Key Takeaways

- Fintech is reshaping India’s financial ecosystem: Rapid adoption of digital payments, online lending, insurance, wealthtech, and neo-banking is driving long-term structural growth.

- Digital-first population: A young, smartphone-first India prefers UPI, app-based investing, and instant credit, expanding fintech reach across urban and regional markets.

- AI, embedded finance, and DPI will drive 2026 growth: Personalisation, OCEN–Account Aggregator integrations, and embedded finance will lower friction and boost scale for fintech stocks.

- Key risks: Policy changes, rising cyber threats, operational outages, and margin pressure can affect the profitability and growth prospects of fintech stocks India.

- Market leaders are improving fundamentals: Companies like PB Fintech and Paytm are focusing on profitability, stronger core metrics, and partnerships—making them important names to track.

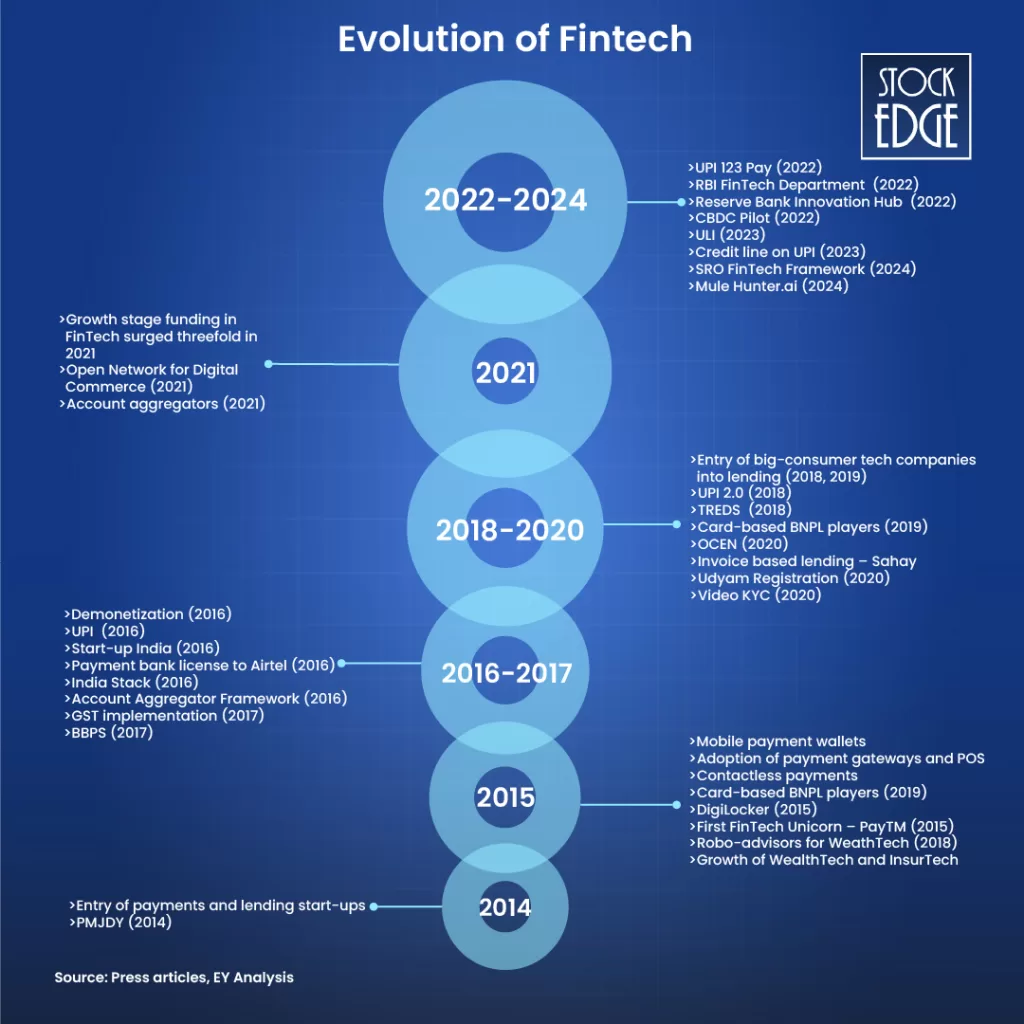

In the early 2000s, managing money in India meant long queues at banks, passbooks filled by hand, and payments made only through cash. Fast-forward to today, and the financial landscape looks nothing like it did back then. A chai seller scans a QR code, an MSME gets a loan in minutes with just a PAN, and a 22-year-old invests her first salary through a mobile app, all without stepping outside.

This shows the evolution of the fintech companies in India. It has become the backbone of India’s financial growth. From digital payments and lending to insurance, wealthtech, and regulatory tech, fintech has woven itself into the everyday lives of consumers and businesses alike.

In this blog, we will understand the fintech stocks and why they are gaining investor attention. Then we will dive deep into the opportunities, risks, trends, and understand the financials of fintech stocks.

What are Fintech Stocks?

Fintech stocks represent companies that leverage technology to improve or automate financial services. From payments and lending to insurance and wealth management, fintech firms are reshaping how individuals and businesses manage money. Investing in fintech stocks allows participation in the growth of India’s rapidly digitising financial ecosystem.

