When market infrastructure companies deliver results, they often tell a deeper story about the health of capital markets themselves. The NSE and BSE show a clear reflection of how India’s equity, derivatives, and mutual fund ecosystem is expanding, both in depth and participation.

As the National Stock Exchange moves closer to its much-anticipated IPO, attention has naturally turned to how India’s only listed exchange is performing.

BSE Q3 result FY26 arrives at an important moment, offering investors a real-time benchmark to assess the earnings strength, operating leverage, and competitive positioning of an exchange business.

In this blog, we will break down the NSE IPO vs BSE, and then analyze the performance of the BSE Q3 result for FY26 and cover key highlights, revenue drivers, profitability trends, risks, and future growth prospects.

Upcoming NSE IPO vs BSE

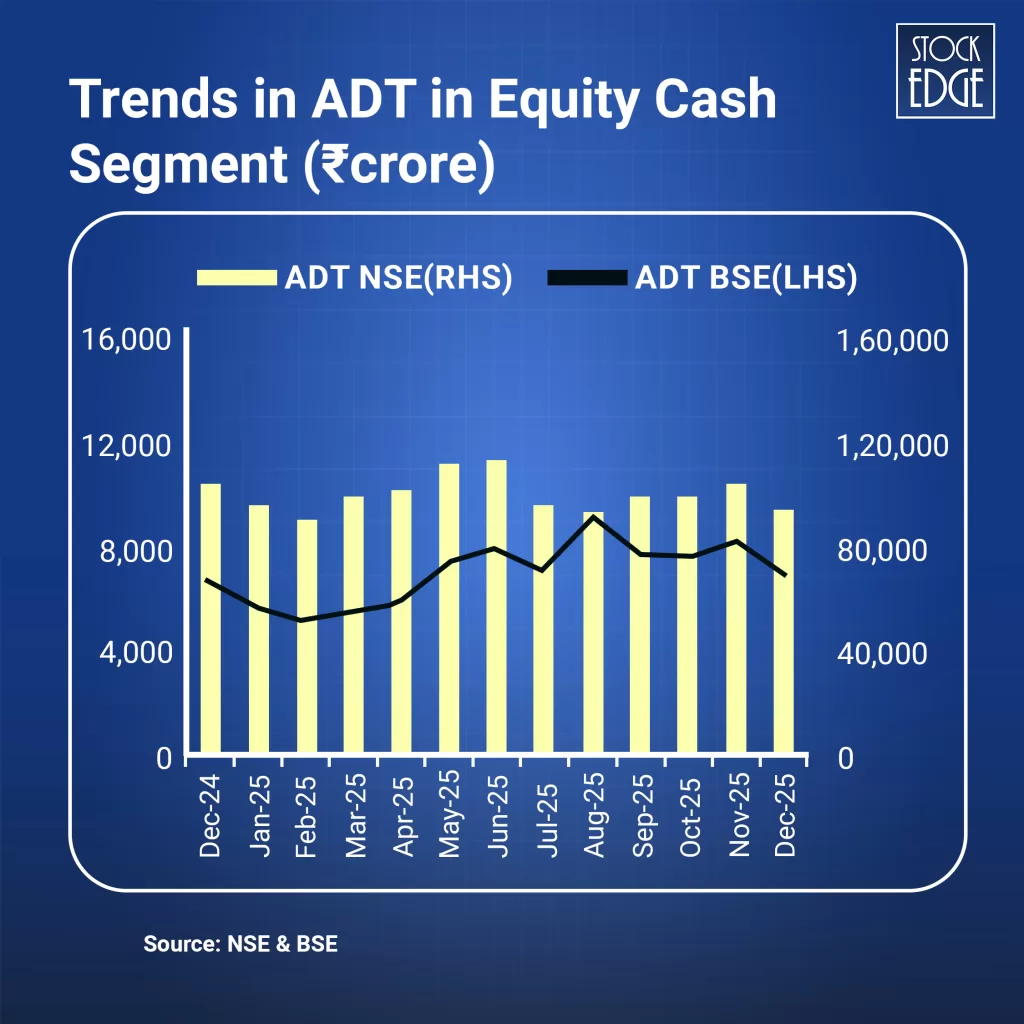

With the NSE preparing for its long-awaited IPO, comparisons between India’s two stock exchanges have come back into focus. While BSE remains the only listed exchange, recent market data shows a clear gap in secondary market activity between the two.

NSE holds a commanding share in most trading segments, ~95%+ in cash equities and derivatives, while BSE remains a distant second with a single-digit market share in major segments.

