Table of Contents

Have you ever wondered how your Amazon, Flipkart or other online package gets delivered to your doorstep within a few days or even a few hours? The answer is India’s strong, efficient and effective logistics. So, what exactly is logistics? It refers to the movement of goods from one place to another. To elaborate further, when a manufacturer produces goods for its end users or customers, how efficiently the goods are delivered to customers is typically referred to as logistics.

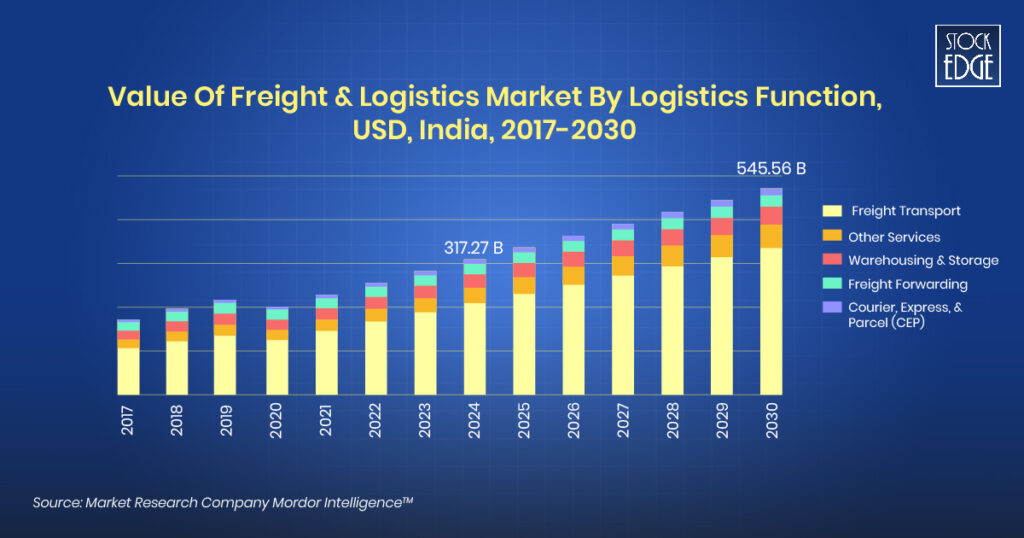

Currently, India’s logistics sector contributes around 13-14% of GDP and provides employment for more than 22 million people. As per Mordor Intelligence Research, Freight and Logistics Market size is estimated at 317.3 billion USD in 2024 and is expected to reach 545.6 billion USD by 2030, growing at a CAGR of 9.46% during the forecast period (2024-2030).

So, India’s logistics sector is poised for steady growth. For investors, this can be a golden opportunity to invest in logistics stocks in India. Hence, in this blog, a complete overview of the logistics industry and some investment-worthy logistics stocks in India will be discussed in particular for your long-term investment portfolio.

Therefore, stay tuned and read the entire blog to identify some of the best logistics stocks in India.

What are Logistics Stocks in India?

In India, logistics stocks refer to publicly listed companies that are involved in the transportation of goods from the point of origin, which is the manufacturing facility, to the point of consumption. The entire process of logistics involves activities such as warehousing, transportation, and distribution of goods.

