Key Takeaways

- Quick stock discovery: StockEdge Technical Scans help traders instantly filter stocks using proven technical rules, removing the need to manually check multiple charts.

- Structured categories for easy use: These technical scans are neatly organised into Trend, Momentum, Volume, and Volatility, making it simple to pick setups based on trading style.

- AI-powered Momentum Score: The Momentum Score blends short-, medium-, and long-term trend strength to highlight stocks with consistent directional movement.

- Deep indicator-based screening: From Moving Averages and RSI to Bollinger Bands, ATR, SuperTrend, and Narrow Range setups, each indicator includes multiple scans for precise entries.

- Made for beginners and pros: StockEdge Technical Scans simplify complex chart analysis into ready-to-use insights, helping traders spot high-quality opportunities faster and with more confidence.

- Key Takeaways

- Overview of Auto Sales in India

- The Importance of the Automobile Industry in India's Economy

- A Snapshot of Recent Years Sales Trends

- Understanding the Monthly Sales Data Collection Process

- Detailed Review of Sales Figures YoY

- Electric Vehicles (EVs) in India

- Growth of EV Sales in India

- Government Policies Boosting EV Sales

- Factors Influencing Auto Sales in India

- Future Trends in the Indian Auto Market

- Conclusion

- Frequently Asked Questions (FAQs)

A company’s top-line growth, which is basically sales growth or revenue growth, is an important factor that determines its future potential. In the Indian automobile industry, auto makers report auto sales data every month, which becomes a barometer of the company’s growth. Additionally, it also gives investors an indication of the company’s growing presence in the market.

So, in this blog, we will analyze the monthly auto sales figures of different automakers in India and understand the importance of auto sales data as an investor and its impact on the stock prices for short-term traders.

Overview of Auto Sales in India

The auto sales figures serve as a vital economic indicator, reflecting consumer confidence and the economic health of India. It also enables automakers to fine-tune production levels, manage inventory effectively, and align product offerings with market preferences. Finally, the analysis of auto sales figures plays a pivotal role in driving growth, fostering innovation, and sustaining employment within the Indian automotive industry.

The Importance of the Automobile Industry in India’s Economy

As mentioned above, the auto sales figures serve as an economic indicator that reflects consumer confidence as rising middle-class income and a huge youth population will result in strong demand. The automobile industry contributed 7.1% of the country’s GDP in 2024-25, which was only 2.77% of GDP in the year 1992-1993. It also contributed 49% of the total manufacturing GDP.

By the end of 2030, India aims to increase its auto industry size to 200 billion$, with exports expected to triple to 60 billion$

The auto industry stocks is divided into sub-segments, which are:

- Two-wheeler vehicles, where India is the world’s largest manufacturer.

