Key Takeaways

- India’s Wind Power Push: With a target of 500 GW renewable energy by 2030, wind energy is set to play a key role alongside solar in India’s clean energy journey.

- Rising Demand: Sectors like manufacturing, data centres, and transport are driving demand for green energy, pushing companies to invest in wind power.

- Policy Support: Government initiatives like repowering old turbines, green hydrogen projects, and hybrid solar-wind setups are boosting sector growth.

- Investor Opportunity: With rising ESG focus, strong future demand, and policy tailwinds, wind energy stocks could offer long-term investment potential.

- Top Players:

- Suzlon Energy

- Inox Wind

- KP Energy

Table of Contents

Global Warming is “real”, and the only way to save ‘mother-earth’ is to reduce dependency on burning fossil fuels. So, what’s the alternative to it? The answer is renewable energy. But what does it mean to reduce dependence on fossil fuels? Imagine driving an electric car instead of driving a petrol/diesel car, which may reduce dependence on extracting crude oil from nature and electricity being generated by renewable energy sources like solar, wind, water (hydrogen) or bio-mass. This blog explores the investing opportunities in the renewable energy industry, especially focusing on wind energy stocks, which may be a good investment in the long term, given the global shifts towards renewable energy.

Why invest in Wind Energy Stocks?

According to the latest data from the Central Electricity Authority (CEA), India’s cumulative wind energy capacity has reached 48.5 GW. However, the Indian government has a 140 GW target of installed capacity by 2030, which indicates a sizable gap that suggests significant wind market growth. As new wind energy capacities are installed, steady growth can be observed in the wind energy sector. Hence, wind energy stocks may turn out to be a good investment in the long term. In addition to financial return by investing in wind energy stocks, there is also a sense of moral responsibility towards nature, which it fulfils.

There is also significant support from the central government as it has enabled public sector undertakings (PSUs) such as NTPC Ltd., PTC India Ltd., SJVN Ltd. and a few others to administer auctions of annual wind and renewable projects in India.

Benefits of Wind Energy Stocks In India

- Sustainability: Investing in wind energy stocks supports an industry dedicated to reducing carbon footprints, offering a sustainable and clean energy alternative.

- Technological Advancements: Wind energy companies drive innovation through improved turbine designs, enhanced efficiency, and seamless smart grid integration, ensuring long-term growth. So, focusing on wind energy stocks that manufacture such equipment could see high demand for its products in the future.

- Growth Potential: While the wind energy sector may experience market volatility, the growing emphasis on renewable energy policies in India presents significant opportunities for investors.

- Global and Domestic Support: Indian wind energy stocks benefit from both international climate agreements and local government initiatives that promote clean energy, strengthening their market position.

- Positive Environmental Impact: By investing in wind energy stocks, investors contribute to reducing carbon emissions and supporting sustainable energy production, aligning with global and national environmental goals.

So, with our country’s ambitious renewable energy targets, the demand for wind energy is set to rise. This sustained growth can positively influence the value of wind energy stocks.

Factors to Consider Before Investing in Wind Energy Stocks

- Financial Stability: Assess the company’s financial strength by reviewing its balance sheet, analyzing its debt levels, and tracking revenue growth to ensure it has a solid foundation.

- Technological Edge: Companies that prioritize technological advancements, particularly in wind turbine development and energy efficiency, are more likely to experience long-term growth.

- Market and Policy Trends: Stay informed about both global and local trends in renewable energy, including government policies and international agreements, as they can significantly impact the sector.

- Portfolio Diversification: To manage risks and optimize returns, consider building a diversified portfolio with a mix of renewable energy stocks in India. Know more on renewable energy stocks here: Sustainable Investments: Best Green Hydrogen Stocks

- Industry Insights: Analyze expert perspectives and observe the investment choices of notable market players, as their actions can provide valuable guidance for your investment decisions.

Best Wind Energy Stocks in India

There are companies who are into the business of generating renewable energy including capacities installed for solar, wind, hydroelectricity, and more. The following list of wind energy stocks includes companies that are also into generating renewable energies from other sources. However, generating wind energy is mostly their core part of business operations. So, without any further ado. Here is a list of top three wind energy stocks in India.

1. Adani Green Energy Ltd.

Adani Green Energy Ltd. (AGEL) is one of India’s leading renewable energy companies, focusing on solar, wind, and hybrid energy projects. has established itself as a major contributor to India’s clean energy transition. It has established itself as a major contributor to India’s clean energy transition. However, the company has a significant presence in the wind energy sector, operating multiple wind power plants across India.

In the nine months ending December 31, 2024, AGEL’s wind energy segment generated 5,614 million units of electricity, contributing substantially to its overall energy production. Wind energy remains a key part of its diversified renewable portfolio.

In 9M FY25, the company sold 20,108 million units of energy, and it increased by ~23% YoY, backed by robust capacity addition. The company’s wind portfolio CUF (capital utilization factor) was at 29.2%, backed by 95% plant availability in 9M FY25. The EBITDA of the company is at ₹6,366 crore in 9M FY25, and it increased by ~18% YoY.

