Key Takeaways

- Real Estate Sector Growth: India’s real estate sector is projected to reach $1 trillion by 2030, contributing 13% to the nation’s GDP by 2025.

- Benefits of Investing: Potential for significant returns due to rising property values. Access to various segments like residential, commercial, and retail properties. Easier to buy and sell compared to physical properties.

- Investment Considerations: Indicates future revenue potential. Reflects the company’s cash flow and operational efficiency. Diversification across cities can mitigate risks. Higher margins suggest better cost management. Manageable debt ensures financial stability.

- Top 5 Real Estate Stocks:

- Godrej Properties Ltd.

- Oberoi Realty Ltd.

- DLF Ltd.

- Prestige Estates Projects Ltd.

- The Phoenix Mills Ltd.

When you think of real estate investing, your dream home might be the first thing that comes to mind. After all, “Ghar ek baar hi banta hai,” right?

However, transforming that dream into reality often comes with a hefty price tag. For many, that dream can quickly become a never-ending cycle of EMIs and home loans. Over time, the excitement of having a home can be overshadowed by the stress of repayment, turning what should be a joyful experience into a race against debt. But what if there is a smarter way to be part of the real estate boom without building a house or taking on a loan?

It’s possible, and the stock market offers a unique gateway to achieve this. By investing in real estate stocks, you can ride the growth wave of the real estate sector without worrying about construction costs, property maintenance, or long-term liabilities. As real estate companies expand and generate higher profits, the value of your investment grows, too. Over time, these returns can be reinvested, helping you build your dream house.

In this blog, you will know the benefits of investing in real estate stocks and the key factors to consider before investing. Additionally, we’ll take a closer look at some of the best-performing real estate stocks in the market.

What Are Real Estate Stocks?

Real estate stocks in India have listed shares of companies that are in the business of ownership, developing, and financing real estate properties. This segment primarily focuses on the realty sector and includes Real Estate Investment Trusts (REITs), real estate developers, and real estate management firms.

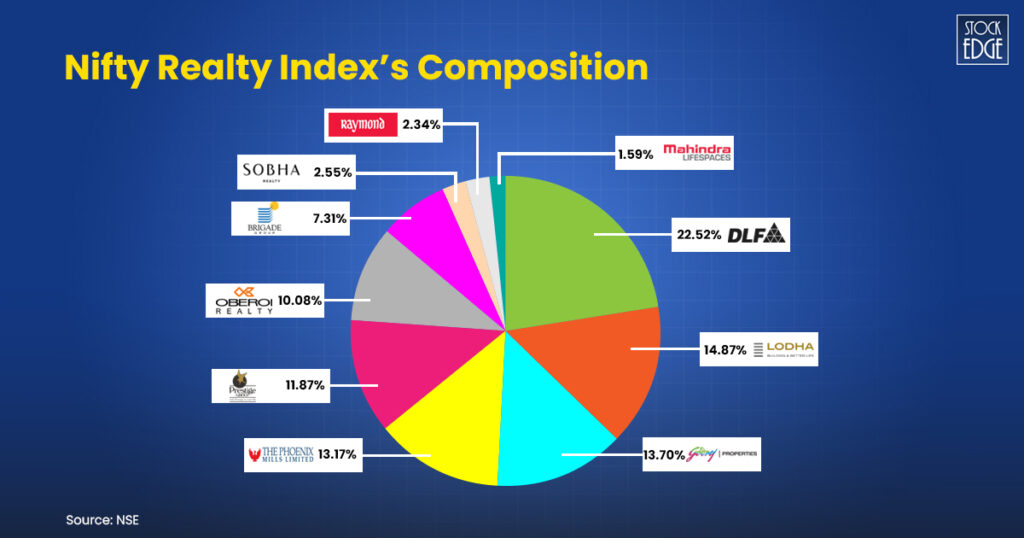

The NSE launched the Nifty Realty Index to reflect the performance of real estate stocks that construct homes and offices. This index comprises a maximum of 10 stocks and can be used for various purposes, including fund portfolio benchmarking, index fund and ETF launches, and structured product development.

