Key Takeaways

- Resilience in Any Economy:: Indian pharma stocks are considered a defensive investment, providing stable returns due to consistent, recession-resistant demand for essential healthcare products and medicines.

- Global Dominance in Generics: India is a world leader in producing high-quality, affordable generic medicines and vaccines, with a dominant international footprint and robust exports to over 200 nations, including highly regulated markets like the USA and Europe.

- Poised for Strong Growth:: The sector benefits from strong government support through schemes like the PLI scheme and increased budget outlays, alongside a crucial focus on continuous research and development and innovation, positioning it for significant market size expansion.

- Leading Players Drive Performance:: Top companies like Sun Pharma, Divi’s Labs, and Cipla stand out due to factors such as market share leadership, strength in APIs and custom synthesis, global presence, focus on innovation, and healthy financial performance.

Amid the current tariff wars by the USA, the Indian pharma sector has an edge over all other sectors or industries. That’s because the USA relies heavily on generic drugs and medicine to fulfil its own demand. Hence, India’s access to the US market allows its generics industry to stay profitable. Currently, India’s pharma industry is subject only to the new 10% baseline duty on all US imports. Therefore, India’s pharma stocks have a greater edge at this point in time.

Table of Contents

What are Pharma stocks?

Pharma stocks are listed companies that develop and manufacture medical drugs that help treat a wide range of illnesses, from life-threatening diseases like cancer to everyday ailments like the common cold. India is home to some of the world’s largest pharma giants, known globally for their expertise in producing high-quality, affordable generic medicines at scale.

Overview of the Pharma Industry in India

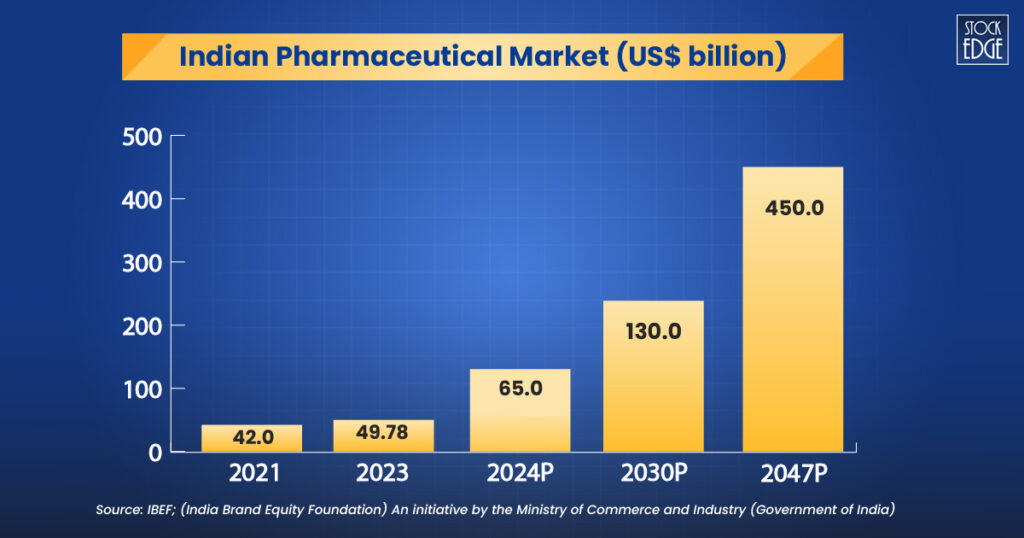

The market size of the Indian pharmaceuticals industry is expected to reach US$ 130 billion by 2030 and ~US$ 450 billion market by 2047.

Globally, the Indian pharmaceutical industry is known for its generic medicines and low-cost vaccines. The Indian pharma industry is the third largest in the world in terms of production volume. They are exported from India to reach more than 200 nations around the world, including highly regulated markets of the USA, West Europe, Japan, and Australia.

Why Should You Invest in Pharma Stocks?

Pharma stocks are considered defensive because they belong to an industry that provides essential healthcare products, which are always in demand regardless of economic conditions. Unlike discretionary products, the need for medicines remains constant even during recessions, making pharma stocks less sensitive to market fluctuations.

