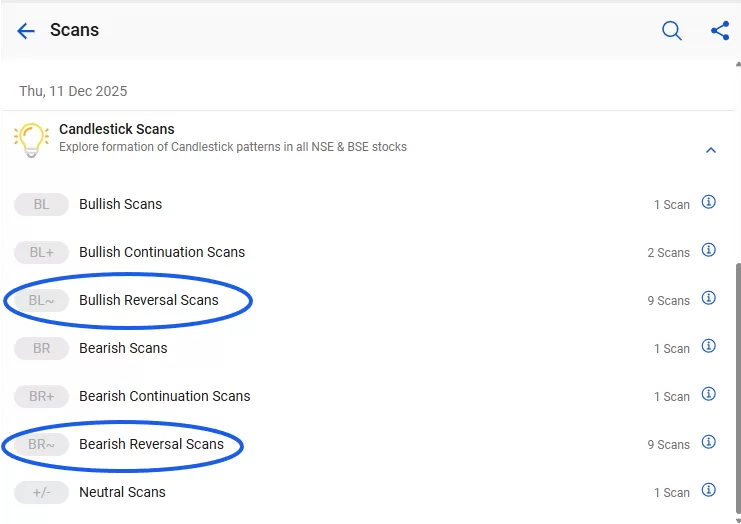

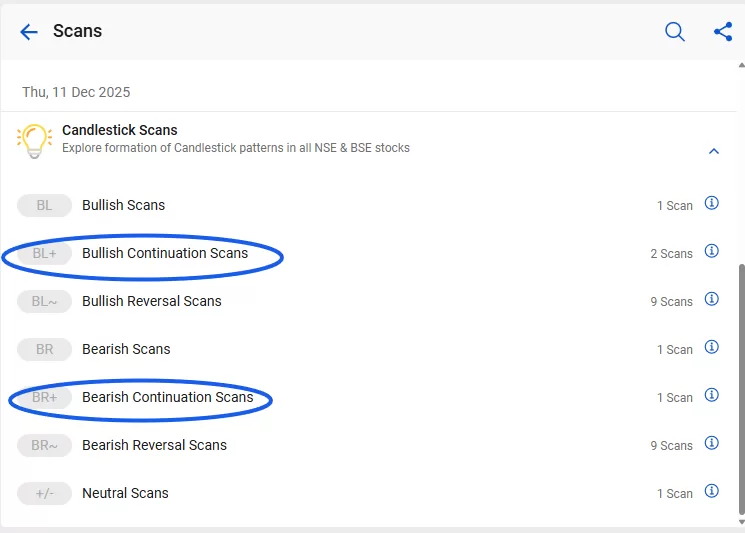

StockEdge organizes candlestick scans into clear, easy-to-understand groups, so you can focus on what actually matters to you:

- Bullish Scans: Identify potential upward price movements.

- Bearish Scans: Identify potential downward price movements.

- Continuation Scans: Look for existing trends to continue.

- Reversal Scans: Look for potential changes in current trends.

- Neutral Scans: Identify stocks that show indecisiveness in the market.

Choose the category that aligns with your trading strategy, and StockEdge will instantly show you all stocks forming that pattern.

Let’s understand this scan step-by-step:

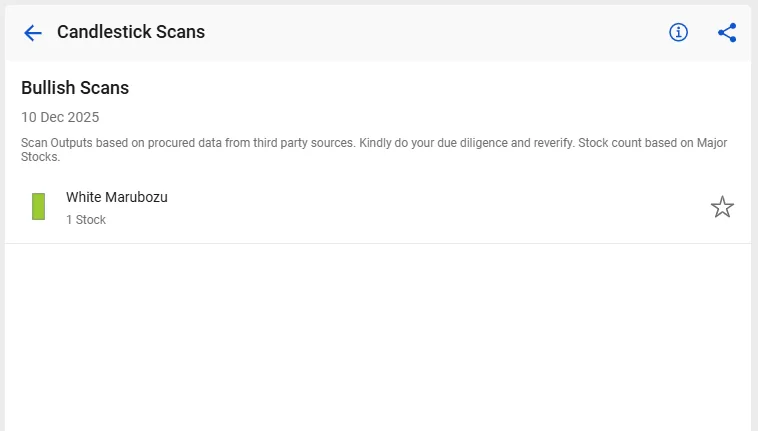

Bullish Scans

A stock is said to be in a bullish trend when its prices are moving upward, reflecting strong investor confidence and buying interest. Bullish scans in StockEdge help you quickly identify stocks showing bullish candlestick patterns, signals that the buyers are in control.

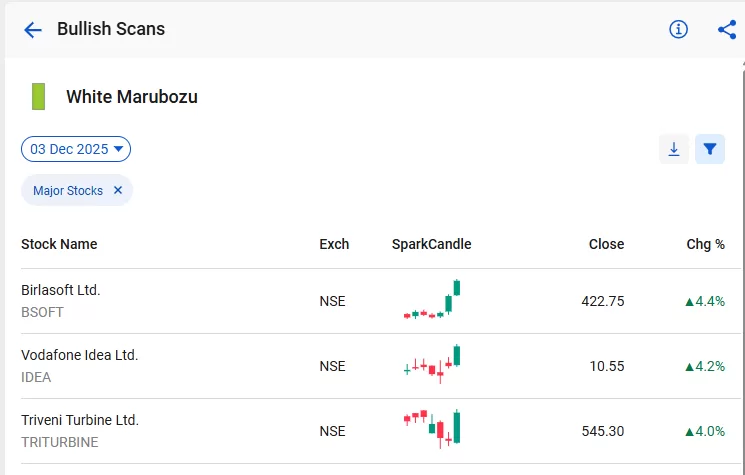

Currently, under this category, there is one key scan, White Marubozu. This pattern indicates that the bulls dominated the session, pushing the price up and closing near the high. It’s a clear sign of market bullishness and potential continuation of the upward trend.

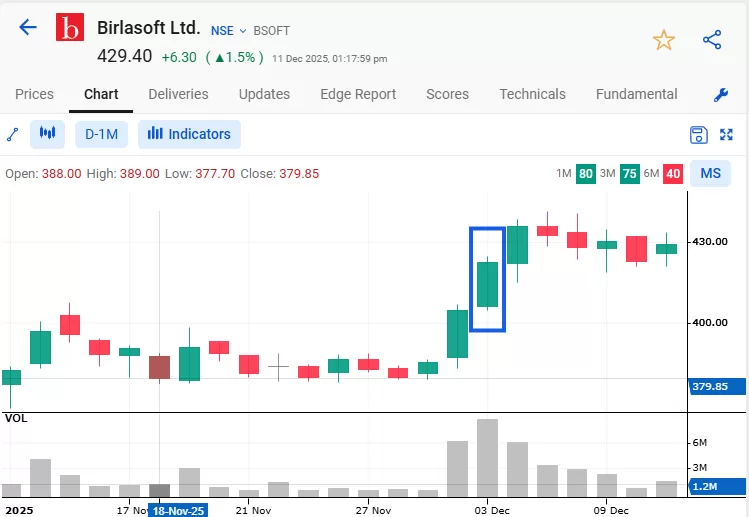

Now, understand this with an example:

On 03rd Nov 2025, Birlasoft appeared in the White Marubozu scan list. From that day till 10th Dec 2025, the stock moved up by approximately 4.4%.