NSE is the world’s largest derivatives exchange by volume, a key competitive advantage when compared to BSE, which is still building scale in this segment.

As per the SEBI bulletin, turnover in the equity cash segment rose by 4.6 per cent at NSE, while it fell by 1.4 per cent at BSE during the month.

NSE IPO listing will be a major event for India’s capital markets, potentially redefining valuations and competitive dynamics.

BSE Q3 Result FY26 Overview

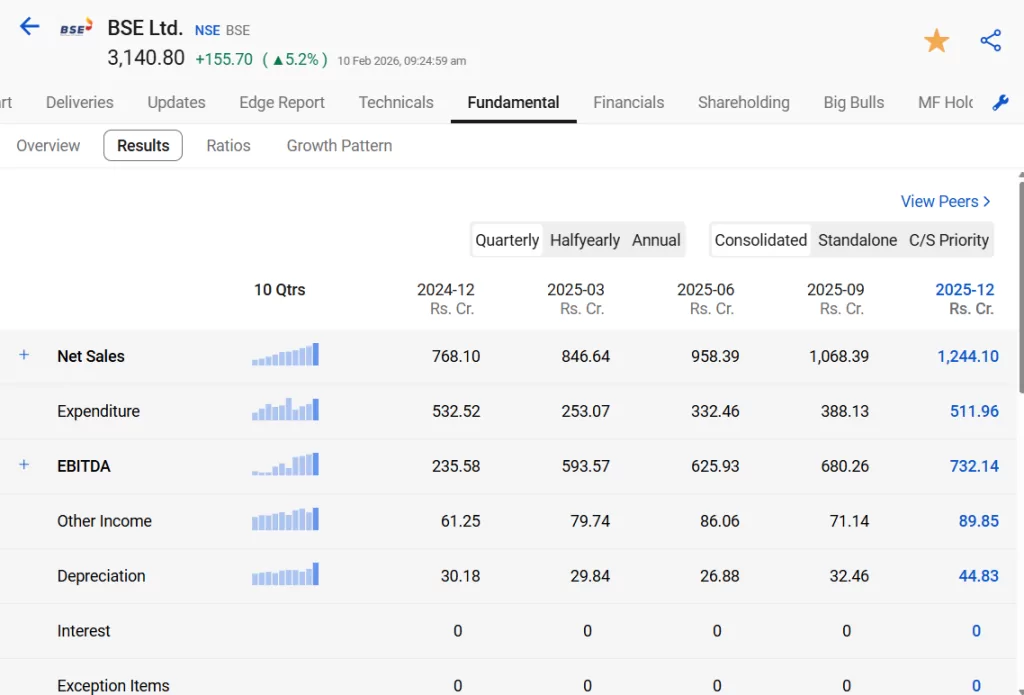

The third quarter of the 2025-26 fiscal year has been a period of significant scaling for BSE. The exchange reported a consolidated revenue from operations of ₹12,441 million for the quarter ended December 2025, a massive jump from ₹7,681 million in the same quarter of the previous year (Dec ’24).

Key Financial Snapshot (Q3 FY26)

- Revenue from Operations: ₹12,441 million

- Net Profit: ₹6,018 million

- Operating EBITDA Margin (Excluding Core SGF): 63%

- Net Profit Margin: 45%

Source: BSE’s Investor Presentation

Key Highlights from BSE Q3 Result

BSE Q3 result for FY26, the performance marks a decisive shift in its role within India’s capital market ecosystem. What was once seen largely as a legacy exchange has now emerged as a modern, technology-driven market infrastructure institution. By combining its 150-year heritage with high-speed trading systems and diversified platforms, BSE delivered one of its strongest financial performances to date.

Below is a closer look at the key drivers behind this transformation.

1. Sharp Acceleration in Financial Performance

The most notable aspect of the BSE Q3 result FY26 is the scale and quality of earnings growth.

Consolidated net profit for the quarter stood at ₹5,966 million, compared with ₹2,186 million in the BSE Q3 result FY25, representing a year-on-year increase of over 170%. This surge was supported by a strong rise in trading activity, particularly in derivatives, while costs grew at a much slower pace.

