Table of Contents

Are finance stocks financially strong?

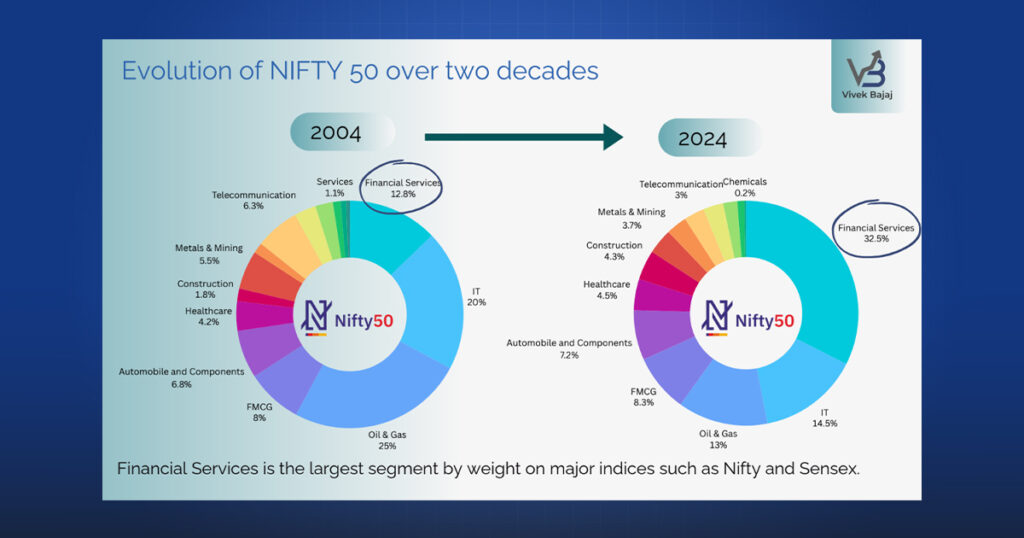

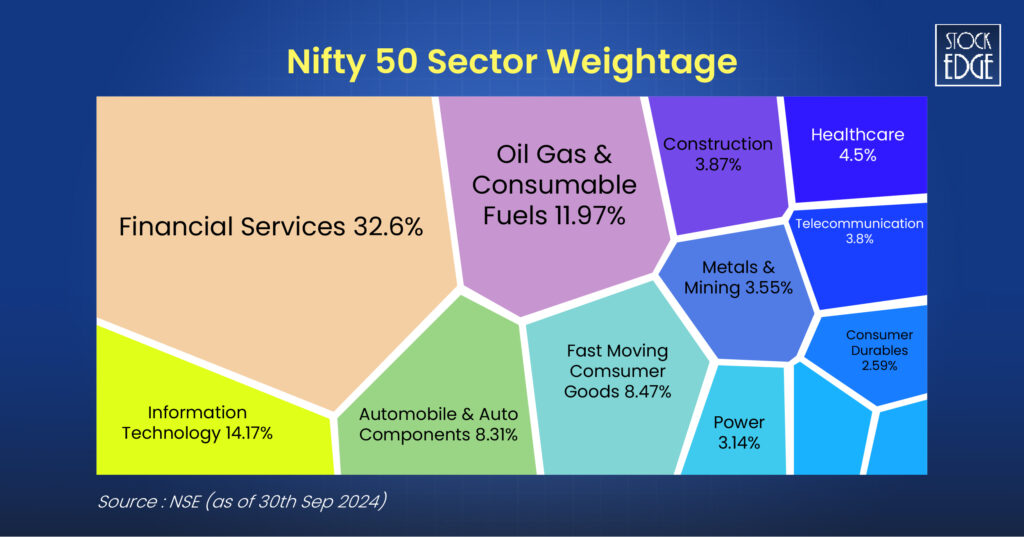

Finance stocks and the overall financial service sector is of high importance in the Indian stock market. Did you finance stocks has the highest weightage of 32.6% in the benchmark index Nifty 50. Here is an overview of the various sector weightage in Nifty 50.

Banking and finance companies are known as the founding pillars of an economy. They serve as a backbone for the economy. It facilitates transfer of capital from savers to borrowers of resources enabling businesses to invest, expand, and create jobs. Additionally, providing individuals with access to credit, savings, and investment opportunities.

In this blog, the objective is to identify investment opportunities in finance stocks to take active participation in India’s growing economy.

What are Finance Stocks?

