Table of Contents

Suppose you are manufacturing cars. You will need various machinery for assembling and shaping car parts, like robots, welding machines, and presses. You will also need tools and dies to form metal parts, as well as material handling equipment like forklifts and cranes to move heavy components around. Right?

These machines are capital goods. In layman’s language, we can say capital goods stocks represent companies that manufacture machinery, equipment, and infrastructure used in producing other goods and services. These include sectors like industrial machinery, construction equipment, and aerospace.

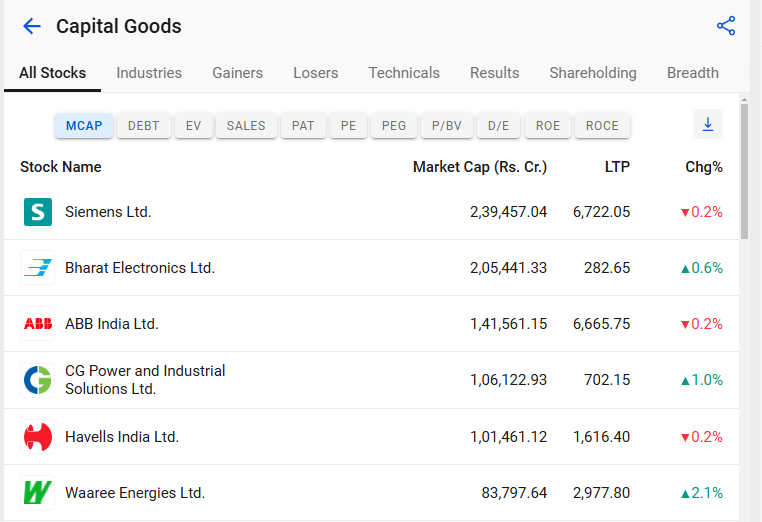

This segment is broad and is divided into seven industries with 323 stocks. Using StockEdge, you can check out the list of capital goods stocks in India.

Before moving ahead, let us discuss why investing in capital goods is considered a wise decision.

Why Is Investing in Capital Goods Stocks a Smart Choice?

Let’s look at the bigger picture. First, understand whether capital goods stocks are a profitable investment.

Suppose you see the 5-Years performance of S&P BSE Capital Goods, which includes stocks of the capital goods sector and the Nifty 50. It clearly shows that capital goods stocks have shown impressive growth over the past five years.

In the above image, it is clearly shown that as of 14th November, BSE capital goods stocks outperformed Nifty 50 over the past 5 years, with a return of 270.26% compared to the Nifty 50’s 97.83%.

Now, let’s look out for why you should keep the capital goods stocks in your portfolio.

Steady Market Demand

India’s capital goods manufacturing sector provides a strong base for its involvement in industries such as engineering, construction, infrastructure, and consumer goods, among others. From manufacturing to construction and energy, the need for capital goods is always present, ensuring a steady market for these stocks. As of January 2023, It accounts for 27% of the total factories in the industrial sector and represents 63% of the overall foreign collaborations. The Capital Goods sector contributes to 12% of India’s manufacturing output and 1.8% of GDP.

Growth Potential in Industrial Expansion

According to CRISIL, the capital goods industry is set to experience continued growth in the fiscal year 2025. Capital goods stocks are expected to see their revenue increase by a substantial 9% to 11%. This positive trend is fueled by government initiatives like the Production-Linked Incentive (PLI) schemes and Make in India, which promote domestic manufacturing, driving demand for capital goods.

While this growth rate is slightly lower than the projected 13% for the current fiscal year, 2024, it still indicates a promising outlook for the sector. This is due to the sustained demand for infrastructure development, modernization of defence capabilities, and the transition towards cleaner energy sources. These factors are expected to drive the demand for capital goods, benefiting manufacturers and contributing to overall economic growth.

Resilience to Economic Cycles

Capital goods stocks may experience volatility due to economic cycles, but in the long run, these industries tend to recover and grow as the economy stabilizes and expands. As demand for products and services rises post-recession, capital goods sectors often see significant rebounds, especially in an era of renewed focus on infrastructure.

How to Analyze Capital Goods Stocks for Investment

Analyzing capital goods stocks requires a comprehensive approach that considers both company-specific metrics and broader industry and economic factors. Let’s look at the key parameters to evaluate the capital goods stocks for investment.

Evaluate Financial Health and Debt Levels

When evaluating capital goods stocks, start with analyzing the balance sheet, profitability, and cash flow. Analyze the company’s ability to generate consistent profits and maintain healthy profit margins. Assess the company’s debt levels and its ability to meet its financial obligations. A strong cash flow generation is essential for funding operations, investments, and dividend payments.

Consider Dividend History

Many capital goods stocks pay regular dividends, which can be a sign of stable profitability and cash flow. Evaluate whether the company has a history of paying and increasing dividends over time, as this reflects management’s confidence in future earnings.

Evaluate Order Book

The order book is a crucial metric for evaluating capital goods companies because it reflects the company’s future revenue potential and the level of demand for its products or services. A strong order book suggests steady future earnings, which is vital for long-term planning and cash flow forecasting.