- Passenger Vehicles

- Commercial vehicles

- Three-wheelers

- Quadricycles

A Snapshot of Recent Years Sales Trends

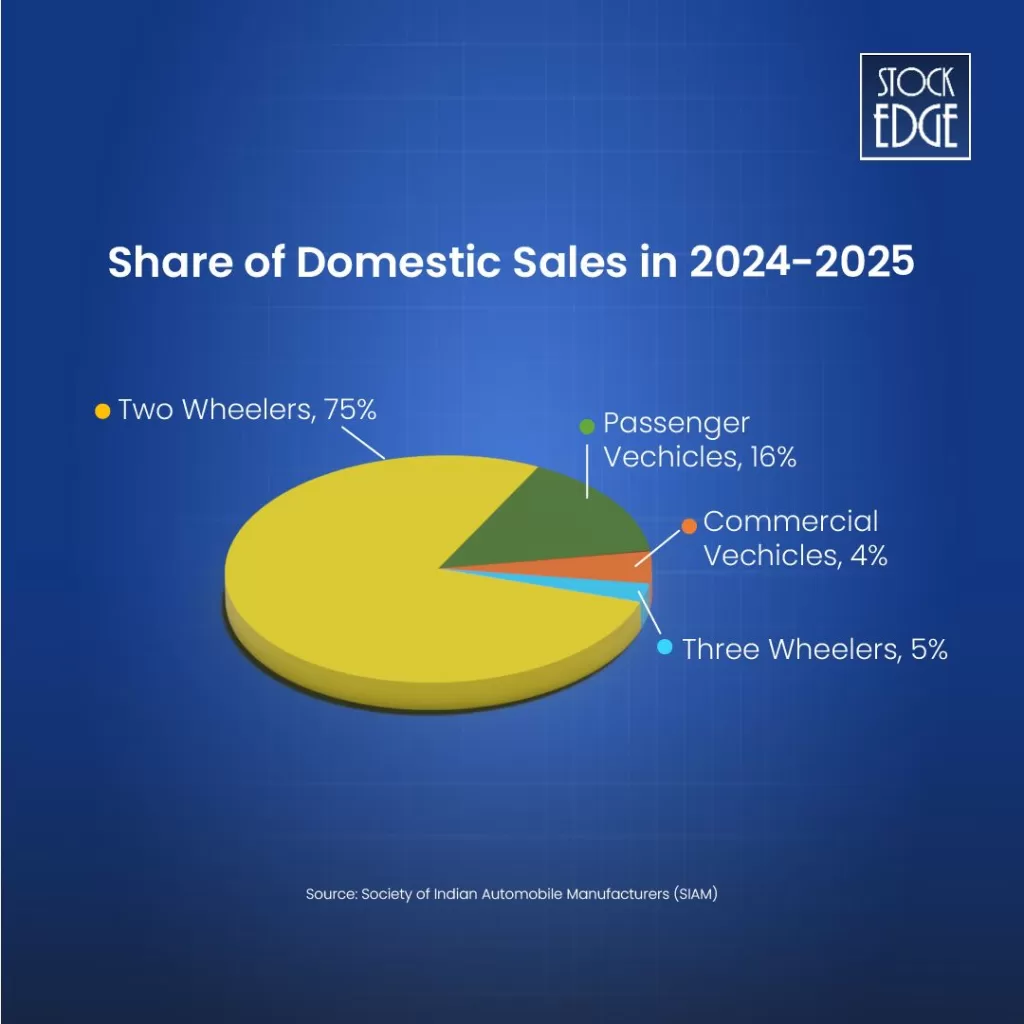

As per the report published by Society of Indian Automobile Manufacturers (SIAM) in 2024–2025, the two-wheelers and passenger cars accounted for 76.57% and 16.80% market share respectively.

Monthly Analysis of Auto Sales Figures

Source: Edge Report by StockEdge

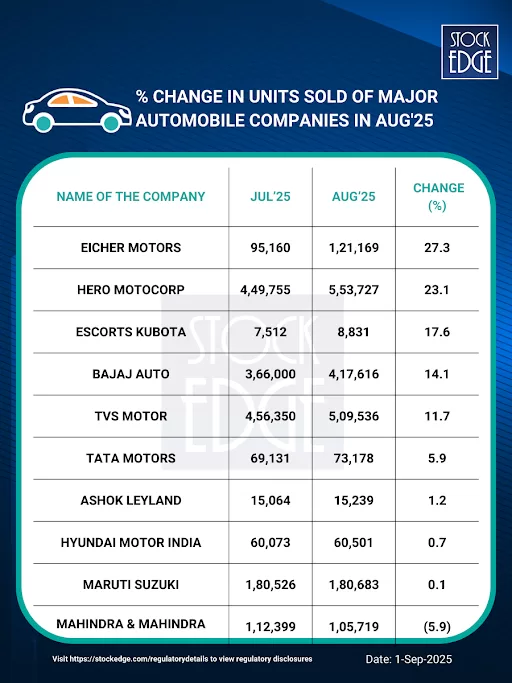

The above figures show the company’s units sold month on month. The higher the percentage change from current month to its previous month indicates the automaker managed to sell a higher number of units which is a sign of high demand for its product in the market.

Understanding the Monthly Sales Data Collection Process

In the data collection process, dealers all over the country play a pivotal role, and the auto sales figures for each month are collected and sent to the automobile manufacturer. By the 1st of every month, the manufacturers of automobile companies share the report of total units sold by them. Units Sold is basically the number of vehicles purchased by consumers in a given period. Accurate and timely reporting from dealerships ensures the reliability of auto sales data. This metric is a fundamental measure of how well a particular automaker or brand is performing in the market.