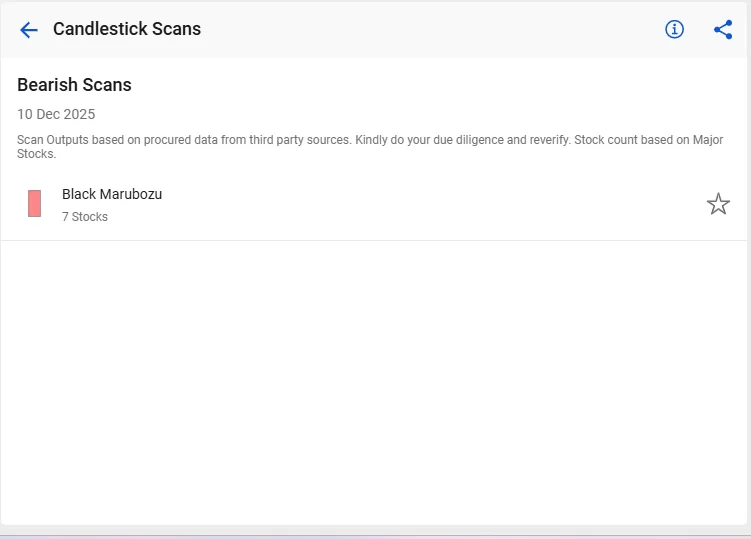

Bearish Scans

A bearish candlestick shows the bearish trend when its prices are moving downward, reflecting strong selling interest. Through bearish scans, you can quickly identify stocks that show the bears have been able to pull the price to a low and close near this range. In short it indicates bearishness in the market

Currently, under this category, there is one key scan, Black Marubozu. This pattern shows strong selling pressure. It is characterized by a long black (or red) body with no upper or lower wicks (shadows), indicating that sellers dominated the market from the open to the close.

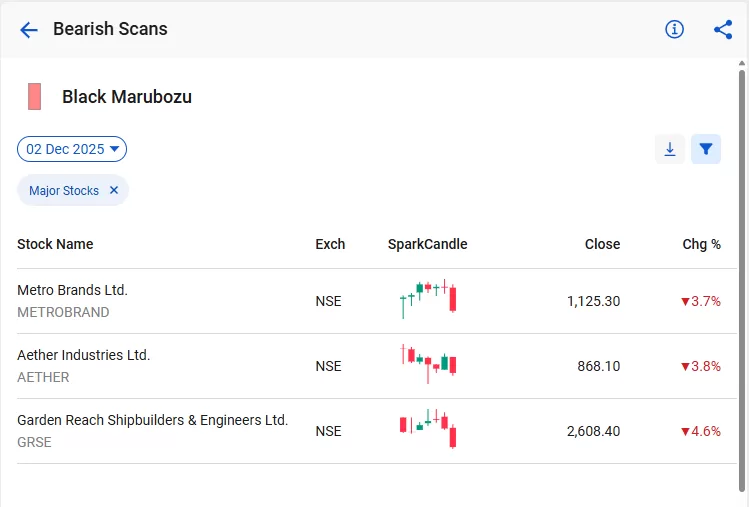

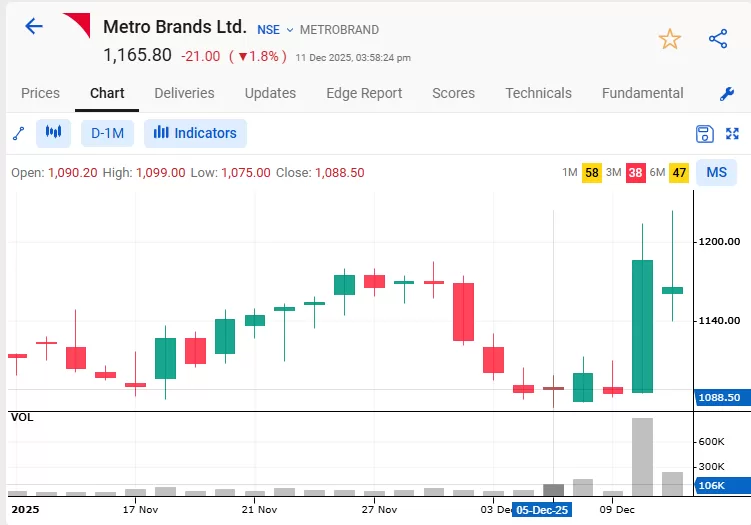

Now, understand this with an example

On 02nd Nov 2025, Metro Brands Ltd. appeared in this scan list. From that day till 11th Dec 2025, the stock fell by approximately 3.7%.