List of Logistics Stocks in India

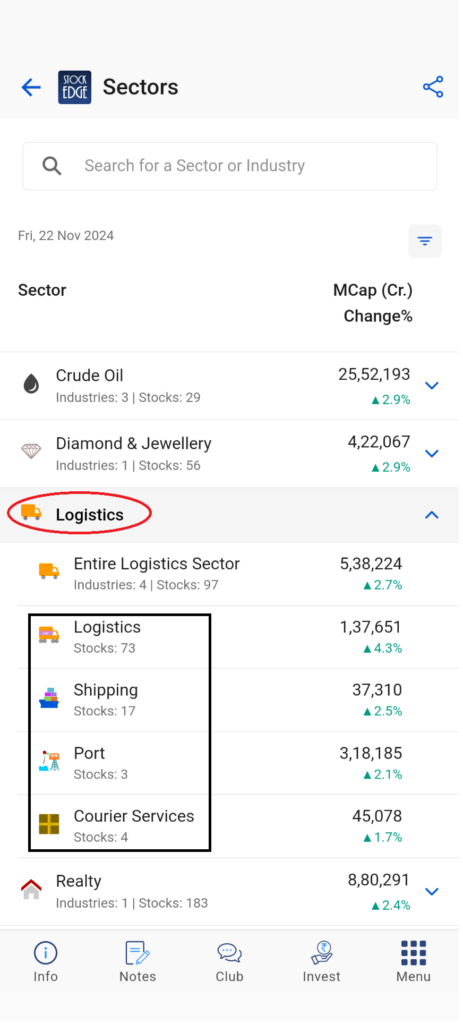

There are 94 logistics stocks in India as of 31st Oct 2024. At StockEdge, you will be able to get the entire list of logistics stocks in India, which are subdivided into four unique industries: shipping logistics, port logistics, courier services and the overall logistics industry. The sub-division of the industries allows you to make informed investment decisions based on your research and findings about each industry.

Industry Overview: Logistics

The logistics sector in India is one of the largest in the world, with addressable investment opportunities. The industry is crucial for the economic growth of the country as it involves elements like transportation, warehousing and distribution, along with other supply chain activities that range from supplier to end users. India is the fifth largest economy in the world, with approximately $3.7 trillion in GDP in 2023. It aims to cross $5 trillion dollars in the near future by 2030.

To achieve such significant growth, the government aims to promote the manufacturing sector via the “Make in India” campaign, which can lead India to become a global manufacturing hub. So, India requires new and innovative logistics solutions to support economic growth. In addition to this, a country requires the best infrastructure for its road and railway networks to efficiently mobilize goods even to its remote pin code.

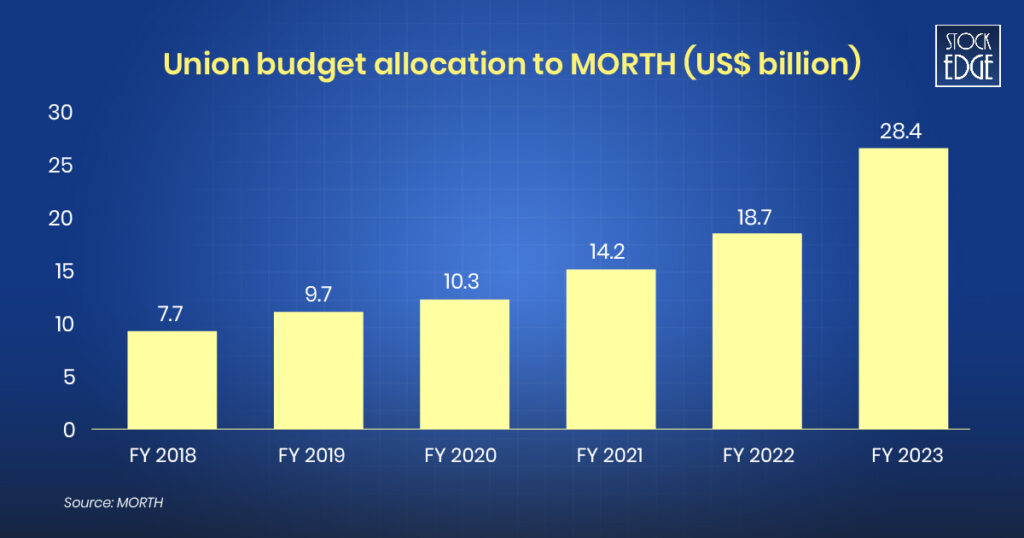

Here is an overview of how the government has increased its budget allocation over the past few years to develop the country’s road and highway infrastructure.