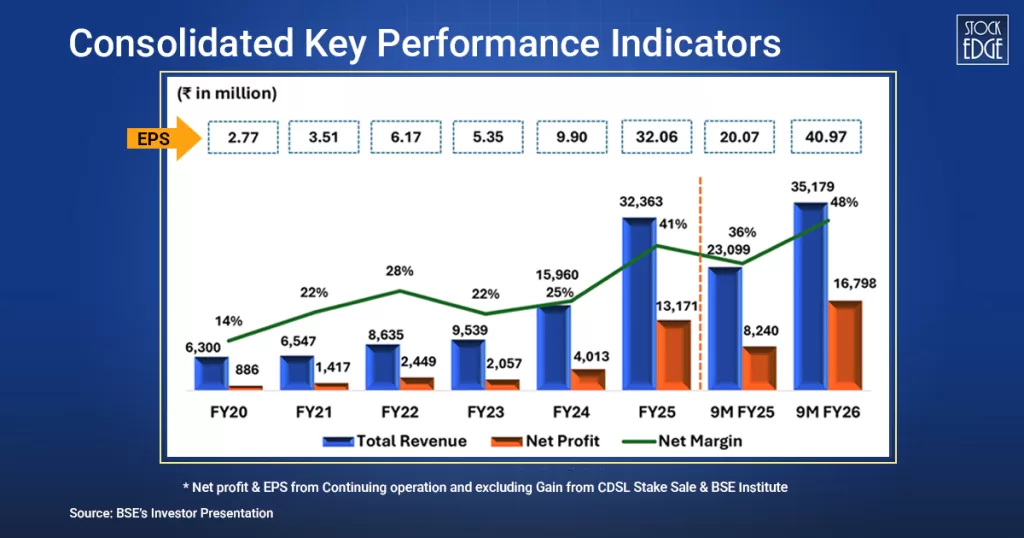

Revenue from operations rose 62% year-on-year to ₹12,441 million, up from ₹7,681 million in the corresponding quarter last year. Importantly, this growth did not dilute profitability. Operating EBITDA margins (excluding the Core Settlement Guarantee Fund) remained robust at 63%, underlining the scalability of the exchange model. For the nine-month period, the consolidated net margin stood at 48%, reflecting sustained operating discipline.

Shareholder returns also improved meaningfully, with consolidated EPS for 9M FY26 at ₹40.97, reinforcing the strength of BSE’s earnings profile.

2. Derivatives Emerge as a Core Revenue Driver

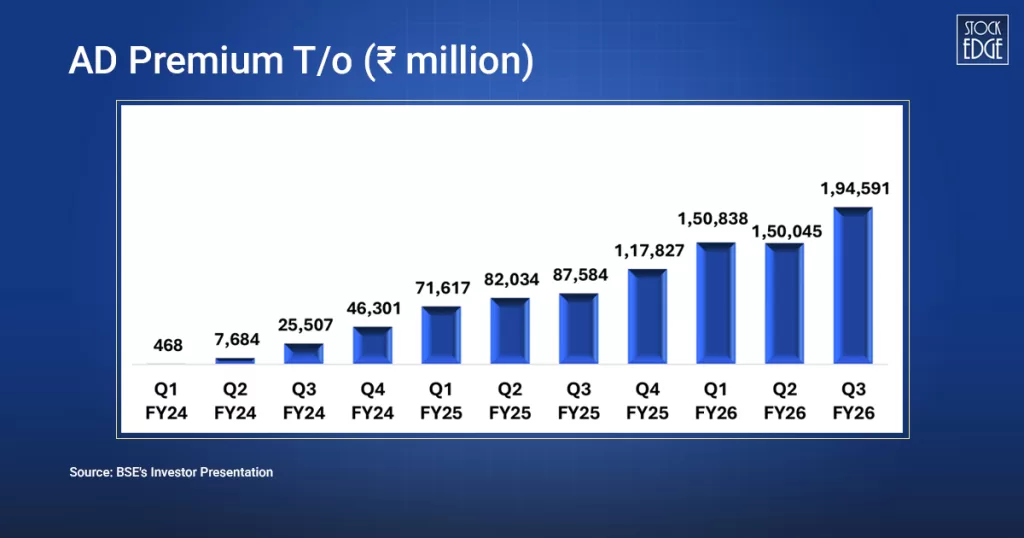

The relaunch and expansion of the equity derivatives segment has materially altered BSE’s revenue mix. The exchange is no longer dependent solely on cash equity volumes. Derivatives have become a central growth engine.

During Q3 FY26, average daily premium turnover in equity derivatives rose to ₹1,94,591 million, compared with ₹87,584 million in BSE Q3 Result FY25. This sharp increase reflects improved liquidity, greater trader participation, and the growing acceptance of weekly expiry contracts, particularly in Sensex derivatives.

As a result, transaction charges climbed to ₹9,526 million for the quarter, up from ₹5,111 million a year earlier. Derivatives are especially significant from a profitability standpoint, as they generate higher revenue per trade than cash equities. Operationally, BSE is now handling around 125 million equity derivative lots per day, a scale that indicates rising confidence among market participants.