The capex for additional solar capacity is ~₹4.5 crore per MW, and wind is ~₹6.5 crore per MW. The new projects are financed with a typical 75:25 debt-to-equity ratio. Therefore, the company’s debt is on the higher side, at 57,000 cr as of 31st Dec 2024. Despite this, in Q3 FY25, the decrease in interest charges on a YoY and QoQ basis was primarily due to the repayment of old bonds with high interest rates, combined with favourable refinancing of some projects.

The company is expanding its wind energy capacity as part of its goal to reach 50 GW of renewable capacity by 2030. The company is focusing on developing large-scale wind projects, including hybrid wind-solar plants, to optimize energy generation.

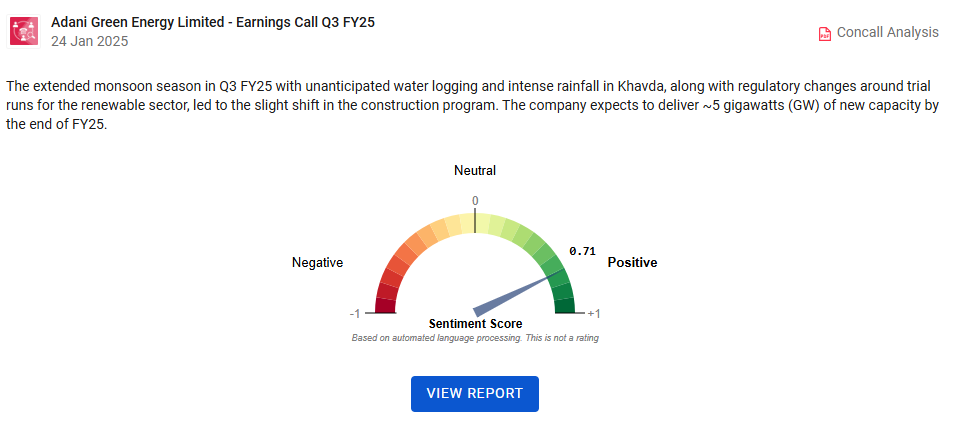

If you would like more detailed financial performance or additional insights, you may read our concall analysis report of Adani Green Energy Ltd.!

2. Suzlon Energy Ltd.

Suzlon Energy Limited is one of the leading renewable energy solutions providers in India and globally, specializing in wind energy. The company has over 20.8 GW of wind energy capacity installed across 17 countries, having a significant presence in both domestic and international markets. The core business revolves around manufacturing and deploying wind turbine generators (WTGs). It has installed over 14.8 GW of wind energy in India alone, making up approximately 32% of the country’s cumulative wind energy market share as of June 30, 2024. The primary revenue stream for Suzlon comes from wind energy.

In Q3 FY25, the net sales and net profit of the company jumped by approximately 90% YoY. The company has significantly reduced its debt as the debt to equity ratio decreased from 1.73x in FY23 to 0.03x in FY24.

Suzlon aims to maintain its leadership in the wind energy sector by focusing on several strategic initiatives such as going forward it plans to enhance its product portfolio further, expanding its 3.x MW series to cater to a wider range of wind regimes. The company is leveraging opportunities in India’s rapidly growing renewable energy sector.

3. Inox Wind Ltd.

Inox Wind Limited is a prominent player in India’s wind energy sector. The company offers comprehensive solutions that cover the entire value chain from manufacturing to operations and maintenance. It produces wind turbine components, including nacelles, hubs, blades, and towers. It has an annual manufacturing capacity of approximately 2.5 GW. It specializes in 2 MW and 3 MW wind turbine generators (WTGs), with plans to introduce 4.X MW turbines in the near future. The company maintains a strong presence in India’s wind energy sector and has a diversified customer base.

In Q3 FY25, the net sales increased by 81% YoY, whereas EBITDA of the company jumped 123% YoY. However the company’s debt to equity ratio is significantly higher at 1.71x. Moreover, the interest coverage ratio is also weak, which makes this wind energy risky. But the company made significant steps to reduce its debt. In FY24, the company raised approximately ₹1,300 crore from global and domestic institutional investors, followed by an additional ₹900 crore in FY25.

Going forward, the company plans to expand its manufacturing capacity through a new facility in Ahmedabad, further optimizing production and reducing costs. By providing clean and reliable wind energy solutions, Inox Wind remains committed to supporting India’s renewable energy goals and Inox Wind is poised to play a pivotal role in India’s renewable energy transition.

The Bottom Line

Investing in wind energy stocks presents a promising long-term opportunity. As governments and corporations globally accelerate their renewable energy commitments, companies with established expertise and strong market presence stand to benefit significantly. So, with the advancements in wind technology, favourable regulatory policies, and increasing demand for clean energy, wind energy stocks are positioned for sustained growth. Additionally, Inox Wind’s focus on operational efficiency, technological leadership, and a robust order book enhances its resilience and potential for profitability. If you are seeking exposure to the renewable energy sector, wind energy stocks may offer a sustainable and forward-looking investment choice.

Happy Investing!