Detailed Review of Sales Figures YoY

Month-on-Month (MoM) comparisons are useful for spotting short-term trends. For example: whether sales are improving sequentially from one month to the next. However, MoM figures can be distorted by seasonality or one-off events (like weather or product launches).

In contrast, Year-on-Year (YoY) comparisons measure performance against the same period of the previous year, making them far more reliable for identifying true growth trends. YoY analysis effectively neutralizes seasonal effects, providing a clearer picture of whether a company is genuinely improving on a structural basis rather than due to temporary fluctuations.

The above data shows you the change in YoY sales of different automobile manufacturers in India for September 2024 and September 2025. Here you need to follow a particular trend in the sales data, whether the automobile manufacturer has been consistently growing positively or not.

For instance, you can see that for Mahindra and Mahindra here, the change in YoY sales has been extremely positive which is a great sign, whereas for Eicher Motors, the Change in YoY sales remains flat. However, please note that this does not necessarily mean that Mahindra is a good buy, or Eicher Motors is not. There are other fundamental factors involved.

Traders can also capitalise on the short term fluctuations by focussing on MoM data.

Let’s look at an example:

This is the daily chart of Ashok Leyland; as earlier, we were discussing how the company’s % change in MoM sales has turned from negative in the month of Jan 24 to a 30% rise in the month of March 24. Its effect is also reflected in the share price as well. When the auto sales data for March 2024 arrived on the 1st of April 2024, the stock price gained 2.82%, and later, after a short pullback, the stock price surged nearly 11% over the month.

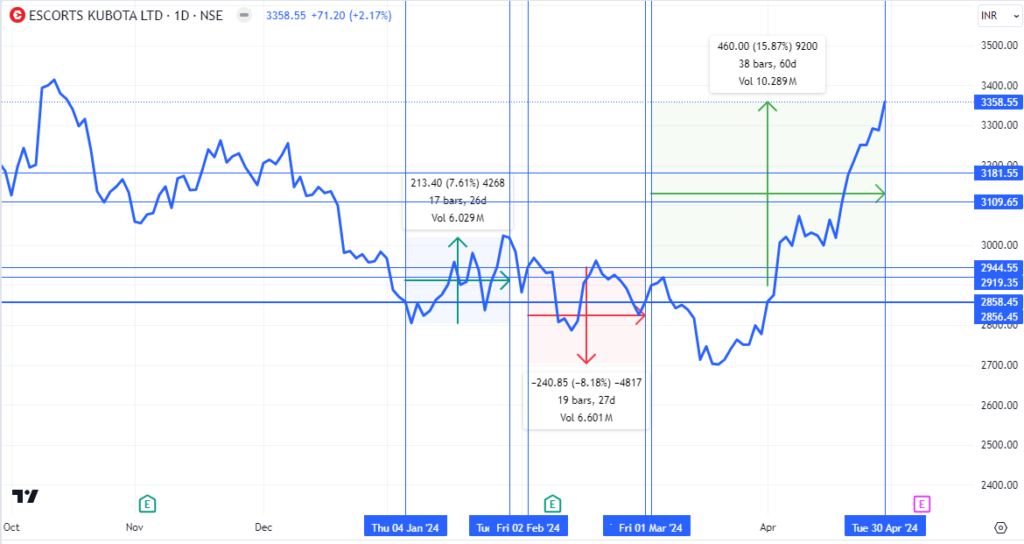

Similar trend can be seen in the stock price movements of Escorts Kubota. The company registered a 27% MoM growth in Jan 2024 but sales growth declined to 5.7% in February of 2024 and then a sharp jump of 30% in March 2024.

As you can see, the share price of Escorts got affected after the auto sales data was released every month.

However, please note there is no certainty that if auto sales data turn out to be good or bad there is an immediate effect, you must consider other technical factors as well before initiating any trade.

Segment-wise Breakdown

As per the data published by the Federation of Automobile Dealers Associations (FADA) for FY 25, the overall auto industry achieved a growth of 5% YoY.

