Key Takeaways

- Industry Outlook: The Indian textile and apparel sector contributes ~2.3% to GDP and ~12% of exports. It’s projected to grow at ~10% CAGR, aiming for $100 billion in exports by 2030 on the back of rising global demand and FTA benefits.

- Policy Tailwinds: Schemes like PM‑MITRA, broad PLI support, and India’s active FTA negotiations (UK, EU, Australia) are boosting infrastructure, investment, and export competitiveness for textile makers.

- Geopolitical Advantage: Rising US tariffs on Bangladesh and new India‑UK FTA are triggering share rallies in stocks like Gokaldas Exports, KPR Mill, Vardhman and creating export tailwinds for Indian firms.

- Risks to Monitor: Cotton price volatility, forex swings, and global demand softness remain potential risks. Investors should stay alert on order inflows, policy shifts, and company-level execution plans.

- Top 3 Picks:

- Arvind Ltd.

- Vedant Fashions Ltd.

- Vardhman Textiles Ltd.

Table of Contents

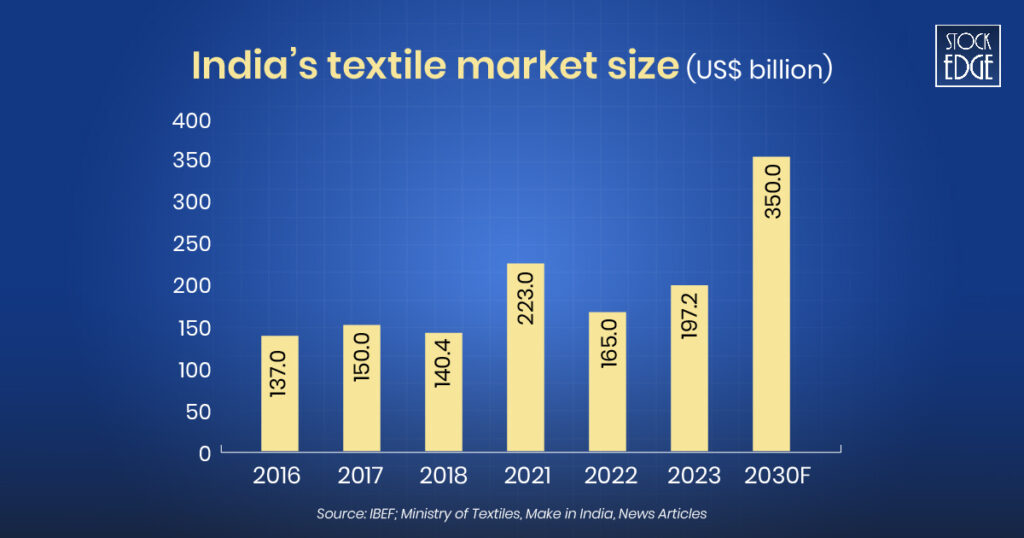

A man’s basic needs are food, clothing and shelter. But in the modern era, clothing is not just a necessity; it has become a style and fashion for every individual. Top global brands like H&M and Levis and domestic brands like Allen Solly and Van Heusen by Aditya Birla Fashion Retail have taken India’s apparel industry to new heights. Currently the domestic apparel and textile industry in India contributes nearly 2.3 % to the country’s GDP, which is expected to increase 5% by the end of this decade and the Indian textiles market is expected to be worth US$ 350 billion by 2030.

According to CRISIL, the retail apparel sector is projected to achieve revenue growth of 8-10% in the current fiscal year. Therefore, this article explores investing opportunities in the textile stocks in India.

What are Textile Stocks?

Textile stocks refers to shares of publicly listed companies engaged in the production, manufacturing, and distribution of textiles, apparels, yarns, fabrics, garments, and clothing related products. These companies operate in segments like cotton, synthetic fibers, silk, garments and home textiles. Some popular textile stocks in India include Raymond, Vardhman Textiles, K.P.R. Mill, Welspun Living, Arvind Ltd., and Trident Ltd.