As on 16th December 2024

Benefits of Investing in Real Estate Stocks

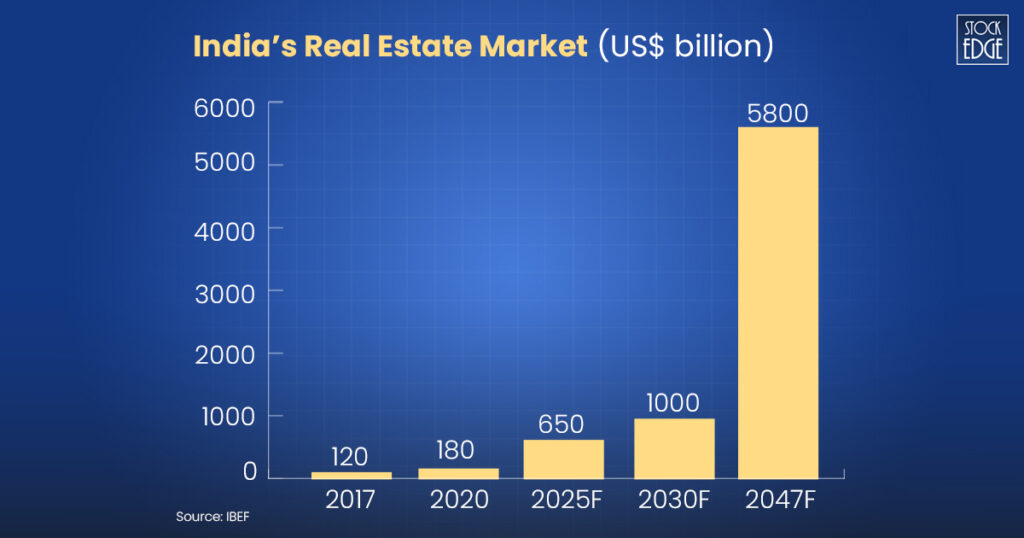

Today, real estate companies are India’s second-largest employer, trailing only agriculture. According to the India Brand Equity Foundation (IBEF), the sector is anticipated to grow to $5.8 trillion by 2047, contributing 15.5% of GDP, up from 7.3% today. India’s real estate sector is estimated to reach $1 trillion by 2030, and by 2025, it will contribute 13% of the nation’s GDP.

Investing in real estate stocks is becoming more prevalent among investors who want to diversify their portfolios. It allows the generation of passive income by paying dividends to their shareholders from the profits they generate through rent, lease payments, and property sales. Unlike direct real estate ownership, these stocks offer a more accessible and liquid way to tap into the lucrative property market. Here are some key benefits of investing in real estate stocks which have the potential to become top gainers in a growing economy.

Capital Appreciation

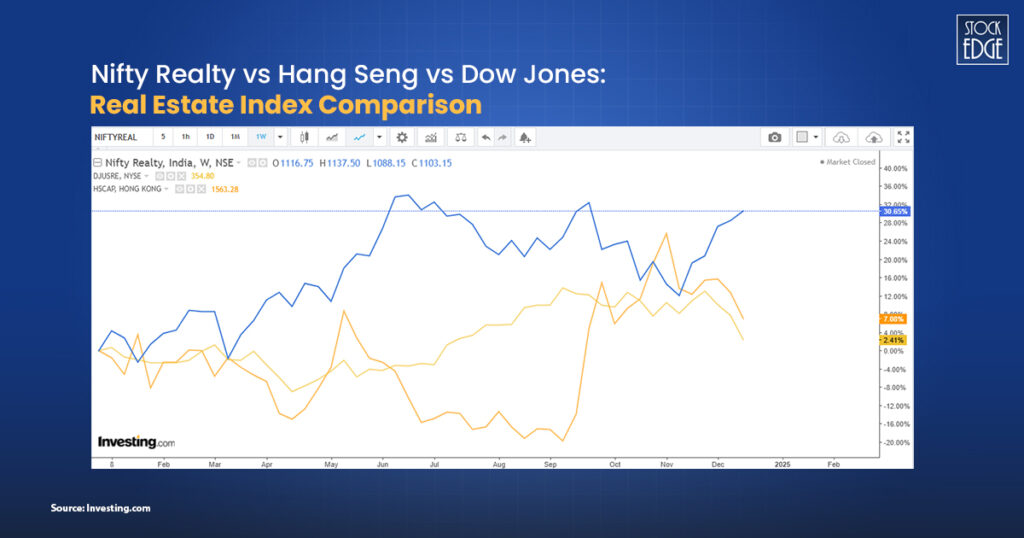

Real estate stocks have the potential for significant capital appreciation, driven by increasing property values and ongoing urban development. This growth boosts the overall investment value, leading to substantial long-term returns for investors. Let’s analyze how the real estate stocks in the USA, China, and India performed over a period of a year.