3. Continued Leadership in Mutual Fund Distribution

BSE’s StAR Mutual Fund platform remains a steady and increasingly important contributor to the group’s earnings. The platform continues to benefit from India’s rising mutual fund penetration and the long-term shift of household savings towards financial assets.

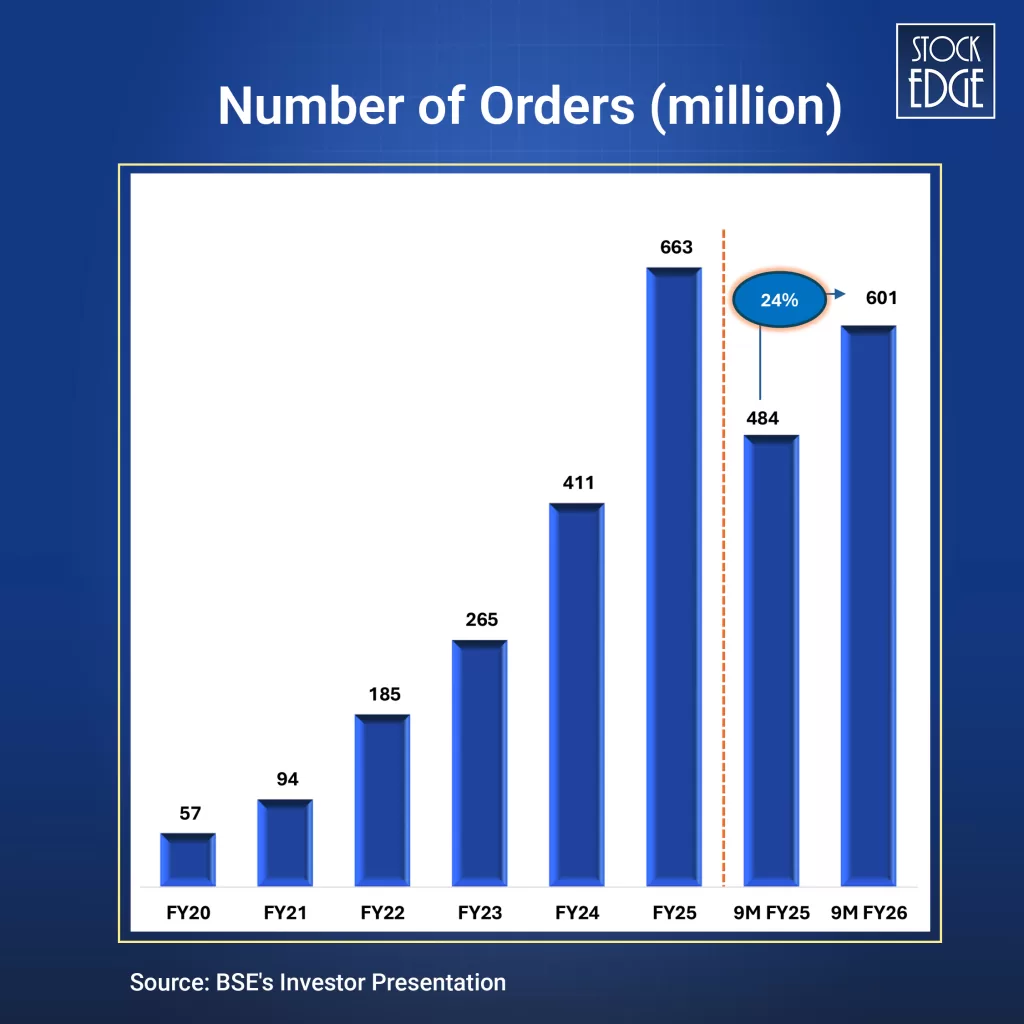

In the 9M FY26 period, the platform processed 601 million orders, up from 484 million in 9M FY25. Its reach spans 721 cities, supported by a distributor network of over 82,969 participants, giving it one of the widest distribution footprints in the country.

Revenue from the mutual fund segment reached ₹2,036 million in 9M FY26, underlining its role as a stable, recurring revenue stream. Unlike trading income, mutual fund transactions, particularly SIP-led flows, are less sensitive to short-term market volatility, adding balance to BSE’s overall earnings profile.

4. Infrastructure Strength and Business Diversification

Beyond trading, BSE has built multiple complementary businesses that reduce its dependence on market cycles.

