Table of Contents

The Indian pharmaceutical market registered a 9% growth in February 2024. Currently, the Indian pharma industry is valued at $50 bn, and by 2030, it’s expected to reach a milestone of $130 bn.

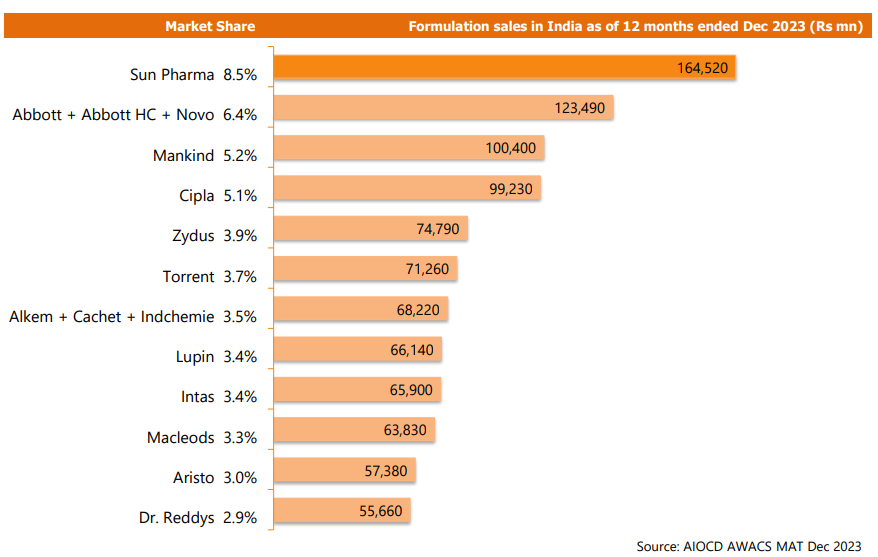

In the stock market, Sun Pharma share is a prominent name with the highest market capitalization in the pharmaceutical industry. It is a constituent of the Indian benchmark index Nifty 50 and has a market capitalization of 3.69 lakh crores. Surprisingly, Sun Pharma is the fifth largest speciality generic pharmaceutical company in the world, and it is the largest pharmaceutical company with an impressive market share of 8.5%.

In the past 1 year, Sun Pharma shares have given a return of 54% to its shareholders. So, should you invest in Sun Pharma shares? Is it a good long-term investment for your portfolio?

In this blog, we will be discussing the potential growth of Sun Pharma share in the long run and how you can strategies your investment with Sun Pharma share.

Company Overview

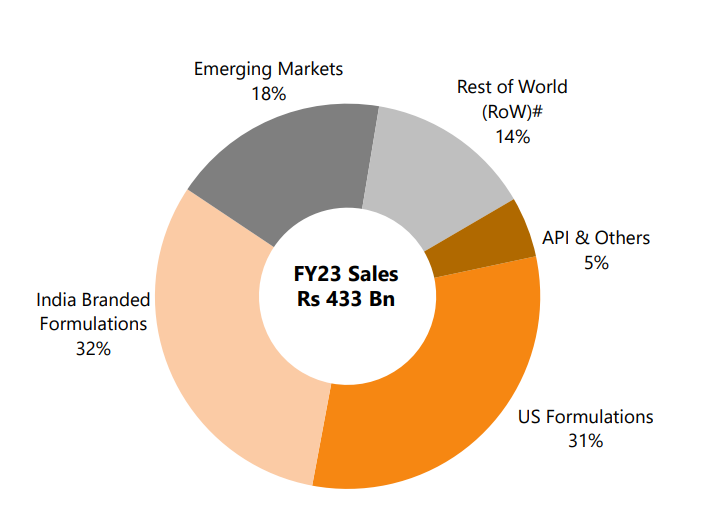

Established in 1983, Sun Pharmaceutical Industries Ltd. started with five psychiatry products and two other persons from marketing. Today It has a global presence with several manufacturing facilities across a few continents. In the US market, which contributes a significant share of its revenues, the company is the leader in the generic dermatology segment. The revenue mix of Sun Pharma for FY 23 is shown below:

Moreover, the company has expanded its footprint into Europe and key high-growth Emerging Markets (EM) such as Russia, Romania, South Africa, Brazil, and Malaysia. Its main focus lies in in-licensing generic and differentiated generic products that are nearing commercialization or are in an advanced stage of development for markets in North America, Western Europe, and Japan.