Diversified Market Exposure

Unlike investing in a single property, where your entire investment is tied to one location or type of property, real estate stocks allow you to diversify your exposure across multiple companies. By owning shares in companies that operate in different segments of real estate, you can reduce the risk of your portfolio being affected by any one project or property market.

High Liquidity and Flexibility

Real estate stocks are traded on stock exchanges, making them highly liquid. Unlike physical property, which can take months to sell, you can buy or sell real estate stocks instantly during market hours. This liquidity provides flexibility, allowing you to react to market changes and exit your position whenever required.

Now, let’s look at how to analyze the real estate stocks.

How to Analyze the Real Estate Stocks for Your Portfolio

To analyze the performance of real estate stocks, you have to consider the following parameters.

Pre Sales

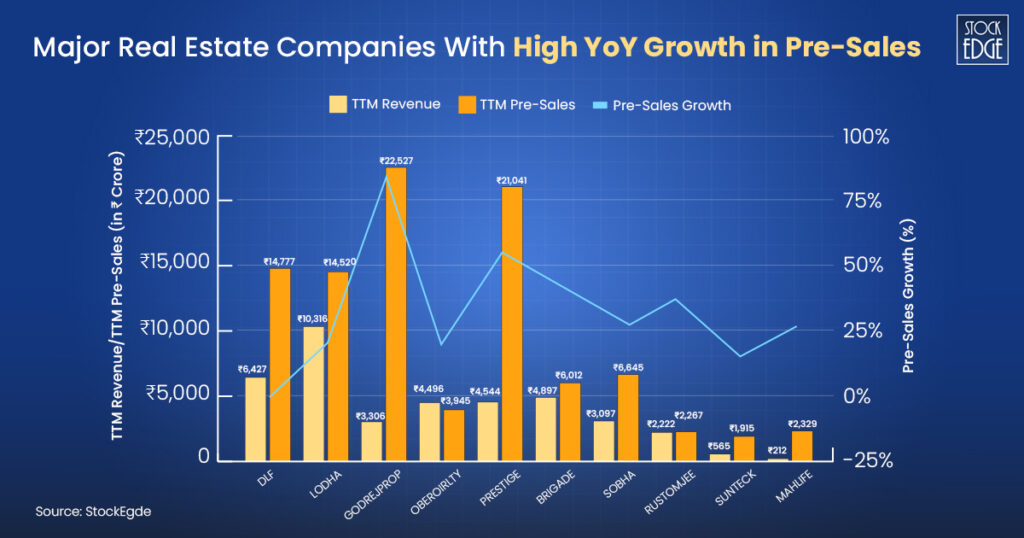

Pre-sales are like pre-ordering a product before it’s officially released. For example, imagine a builder planning to construct a new apartment complex. Instead of waiting for the building to be finished, they start selling individual apartments to buyers, which is known as pre-sales. Pre-sales generally reflect the demand for a company’s projects before they are completed. In FY24, Godrej Properties Ltd. had the highest pre-sales growth.

In StockEdge, check out our edge reports to find the significant real estate companies with high YoY growth in pre-sales, including insights on stocks near all time high driven by strong demand.