Passenger Vehicles – Analysis and Trends

Passenger Vehicle sales stood at 1.04 million units in Q2 of 2025–26, registering a de-growth of (-)1.5% compared to Q2 of 2024–25. However, the segment showed signs of recovery towards the end of the quarter, with September 2025 sales up by 4.4%, aided by recent GST reduction measures, improved consumer sentiment, and the onset of the festive season.

Commercial Vehicles – Insights into Sales Data

Commercial Vehicle sales stood at 2.40 Lakh units in Q2 of 2025–26, reflecting a growth of 8.3% compared to Q2 of 2024–25.

The growth was broad-based across segments, with Medium & Heavy Commercial Vehicles (MHCVs) benefiting from strong freight demand, and Light Commercial Vehicles (LCVs) showing improvement due to robust intra-city logistics requirement.

Electric Vehicles (EVs) in India

The Eclectic Vehicles (EV) segment in India is witnessing significant growth and attention in recent years. As the world moves towards sustainable transportation solutions, India is also making strides in embracing electric vehicles as a key component of its mobility ecosystem.

The EV segment in India is not only about cars; it encompasses a wide range of vehicles, including electric scooters, motorcycles, rickshaws, and buses. This diversity reflects the potential for electrification across different modes of transportation in the country.

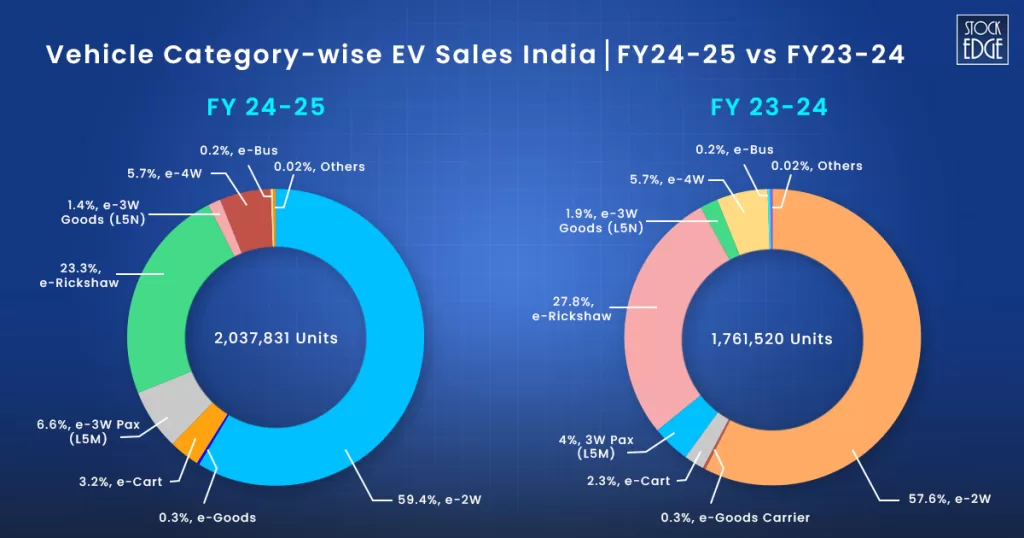

Growth of EV Sales in India

IIndia’s electric vehicle (EV) market is experiencing rapid growth, driven by government incentives, rising fuel prices, and increasing consumer awareness about environmental sustainability. Sales nearly doubled in 2023 and are expected to climb another 17% this year, according to IBEF research. This surge is placing India among the world’s fastest-growing EV markets.

Electric passenger vehicles crossed the 100,000-unit mark, with a total of approximately 107,462 units sold in FY25, up from 91,321 in FY24; marking a 18.2% increase YoY

Similarly, the electric vehicle two-wheeler segment witnessed a growth of 21.2% YoY. The sales of electric two-wheelers increased to 11,50,000 units in FY 25 from 9,44,000 units in FY 23.