In regards, the performance of textile stocks depends on factors like raw material prices (cotton, polyester), export demand, government policies, and consumer trends. Can textile stocks outperform the benchmark index Nifty 50? A sectoral overview may showcase the factors of growing textile industry in India.

Sector Overview: Textile & Apparel

The Indian textile industry is one of the major sectors contributing significantly to the country’s GDP, exports, and employment. Currently, India is strategically capitalizing on the opportunities that arise from the US-China trade war. In addition, due to political turmoil in the neighbouring country of Bangladesh, it could benefit India’s Textile Industry and so could be benefiting the textile stocks in India.

Here are some of the key highlights of the textile industry:

- The textile and apparel industry contributes 2.3% to India’s GDP, 13% to industrial production, and 12% to exports.

- India’s textile exports are expected to reach $65 billion by 2026 and target $100 billion by FY30.

- India is the world’s largest producer of cotton, with estimated production at 32.3 million bales in 2023-24. The country also has a strong base in silk, wool, and synthetic fibres.

- The sector has attracted $4.47 billion in FDI since 2000, with 100% FDI allowed under the automatic route.

- India is the world’s largest producer of cotton, with estimated production at 32.3 million bales in 2023-24. The country also has a strong base in silk, wool, and synthetic fibres.

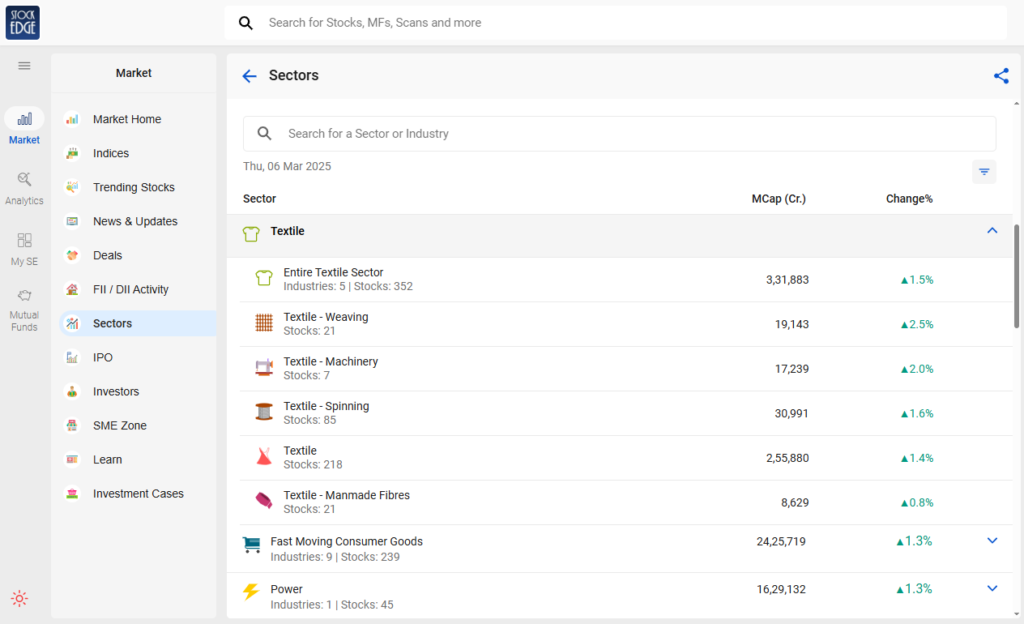

Thus, with increasing demand, strong government support, and expanding global markets, India’s textile industry is poised for significant expansion in the coming decade. You may now wonder, which textile stocks are listed in the Indian stock market? StockEdge classifies the overall textile industry into 5 industries consisting of 352 textile stocks in India as of now. (February 2025)

As you can see, you can view textile stocks list from each industry of the textile sector from StockEdge.