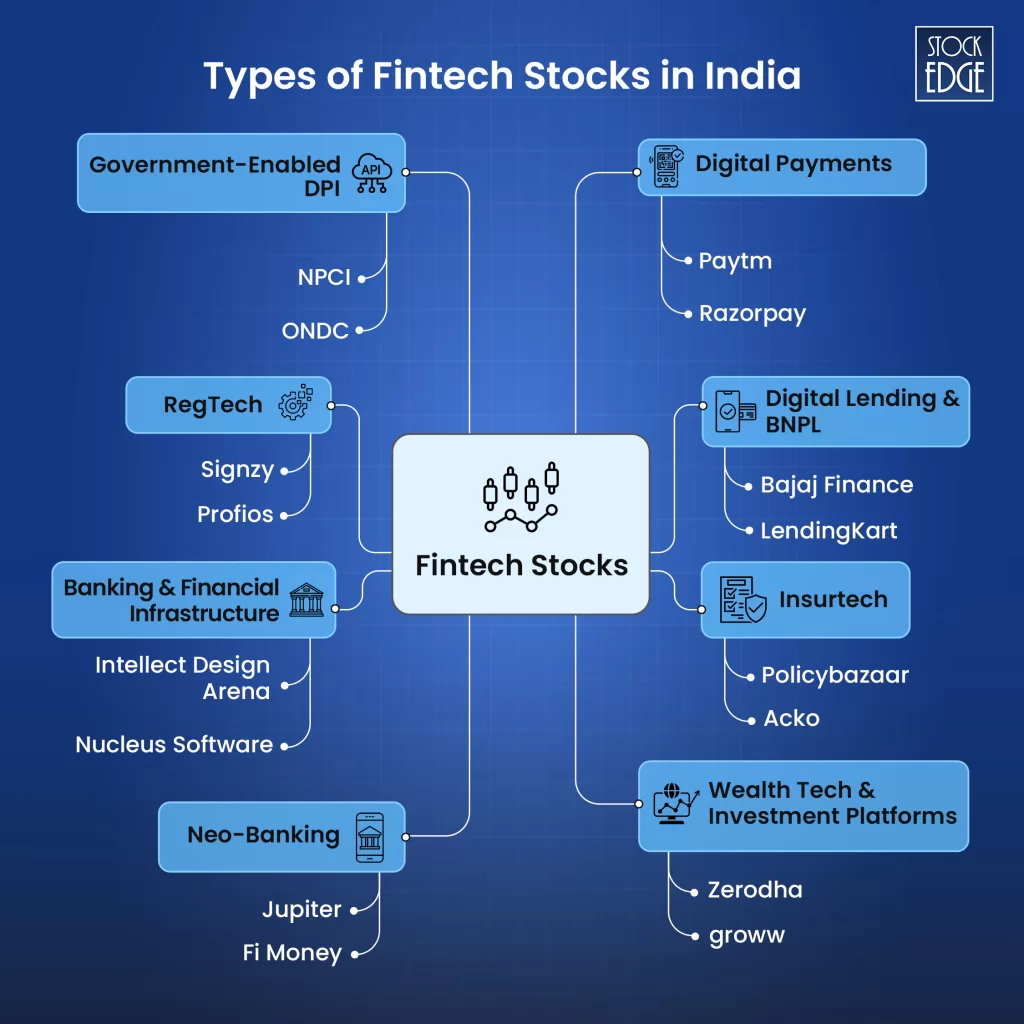

Types of Fintech Stocks

- Digital Payments

What they do: Enable fast, cashless transactions via apps, UPI, QR codes, POS, and gateways. Power merchant payments, bill settlements, and seamless fund transfers.

Examples: Paytm, Razorpay, PhonePe, BillDesk - Digital Lending & BNPL

What they do: Offer instant, paperless loans and Buy Now Pay Later options using technology and alternative data. Serve consumers and SMEs with rapid credit approvals.

Examples: Bajaj Finance, LendingKart, ZestMoney, CASHe - Insurtech

What they do: Digitise insurance discovery, purchase, and claims with AI, online KYC, and automated claims processing. Improve accessibility and affordability.

Examples: Policybazaar, Acko, Coverfox - WealthTech & Investment Platforms

What they do: Simplify investing in stocks, mutual funds, SIPs, ETFs, and gold. Offer robo-advisory, digital KYC, and goal-based planning.

Examples: Zerodha, Groww, Upstox, CAMS - Neo-Banking

What they do: Mobile-first, branchless banks with savings accounts, zero-fee cards, budgeting tools, and SME solutions. Analytics-driven personal finance management.

Examples: Jupiter, Fi Money, RazorpayX - Banking & Financial Infrastructure (BFSI Tech)

What they do: Provide core banking systems, loan management, payment switches, and fraud detection tools for banks, NBFCs, insurers, and fintech platforms.

Examples: Intellect Design Arena, Nucleus Software, Infosys Finacle, TCS BFSI - RegTech (Regulatory Technology)

What they do: Help financial institutions meet compliance efficiently using AI and automation – KYC, AML, fraud detection, and risk management.

Examples: Signzy, Perfios, IDfy - Government-Enabled Digital Public Infrastructure (DPI)

What they do: Enable fintech scalability and interoperability through platforms like UPI, Aadhaar, e-KYC, FASTag, BBPS, and Account Aggregators.