Its wholly owned index arm, BSE Index Services Pvt. Ltd. (BISPL), has seen strong traction since becoming a 100% subsidiary in June 2024. Revenue from core index operations doubled, with 150+ new clients added and over 50 new indices launched. As passive investing grows, index licensing and data services are emerging as high-margin, long-duration revenue streams.

Corporate and listing services also remain a stable contributor. Listing-related income stood at ₹2,905 million in 9M FY26, supported by companies with a combined market capitalization of USD 5.30 trillion. These services provide predictable, recurring income irrespective of market volatility.

On the technology front, BSE continues to operate as the world’s fastest exchange, with a trading speed of 6 microseconds. Its clearing arm, ICCL, has expanded capacity to handle up to 10 crore equity trades per day, ensuring scalability as volumes grow.

5. Expanding Investor Base and Global Ambitions

BSE’s growth is underpinned by a rapidly expanding market ecosystem. The exchange now services over 238 million registered investors, reflecting deep retail penetration and successful adoption of its digital platforms.

Internationally, BSE’s presence at GIFT City through India INX is positioning the group as a gateway for global capital. With access to 135+ international exchanges, BSE is steadily building relevance beyond domestic markets, particularly in derivatives, debt, and global access products.

By integrating trading, clearing, distribution, index services, and data dissemination, BSE has created a multi-layered revenue model that captures value across the entire market lifecycle.

Strengths

- High operating leverage: EBITDA margin of 63% in Q3 FY26 (excluding Core SGF) highlights strong cost efficiency and scalability as volumes rise.

- Strong profit visibility: Net profit grew over 170% YoY as reported in the BSE Q3 result FY26, reflecting the earnings power of the exchange model.

- Diversified revenue mix:

- Transaction charges at ₹9,526 million (Q3 FY26) remain the primary driver.

- Mutual fund distribution revenue of ₹2,036 million (9M FY26) provides recurring income.

- Listing services contributed ₹2,905 million (9M FY26), adding stability.

- Growing derivatives franchise: Rapid growth in equity derivatives with rising premium turnover and improved liquidity, supporting higher revenue per trade.

- Technology leadership: World’s fastest exchange with 6 microseconds latency, backed by ICCL’s capacity to process 10 crore equity trades per day.

- Large and expanding ecosystem: Over 238 million registered investors and a wide distributor network, creating strong network effects.

Risks

- Volume-dependent earnings: A slowdown in trading activity or lower market volatility could impact transaction charge growth.

- Derivatives concentration risk: Increasing reliance on derivatives means regulatory changes to margins, contract structure, or expiries could affect revenues.

- Competitive pressure: NSE continues to dominate market share, particularly in derivatives, making liquidity retention a key challenge.

- Regulatory uncertainty: Changes in SEBI regulations, fee caps, or settlement norms may impact profitability.

- Margin sensitivity: Higher investments in technology, compliance, and risk management could compress margins if revenue growth moderates.

- Macro-driven participation risk: Global or domestic economic slowdowns may reduce retail and institutional market participation.

Future Growth Outlook

- Sustained retail participation: Rising demat accounts and financialization of household savings support long-term volume growth.

- Derivatives as key growth lever: Further scale-up in Sensex derivatives and new contract introductions could materially boost earnings.

- Stable annuity income: Growth in SIPs and mutual fund penetration to support steady expansion of the StAR MF platform.

- Index and data monetization: Increasing adoption of passive investing to drive high-margin index licensing revenues.

- GIFT City opportunity: India INX provides access to 135+ global exchanges, opening avenues for international growth.

Conclusion

BSE Q3 result for FY26 reflects more than strong quarterly numbers, they signal a structural shift in the exchange’s business model. With derivatives gaining scale, mutual fund distribution providing stability, and technology-led operating leverage driving margins, BSE is increasingly being viewed as a long-term market infrastructure compounder rather than a legacy institution.

Read: Bajaj Finance Q3 Result 2026 Analysis

Frequently Asked Questions (FAQs)

1. Did BSE’s profit increase or decline in BSE Q3 Result FY26?

BSE’s profit increased sharply as reported in the BSE Q3 Result FY26, with net profit attributable to shareholders rising to ₹6,018 million, driven by higher transaction volumes and margin expansion.

2. Which segments contributed most to BSE’s revenue in Q3 FY26?

The biggest contributors to BSE’s revenue in Q3 FY26 were transaction charges from equity and derivatives trading, followed by services to corporates such as listing and related fees, and treasury and investment income. Among high-growth areas, equity derivatives saw strong traction, while the StAR Mutual Fund platform continued to add steady and recurring revenue.