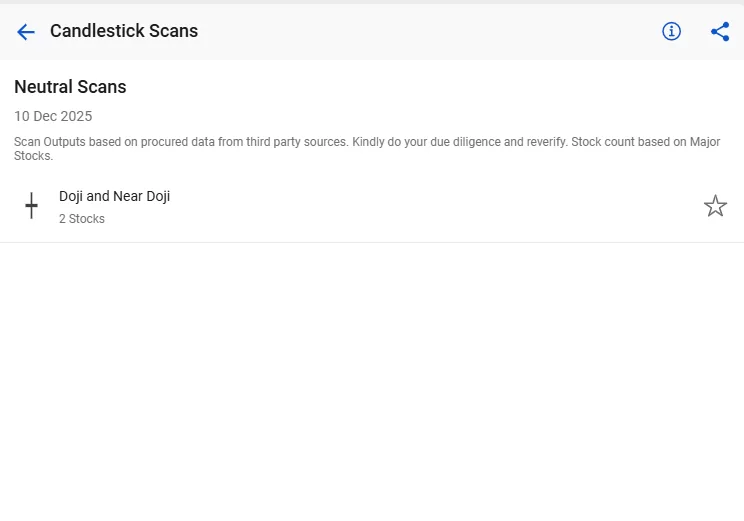

Neutral Scans

Neutral candlestick patterns represent market indecision. In these situations, neither buyers nor sellers is fully in control. Such scans in StockEdge help you identify stocks where price movement has paused or consolidated, indicating a possible upcoming breakout or breakdown.

Currently, under this category, one key scan is the Doji pattern.

A Doji forms when the opening and closing prices are almost the same, reflecting hesitation in the market. It shows that even after active trading during the session, neither side could dominate.

A Doji signals two possibilities:

- The existing trend may be losing momentum

- A strong move may come once direction becomes clear

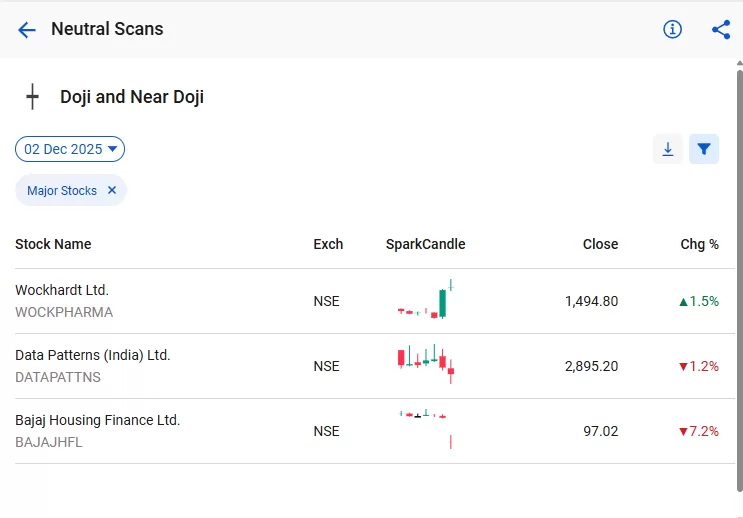

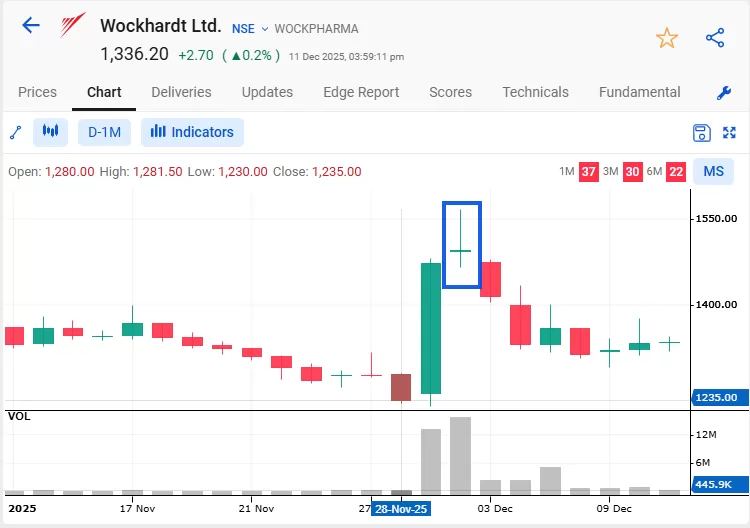

Let’s understand how to use this with an example:

On 02nd Nov 2025, Wockhardt Ltd. appeared in this scan list. It does not confirm direction by itself; it acts as an early warning signal for traders to stay alert.

Reversal Scans

Reversal Scans in StockEdge help you identify candlestick patterns that signal a possible change in the current trend. These scans highlight stocks where the ongoing uptrend or downtrend may be weakening and preparing to reverse.

Reversal scans are divided into two types

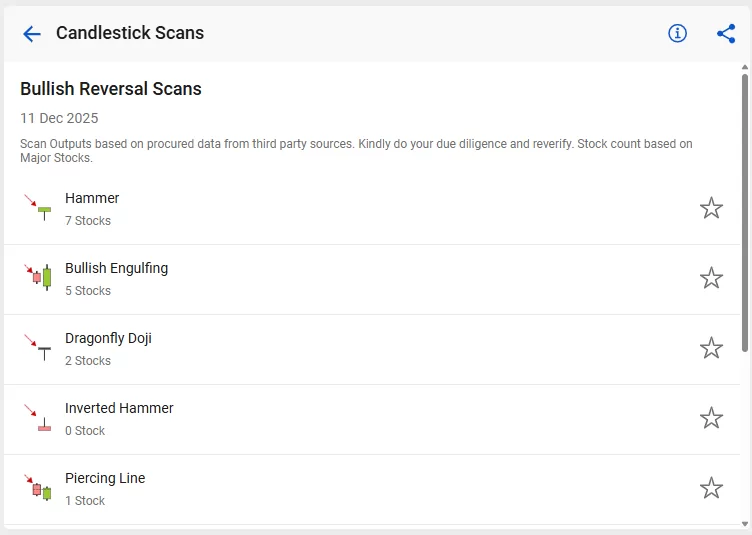

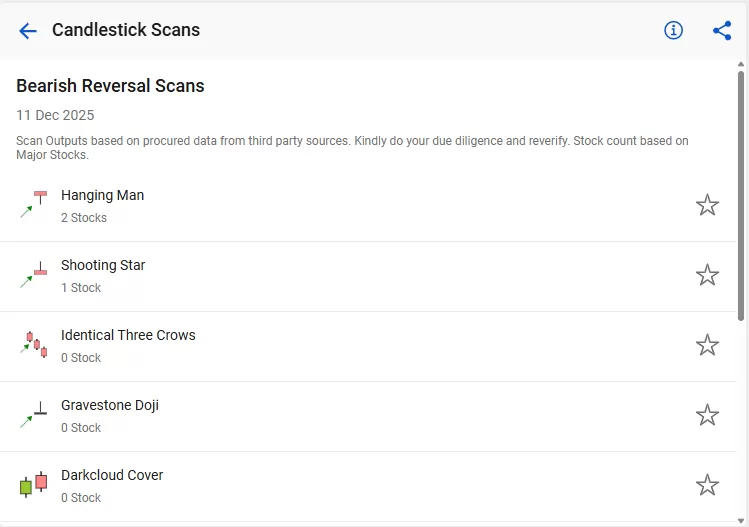

Bullish reversal scans identify patterns that form after a downtrend and suggest that buying strength is returning. These patterns often indicate the beginning of a new upward trend. StockEdge highlights key bullish reversal patterns such as:

Bearish reversal scans highlight patterns formed after an uptrend and indicate that selling pressure may be taking over. These patterns suggest a possible start of a downward move. StockEdge includes major bearish reversal patterns such as:

To know more about these scans, read our blog How to trade Reversal Candlestick Patterns?