Key Players: NPCI, ONDC, India Stack

Why Fintech Stocks in India Are Gaining Investor Attention

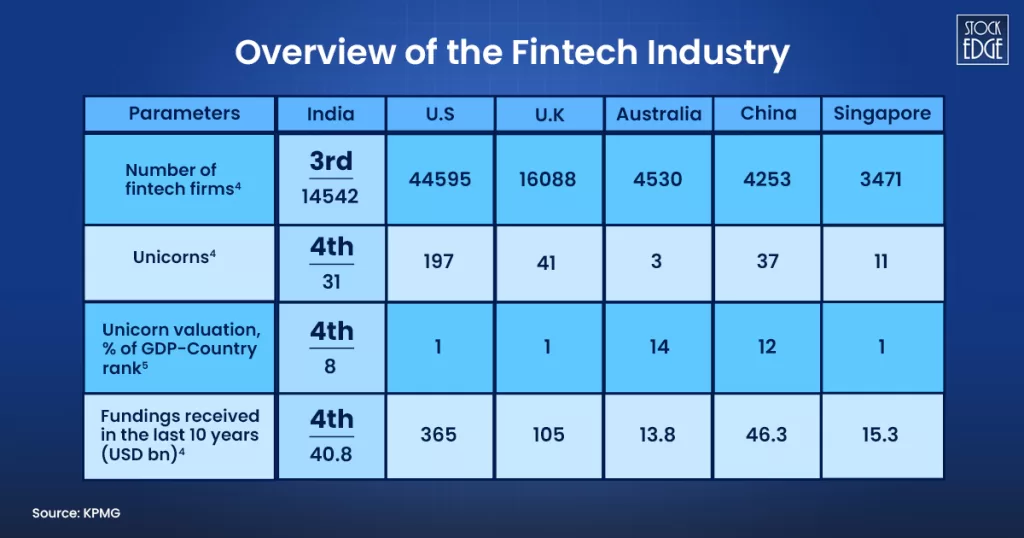

After a decade of rapid innovation and growth, the Indian FinTech ecosystem is now focused on inclusivity, scalability and sustainability.

What makes this sector especially attractive to investors today is the powerful combination of macro-economic strength, digital infrastructure, demographic advantages, and massive underpenetration. Let’s understand the structural tailwinds that are reshaping the financial services landscape and positioning fintech companies for multi-year expansion.

Macroeconomic Growth & Rising Middle-Class Wealth

With India’s GDP per capita rising from $800 in 2005 to $2,711 in 2024, millions of households are becoming credit-active, investment-ready, and more financially aspirational. A middle-income population of 470–500 million adults, along with 110+ million affluent consumers, is driving unprecedented demand for digital payments, online lending, WealthTech apps, and insurance platforms, directly benefiting fintech stocks.

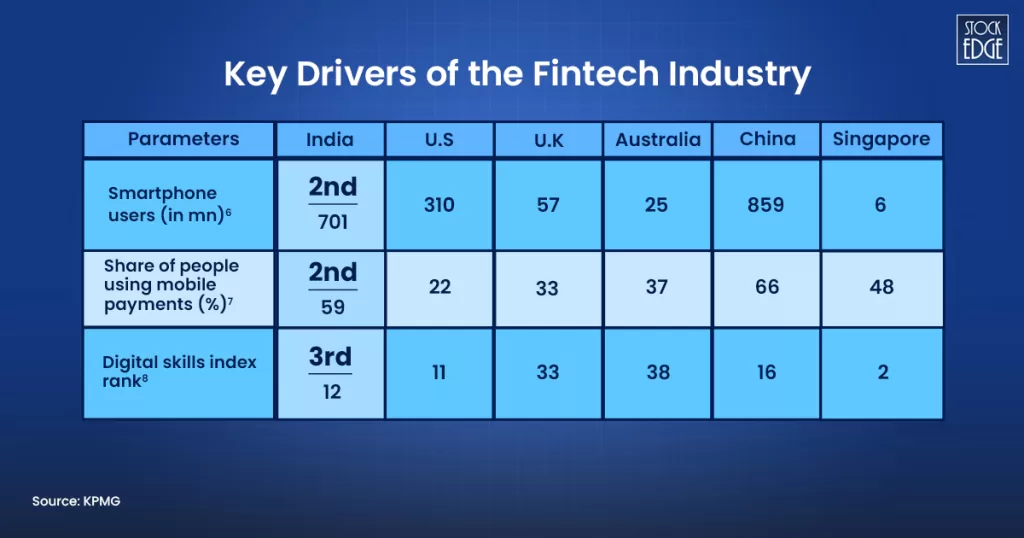

A Young, Digital-First Population Driving Adoption

India’s median age of 27.9 gives it a demographic advantage unmatched by developed markets. Millennials and Gen Z prefer UPI over cash, SIPs over savings accounts, and online insurance over offline agents. As more young professionals and women join the workforce, digital financial management is becoming mainstream, fueling long-term fintech growth.