Global Demand

India has the largest number of USFDA-compliant pharmaceutical plants outside the US and over 2,000 WHO-GMP-approved facilities, serving demand from 150+ countries worldwide, with 10,500+ manufacturing facilities. Did you know that India’s drugs and pharmaceutical exports stood at US$ 27.82 billion in FY24? Interestingly, according to Government data, the Indian pharmaceutical industry is worth approximately US$ 50 billion, with over 50% (US$ 25 billion) of the value coming from exports. This sustained global demand strengthens the industry’s growth potential.

Stable Returns for Investors

Pharma stocks are known for their resilience during economic fluctuations. Due to the constant demand for healthcare and medicines, pharma stocks often deliver steady returns, making them a reliable choice for long-term investors.

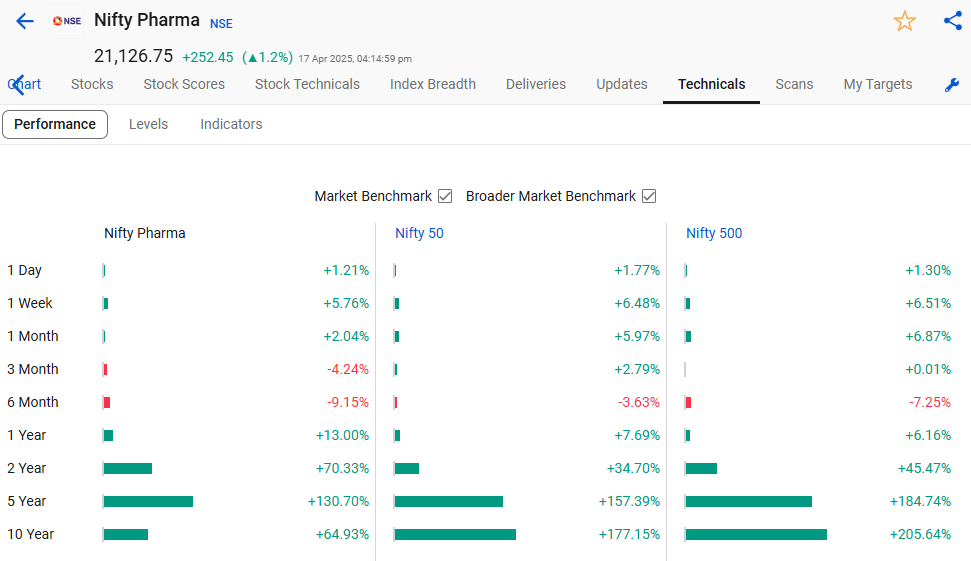

Comparison: Nifty Pharma Vs Nifty 50 Vs Nifty 500

Government Policy

To boost India’s manufacturing capacity, elevate investment, and diversify product offerings in the pharma sector, the government of India introduced the product linked incentive (PLI) scheme with a total outlay of US$ 2.04 billion (Rs. 15,000 crores) spanning from 2020-21 to 2028-29. The total outlay for the development of the pharmaceutical industry for FY25 was increased to US$ 156.5 million (Rs. 1,300 crore), while the budget for the promotion of medical device parks was raised to US$ 18 million (Rs. 150 crore) for FY25.