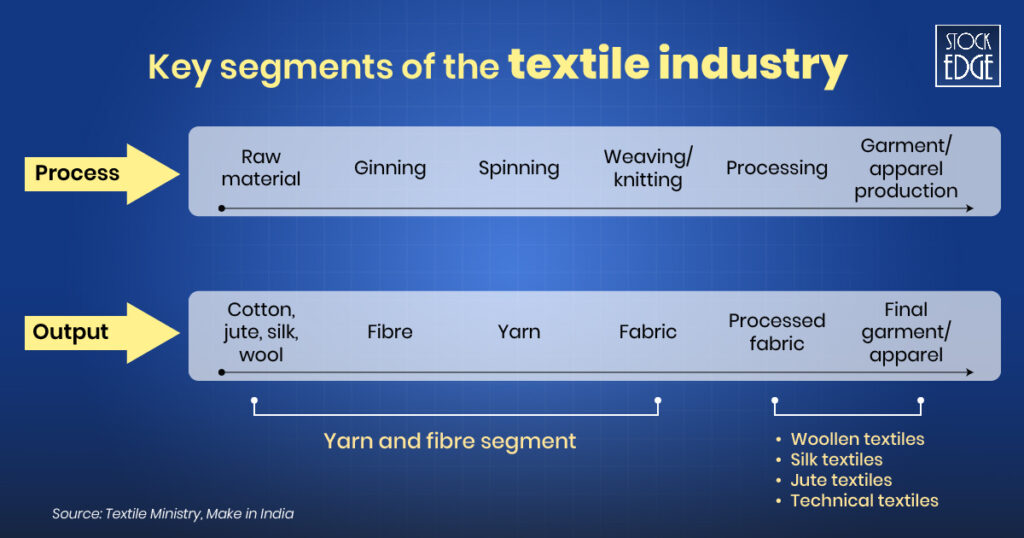

To understand the several industries of the textile sector, you must understand the Value Chain of the textile industry and what are the different segments of it.

Value Chain: Key segments of the textile industry

The textile industry value chain consists of multiple stages, from raw material production to the final product reaching consumers. Each stage adds value and involves key players, processes, and opportunities for investment in textile stocks.

| Stage | Key Activities |

| Raw Material Sourcing | – Cotton, jute, wool, silk, and synthetic fibre production.- Procurement of dyes, chemicals, and other inputs. |

| Ginning & Spinning | – Processing raw cotton into fibres & spinning fibres into yarns. |

| Weaving & Knitting | – Converting yarn into fabric through weaving, knitting, or non-woven processes. |

| Processing & Dyeing | – Bleaching, dyeing, and finishing fabrics for different applications. |

| Garment & Apparel Manufacturing | – Cutting, stitching, and finishing garments for domestic and export markets. |

| Distribution & Retail | – Selling through wholesale, retail, and e-commerce platforms. |

| Exports & International Trade | – Exporting textiles and apparel to global markets. |

To better understand the value chain, here is a pictorial representation:

As you briefly understand the process and output of various stages of the value chain in the textile industry, there are a number of textile stocks that operate in different segments. But why should you invest in textile stocks? Are there any good investment opportunities?

Key Factors: Investing in Textile Stocks

The Indian textile sector presents an interesting long-term investment opportunity, but it comes with both growth potential and risks. Here is a breakdown of key factors that make it attractive for long-term investors.

1. Sector Growth

The Indian textile and apparel market is projected to grow at a CAGR of 10% and reach $350 billion by 2030. A rise in disposable income by the middle class, urbanization, and fashion trends may fuel domestic consumption. Moreover, textile exports are expected to hit $100 billion by 2030 indicating increasing global demand for Indian textiles.

2. Government Policies

The PM Mega Integrated Textile Region and Apparel (PM MITRA) scheme is developing mega textile parks to boost infrastructure and manufacturing. In addition, the 100% Foreign Direct Investment (FDI) policy encourages foreign investment and technology transfer.

3. Export Demand & Free Trade Agreements (FTAs)

India is the 3rd largest exporter of textiles and apparel, holding a 4.6% global market share. FTAs with UAE, Australia, and upcoming deals with the EU & UK can significantly boost exports.

