Key Takeaways

- Aluminium fuels India’s industrial growth: Its widespread use in EVs, infrastructure, packaging, and renewable energy drives long-term demand.

- Value chain of Aluminium Stocks: From bauxite mining to finished products, integrated companies hold strong cost and pricing advantages.

- EVs and renewable energy boost demand: Lightweight and recyclable aluminium is becoming essential in solar, batteries, and electric vehicles.

- Energy and raw material prices affect margins: Global aluminium prices, alumina costs, and power expenses heavily influence profitability.

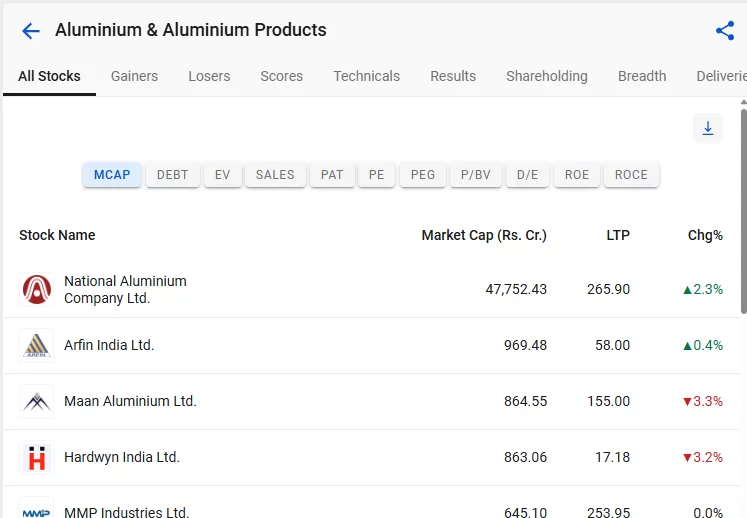

- Market leaders remain well-positioned: Hindalco, NALCO, and Vedanta benefit from scale, captive resources, and robust export capabilities.

- Key Takeaways

- What are Aluminium Stocks?

- Value Chain of Aluminium Stocks

- Overview of the Aluminium Industry

- Key Drivers of Aluminium Stocks

- Factors to Consider When Investing in Aluminium Stocks

- Risks Involved in Investing in Aluminium Stocks

- Overview of the Best Aluminium Stocks in India

- Conclusion

- Frequently Asked Questions (FAQs)

Aluminium is one of the most essential industrial metals powering India’s growth story, quietly but decisively. From electric vehicles and renewable energy to construction, packaging, and aerospace, aluminium has become a strategic commodity shaping the future of multiple sectors.

As global demand continues to rise and India strengthens its position as a major producer, investors are increasingly turning their attention to aluminium stocks as long-term wealth creators.

In this blog we will explore what aluminium stocks are, their value chain, key growth drivers, risks, and the top aluminium stocks in India.

What are Aluminium Stocks?

Aluminium stocks are simply shares of companies that make aluminium or turn aluminium into finished products. But the aluminium business isn’t a single-step process. It runs through a long value chain, and understanding this chain helps you see where each company actually earns its money.