Research and Development

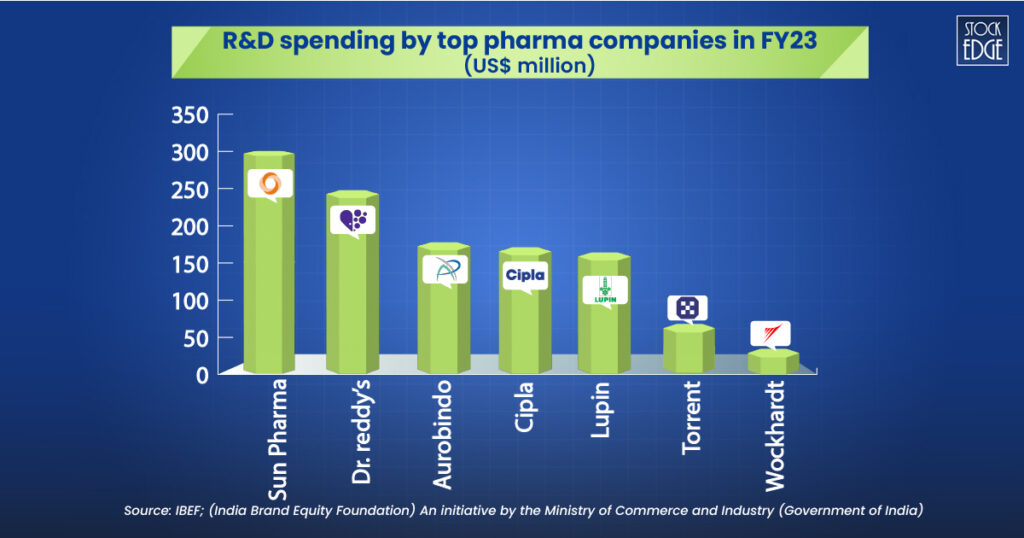

The pharmaceutical industry demands new drug discovery, biologics, and clinical trials to find cures for numerous diseases. Think of the pandemic situation of COVID-19. It was high time for major pharma companies to discover a vaccine, which required pharma companies to undergo several research and development. A company’s rigorous R&D improves its products, and it is especially important for pharma companies to find cures for deadly diseases.

Here are the top pharma stocks of India spending on R&D:

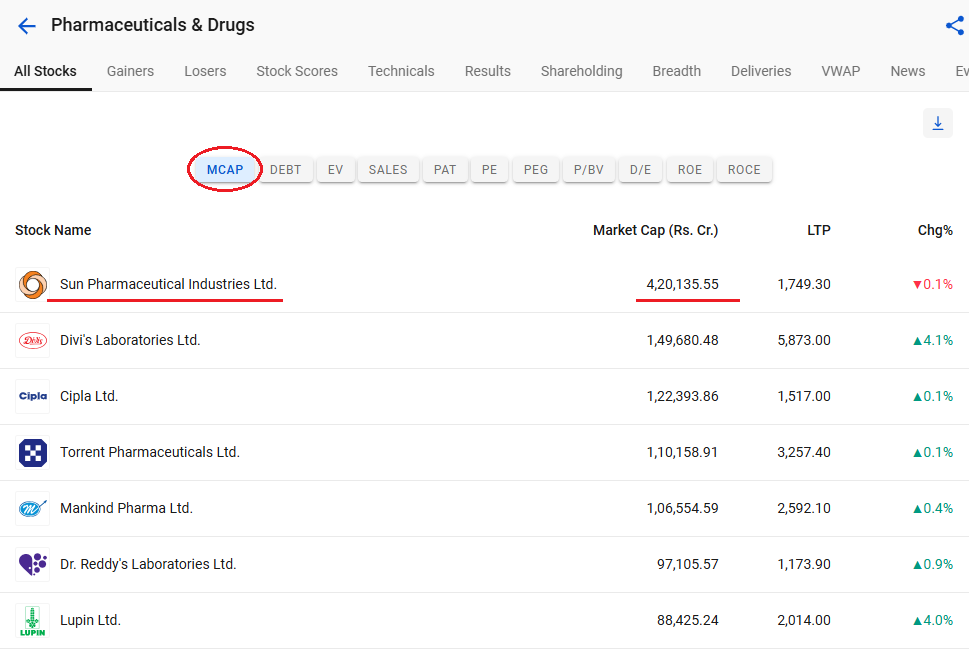

Best Pharma Stocks in India

1. Sun Pharmaceutical Industries Ltd.

Did you know Sun Pharma is one of the largest pharma stocks in terms of market capitalization and also the largest pharma company in terms of market share, as it holds 8.2% of India’s overall pharmaceutical market? Established in 1983, it is the fifth-largest speciality generic pharmaceutical company in the world.

In the previous quarter of Q3 FY25, the revenue from operations increased by 10.5%, and net profit jumped by 15%. The material cost was lower as a percentage of sales on a YoY basis, driven by higher sales and a better product mix. Also, the company is making expenditures in research and development; nearly 6% of the total revenue is spent on R&D, which is pretty high among the industry standards.