Top 3 Textile Stocks in 2025

1. Arvind Limited.

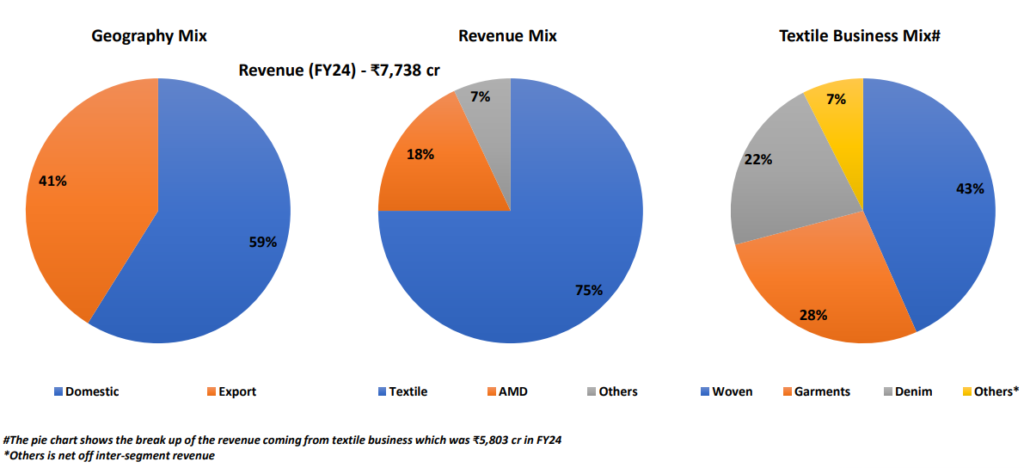

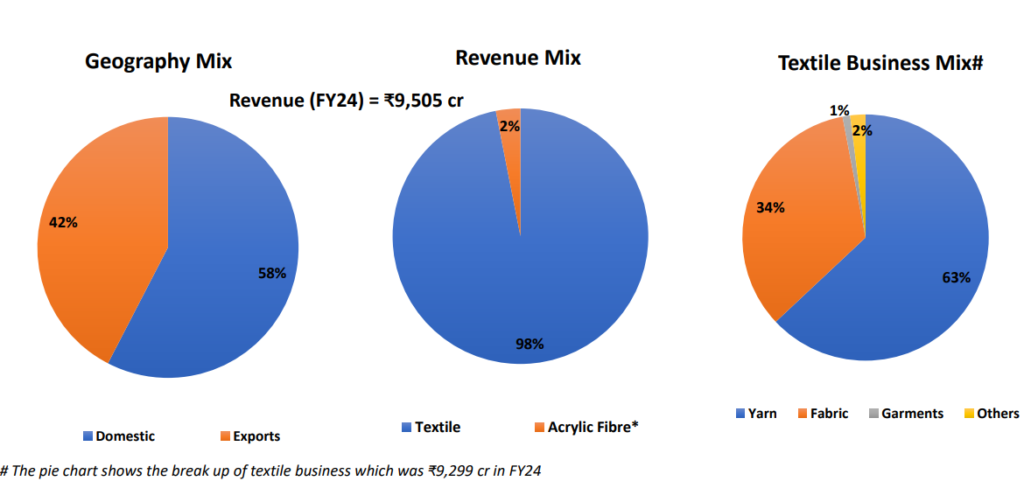

Arrow, US Polo Assn., Flying Machine, Calvin Klein, Tommy Hilfiger– Do you know these clothing brands? Of course, you are already familiar with such international brands, but what you may not know is that these clothing brands manufacture their products from domestic companies like Arvind Limited. Yes! It is one of India’s leading vertically integrated textile companies. It is a prominent player in denim, woven & knits, garments and advanced materials catering to several domestic and international brands across the globe. Here is the revenue mix for the financial year 2024-

So far, the financial performance of the company is concerned; in Q3 of FY 25, the revenue from operations increased by 10% YoY, and net profit jumped by 12% YoY. In addition, the PAT margin has been consistently growing for the past three consecutive quarters, which is a sign that the company’s financial performance is exhibiting strength. Also, in terms of debt to equity ratio, the company has been reducing its debt significantly over the past few years as solvency improved; the debt to equity ratio has declined from 0.91 in FY20 to 0.37 in FY24.