Value Chain of Aluminium Stocks

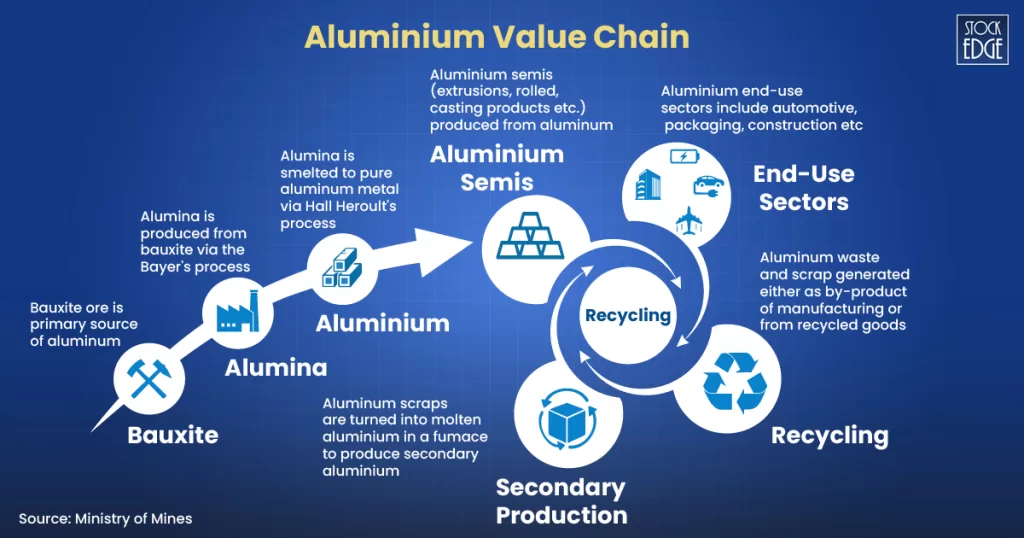

The aluminium industry is broadly divided into two parts

- Upstream Segment

- Downstream Segment

The upstream segment focuses on turning bauxite into primary aluminium, while the downstream segment converts this aluminium into semi-finished and finished products used across industries. Here’s how the entire value chain flows.

1. Bauxite Mining

The aluminium journey starts with bauxite, a reddish ore found close to the surface. It’s extracted through open-cast mining and sent to refineries. Companies with low-cost, high-quality bauxite reserves hold a natural cost advantage.

2. Alumina Refining

Refineries use the Bayer Process to convert bauxite into alumina, a white intermediate powder. Around 6–7 tonnes of bauxite are needed to make 2 tonnes of alumina. This step heavily influences a company’s refining efficiency and cost structure.

3. Primary Aluminium Production

Alumina is then smelted into aluminium using the Hall–Héroult electrolysis process. This energy-intensive step casts aluminium into ingots, billets, or slabs. About 2 tonnes of alumina produce 1 tonne of aluminium, making power costs a key profit driver.

4. Secondary Aluminium Production

Scrap aluminium is collected, melted, and recycled into usable metal. This process requires only about 5% of the energy needed for primary aluminium, making recycling vital for cost savings and sustainability.

5. Aluminium Semis

Primary or recycled aluminium is shaped into semi-finished products such as rolled sheets, foils, extrusions, and castings. These “aluminium semis” form the backbone of industries like packaging, construction, engineering, and automotive.

6. End-Use Applications

These semi-finished products are further processed into final items like cans, cables, window frames, auto parts, aircraft components, and solar frames. This stage involves machining, shaping, welding, and assembling to deliver finished, consumer-ready products.

Now, let’s look at the list of aluminium stocks in India:

Overview of the Aluminium Industry

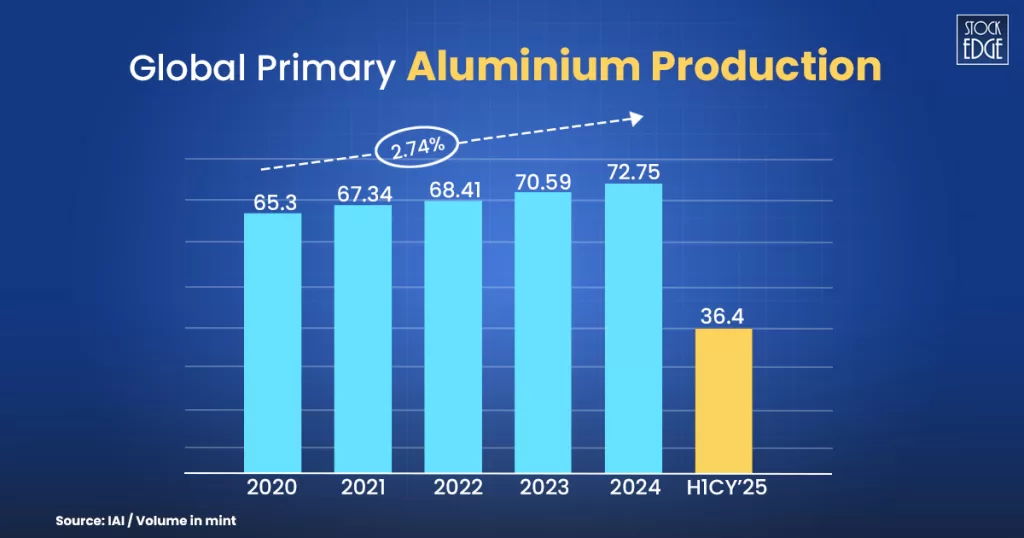

From 2020 to 2024, global primary aluminium output climbed from 65.3 million tonnes to 72.75 million tonnes, maintaining a steady annual growth rate of around 2.7%. Demand held firm, supported by stable LME prices and continued industrial activity.