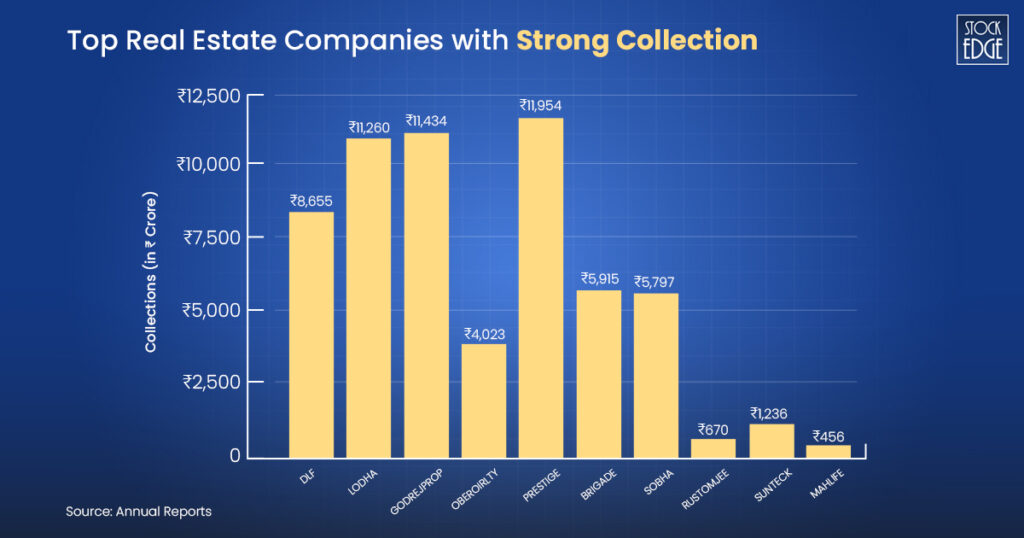

Collections

Collections refer to the amount of cash received by the company from customers against advances or pre-bookings for properties under construction or newly launched. This is a crucial metric for assessing the liquidity and operational efficiency of real estate companies. Here’s a list that highlights the strong collection performance of top real estate companies with strong collections, some of which are also featured among 52 week low high stocks due to their recent price movements.

Geographic Exposure

Companies operating in high-demand areas (like Mumbai, Delhi, or Bengaluru) offer better growth prospects. Diversification across multiple cities or regions can reduce geographic concentration risks. For example, Godrej Properties Ltd. operates in 12 cities across India, whereas Prestige Estates Projects Ltd. operates in 5 cities.

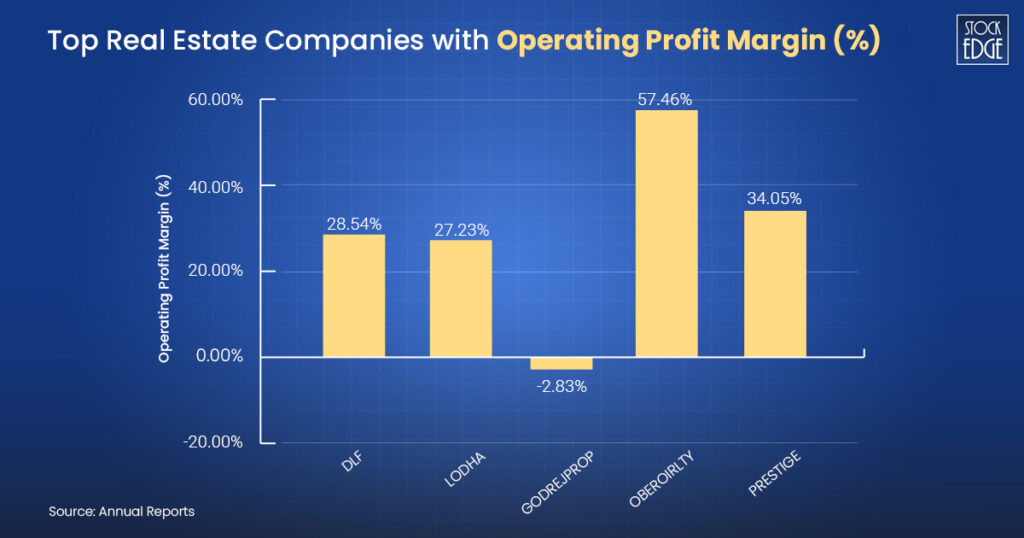

Operating Profit Margin (%)

This margin shows how efficiently a company manages its operating expenditure in relation to its revenue. A higher operating profit margin indicates better cost control and operational efficiency. Here’s a list that highlights the strong collection performance of top real estate companies with their operating profit margin.

