Key Takeaways

- India’s Chemical Growth: India is the 6th largest chemical producer in the world, and the sector is expected to see strong demand across pharma, agriculture, and FMCG.

- Growing Exports: Global companies are reducing dependency on China, which is creating more export opportunities for Indian chemical manufacturers. With rising global demand and cost advantages, the chemical sector offers good long-term investment opportunities for Indian investors.

- Government Support: Policies like PLI schemes, Make in India, and stricter pollution controls in China are giving Indian chemical firms a competitive edge.

- Top 3 Picks:

- Aarti Industries

- Pidilite Industries Ltd.

- SRF Ltd.

Table of Contents

From manufacturing textiles to producing life-saving cancer medicines, what is the common ingredient that powers both industries?

That’s chemical!

Now, the chemical sector is the backbone of modern industry, playing a crucial role in everything from agriculture and pharmaceuticals to construction and consumer goods. Today, India ranks 14th in worldwide chemical exports and 8th in global imports (excluding pharmaceuticals).

In this blog, we will explore chemical stocks in India, how to choose the best chemical stocks to buy in 2025.

What are Chemical Stocks?

Chemical stocks represent companies engaged in the manufacturing and distribution of chemicals used in various industries, such as agriculture, pharmaceuticals, consumer goods, and industrial applications. These chemicals can be broadly divided into three major sub-groups:

- Basic Chemicals: Chemicals, including organic and inorganic compounds, various chemical intermediates, dyes and pigments, and printing inks, are considered basic chemicals. These are also referred to as commodity chemicals. Notable examples of chemical stocks operating in this segment are Atul Ltd, Sudarshan Chemical Industries Ltd and many more.

- Specialty Chemicals: These are also known as performance chemicals, are low-volume but high-value compounds. They are derived from basic chemicals and sold based on their functions. Examples include paints, adhesives, electronic chemicals, water management chemicals, oilfield chemicals, flavours and fragrances, rubber additives, paper additives, industrial cleaners and fine chemicals, sealants, coatings, catalysts, etc. Some chemical stocks operating in this segment include Pidilite Industries, SRF Ltd, Gujarat Fluorochemicals Ltd and many others

- Pesticides and Agrochemicals: Pesticides and Chemicals that are designed to protect agricultural crops from insects and pests are included in this sub-group. The chemical stocks operates in these segments are UPL Ltd, PI Industries Ltd, BASF India Ltd

Why Invest in Chemical Stocks?

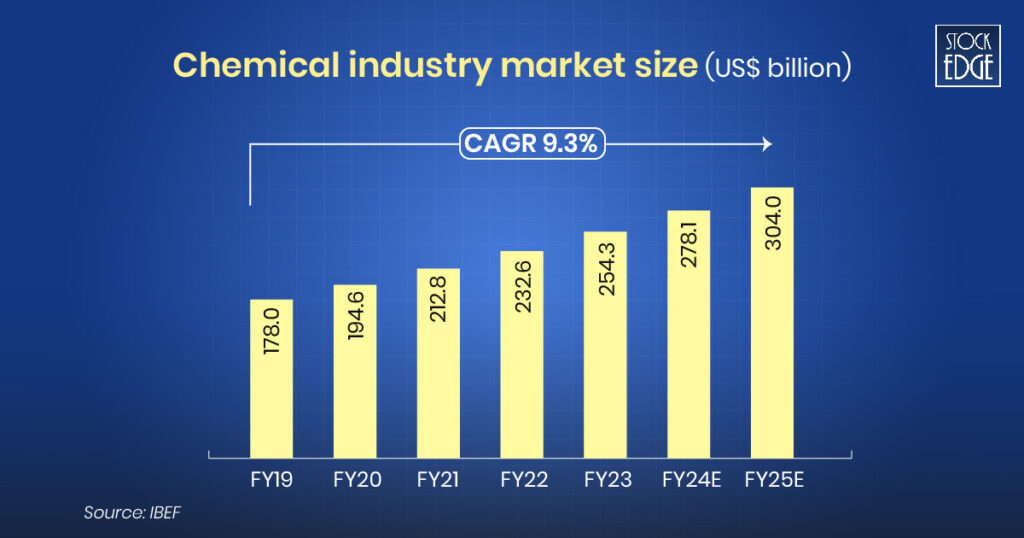

According to IBEF, India’s chemical sector, currently valued at an impressive US $220 billion, is anticipated to reach US $300 billion by 2030 and US $1 trillion by 2040. It is also wonderful to see that the demand for chemicals is projected to expand at a vibrant 9% per year by 2025.