Continuation Scans

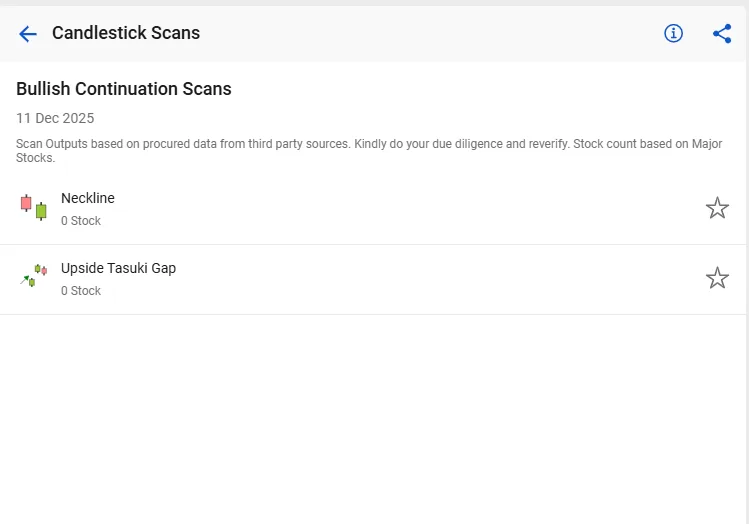

Continuation Scans in StockEdge help you identify candlestick patterns that signal the current trend is likely to continue. These scans highlight stocks where buyers or sellers are still in control, and the existing momentum may carry forward.

Continuation scans are useful for traders who prefer entering trades in the direction of the prevailing trend rather than anticipating reversals. This scan has also been divided into two parts:

These scans identify patterns that appear during an uptrend and suggest that buying pressure is still strong. StockEdge highlights key bullish continuation patterns such as:

These scans help identify patterns formed during a downtrend that suggest the selling pressure is intact. StockEdge highlights important bearish continuation patterns such as:

Most importantly, avoid trading solely on a single candlestick pattern. Always combine multiple confirmations to make safer and more informed trading decisions.

Conclusion

StockEdge Candlestick Scans convert complex pattern identification into a quick, reliable, and data-driven process. When combined with basic confirmations like volume, trend, and support/resistance, these scans become a powerful part of a trader’s toolkit.

Whether you’re a beginner or an experienced trader, using candlestick scans systematically can significantly improve your trade selection and overall performance.

Also Read: How to Use StockEdge Technical Scans

Frequently Asked Questions (FAQs)

1. Are candlestick scans useful for beginners?

Yes, they simplify pattern detection and help beginners understand price behaviour more clearly. They save time and eliminate guesswork.

2. How should I confirm a candlestick scan before taking a trade?

Before acting on any candlestick scan, always look for additional confirmations. Check the overall trend direction to ensure the setup aligns with the broader market move. Validate the signal with volume, as stronger volume adds reliability. Identify nearby support or resistance levels to understand whether the price has room to move. Use indicator confirmations, such as RSI or MACD, to strengthen the signal.

Most importantly, never trade based on a single candlestick pattern. You must always combine multiple confirmations for safer decision-making.

3. How often are these scans updated in StockEdge?

StockEdge’s candlestick scans are updated daily at the end of the day.

4. Can I combine candlestick scans with other indicators on StockEdge?

Yes, you can combine candlestick scans with other indicators using custom scans. To know more about the custom scans, read our blog StockEdge Version 14.0 – Custom Scans.