Table of Contents

Introduction

Within the ever-changing field of engineering and construction, Larsen & Toubro (L&T) is a trailblazing leader. With over a decade-long history, L&T has left its imprint on the world stage by completing landmark projects that revolutionise infrastructure. With its innovative technologies and environmentally friendly solutions, L&T has a positive impact on the new age India. How can this massive engineering company continuously innovate? How does it contribute to the advancement of sustainable practices? Let’s find out if L&T stock can be a good investment opportunity or not?

Company Overview

Larsen & Toubro Limited is one of the renowned most popular Indian multinational conglomerates and is operating in sectors like “engineering”, “construction”, “manufacturing”, “information technology”, “technology”, “financial services” and “military”. The company has been in business since 1938. However, it was legally incorporated in 1946 by Danish engineers Henning Holck-Larsen and Søren Kristian Toubro.

L&T share addresses critical needs in key sectors like Hydrocarbon, Infrastructure, Power, Process Industries and Defence; for customers in over 30 countries around the world. The company’s manufacturing presence extends across eight countries in addition to India. It is engaged in core, high impact sectors of the economy and the integrated capabilities span the entire spectrum of ‘design to deliver’. With eight decades of a strong, customer focused approach and a continuous quest for world-class quality, the company have an unmatched expertise across Technology, Engineering, Construction, Infrastructure Projects and Manufacturing, and maintains a leadership in all the major lines of business.

The company serves the government and large corporate customers across multiple sectors, both in India as well as globally. The realty and financial services businesses provide B2C offerings as well in addition to B2B products/services. In FY23, the company generated 62% of revenues from domestic and remaining 38% from other countries. As at 31st March 2023, the L&T Group comprises 97 subsidiaries, 5 associate companies, 15 joint ventures and 35 jointly held operations. L&T’s commitment to both innovation and sustainability reinforces its pioneering position in the engineering sector. Hence, the factors have the potential to impact the potential of growth for L&T.

Business Portfolio of L&T

The company boasts a diverse business portfolio spanning various segments. Here’s a quick breakdown:

1. EPC (Engineering, Procurement, Construction): This core segment focuses on large-scale infrastructure projects like roads, bridges, power transmission & distribution, catering to government and private clients. Think of them as architects, builders, and commissioning experts rolled into one for critical infrastructure needs.

2. Manufacturing: L&T’s manufacturing arm specializes in custom-built equipment for defense, shipbuilding, and process industries. They’re the muscle behind sophisticated machinery and vessels.

3. Services: This dynamic segment encompasses information technology (LTI and Mindtree), technology services (LTTS), smart world & communication, real estate, and financial services (LTFHL). They bring expertise in IT solutions, data management, smart city infrastructure, and financial advisory services.

4. Development: L&T isn’t just about building; they also develop. They’ve undertaken projects like the Hyderabad Metro, road operations, and power plants, shaping communities and industries.

L&T is more than just an engineering company; it’s a multifaceted business group delivering solutions across infrastructure, manufacturing, services, and development. This strategic re-classification reflects their commitment to diversification and growth, solidifying their position as a leading force in India’s industrial landscape.

L&T’s Sector & Industry Outlook: A Promising Landscape

Infrastructure: India’s infrastructure push offers a strong tailwind for L&T. Government spending on roads, railways, and renewables is expected to remain high, driving demand for their EPC expertise. However, rising input costs and competition from global players pose challenges.

Engineering & Construction: The industry is on a recovery path after pandemic disruptions. Growth in data centers, power transmission, and green infrastructure bodes well for L&T. Still, intense competition and margin pressures require operational efficiency and strategic partnerships.

Competitive Landscape: Compared to domestic peers like KNR Construction and IRB Infrastructure, L&T has a wider portfolio, including high-margin manufacturing and services segments, providing diversification benefits. However, international giants like Bechtel and Fluor have larger scales and global reach, highlighting the need for L&T to expand strategically.

It is the largest company in the infrastructure sector in India with a presence in almost every sub-sector. The company has been witnessing one of the highest quarterly order inflows in the history of the company. Over the years, the company has also gained market share and consolidated its leadership in various segments. The odds of L&T further consolidating its market share is high as the company is better placed to deal with the fallout of the competition. Unlike other infrastructure companies, L&T has a fair degree of flexibility to move across segments due to its various capabilities

Overall, L&T’s outlook is positive, supported by India’s infrastructure focus and their diversified business model. However, navigating competition and cost pressures will be key for sustained growth.