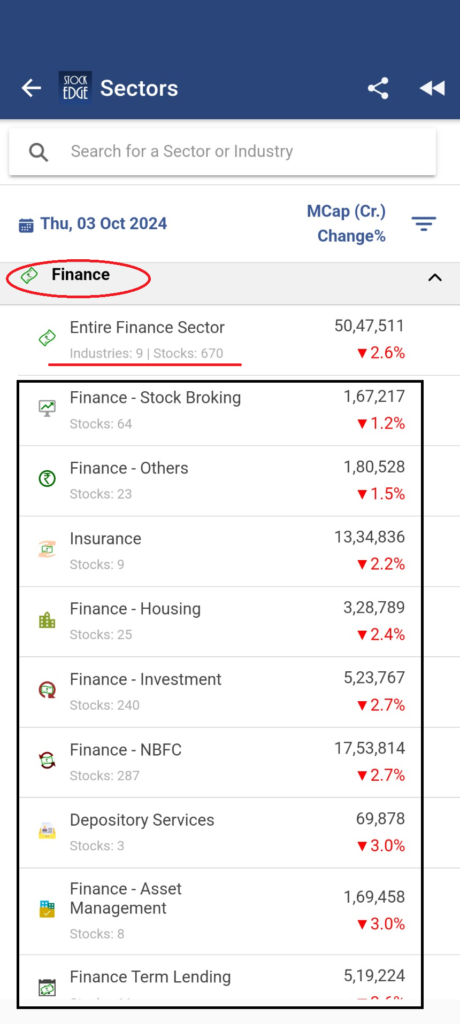

In India, finance stocks are listed companies in the stock market that are involved in various financial services like insurance, depositories, broking, asset management, housing finance, NBFCs, etc. There are 670 finance stocks listed in the Indian stock market as of 30th Sep 2024; that’s one of the largest number of stocks listed under a particular sector. As the overall financial sector in India is huge and highly diversified, spanning several industries, we at StockEdge have classified the finance stocks into 9 industries such as insurance, NBFCs, housing finance, etc. Other financial industries are as follows:

Sectoral Overview of Finance Stocks in India

The growth in the Indian economy heavily depends on the finance sector because it provides the necessary capital, credit, and investment to fuel businesses, infrastructure, and innovation. If a country has a robust financial system then it can efficiently allocate resources to drive economic development. Therefore, India’s target to become a $5 trillion economy is dependent on the financial sector. Henceforth, finance stocks in India can be a thriving opportunity for long term investors.

Over the past years, the weightage of finance stocks have increased steadily which emphasized the importance of the finance sector in India. Here is an interesting fact about the growing investment opportunity in finance stocks in India.

In the past 20 years, the finance stocks have gained heavy weights. Back in 2004, where the weightage for finance stocks was just 12.8% in Nifty 50, it now holds the highest weightage in the benchmark index. That signifies its importance and potential for growth in years to come.