Watch for Government Policies and Infrastructure Spending

Capital goods stocks are often heavily influenced by government policies and infrastructure investments. For instance, initiatives like ‘Make in India’, ‘UDAN (Ude Desh ka Aam Naagrik) scheme’, and ‘Bharatmala scheme’ are driving growth in manufacturing and industrialization, providing new opportunities for companies in the sector.

You can check out the Investment Theme on StockEdge, where you will find the list of capital goods stocks that are involved in these initiatives.

Consider Global Economic Indicators

Capital goods demand is closely tied to economic growth. Indicators like GDP growth, industrial production index, and manufacturing PMI (Purchasing Managers’ Index) can give insights into the potential demand for capital goods.

Risks Associated with Capital Goods Stocks

Investing in capital goods stocks can be profitable, but it comes with unique risks. Understanding these risks helps investors make more informed decisions and develop strategies to mitigate them. Here are some key risks associated with capital goods stocks:

Economic Sensitivity

The capital goods sector is highly cyclical, meaning that its performance tends to rise and fall with economic conditions. During economic downturns or recessions, companies and governments often cut back on infrastructure spending, delaying or cancelling large capital projects. This leads to reduced demand for machinery, equipment, and other capital goods.

Dependency on Government Contracts

Many capital goods companies rely on government contracts, especially for infrastructure projects in sectors like transportation, energy, and construction. A change in government priorities or budget cuts can lead to delayed projects, reduced contract awards, or even cancellations, directly impacting revenue and profitability.

Technological Disruption

Government contracts often come with complex regulations and requirements. Changes in rules or political shifts can increase compliance costs or create operational delays. For example, a new environmental regulation may require companies to adapt their products, raising costs and reducing margins.

Now, understand the risks associated with capital goods stocks and how to analyze these stocks. Let’s take a look at Capital Goods Stocks You Should Keep an Eye On.

Capital Goods Stocks That Are a Must-Watch

Siemens Ltd.

Siemens is a technology company focusing on industry, infrastructure, mobility, and healthcare. It operates in 4 segments that include energy, innovative infrastructure, digital industries & mobility. The largest segment, Smart Infrastructure, contributes 35% to the overall revenue, focusing on technologies for smart cities, automation, and digital infrastructure. The Energy segment holds a significant 32% share, offering integrated products, solutions, and services for oil and gas production, power generation, and transmission. The Digital Industries segment, comprising 22%, specializes in automation, drives, and software solutions for various industries. Lastly, the Mobility segment accounts for 11% of the revenue, providing solutions for passenger and freight transportation, including rail and road technologies.

In 9M FY24, EBITDA grew by 21% YoY to ₹2,166 crore, and new orders stood at ₹17,400 crore. Going forward, it might witness a downward trend in the commodity prices and the business is expected to be in line with the market growth.

Want to dive deeper? Explore our Edge Report. For insights from our analytical tool, head to the dedicated dashboard in the app. To learn more about our latest advancements, check out our blog post, “The New Age of StockEdge: Sharper & Smarter“.

ABB India Ltd.

ABB India Ltd. is a global technology leader specializing in electrification and automation, driving a more sustainable and resource-efficient future. The company combines engineering expertise with software solutions to enhance and optimize how products are manufactured, moved, powered, and operated. ABB’s innovations help improve operational efficiency, reduce environmental impact, and support industries in achieving their sustainability goals. ABB India showcased strong financial performance in Q3 2022, with a notable 38% increase in orders year-over-year and a 19% rise in revenues. Profit before tax (PBT) rose by 39%, reaching INR 229 crore, while profit after tax (PAT) grew by 69% to INR 203 crore, demonstrating improved operational efficiency and cost optimization. The order backlog increased by 37%, signalling sustained demand.

Elgi Equipments Ltd.

Elgi Equipments (Elgi) manufactures a wide range of air compressors and automotive equipment. The company generates approximately 92.5% of its revenue from the production of air compressors and about 7.5% from automotive equipment. Elgi holds a ~22% market share in the Indian air compressor market, making it the second largest player domestically. On a global scale, Elgi ranks among the top eight players in the air compressor industry, reflecting its strong international presence and competitive position in the sector.

EBITDA for the quarter stood at ₹113.9 crore as compared to ₹88.6 crore in Q1 FY24. Volume and contribution for the quarter had a positive impact of ₹39.6 crore and ₹5.2 crore, respectively. Higher employee costs of ₹10.4 crore, along with higher other expenses of ₹9.1 crore, led to a net increase in EBITDA of ₹25.3 crore on a YoY basis. EBITDA could have been higher given that the USA would have reported growth as budgeted.

The Bottom Line

As per the Economic Survey 2019-20, energy sector projects account for the highest share (24%) in the ₹111 lakh crore national infrastructure pipeline for the period 2019-20 to 2024-25. Innovation and investment in infrastructure are the keys to scaling up manufacturing and growth. The Union Budget has allocated ~33% higher capital expenditure compared to the previous year. As India has emerged as the world’s fastest-growing huge economy, it is not surprising that demand for capital goods has more than doubled over the last decade. The growth rate of capital goods production in India was 13% in fiscal year 2023. It was a slight decrease from the previous year’s 16.9%. In FY24, exports of capital goods stood at US $109.32 billion, showing a marginal growth of 2.1% YoY growth. The government of India has announced the national infrastructure pipeline, which envisages significant infrastructure investments for the next few years.

Happy Investing!