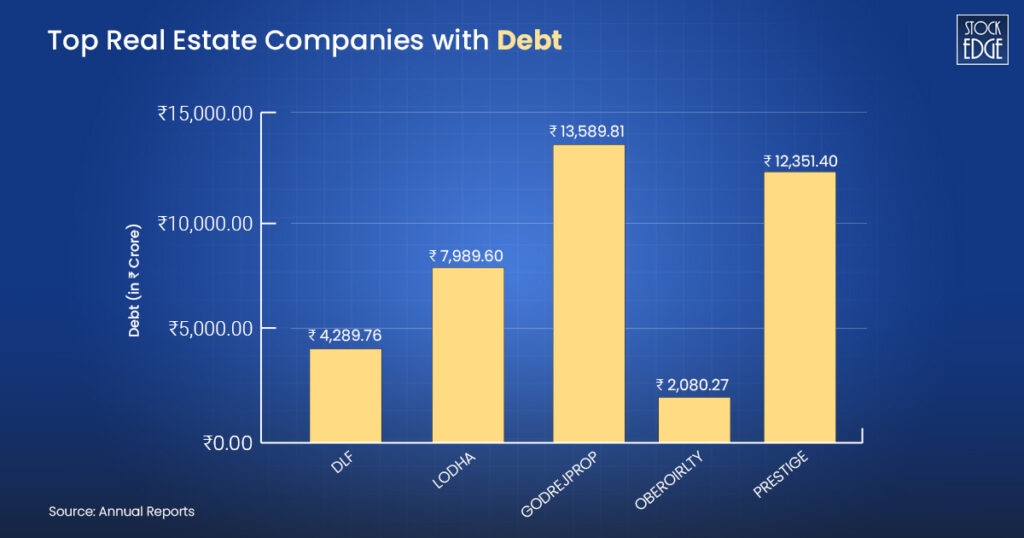

Debt Tracking

Real estate is a highly leveraged sector. High debt during upcycles allows companies to invest aggressively in land acquisition and construction. In downcycles, excessive debt can lead to financial strain due to reduced cash flow. Check out the list that highlights the strong collection performance of top real estate companies with their debt, some of which are currently positioned as stocks near all time high due to positive investor sentiment.

After understanding the important parameters for analyzing real estate stocks, we will examine the top-performing companies.

Top-performing Real Estate Stocks to Invest

Now, let’s look at the top-performing real estate stocks

Godrej Properties Ltd.

Godrej Properties Limited is the real estate development arm of Godrej Group, which is primarily engaged in construction and real estate development. It focuses on residential, commercial, and township projects. The company is headquartered in Mumbai and is present in 11 cities in the country. Through joint development and joint venture projects, it maintains an asset-light model.

As of March 31, 2024, the company had 102 active and upcoming projects with a combined developable area of ~223 million square feet. It focuses on four core regions: the Mumbai Metropolitan Region (MMR), the National Capital Region (NCR), Pune, and Bangalore. Since FY18, it has delivered ~47 million square feet of real estate and added 66 residential projects with ~136 million square feet of saleable area.

The company achieved a quarterly sales booking value of ₹5,198 crore from the sale of 5.15 million sq. ft. of area. The booking value grew 90% year over year to ₹13,835 crore in H1 FY25 from the sale of 13.14 million sq. ft. The company’s share was 93% during H1 FY25.

To know more, check out our Edge reports.

Oberoi Realty Ltd.

Oberoi Realty Ltd is a Mumbai-based real estate development company focused on premium developments. While the company focuses on residential projects, it also has a diversified portfolio of projects covering segments of the real estate market, such as commercial, retail, social infrastructure, and hospitality projects.

As of March 2024, the company had constructed around 47 projects in prime locations across the Mumbai skyline, constituting ~13.6 million sq. ft. of space (the group entity includes the promoter group). Another 29.7 million square feet (carpet area) were in the works. The company has ambitious plans for future developments in various districts of Mumbai and other regions.

To achieve the scalability required to undertake significant developments, they outsource work to leading international and domestic consultants in architecture, design, engineering, and construction. The company appointed Samsung C&T Corporation as its general contractor for the iconic high-rise mixed-use project in Worli, Mumbai.

To know more, check out our Edge reports.

DLF Ltd.

DLF Ltd. began by establishing 22 urban colonies in Delhi. In 1985, the company moved into the then-unknown Gurugram region, producing extraordinary living and working environments for India’s new global professionals. Today, DLF Ltd. is India’s largest publicly traded real estate company, with residential, commercial, and retail properties in 15 states and 24 cities.

In H1FY25, they reported strong performance, with Rs 7,094 crore in sales bookings despite delays in approvals. DLF Cyber City Developers Limited (DCCDL) saw 13% revenue growth and 25% profit growth YoY. The company remains optimistic, expanding its rental portfolio and progressing on key projects in Gurugram and Chennai.

Prestige Estates Projects Ltd.

Prestige Estates Projects Ltd is one of South India’s leading real estate developers. With a legacy of over thirty years in real estate development, it has a diversified portfolio covering Residential, Office, Retail, Hospitality, Property Management, and warehousing. It operates in 13 cities across 8 states.