With strong government support, rising demand, and expanding foreign investment, this sector offers an appealing investment opportunity. Here are the key reasons to invest in this sector.

- Strong Global Presence: India is the sixth-largest chemical producer in the world and third-largest in Asia. The country accounts for 3.4% of the global chemical market and is a leader in dye manufacturing, supplying 16% to 18% of global dyestuffs.

- Growth in Specialty Chemicals: The specialty chemicals sector is expected to grow at a CAGR of 12.4%, reaching $64 billion by 2025. Demand is mostly driven by sectors such as agrochemicals, coatings, and adhesives.

- Rising Demand: Chemicals are essential for agriculture, construction, automotive, textiles, and personal care. The government’s push for smart cities and infrastructure is increasing the demand for construction chemicals.

- Growing Exports & China+1 Strategy: India’s chemical exports reached $14.09 billion between April and September 2024. With global companies looking to diversify from China, India has become a key manufacturing hub.

- Government Support & Investment Opportunities: 100% FDI allowed in the chemical sector (except hazardous chemicals). The Petroleum, Chemicals & Petrochemicals Investment Region (PCPIR) initiative has attracted $22.7 billion in FDI. Over ₹8 lakh crore ($107.38 billion) investment is expected in the chemicals and petrochemicals sector by 2025.

Emerging Trends in the Chemical Industry

Green Chemistry & Sustainability

There is a rise in global awareness on climate change and environmental protection, sustainable practices have become a key focus in the chemical sector. Green chemistry emphasizes the development of eco-friendly and non-toxic chemical processes that reduce waste and minimize environmental impact.

- Bio-based Chemicals: The industry is shifting towards renewable raw materials, replacing petrochemical-derived chemicals with plant-based alternatives.

- Recycling and Circular Economy: Companies are investing in plastic recycling and waste reduction technologies to create a closed-loop system.

- Eco-friendly Solvents and Catalysts: New chemical processes are being designed to reduce hazardous emissions and improve energy efficiency.

- Carbon Capture and Utilization (CCU): Technologies that convert industrial CO₂ emissions into valuable chemicals and fuels are gaining traction.

- Sustainable Agrochemicals: The development of biodegradable pesticides and fertilizers is helping to reduce soil and water pollution.

Major chemical stocks, such as BASF and Tata Chemical, are investing in biodegradable plastics and low-carbon production methods to align with global sustainability goals.

Digital Transformation

Currently chemical manufacturers are adopting digital solutions that enhance efficiency, reduce costs, and improve safety. Digital transformation is enabling companies to optimize operations, improve supply chain transparency, and enhance decision-making processes.

- Artificial Intelligence and Big Data Analytics: AI-driven models are being used for predictive maintenance, demand forecasting, and process optimization.

- IoT (Internet of Things) Sensors: Real-time monitoring of chemical production ensures improved safety and efficiency.

- Automation and Robotics: Advanced robotics are increasing precision and reducing human error in chemical plants.

- Blockchain in Supply Chain: Blockchain technology being utilized to ensure transparency and prevent fraud in chemical trading.

Companies such as Reliance Industries, Aarti Industries are implementing AI and IoT in petrochemical manufacturing and investing in automation and smart manufacturing.

Battery and EV Growth

The rapid expansion of the electric vehicle (EV) industry and renewable energy storage is driving demand for specialty chemicals and battery materials. The chemical industry plays a crucial role in the production of lithium-ion batteries, fuel cells, and hydrogen storage technologies.