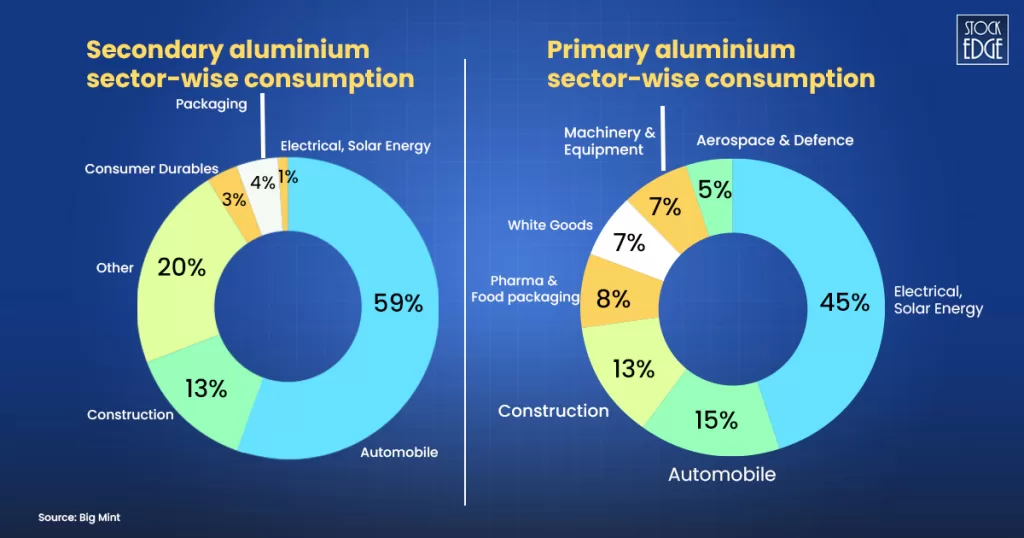

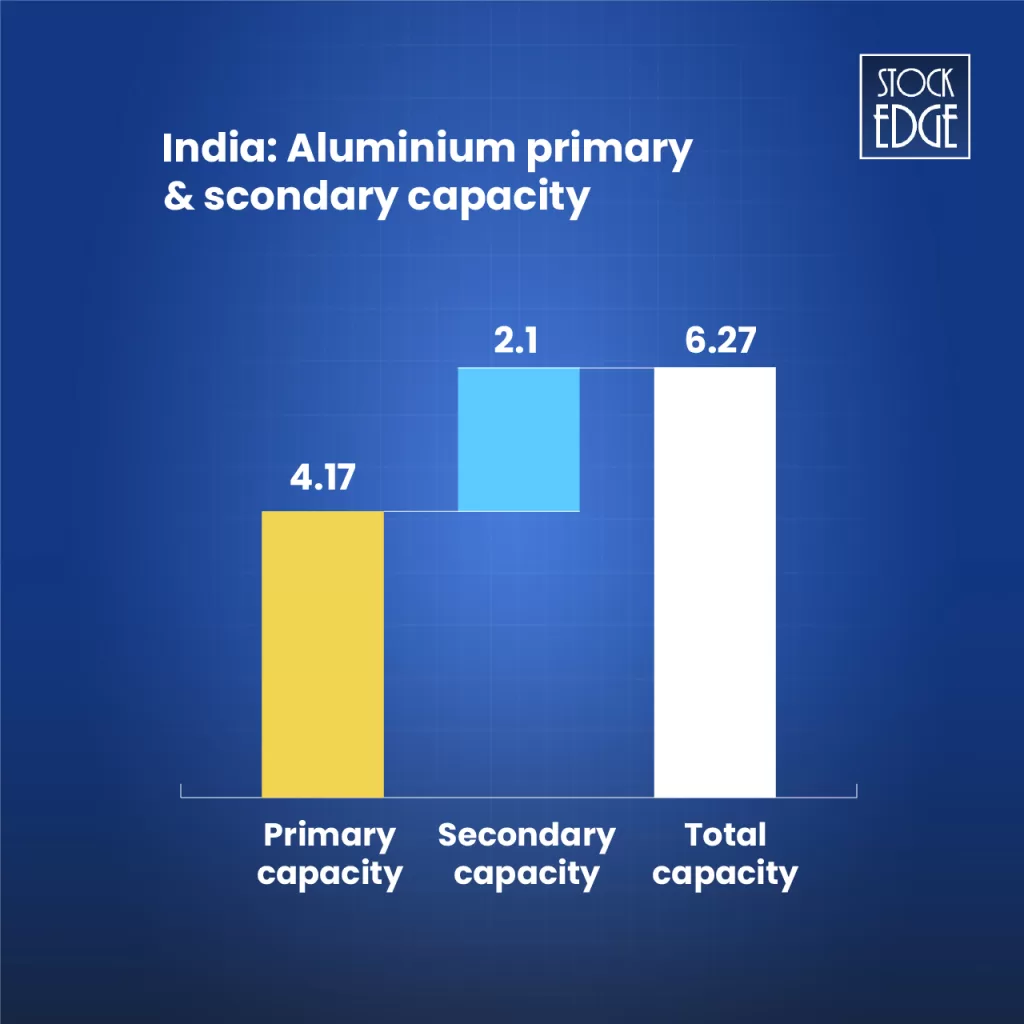

India’s aluminium landscape is defined by two core segments: primary and secondary production. As of FY’25, the country’s total aluminium production capacity is estimated at 6-6.2 mnt, comprising approximately 4.17 mnt from primary production and 2-2.2 mnt from secondary production via scrap recycling.

Key Drivers of Aluminium Stocks

- Rising Demand from End-User Sectors: Growth in infrastructure, automotive (especially electric vehicles), packaging, and power sectors drives aluminium demand due to its lightweight, corrosion-resistant, and recyclable nature. Government programs like the Smart Cities Mission and Make in India further boost aluminium consumption.

- Renewable Energy and EVs: Aluminium is preferred in renewable energy sectors for solar panels and battery enclosures due to its durability and weight. EV adoption, expected to grow significantly, increases aluminium consumption for lightweight vehicle components.

- High Recycling Rates: Aluminium’s recyclability reduces energy consumption in production and supports sustainable growth, making it attractive from both supply chain and environmental perspectives.

- Exports and Production Milestones: Indian companies like Vedanta and NALCO have reached record production and export levels, enhancing their market presence and revenue growth prospects.

Factors to Consider When Investing in Aluminium Stocks

- Global Aluminium Price Movements: Aluminium prices on international markets (like the London Metal Exchange) strongly influence Indian producers’ profitability and stock valuations.

- Company Financials: Healthy balance sheets with lower debt, strong cash flow, and consistent profitability are important to withstand commodity price volatilities.

- Vertical Integration: Companies involved in the entire value chain, from bauxite mining, alumina refining, to finished aluminium products, have cost advantages and greater control over supply.

- Industry Positioning: The dominant players in India, Hindalco, Vedanta, and NALCO, have scale, diversification, and market leadership, offering more stability.

- Government Policies and Infrastructure Spend: Supportive policies for mining, export incentives, energy subsidies, and infrastructure investments play a significant role in industry growth.

- Sustainability and Innovation: Firms focusing on environmentally friendly practices and adopting advanced technologies maintain a competitive advantage in a regulated environment.

Risks Involved in Investing in Aluminium Stocks

- Raw Material and Energy Cost Volatility: Fluctuations in prices of bauxite (primary ore) and alumina, along with high electricity costs for smelting, can squeeze margins.

- Environmental Regulations: Increasing norms concerning emissions and waste management may lead to higher compliance and operational costs.