Financial Highlights

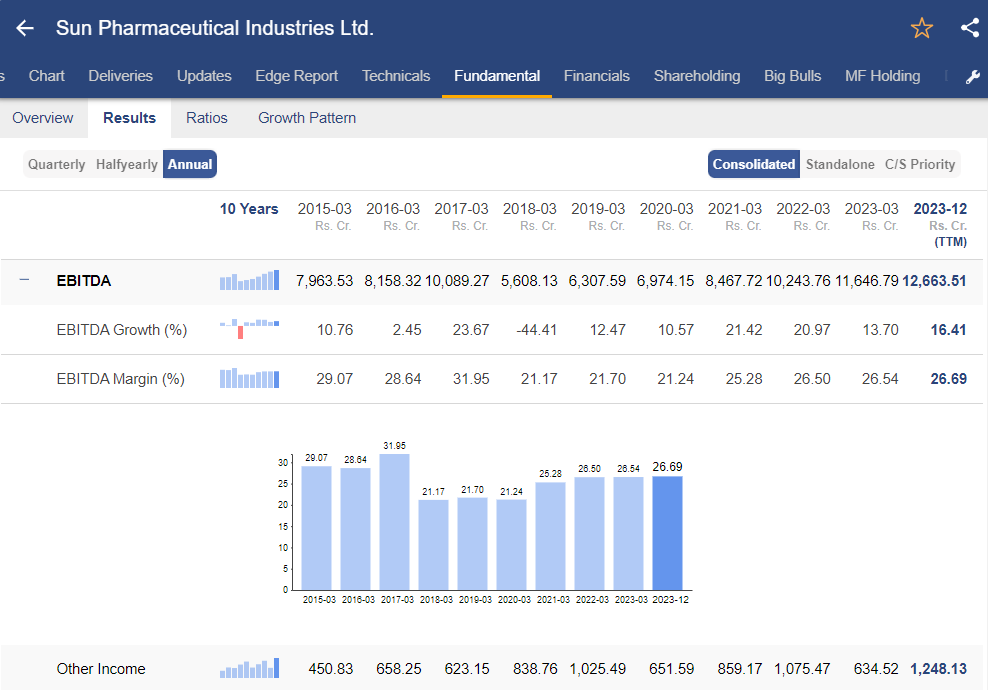

The overall sales of the company has increased by 10.1% YoY whereas the net profit jumped by 17.4% in Q3 of FY 24. Additionally, the material cost as a percentage of sales stood at 22.% during the quarter and witnessed a decline YoY, mainly due to better product mix and higher specialty product sales. The other expenses increased YoY on account of selling & distribution expense and research & development expense towards the consolidation of the Concert business.

The EBITDA margins of the company stood at 28.1% for Q3 FY24. However, you can track the annual EBITDA margins of Sun Pharma from StockEdge app:

Growth in India Business

In Q3 FY24, the sales of formulations in India were at ₹3,779 crore, up by ~11% on a YoY basis. This segment grew higher than the Indian Pharmaceutical Industries across therapies in chronic and the sub-chronic segment for the quarter.

Sun Pharma launcher 28 new products for the Indian market in Q3 FY24 that witnessed strong growth after its launch.

Growth in US Business

As mentioned earlier, Sun Pharma’s US formulation business accounts for 31% of the company’s total revenue. In Q3 FY24, their overall sales in the US grew by ~13% YoY to $477 million. However, the generic sales were substantially lower during the quarter and the same observed a flattish growth QoQ.

Sun Pharma launched 3 new generic products in the US market for Q3 FY24.

SWOT analysis of Sun Pharma Share

We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strengths

It is the 14th largest generics company in the USA, with a strong pipeline of 13 NDAs and 95 ANDAs awaiting clearance from the USFDA. Additionally, the Specialty R&D pipeline includes five molecules currently undergoing clinical trials. It plans to increase R&D investments for both speciality and generic businesses in the future.

Currently, most of the drug companies are facing high single-digit price erosion; the impact on Sun Pharma is less, given its focus on a specialty drug portfolio. The continued growth momentum for its US speciality drug portfolio, acquisitions, and outperformance in the domestic pharma market is likely to aid in sustaining its growth trajectory.

The API business provides the advantages of vertical integration and ensures continuity in the supply chain for its formulations business. It continues to focus on increasing API supplies for captive consumption relating to its key products.

Weaknesses

The generic business in the US is expected to have low growth or degrowth, with volume growth but no value growth from an industry perspective.

Opportunities

It expects high single digit consolidated top line growth for FY24. FY24 R&D expense guidance at 7-8% of sales. The company has shifted its US business strategy towards launching more speciality products in the US rather than pursuing highly competitive generic products. The company’s management considers API a key segment, as it provides vertical integration benefits and aids the continuity of the supply chain for the main formulations business. Therefore, it continues to focus on increasing API supply for captive consumption of key products.

Threats

The company has exposure in both turmoil-hit nations, Russia & Ukraine. Russia is an important market for the company, and currently, it is represented in more than 50 cities of Russia. It also has a presence in other CIS (Commonwealth of Independent States) nations. Additionally, sanctions against Russian banks may impact remittances of outstanding trade receivables from that country. Also, the ongoing tension in Israel could have a bearing on the performance of the company. This remains monitorable.

The Bottom Line

The management focus continues to remain on top line growth, achieve operational efficiencies and expansion of its specialty business, globally. The shift in strategy towards specialty products in its US business may prove beneficial for the company’s performance, in the long term. Additionally, they would continue to focus on launching new products by improving the contribution of the products in the overall Indian business.

However, the company needs to pace its transition to avoid competitive intensity.

The expected growth in the high margin specialty business vertical, coupled with recovery seen in other verticals is likely to be the growth drivers.