Smartphone & Internet Penetration

With 700+ million internet users and 650 million smartphones, fintechs can scale faster and cheaper in India than almost anywhere in the world. The number of online transactors has grown from 100 million to nearly 450 million in just five years, unlocking explosive growth for fintech platforms in Tier 2, Tier 3, and rural markets as well.

UPI and the Digital Payments Revolution

UPI accounts for 73% of all non-cash transactions in India and is expected to grow from 44 billion transactions (FY21) to 500–550 billion by FY28. This frictionless, zero-cost payments infrastructure allows fintechs to onboard millions at negligible cost and improve monetisation opportunities across lending, insurance, and wealth management.

Global-Leading Digital Public Infrastructure (DPI)

Aadhaar, UPI, Digilocker, AA, FASTag and other government-backed digital rails have given India a 10-year head start over the rest of the world. These systems reduce onboarding costs by up to 90–95%, eliminate paperwork, and enable seamless, making Indian fintech stocks a highly attractive investment opportunity.

Key Trends to Watch in 2026

India has rapidly emerged as one of the world’s most dynamic and fast-growing fintech ecosystems. With rising digital adoption, supportive regulations, and a surge in innovation, the country now stands among the global leaders transforming financial services.

Let’s now take a look at key trends to watch in 2026:

AI-Led Personalization Across Financial Services

In 2026, fintechs will use AI to evaluate risk profiles in seconds, even for new-to-credit customers. Robo-advisors, automated wealth portfolios, and AI-driven insurance pricing will become mainstream. This improves customer experience while significantly reducing operating costs. This is a win-win for investors and users.

Embedded Finance Becoming Universal

Imagine booking a flight and automatically receiving insurance options… or buying a phone with instant EMI approval through UPI Credit. This is embedded finance, and it reduces customer friction drastically. By 2026, most e-commerce, travel, gaming, and retail apps will offer financial products via fintech partnerships, expanding reach without marketing spend.

OCEN & Account Aggregator Will Transform Lending

The combination of OCEN (Open Credit Enablement Network) and Account Aggregators enables lenders to access verified, consent-based financial data instantly. This improves underwriting accuracy and reduces fraud. Expect MSME lending, BNPL, micro-loans, and credit-on-UPI to explode in adoption.

Fintech-Bank Partnerships Will Deepen

Banks need fintechs for digital agility; fintechs need banks for regulation and capital. Together, they build stronger products digital credit cards, cashflow lending, AI-based underwriting, co-branded insurance, and UPI credit. This partnership model improves customer experience and profitability across both ecosystems.

WealthTech Will Enter Hyper-Growth Phase

Rising incomes, better financial literacy, and social-media-led awareness are driving young Indians toward wealth creation. Fintech platforms will offer gamified investing, AI-driven portfolio rebalancing, and micro-investing, making wealth creation accessible even for first-time investors.

Risks to Invest in Fintech Stocks

Regulatory Risk

The fintech sector operates in a dynamic and highly fragmented regulatory environment. Governments and regulators across the world keep updating rules on data privacy (like GDPR), anti-money laundering (AML), KYC norms, digital lending, and consumer protection. Any non-compliance can result in significant fines, business restrictions, or even shutdowns. This regulatory uncertainty directly affects profitability, scalability, and long-term planning.

Cybersecurity Threats

Fintech companies store and process highly sensitive data, including bank details, identity documents, transaction history, and personal information. According to PIB, cybersecurity incidents in India rose from 10.29 lakh in 2022 to 22.68 lakh in 2024. One major breach can erode customer trust overnight, trigger legal action, and cause regulators to impose strict penalties.

Operational & Technology Risks

Fintech businesses rely heavily on cloud providers, payment processors, APIs, and automation platforms. A single system outage, server crash, or payment gateway failure can halt operations for thousands or even millions of users. Such disruptions damage brand reputation and cause financial losses, especially for businesses dealing with real-time transactions.