Hence, it is a clear indication that the government is supporting the logistics industry by developing road and highway infrastructure. There are not only roadways for transporting goods but also there are other modes of transporting goods to their destination. The overall infrastructure development is the country is at good pace. You may read one our previous blog: Which Infrastructure Stocks Should Be in Your Portfolio?

Classification of Logistics Market Structure

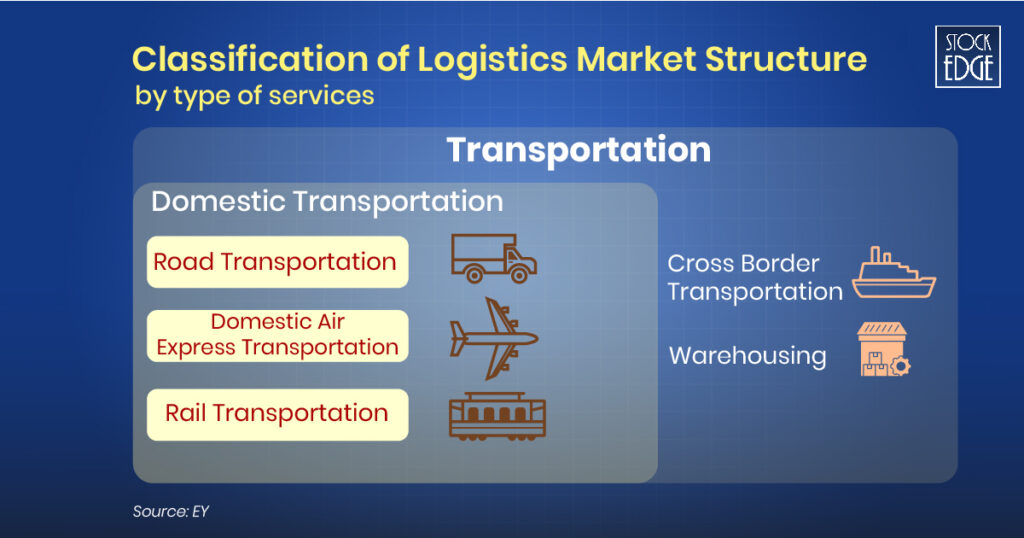

The structure of the logistics market can be classified based on the type of service offerings, such as roadways, railways, airways, and cross-border transportation, which are usually done by waterways via shipping containers. Other than this, the warehousing of goods also comes under logistics services in India.

As you can see, the market structure of the logistics industry is quite simple and straightforward. The government of India is developing each aspect of the market structure to efficiently mobilize the goods to its end user, which could lead to the overall growth of India’s logistics sector. Moreover, a growing sector can lead to increased investment opportunities in the logistics stocks in India.

Development of Logistics Sector in India

The Government of India has implemented several measures to develop the logistics sector in India, such as:

Infrastructure Development

- Dedicated Freight Corridors: High-speed railway corridors for efficient freight transportation. It enhances the efficiency and effectiveness of logistics operations. As of January 2023, 1,724 kilometres of dedicated freight corridors have been completed connecting Delhi, Mumbai, Chennai, and Howrah.

- Multi-Modal Logistics Parks: They include provisions for multiple forms of transportation and storage. These multi-modal parks provide access to a variety of modes of transportation, including road, rail, and air, as well as advanced storage options such as streamlined warehouses, cold storage facilities, and critical services such as customs clearance and quarantine. It aims to optimize logistics operations and enhance supply chain efficiency by lowering freight costs, warehouse expenses and vehicle congestion.

Digitalization and Process Improvement

- E-Way Bill: Electronic documentation for inter-state transportation. The implementation of the e-way bill system mandates using electronic documentation for truckloads valued above ₹50,000. The digital document eliminates the requirement for paperwork and state boundary checking, simplifying inter-state vehicle transport.

- PM GatiShakti: A comprehensive plan for integrated infrastructure and logistics launched by the Prime Minister in October 2021. It seeks to minimise disruptions and enhance efficiency by focusing on multi-modal connectivity.