- Global Competition and Import Risks: Cheap aluminium imports and international trade tariffs can impact domestic producers’ market share and profitability.

- Geopolitical and Macroeconomic Factors: Currency fluctuations, trade disputes, and global economic slowdowns affect aluminium prices and export demand.

- Price Volatility: Aluminium prices are cyclical and influenced by global demand-supply imbalances, introducing short- to medium-term stock price risks despite long-term growth potential.

Overview of the Best Aluminium Stocks in India

Hindalco Industries Ltd.

Hindalco Industries Limited, the Aditya Birla Group’s metals flagship, is the world’s largest aluminium rolling and recycling company, a major copper player, and one of Asia’s top primary aluminium producers. Hindalco’s aluminium production units in India cover the entire value chain, from bauxite mining, alumina refining, coal mining, captive power generation, and aluminium smelting to downstream value-added operations such as aluminium rolling, extruding, and foil manufacture.

In FY25, Hindalco delivered strong operational scale across its aluminium value chain. The company operated 1.34 million MT of primary aluminium capacity, supported by its smelting operations in India. It further strengthened its value-added portfolio with 0.43 million MT of aluminium VAP (value-added products), reflecting its focus on higher-margin segments.

Through its global subsidiary Novelis, Hindalco also maintained a substantial downstream presence with 4.2 million MT of aluminium rolling capacity, making it one of the world’s largest producers of flat-rolled aluminium products.

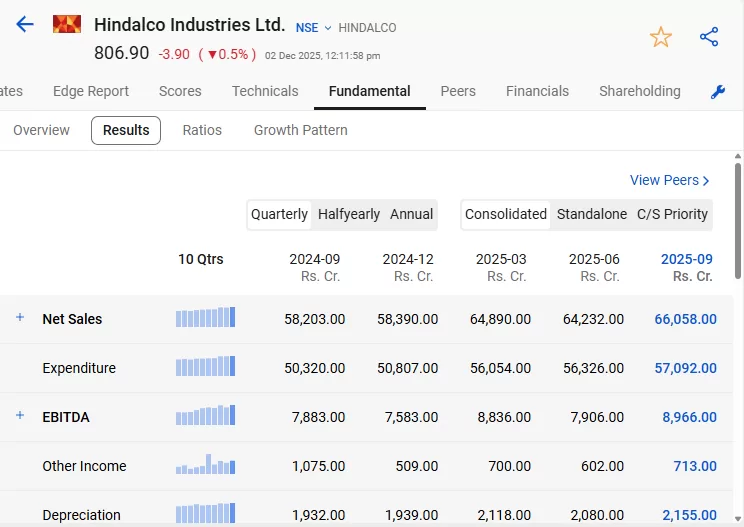

Financials

Hindalco reported net sales of INR 660.6 billion in Q2FY26, up 14% YoY and 3% QoQ, driven by better pricing and product mix. EBITDA stood at INR 89.7 billion, also up 14% YoY and 13% QoQ, supported by higher aluminium prices and cost-saving measures. Adjusted PAT was INR 48.7 billion, rising 14% YoY and 22% QoQ, helped by strong performance in both India operations and Novelis. The net debt-to-EBITDA ratio increased to 1.23x, compared to 1.02x in the previous quarter.

In the aluminium business, the upstream revenue rose to INR 100.8 billion, up 10% year-on-year, mainly because aluminium prices were higher. Upstream EBITDA also increased to INR 45.2 billion (22% YoY growth), supported by better volumes and favourable pricing.

The downstream business also showed strong growth. Revenue increased to INR 38.1 billion, a 20% YoY rise, thanks to higher shipments and better pricing. Downstream EBITDA jumped 69% YoY to INR 2.6 billion, mainly due to an improved product mix. This works out to an EBITDA per tonne of USD 265, which is 49% higher than last year.

National Aluminium Company Ltd.

National Aluminium Company Ltd. (NALCO), incorporated on 7 January 1981 as a wholly owned Government of India enterprise, manufactures and sells alumina and aluminium products through domestic MoUs, tenders, and global online tenders. It operates captive coal and bauxite mines plus four wind power plants, serving 23 Indian states and 13 countries as a Navratna CPSE under the Ministry of Mines.