Moreover, it is included in the Nifty 50, which serves as India’s benchmark index. For further insights into Nifty 50 stocks, explore All About NIFTY50, its components, and strategies for investing in it.

Unveiling L&T’s Growth Story: A Financial Snapshot

Let us delve into the financial performance of Larsen & Toubro (L&T), dissecting key metrics like sales, profitability, and more.

Sales Growth

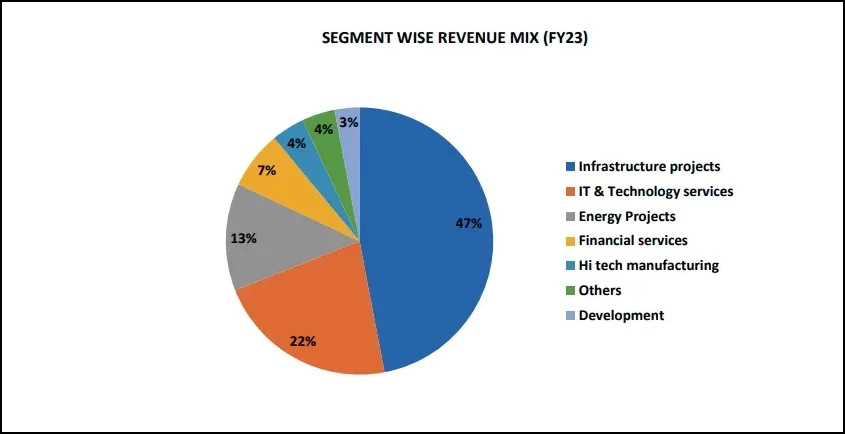

In FY23, the consolidated sales grew by 17% YoY to ₹1,83,341 cr driven by growth in infrastructure projects on account of improved execution and IT & technology services. International sales stood at ₹68,787 cr constituted 38% of the total sales. In H1 FY24, the consolidated sales grew by 26% YoY to ₹98,906 cr primarily aided by strong execution in the projects and manufacturing portfolio. The projects and manufacturing business includes infrastructure projects, energy projects, hi-tech manufacturing and others segment, grew by 36% YoY. As on 30th September 2023, the consolidated order book stood at ₹4,50,734 cr, with 35% of orders from international segment. Around 91% of the total order book is from infrastructure and energy business segment.

PAT Growth

In FY23, the PAT grew by 23% YoY to ₹12,625 cr supported by higher other income and lower tax expenses. In FY23, the effective tax rate stood at 25.2% (v/s 29.1% in FY22). In H1 FY24, the PAT grew by 36% YoY to ₹6,972 cr supported by higher other income during the period. The other income increased by 59% YoY to ₹2,279 cr aided by treasury operations. The 5 year CAGR is around 8.4%

EBITDA and PAT Margins

In H1 FY24, the EBITDA margin contracted by 147 bps YoY to 13.5% because of margin contraction in the infrastructure projects due to cost pressures in the legacy EPC (engineering procurement and construction) projects taken prior to Covid and margin pressure in IT & Technologies services due to increased talent acquisition & retention costs. The margins in other segments such as energy projects and hi-tech improved YoY.

However the PAT margin expanded by 55 bps YoY to 7% supported by higher other income.

ROCE

In FY23, the ROCE improved to ~13% led by an improvement in the overall PBIT. L&T has been working on bringing an overall cost and operational efficiencies for achieving profitable growth. The key endeavor is to lower costs as well as put greater emphasis on contract and project management. In the infrastructure segment, the company is witnessing margin pressure due to cost pressure witnessing in the legacy projects which taken prior to Covid. The margin recovery in infrastructure projects shall be seen in H2 FY24 on account of completion of these legacy projects.

To conclude, we can infer from the above data that L&T has had strong financial performance in recent years, barring some exceptional situations due to COVID years.

Decoding Working Capital Cycle and Cash Flow Health

Understanding a company’s efficiency often goes beyond top-line figures. This analysis dissects L&T Share’s performance through the lens of its working capital cycle and cash flows, unveiling critical insights into its ability to generate revenue, manage resources, and stay financially flexible.