- Battery Chemicals: High-purity lithium, cobalt, nickel, and graphite are essential for EV batteries.

- Electrolytes and Separators: These materials are crucial for battery performance and efficiency.

- Hydrogen Economy: Growth in hydrogen fuel cells is boosting demand for catalysts and membranes.

- Lightweight Materials: Advanced polymers and composites are being developed to reduce EV weight and improve energy efficiency.

Leading companies such as Tata Chemicals, Himadri Speciality Chemical are investing in lithium-ion battery materials and specialty carbon materials for batteries.

How to Choose the Best Chemical Stocks?

As global demand increases, along with government incentives and rising interest in specialty chemicals, Indian chemical stocks are capturing investors’ interest.

However, with so many choices available, how do you determine which ones are the best? Let’s examine the key factors that distinguish the top performers from the chemical sector.

Revenue Growth & Profitability

Before investing, check how consistently a company is growing its revenue and profit margins. A company with steady growth and strong profit margins can withstand market downturns. You should look at the CAGR (Compound Annual Growth Rate) of revenue and net profit over 5-10 years. In addition, a high EBITDA margin compared to peers means better efficiency.

Dividend Yield

If you are looking for passive income and growth, dividend-paying chemical stocks should be on your radar. Companies with a strong dividend history and sustainable payout ratios provide steady income while signaling financial strength. To sustain dividends, ensure the company has low debt and strong free cash flow. You may identify high dividend yield chemical stocks using StockEdge scans.

Innovation, Research & Development

Research and development are vital to long-term success. Companies investing in new technologies, specialty chemicals, and green chemistry tend to outperform. Higher R&D expenses as a percentage of revenue often indicate a focus on future growth, particularly in sectors like EV battery materials, sustainable chemicals, and biotech-driven solutions.

Global Expansion

Global expansion and market reach also matter. Firms with strong export markets, strategic partnerships, and a presence in high-growth regions like the U.S., China, and Europe are better positioned for stability and growth. A diversified product portfolio across agriculture, pharmaceuticals, and industrial applications reduces sector-specific risks.

Top Chemical Stocks in 2025

Pidilite Industries Ltd

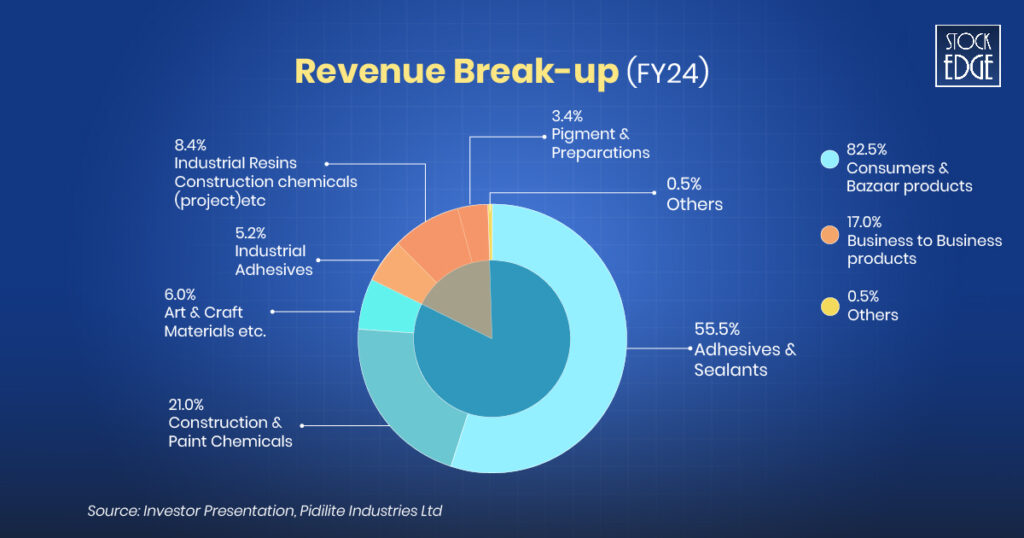

Pidilite Industries is the market leader in adhesives, holding over 65% of the market share. The company boasts strong brands such as Fevicol, Fevikwik, M-Seal, Dr. Fixit, Fevicryl, and Araldite. The company operates through three segments:

- Consumer & Bazaar Products (C&B): This is the major segment, which includes products like adhesives, sealants, art and craft materials, and construction and paint chemicals. These products are widely used by carpenters, painters, plumbers, mechanics, households, students, and offices.