Government Policy Reforms

- National Logistics Policy 2022: It aims to improve logistics efficiency and reduce costs. The objective is to boost economic growth and activity by providing a single window to operate the logistics system, especially for MSMEs in India. So, it can help lower the logistics cost for organizations in India.

- Logistics Efficiency Enhancement Programme (LEEP): It focuses on improving freight transport efficiency. Also, it seeks to reduce costs and time for transporting goods, as well as improve practices like transferring and tracking goods through technological advancements and streamlined processes.

The logistics industry in India is anticipated to become much more competitive and efficient as a result of these actions. Therefore, the logistics industry in India may become more efficient and thrive with the introduction of new policies, infrastructural development, and cutting-edge technologies.

List of Best Logistics stocks in India

Now here comes the best logistics stocks in India where you may invest for the long term. Investing in logistics stocks can be good diversification for your portfolio considering the overall growth expected in the logistics sector in the long run.

1. Container Corporation Of India Ltd.

The company is a ‘Navratna’ public sector undertaking incorporated in 1988. Almost 94% of its inland transport is conducted through the Indian railways networks. However, over the years, the company has diversified into several container logistics activities such as container port, air cargo complex, air freight station, warehousing, logistics park, supply chain management, etc.

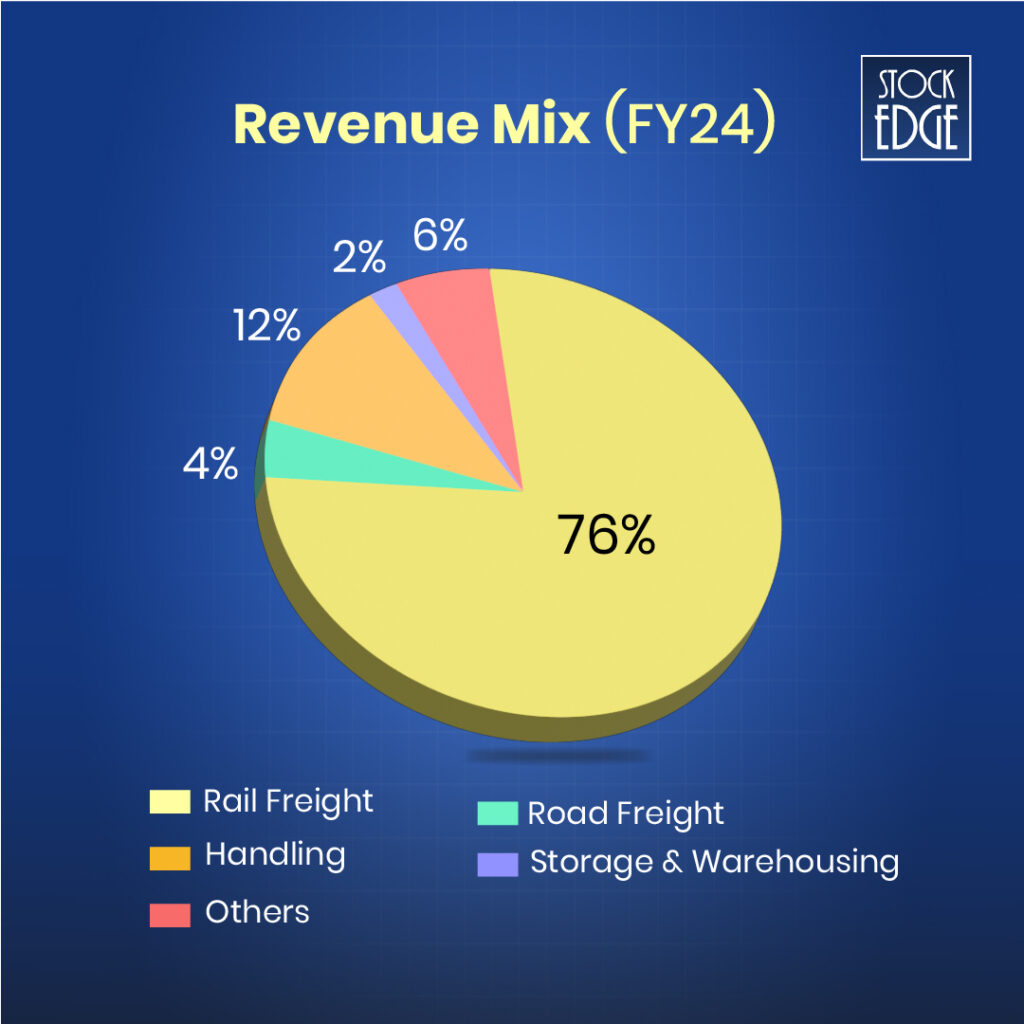

Here is the company’s revenue mix based on the logistics service it offers:

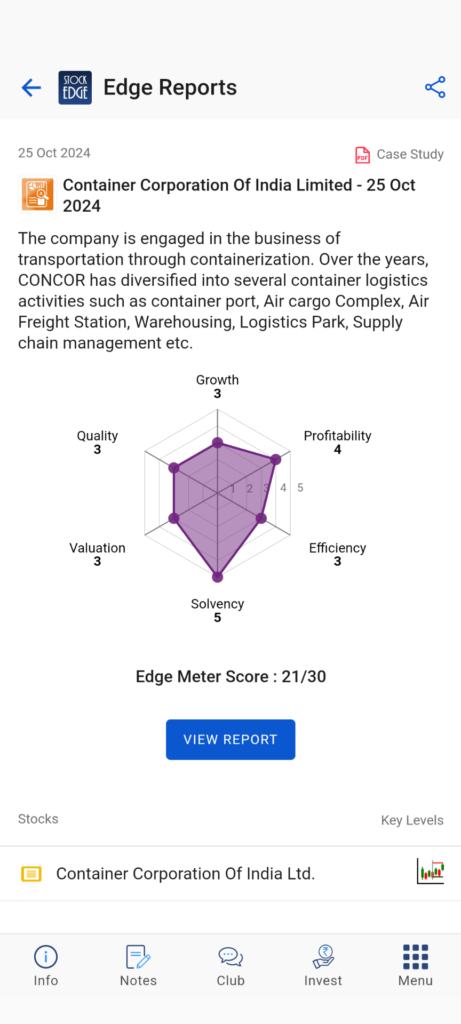

From a financial point of view, in the latest quarter of Q2 FY25, the total revenue from operation volumes increased by 7% YoY, and the company witnessed growth in market share and improvement in margins. To read more about its financials, you can view the case study of Container Corporation Of India (CONCOR) from the StockEdge app. The case study focuses on six key areas to evaluate the company such as growth, quality, profitability, valuations, efficiency and solvency.

Going forward, the company anticipates 18% business growth from its operations and its EBITDA margin guidance at 25% for FY25.