It builds and operates hotels at prime locations by collaborating with hospitality brands such as JW Mariott, Sheraton Grand, and Conard by Hilton and has been responsible for introducing some of the world’s most renowned international brands to South India, such as Banyan Tree for resorts and Oakwood for serviced apartments. The company’s projects have also garnered well-known clients, including Intel, Microsoft, Hewlett Packard, Oracle, IBM, and Cisco, to mention a few. It has a land bank of 888 acres (679 acres are Prestige shares). The company also offers comprehensive property management services, with 185 projects under maintenance totalling 120 million square feet and 95 projects in the queue totalling 150 million square feet.

In H1 FY25, the revenue stood at ₹4,448.3 crore with an EBITDA of ₹1,709.4 crore and PAT of ₹541.6 crore. The average realization per sq. ft for apartments, villas and commercial space was ₹13,782, up by 33% YoY in Q2 FY25. Whereas for plots, the average realization for the quarter was ₹6,654 per sq. ft.

The Phoenix Mills Ltd.

Phoenix Mills Ltd. was incorporated in 1905 in Lower Parel, Mumbai, as a textile manufacturing company. Its objective was to manufacture cotton textile goods. In 1987, it entered the real estate market with the High Street Phoenix market.

Now, the company, including its subsidiaries and group companies (PML Group), is a leading retail-led mixed-use asset developer and operator in India. It has completed the development of over 19 million sq. ft. across retail, hospitality, commercial, and residential asset classes. Its functions typically encompass all real estate operations, from land acquisition, planning (liaison, approvals), development, execution, and marketing to leasing, management, maintenance (malls, offices), and sales (residential development).

The group owns real estate properties in Mumbai, Bengaluru, Chennai, Pune, Raipur, Agra, Indore, Lucknow, Bareilly, and Ahmedabad. It has formed strategic alliances with the Canada Pension Plan Investment Board (CPPIB) and the Government of Singapore Investment Corporation (GIC). The group has an operational retail portfolio of over 11 million sq. ft. of retail space spread across 8 major cities of India and 12 malls. It is further developing 2 new retail destinations and expanding 2 of its existing retail destinations, which will together take the retail portfolio to 14 million sq ft by FY27.

Final Thoughts

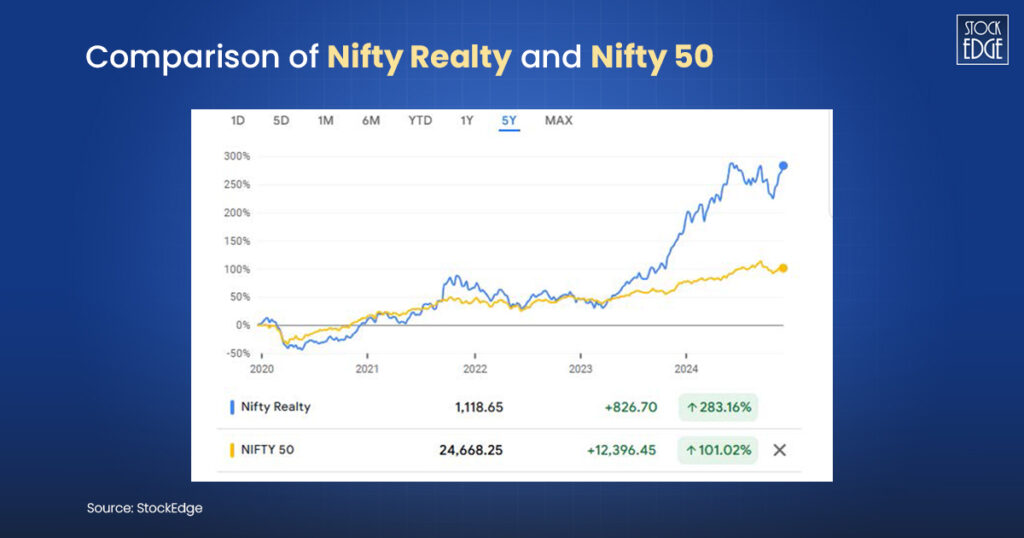

Let’s look at the bigger picture. The 5-year performance of Nifty Realty and the Nifty 50 clearly shows that real estate stocks have demonstrated impressive growth over the past five years.

The above image clearly shows that as of 16 December, NSE Realty stocks had outperformed the Nifty 50 over the past five years, with a return of 283.16% compared to the Nifty 50’s 101.02%.

Let’s check the current trend of the real estate stocks.