For further analysis, you may read the latest edge reports in StockEdge.

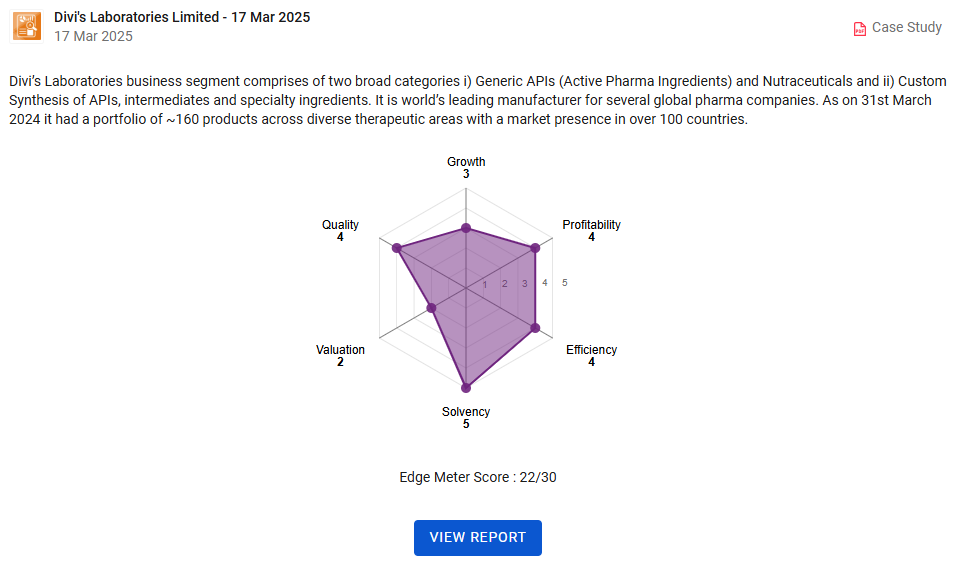

2. Divi’s Laboratories Ltd.

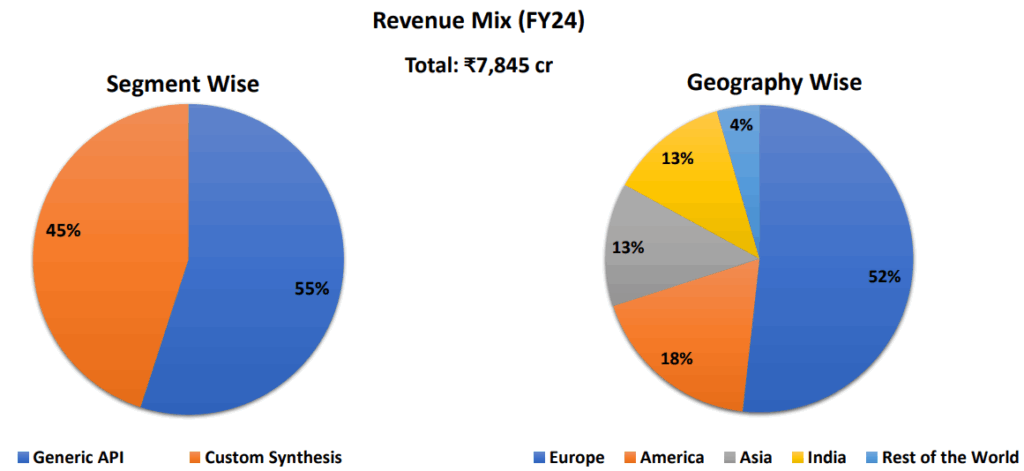

The company is majorly engaged in manufacturing APIs. What is API? Active Pharmaceutical Ingredients (APIs) are the biologically active components of a medication, which is a key component of the medical drug. It has a product portfolio which is divided into two main categories:

a) Generic APIs (active pharmaceutical ingredients) and Nutraceuticals

b) Custom Synthesis of APIs, Intermediates, and Specialty Ingredients

In 9M FY25, the net sales were ₹ 6,775 cr v/s ₹ 5,542 cr in 9 M FY24 and increased by 22 % YoY. Exports to Europe and the USA constituted 72 % of total sales, which is a significant contribution from one particular region. Also, EBITDA jumped 41 % YoY. This rise was led by stable raw material prices and backward integration by the company, which has helped it reduce other expenses. Lastly, net profit also increased by 44% YoY.