2. Aegis Logistics Limited

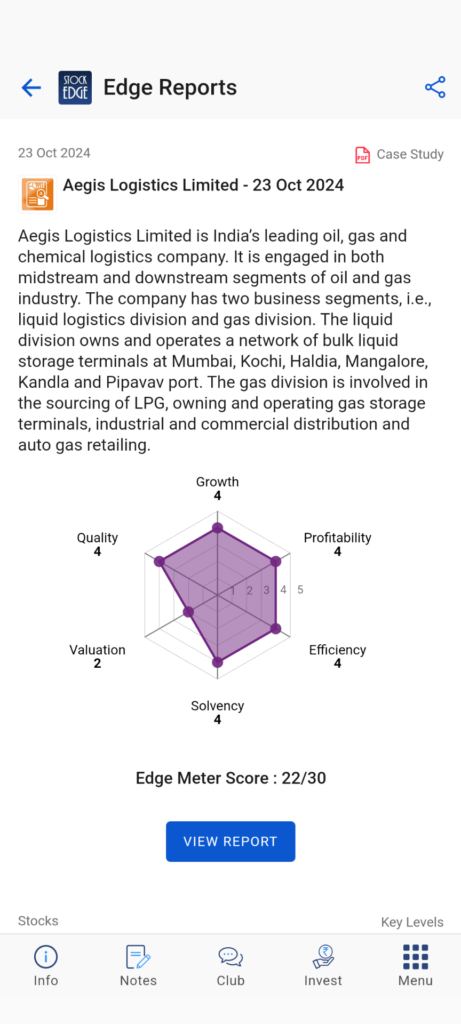

Originally incorporated in 1956 as a chemical manufacturing company, it ventured into the logistics industry in 1996-97. It is now India’s leading logistics company, especially in transporting oil, gas and chemicals. The company has a network of 142 autogas stations in 10 states and 290 LPG distributors across 140 cities in 15 states. Some major clients of the firm are Bharat Petroleum, Hindustan Petroleum, Reliance Industries, Caltex, Supreme Industries, Jubilant Lifesciences, Bombay Dyeing and Laxmi Organics.

The company has two major revenue segments: the gas terminal division and the liquid terminal division. In FY24, 92% of the company’s revenue came from the gas terminal division, whereas only 8% of revenue accounts for the liquid terminal division.

From a financial point of view, in the latest quarter of Q2 FY25, the total revenue from operation jumped 41.8% YoY, and in H1 FY25, the company reported a PAT of ₹310 crore, an increase of 10% on a YoY basis. Also, the EPS (Earnings per share) for the half year ended 30th September 2024 was ₹7.33 as compared to ₹6.92 in H1 FY24. Overall, the company seems to be financially strong. To read more about its financials, you can view the case study of Aegis Logistics Limited from the StockEdge app.

3. Blue Dart Express Ltd

Incorporated in 1983 by three partners to start a courier service company in India. The company gained market share and reputation. It was soon acquired by global logistic giant DHL in 2005. DHL owns 75% of the shares in Blue Dart Express. It is South Asia’s premier express air and integrated transportation & distribution company, offering secure and reliable delivery of consignments to thousands of pin codes in India.

From a financial point of view, in the latest quarter of Q2 FY25, it reported revenue from operations of ₹1,449 crore, a 9.4% increase compared to ₹1,324 crore in Q2 FY24. However, the net profit declined due to higher employee compensation. However, the management announced a general price increase (GPI) of 10%-12%, effective from January 2025, to offset inflationary pressures, revive its profitability and improve the margins of the business.

Moreover, the growth in courier service companies can mainly be attributed to an increase in online shopping. A gradual shift towards online purchases has triggered a rise in e-commerce platforms in the country in terms of the supply of products to consumers. Therefore, Blue Dart, which is a market leader in courier logistics services, can be highly benefited.

Similarly, e-commerce logistics companies are about to grow aggressively over the next few years. Hence, at StockEdge, we have developed an Investment theme specifically to ride the momentum of such logistics stocks in India.

Click here to view the list for top logistics stocks in India which are poised to grow in the new age era of e-commerce logistics.

The Bottom Line

The fast growth of the e-commerce industry and the increase in manufacturing activities driven by the “Make in India” initiative make long-term investments in logistics stocks in India extremely promising. As businesses strive to optimize supply chains and online shopping becomes a fundamental aspect of consumer behaviour, the need for effective logistics and warehousing services is expected to increase substantially. In addition, government programs to improve connectivity and strengthen infrastructure further establish the logistics industry as a pillar of India’s economic expansion. By taking advantage of these tendencies, you may align yourself with a sector that is expected to grow steadily and yield strong profits.

Want to explore more investment opportunities? Start with our Beginner’s Guide to Investing and build a strong foundation today!

Happy Investing!