- Industrial Products (B2B): This segment includes industrial adhesives, synthetic resins, organic pigments, pigment preparations, construction chemicals (projects), and surfactants. These products serve various industries, including packaging, textiles, paints, printing inks, paper, and leather.

- Others: This segment largely focuses on the manufacture and sale of specialty acetates.

During the third quarter of FY25, the standalone revenue from operations growth was aided by underlying volume growth (UVG) of 9.7% YoY across categories and geographies. For 9M FY25, the UVG was 9.2%. The growth was broad based across both segments with C&B UVG of 7% and B2B UVG of 20.2% on a YoY basis. During the quarter, the consumption cost of vinyl acetate monomer (VAM) was $884 per tonne as compared to $902 per tonne in Q3 FY24. To know more about their financial performance, check out the case study of Pidilite Industries Ltd.

SRF Ltd

SRF Ltd. operates as a multi-business entity focused on chemicals, producing industrial and specialty intermediates. These intermediate products are primarily supplied to other sectors for their final manufacturing needs. The company categorizes its primary operations into Technical Textiles Business (TTB), Chemicals Business (CB), Packaging Films Business (PFB), and other initiatives.

Chemicals Business(CB) has two divisions: Specialty Chemicals and Fluorochemicals. The specialty chemicals division develops and produces advanced intermediates for the agrochemical and pharmaceutical sectors, with manufacturing plants in Dahej, Gujarat, and Bhiwadi, Rajasthan. The Fluorochemicals division produces and sells refrigerants, pharmaceutical propellants, and industrial chemicals.

In Q3 FY25, EBITDA rose 15.1% YoY to ₹693 crore, with the margin increasing ~11bps YoY to 19.9%. Revenue from chemicals grew 7% YoY and 10% QoQ to ₹1,496 crore. EBIT increased 13% YoY to ₹364 crore from ₹322 crore in Q3 FY24, while the EBIT margin improved ~600 bps QoQ and ~100 bps YoY. The speciality chemicals sector performed well, showing strong revenue and margin growth, despite ongoing inventory buildup issues in the agrochemical industry customers. For more details on a company’s financial performance to make an informed investment decision, you may check the case study of SRF Ltd.

PI Industries Ltd

PI Industries Ltd is one of India’s leading agri-sciences and fine chemical companies. It has a strong position in the domestic agricultural inputs and offers plant protection products, and specialty plant nutrient products and solutions. It is India’s oldest and among one of the largest CSM (custom synthesis manufacturing) players in global markets.

Under the segment, it offers contract research and production of agro-chemicals, intermediates and other niche fine chemicals for global innovators. The company’s products include insecticides, fungicides, herbicides and specialty products. It is rapidly expanding its product offerings across agro-chemicals, electronic chemicals and pharma space. It has presence in both the domestic as well as international markets (catering to more than 30 countries).

In Q3 FY25, revenue remained almost flat. However, revenue from agro chemical export segment grew by ~2% YoY, while revenue from new products increased by ~40% YoY. In 9M FY25, revenue was ₹5,925 crore, up by 4% YoY. During this period, exports increased by ~9% YoY, backed by volume gains and new product contributions. EBITDA for the quarter was ₹512.2 crore and it de-grew by 8% YoY. Further, EBITDA for 9M FY25 was ₹1,726.4 crore, up by 9% YoY. You can check out the case study of PI Industries Ltd to know more about the company’s financials.

Aarti Industries Ltd

Aarti Industries Limited (AIL) is amongst the most competitive benzene-based, speciality chemical companies in the world. It has a derisked portfolio, i.e., multi-product, multi-geography, multi-customer and multi-industry. Its 100+ products are sold to 700+ domestic and 400+ global customers in 60 countries across the globe, with major presence in the USA, Europe and Japan.