To read more about the company’s financial performance, you may read our case study report on Divi’s Laboratories Limited.

3. Cipla Ltd.

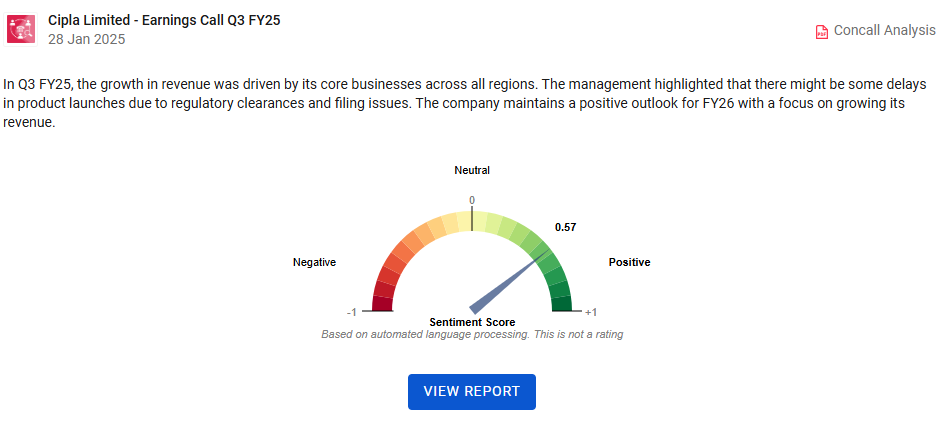

It is a global pharmaceutical company focused on responsible and sustainable growth of complex generics and deepening portfolio in home markets of India, South Africa and North America, as well as key regulated and emerging markets. The company manufactures, develops, and markets a wide range of branded and generic formulations and Active Pharmaceutical Ingredients (APIs).

In the previous quarter for Q3 FY25, the growth in revenue was driven by its core businesses across all regions. The revenue from operations of the company increased by 7.1% YoY, whereas net profit jumped by 48.2% YoY. The revenue was strongly driven by its core businesses across all regions. Also, the company’ EBITDA margins improved, by 184 bps YoY to 28.1%.

As per the latest concall, the management is focusing on innovation, geographic diversification and product portfolio expansion to drive growth in FY 26.

You can read the con-call summary of Cipla Ltd., in StockEdge to get an future outlook of the company.

The Bottom Line

Therefore, pharma stocks present a unique long-term investment opportunity primarily because of their defensive nature. The consistent demand for healthcare, irrespective of economic cycles, provides a stable foundation for revenue and growth. This makes the pharmaceutical sector less vulnerable to market volatility, offering a safety net during uncertain times. For investors seeking steady returns with lower risk, pharma stocks offer a blend of reliability, growth potential, and long-term value.

Happy Investing!

Frequent Asked Questions (FAQ)

Are pharma stocks good investments?

Pharma shares can be a good investment because there is constant demand for healthcare, elderly populations, and medical innovations. They also tend to do well in economic downturns. However, investors should look at regulations, patents, and international competition before investing in this segment.

Are there any pharma penny stocks in India?

There are a few pharma penny stocks in India that are available at cheaper prices and show potential for growth. These involve Sun Pharma, Shukra Pharmaceuticals, Nectar Lifesciences, Oxygenta Pharmaceutical, and others. However, investing in penny stocks involves a high risk, so careful research and caution are the keys.

What factors influence the performance of pharmaceutical stocks?

The performance of pharmaceutical stocks depends on regulatory approvals, R&D, product pipeline, pricing policies, global demand, and healthcare policies. Market sentiment, patent losses, and competition also influence the same. Continuous innovation and sound financials tend to drive long-term growth for this sector.

What are the advantages of investing in pharmaceutical stocks?

Stable demand, high returns, and resistance to economic recession are some advantages of pharmaceutical stocks. The potential to benefit from innovation, government incentives, and increased global awareness of health, makes them a great investment option for long-term investors.