In the near future, the company is aiming to reach a production capacity of 40 million garments in FY25, growing to ~48-49 million in FY26. Also, the capex for FY25 is expected to be ₹400-₹450 crore, which may enhance the production capacity in the future.

To know more about its financial performance and to understand whether it is a good investing opportunity, read our case study on Arvind Limited.

2. Vedant Fashions Ltd.

The company operating under the brand name – “Manyavar” has successfully brought the fashion trend of wearing traditional Indian attire during weddings or any other festivals back into the trend with its most popular ad campaign “Shaddi hai! Taiyaar Hokar Aaiye”

Today, ‘Manyavar’ is a category leader in the branded Indian wedding and festive celebration wear market with a pan India presence. The company operates in three different categories:

- Franchisee-owned exclusive brand outlets (EBOs)

- Multi-brand outlets (MBOs),

- Large format stores (LFS)

The company operates on an asset-light, franchisee-owned, franchisee-operated model. Franchisees manage store operations, while the company handles branding and design. There are two franchise models: one where the company covers rental costs (franchisee margin: 18%) and another where the franchisee bears rent (margin: 29.5%). About 60% of revenue comes from stores where the company pays for the lease, enabling a scalable and cost-efficient expansion strategy.

As the financial performance of the company is concerned, its revenue from operations on a standalone basis increased by 7.8% YoY but profit growth took a set-back growing by only 0.2% YoY in the third quarter of FY 25. This is mainly due to muted consumer demand, but the company maintained a high average selling price (AVS) and, with it, reduced advertising expenses, which partially offset the decline in profitability.

However, the PAT margins of the company have been steadily increasing in the last three consecutive quarters. In terms of the company’s liabilities, it is a debt free company. Also, the company’s cash flow from operations is steadily increasing and has doubled from ₹243 cr in FY 20 to ₹483 cr in FY 24.

To know more about its financial performance and to understand whether it is a good investing opportunity, read our case study on Vedant Fashions Ltd.

3. Vardhman Textiles Ltd.

The company is one of the leading textile manufacturers in India, with a presence across the textile value chain. It operates across a wide spectrum from manufacturing yarns to fabric and is one of the few vertically integrated fabric manufacturers that produces fabrics for both tops and bottoms in the apparel segment. However, Yarn contributes largely to the revenue for Vardhman Textiles Ltd. Here is a complete breakdown of the revenue mix for the company in FY 24:

Source: Edge reports by StockEdge

So far, the financial performance is concerned; revenue from operations increased by 5% YoY, but PAT surged by 26% YoY for the third quarter of FY 25. Also, the company has significantly reduced its liabilities in the last few years, where the debt to equity ratio declined from 0.78 in FY 15 to 0.20 in FY 24. In terms of valuation, the p/e ratio on a trailing twelve months basis stands at 13.59 compared to the industry p/e ratio of 43.91 signifies undervaluation at current level.

To know more about its financial performance and to understand whether it is a good investing opportunity, read our case study on Vardhman Textiles Ltd.

So, are these top 3 textiles stocks to buy in India? Certainly, not for all, that is because every investor has its own risk appetite and therefore you must take an in depth look at the textile stocks which are good for your investment portfolio that may align with your investment objectives and suit your risk appetite.

We have also curated another list of top automobile stocks in India, which you may also read before diversifying your portfolio to the auto sector.

The Bottom Line

The Indian textile sector presents a compelling long-term investment opportunity driven by rising domestic demand, strong government support, and expanding global exports. With initiatives like the Production-Linked Incentive (PLI) scheme, PM MITRA mega textile parks, and 100% FDI allowance, the industry is set for rapid modernization and growth. Additionally, India’s dominance in cotton production, the rise of technical textiles, and increasing e-commerce penetration further enhance the sector’s potential. While challenges like raw material price fluctuations and global competition exist, companies that focus on innovation, sustainability, and export markets are well-positioned for long-term profitability. For investors seeking steady growth and strong fundamentals, textile stocks offer a resilient and rewarding opportunity in the evolving economic landscape.

Happy Investing!