At StockEdge, you can track the current trend of the sector using the sector rotation feature. On 17th December 2024, Nifty Realty gained over 4% this week and is the top gainer today as well. It showed a bullish trend, i.e., green in colour, which suggests that real estate stocks were likely to outperform the market. You can also check the all time high low performance of that real estate stocks here. The index breadth reveals that the sector is to remain bullish as 70% of stocks are RS55 positive, and this number has increased significantly over the past few days. 90% of stocks are trading above their SMA20, indicating the short-term trend is bullish and strong. At the same time, 70% of stocks are trading above their SMA200, which indicates strength in the long term.

For more information on how to use StockEdge’s cutting-edge advanced analytics tools, check out our blog, The New Age of StockEdge: Sharper & Smarter!

To find out why this increase happened, join the StockEdge Club, where you will receive insightful ideas, and our team of research analysts will assist you with questions about investments, trading, and IPOs.

Also Read: 5 Star Rating: Best Hotel Stocks in India

FAQ’s

How Can I Start Investing in Real Estate Stocks?

To start investing in real estate stocks, follow these steps:

- Open a Demat and Trading Account: You need to have a Demat and trading account with a brokerage firm.

- Research the Market: Understand the types of real estate stocks available, such as REITs, real estate developers, and property management firms.

- Select the Right Stocks: Choose real estate stocks that are consistent with your investment objectives, financial capability, and risk tolerance.

- Diversify Your Portfolio: Instead of investing all your money in a single real estate stock, diversify by investing in various enterprises or industries, including residential, commercial, and SEZ.

- Start with Small Investments: If you’re new to real estate stocks, start small and increase your investment gradually as you gain confidence.

- Track and Review: Monitor the performance of your real estate stocks and keep an eye on real estate market trends, interest rates, and regulatory changes.

Are these stocks suitable for beginner investors?

Yes, real estate stocks are suitable for beginner investors. Here’s why:

- Easy Entry: You don’t need large amounts of capital as you would for buying physical real estate.

- Diversification: Real estate stocks expand your investing portfolio by giving exposure to the real estate industry.

- Steady Income: REITs offer regular dividend payouts, making them an attractive option for passive income.

- Liquidity: Unlike physical real estate, real estate stocks are easily traded on stock exchanges.

- Regulatory Oversight: Many REITs are regulated, providing investors with greater transparency and protection.

However, new investors should be aware of potential hazards, such as market volatility, interest rate changes, and economic slowdowns, which can all impact real estate stock performance.Want to learn how to navigate the market with confidence? Start with our Beginner’s Guide to Investing today!

What makes these real estate stocks a good investment?

Real estate stocks offer several key benefits that make them an attractive investment option:

- Dividend Income: REITs, in particular, are required to pay a significant portion of their profits as dividends, offering regular passive income.

- Portfolio Diversification: Real estate stocks provide exposure to the real estate sector, balancing risk in a stock-dominated portfolio.

- Inflation Hedge: Real estate prices generally rise with inflation, which can lead to higher rents and increased returns for real estate companies.

- Capital Appreciation: Aside from dividend income, investors can gain from price appreciation in real estate stocks as property values rise over time.

- Liquidity: Unlike direct property investments, real estate stocks can be traded on stock exchanges, providing greater liquidity.

Investing in real estate stocks allows you to benefit from the industry’s growth without having to manage physical property. However, before making investing selections, it is critical to undertake comprehensive research and consult with financial specialists.

What are the major risks of investing in real estate stocks?

Here are the major risks associated with investing in real estate stocks:

- Market Volatility: Real estate stocks, like any other investment, are subject to market fluctuations. Economic downturns, interest rate changes, and global events can negatively impact their performance.

- Economic Cycles: Economic cycles, with their periods of expansion and contraction, can significantly affect real estate demand. A weak economy can lead to decreased demand for both residential and commercial properties, impacting the value of real estate stocks.

- Interest Rate Risk: Rising interest rates can increase the cost of borrowing for real estate companies, which can hurt their profitability. Additionally, higher interest rates can reduce demand for real estate, mainly residential properties.

- Management Risk: The quality of management can significantly impact a real estate company’s performance. Poor management decisions can lead to financial difficulties and lower returns for investors.

- Liquidity Risk: Some real estate stocks may be less liquid, making it challenging to trade quickly, especially in large quantities. This can impact your ability to exit a position when desired.

- Regulatory Risk: Any changes in government regulations, such as zoning laws, tax policies, and environmental regulations, can affect the profitability of real estate companies.