It also exports significant volumes of alumina, giving it a strong global presence, while its cost-efficient operations and access to captive mines and power provide a strategic competitive advantage. The company is currently expanding its alumina refinery, targeting 1.25–1.28 million tonnes of alumina sales in FY26, with plans to double its aluminium capacity by FY30 through a large capex programme of about ₹300 billion.

Financials

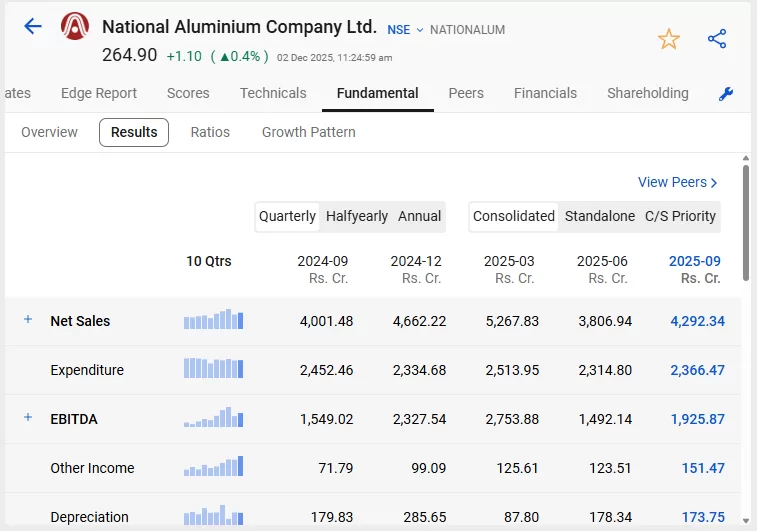

NALCO delivered a strong consolidated performance in Q2FY26, with revenue rising to ₹42.9 billion, up 7% YoY and 13% QoQ, supported by favourable aluminium prices and a sharp jump in alumina volumes. Consolidated EBITDA came in at ₹19.3 billion, growing 24% YoY and 29% QoQ, with margins improving significantly to 44.9%. Adjusted PAT also saw healthy growth, rising 37% YoY to ₹14.3 billion.

NALCO delivered a strong consolidated performance in Q2FY26, with revenue rising to ₹42.9 billion, up 7% YoY and 13% QoQ, supported by favourable aluminium prices and a sharp jump in alumina volumes. Consolidated EBITDA came in at ₹19.3 billion, growing 24% YoY and 29% QoQ, with margins improving significantly to 44.9%. Adjusted PAT also saw healthy growth, rising 37% YoY to ₹14.3 billion.

Conclusion

Aluminium is a cyclical commodity, but its long-term structural demand remains strong, driven by the growth of EVs, renewable energy, urban infrastructure, and sustainable packaging. Aluminium stocks offer an opportunity to participate in India’s industrial expansion, provided they understand the value chain, global price cycles, and each company’s cost efficiency.

Leaders like Hindalco, NALCO, and Vedanta benefit from scale, integration, and strong export capabilities, making them well-positioned to capture future demand. However, prudent investors should closely track aluminium prices, energy costs, and global macro trends before making decisions.

Also read: Best Insurance Stocks in India

Frequently Asked Questions (FAQs)

1. How do Aluminium Stocks perform in economic downturns?

Aluminium is a cyclical commodity, so aluminium stocks generally face pressure during economic downturns. Demand from key sectors like construction, real estate, automotive, and industrial manufacturing slows down, leading to lower aluminum prices and reduced profitability for producers.

2. How can I analyze aluminium stocks before investing?

To analyze the aluminium stocks, you have to look at a few key factors like how aluminium prices are trending, the company’s cost structure (especially power costs), its production capacity, debt levels, and whether it has an integrated setup from mining to smelting. Also, check demand trends in industries like autos, packaging, and infrastructure.

3. Are aluminium stocks good for long-term investment?

Aluminium has long-term use cases in transport, packaging, renewable energy, and EVs. But since prices move in cycles, aluminium stocks can be volatile. So, if you have a higher risk appetite and a long-term horizon, you may consider these stocks.