High Competition & Margin Pressure

Competition in fintech stocks is fierce because users have plenty of choices like digital wallets, UPI apps, neobanks, payment gateways, P2P lenders, robo-advisors, and more. They burn cash to acquire users but make minimal revenue. Only companies with strong technology, differentiated offerings, and sustainable business models can thrive.

Economic & Financial Instability

Fintech stocks tend to be highly volatile because many companies are still in growth phases and not consistently profitable. Their valuations depend heavily on investor sentiment, interest rates, and global macro trends. In H1FY25, the global fintech market saw $44.7 billion investment during which is the lowest six-month period since H1FY20.

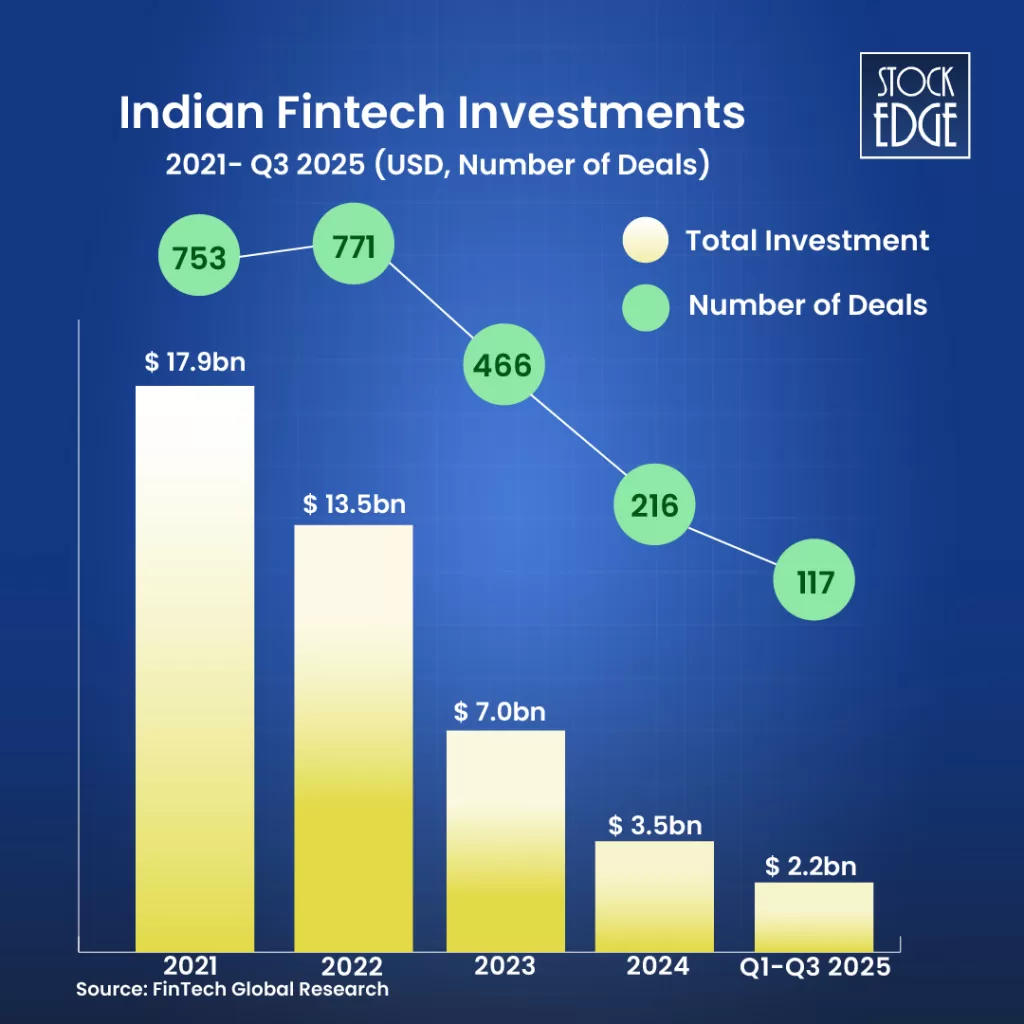

Even in Q1-Q3 2025, the Indian FinTech market also experienced a significant decline in both funding and deal activity compared with the same period in 2024. A total of 117 deals were completed across the first three quarters of 2025, representing a 40% decrease from the 194 deals recorded in Q1-Q3 2024. This puts pressure on companies that rely on external capital to expand operations.