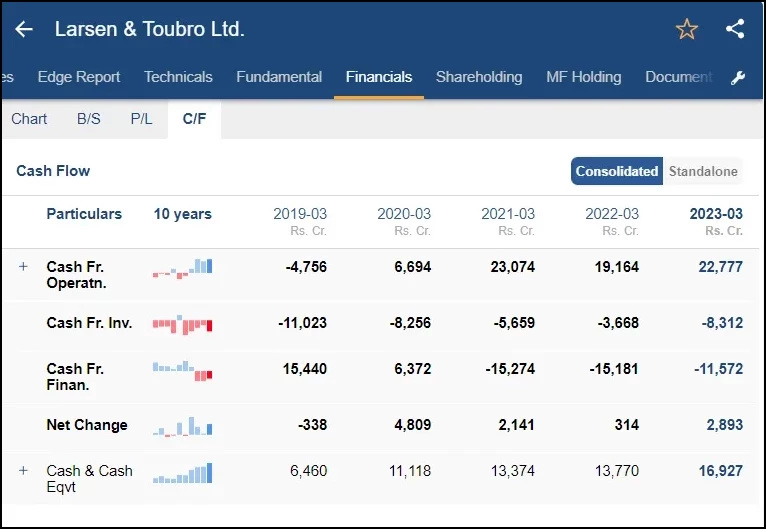

Cash Flows

In FY23, the cash from operation increased to ₹22,777 cr supported by healthy execution and working capital management. Under investing activity, net investment for capex activities was ₹3,793 cr. Under financing activity, the cash outflows stood at ₹11,572 cr as the company repaid non-current borrowings ₹4,854 cr, paid interest and dividend worth ₹3,046 cr and ₹3,091 cr, respectively.

Working capital cycle

L&T has had healthy working capital days over the years on account of lower receivable days and high payable days. Initiatives such as putting emphasis on speedy customer collections, accelerating invoicing of work completed and reducing inventory levels has primarily helped to improve the working capital cycle days.

Free Cash Flow

Being a capital intensive business, the company witnesses huge sums of capital outflows which are needed for upgradation, acquisition and expansion. In FY23, the company incurred capital expenditure of ₹3,793 cr. Going forward the management expect capital expenditure towards existing businesses comprising projects, manufacturing and realty segment. ~₹6,000 to ₹7,000 cr will be towards new businesses like data centers, green EPC, electrolyzers and battery.

L&T’s Management Approach to Quality and Long-Term Value

The management’s focus remains on ensuring efficient conversion of the order book into healthy margins through execution, operational excellence and digitalization initiatives and driving the growth of the services businesses having a high ROE profile. They have been proactive in managing the workforce during the pandemic and slowed down execution from the month of February 2020 itself. Though it led to lower execution of the projects, but in the latter half, the company has been able to bring up the work force efficiently. The management has been working on divesting the non-core assets to improve the capital efficiency and also invest and improve the core businesses which would generate stakeholder returns in the long term.

Future possibilities of L&T stock

The future prospects of L&T share rely upon different elements, including foundation advancement patterns, project execution productivity, and monetary circumstances. In H1 FY24, the group order inflow grew by 65% YoY to ₹1,54,672 cr. International orders stood at ₹87,333 cr during the period comprised 56% of the total order inflow. During the period, the orders were received across diverse segments like onshore verticals of the hydrocarbon business, urban transit systems, transmission & distribution, residential & commercial space, rail, renewable and rural water supply. The company maintained its guidance of ~10%-12% growth in consolidated order inflow and 12%-15% growth in consolidated sales for FY24.

It expects projects & manufacturing business EBITDA margin to be in the range of 8.5%-9% in FY24 from the earlier guidance of ~9%.

The company’s focus continues to be on efficient execution of its large order book, working capital reduction, cost optimization through use of digital technologies aimed at operational efficiencies and driving an agile balance sheet.

Conclusion

From the above analysis, investing in L & T shares is a great opportunity for investors as the company is at its stage of growth, which focuses on expanding the business further and ensuring digital innovation and development. The growth-centric focus of the company towards cost optimisation, digitisation and cost reduction can help the company to sustainable growth.