Government Policies Boosting EV Sales

Government subsidy schemes like FAME-II offer financial incentives to EV manufacturers and buyers, making EVs more affordable. The FAME II scheme, with a budget outlay of Rs 10,000 crore, was introduced in 2019 for a period of three years, which ended in March 2024. This triggered a setback for the overall growth of the EV industry in India. However, the Centre has reportedly extended its FAME-II scheme by four months to avoid any disruption in the EV industry and allocated Rs 500 crore to cover subsidies for demand incentives for e2W and e3Ws until July 31, 2024.

Factors Influencing Auto Sales in India

The two major factors that are influencing the auto sales in India are as follows:

Economic Factors and Consumer Spending

- Economic growth and disposable income: A strong economy with rising disposable income puts more money in people’s pockets, allowing them to afford car purchases. Conversely, economic downturns can significantly dampen sales.

- Interest rates: Low-interest rates make car loans more affordable, stimulating demand. Higher rates have the opposite effect.

- Fuel prices: Rising fuel costs can incentivize consumers to shift towards more fuel-efficient vehicles or even EVs.

Technological Advancements and Their Impact

- Fuel efficiency and alternative fuel options: Advancements in engine technology and the growing popularity of EVs are giving buyers more fuel-efficient options, reducing running costs and environmental impact.

- Safety features: Increasing integration of advanced safety features like airbags, ABS, and electronic stability control makes cars more appealing to safety-conscious buyers.

- Connectivity and convenience features: Features like touchscreen infotainment systems, navigation, and connected car technology enhance the driving experience and attract tech-savvy consumers.

Future Trends in the Indian Auto Market

Here’s a glimpse into emerging market trends in the automobile industry based on current data:

- Surge in Electric Vehicles (EVs): Fueled by government incentives, dropping battery prices, and rising environmental concerns, EV sales are expected to soar in emerging markets like India.

- Focus on affordability: As a cost-conscious demographic dominates emerging markets, carmakers will prioritize developing and offering budget-friendly EVs alongside premium models.

- Rise of Mobility-as-a-Service (MaaS): Car ownership might decline in favour of convenient and economical MaaS options like ride-hailing and car-sharing, especially in densely populated cities.

- Shared electrification: With MaaS gaining traction, fleet electrification is likely to become a priority for ride-hailing and car-sharing companies to reduce operational costs and environmental impact.

- Two-wheeler electrification: The two-wheeler segment is expected to be a major driver of EV growth in emerging markets due to lower upfront costs and government initiatives promoting clean transportation.

Conclusion

In conclusion, India’s auto industry is experiencing a resurgence fueled by a rise in disposable income, technological advancements, and a growing preference for EVs. The future looks bright with increasing EV adoption, a focus on safety and connectivity, and the potential for disruptive mobility solutions. This sector is poised to be a key driver of India’s economic growth in the years to come.

Now, that you have a deep understanding of analyzing the auto sales data, here is another blog which may enlighten you about the Indian aviation sector and the investment opportunities in it.

Happy Investing!

Frequently Asked Questions (FAQs)

1. What Are the Best-Selling Car Models in India?

As per TeamBHP.com data published in September 2025, the best selling cars in India are ranked below:

1. Tata Nexon

2. Maruti Dzire

3. Hyundai Creta

4. Mahindra Scorpio

5. Tata Punch

6. Maruti Swift

7. Maruti WagonR

8. Maruti Fronx

9. Maruti Baleno

10. Maruti Ertiga

2. How Do Fuel Prices Affect Auto Sales?

Higher fuel prices tend to push consumers towards more fuel-efficient vehicles and can also dampen overall sales due to budget constraints.

3. What Is the Forecast for EV Sales in India?

India has set an ambitious target of ensuring that 30% of all vehicles sold are electric by 2030. The country’s EV adoption, though initially slow, has begun to accelerate in recent years. Electric vehicle sales in India surged from just 50,000 units in 2016 to 2.08 million in 2024, reflecting growing consumer acceptance, government incentives, and expanding charging infrastructure. In comparison, global EV sales rose from 918,000 units in 2016 to 18.78 million in 2024.

While India’s EV penetration in 2020 was only about one-fifth of the global average, it has since strengthened to over two-fifths of global penetration by 2024, signaling a steady narrowing of the adoption gap.