Top Fintech Stocks based on Market Cap in India

PB Fintech Ltd.

PB Fintech Ltd., widely known for its flagship brand PolicyBazaar, is India’s largest online platform for insurance and lending products. The company operates an asset-light business model, serving as an intermediary without underwriting insurance or retaining credit risk. This fintech stock’s core platforms include PolicyBazaar, PaisaBazaar, and PB Partners. PolicyBazaar dominates the digital insurance marketplace with a 93% market share, 86.9 million registered users, 18.3 million active users, and over 46.8 million insurance policies sold. PaisaBazaar, India’s largest credit comparison platform, serves over 47 million consumers, with 5.8 million actively transacting.

They have seen a significant shift in revenue toward core insurance brokerage, with strong profitability improvements in recent periods. In Q2 FY26, total revenue reached ₹1,614 crore, up 38% YoY, marking the highest-ever quarterly revenue. Profit after tax (PAT) surged 165% YoY to ₹135 crore, with the PAT margin improving to 8%, a sharp turnaround from negative margins in Q2 FY22

One97 Communications Ltd.

One 97 Communications Ltd (Paytm) is India’s leading digital consumer–merchant ecosystem, operating across payments, financial services, and commerce. This fintech stock has the country’s largest merchant network of 4.2 crore merchants and 112 lakh payment devices. Paytm offers QR, UPI, cards, POS, Soundbox, loan distribution, insurance, wealth products, ticketing, vouchers, and advertising solutions. Recent launches such as UPI Lite Auto Top-Up, NFC Card Soundbox, and integrations with Samsung Wallet and FlixBus highlight its shift toward high-frequency, device-driven engagement.

Strategic divestments of the movie/events business (₹2,048 Cr) and PayPay stake (₹2,364 Cr) have strengthened liquidity, while regulatory clarity improved after PPSL re-applied for the PA license and Paytm regained approval to onboard new UPI users.

Payment Services (59% of H1 FY25 revenue) saw 7.1 Cr monthly users, 112 lakh merchant subscriptions, and ₹4.5 lakh Cr GMV in Q2 FY25. Financial Services (21% of revenue) disbursed ₹5,280 Cr loans in Q2 FY25, supported by merchant and personal loans, while postpaid loans (47% of FY24 disbursals) remain halted. Marketing & Commerce (20% revenue) delivered ₹2,383 Cr GMV in Q2 FY25, with 13.8 lakh active credit cards (up from 8.7 lakh YoY). Marketing spend has reduced significantly from 17% of revenue in FY22 to 9% in FY24, improving margins.

Conclusion

India’s fintech story is still being written. The last decade was about digitization, getting people online, enabling payments, and modernizing financial access. But the next chapter will be about AI-driven personalized financial journeys, embedded banking, and a massive shift toward digital wealth creation.

Also Read: AI Stocks in India – Future Prospects and Analysis

Frequently Asked Questions (FAQs)

1. What makes a fintech stock strong in the long run?

A fintech stock or company becomes strong in the long run when it combines a scalable business model with strong unit economics, low customer acquisition costs, and high user retention. Consistent innovation, technology, regulatory compliance, and effective risk management are crucial. Companies that build trust, diversify revenue streams, and maintain a clear path to profitability tend to sustain growth and outperform competitors over time.

2. Which listed fintech companies are in India?

India’s stock exchanges feature several notable fintech players, including PB Fintech (Policybazaar), One97 Communications (Paytm), Pine Labs, Seshaasai Technologies, Mobikwik, and many more. To explore the updated list of fintech companies in India, you can check it on StockEdge.