The company uses feedstock materials such as benzene, toluene, nitric acid, chlorine, methanol, aniline, sulphur, etc., along with a wide range of reactions to service leading chemical companies around the globe. Its key value chains include Nitro Chlorobenzenes (NCBs), Di-Chlorobenzenes (DCBs), Phenylenediamines (PDAs), the Nitrogen Toluene Value Chain, and Equivalent Sulphuric Acid (E.S.A) and downstream.

The company’s end-user industries are agrochemicals, pharmaceuticals, home and personal care, dyes and pigments, polymers, additives, and other discretionary products. It has 11 zero-liquid-discharge plants and a strong focus on Reduce, Reuse, and Recover across its 16 manufacturing sites.

In Q3 FY25, the EBITDA (including other income) grew by 17% QoQ, led by strong volume growth, operating leverage and product mix improvements. On a YoY basis, the EBITDA declined by 12% YoY to ₹236 crore. During the quarter, the net profit declined by 11.5% QoQ due to mark to market loss on long term external commercial borrowing (ECB) loan of ₹23 crore, arising due to rupee depreciation. In 9M FY25, the EBITDA grew by 7% YoY to ₹749 crore. For further details on a company’s financial performance to make an informed investment decision, you may check the case study of Aarti Industries Ltd.

Final Thoughts

The chemical industry is no longer just about basic materials, it’s evolving rapidly with trends like green chemistry, specialty chemicals, and digital transformation reshaping the landscape. With strong government policies, increasing global demand, and India’s emergence as a major chemical manufacturing hub, the sector presents immense potential for long-term wealth creation.

However, as with any investment, risks remain. Volatility in raw material prices, regulatory challenges, and global supply chain disruptions can impact performance. The key lies in choosing companies with strong fundamentals, innovation-driven growth, and a solid global footprint. By focusing on the right stocks, you can position yourself for a winning portfolio in 2025 and beyond.

Are you ready to take advantage of the chemical sector’s boom? Let’s invest wisely and make 2025 a year of smart financial growth!

FAQs

Are chemical stocks a good long-term investment?

Yes, chemical stocks can be a strong long-term investment due to the sector’s steady growth, high demand across industries, and expanding exports. India’s chemical industry is projected to grow from $220 billion in 2022 to $1 trillion by 2040, driven by specialty chemicals, petrochemicals, and agrochemicals.

How does ESG impact chemical stock investments?

Environmental, Social, and Governance (ESG) factors are becoming critical in the chemical sector. Investors prefer companies that focus on sustainable manufacturing, waste management, and carbon neutrality. Regulations on pollution control and carbon emissions are also influencing investment decisions. You can read our blog to know Top 10 ESG Stocks to Watch in 2025 for sustainable growth.

What are the biggest risks in chemical stock investing?

- Raw Material Price Volatility: Dependence on crude oil and natural gas makes chemical companies vulnerable to price fluctuations.

- Regulatory Challenges: Stringent environmental laws and compliance costs can impact profitability.

- Global Supply Chain Disruptions: Dependence on imports, particularly from China, for key inputs can affect production.

- Market Cyclicality: Demand fluctuations in industries like automotive, construction, and textiles can lead to earnings volatility.

Which sectors benefit most from chemical stocks?

Chemical stocks play a crucial role in various industries, including:

- Automotive & EVs: Chemical companies supply battery materials, coatings, and polymers to EV manufacturers.

- Infrastructure & Construction: Companies like SRF Ltd. and Pidilite Industries provide adhesives, paints, and waterproofing solutions.

- Textiles & Consumer Goods: Specialty chemicals support dyes, coatings, and packaging solutions.

What role does R&D play in the success of chemical companies?

Research and Development (R&D) is crucial for product innovation, sustainability, and competitive advantage. Leading companies invest heavily in R&D to develop high-value specialty chemicals, green alternatives, and advanced materials.