Key Drivers in Finance Stocks

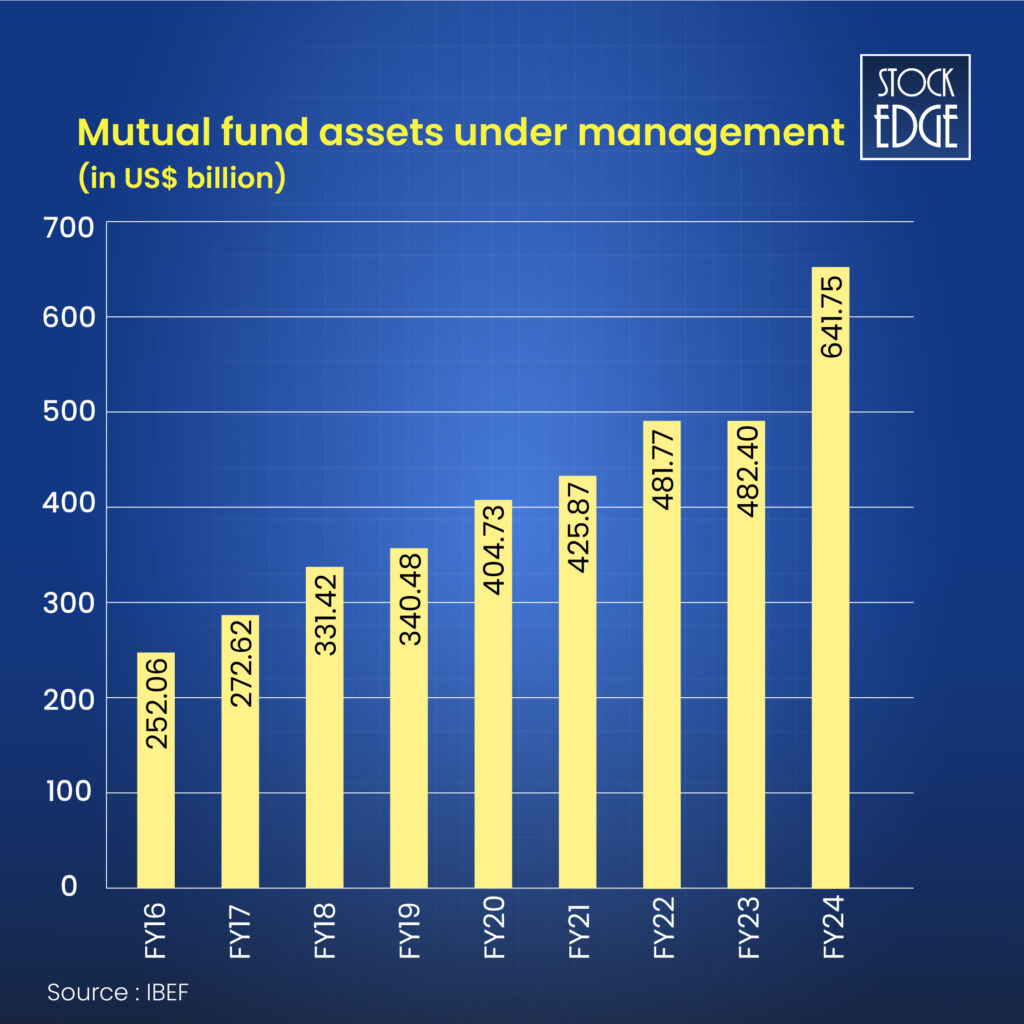

- Savings Growth – The gross savings rate by Indians has steadily increased over the years. In 2023, the gross savings is at 30.2% of the country’s GDP compared to 29.3% of GDP in 2021. So, as savings increase, there is a need for investment avenues, and therefore, it can positively influence the finance stocks under asset management. In FY24, AUM managed by the mutual funds industry stood at Rs.53.40 lakh crore (US$ 641.75 billion. As per a report published by IBEF, the assets under management growth is expected to double to ₹100 trillion (US$ 1207 billion) by 2030, implying a CAGR of 14% from FY24 to FY30.

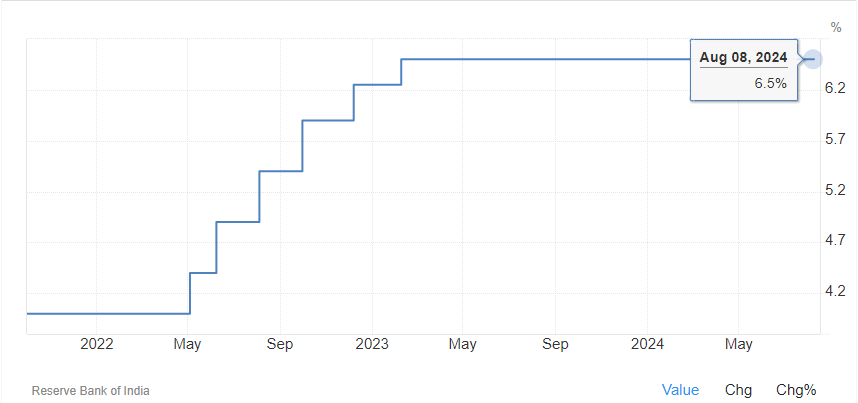

Also, it suggests that the number of Ultra High Net Worth Individuals (UHNWI) is estimated to increase from 12,069 in 2022 to 19,119 in 2027. The number is expected to expand by 58.4% in the next 5 years. So, the advisory or wealth management business is to flourish as the pace of the India equity market continues. Therefore, finance stocks which are into broking business, depositories and exchanges can also have a direct positive impact. Interest Rate – Finance stocks are highly sensitive to interest rate changes in the economy. - Interest Rate – Finance stocks are highly sensitive to interest rate changes in the economy.

Source: Trading Economics

The Reserve Bank of India maintained its benchmark policy repo at 6.5% for the ninth consecutive meeting in August 2024 to ensure desired inflation in the economy. Now that the US Fed has started a rate cut of 50 bps on Sep 24, after a long halt, as inflation in the economy declined. Similarly, when the Indian economy sees lower inflations, RBI is most likely to start its rate cut. This can positively impact the fiance stocks. For instance, NBFCs will have lower borrowing costs, allowing them to access cheaper capital and eventually improve their profit margins. Next, finance stocks in the housing finance industry can also see loan book growth due to lower interest rates for people to borrow more to buy houses. - Government Policies: One of the best initiatives by the Government of India was the launch of Pradhan Mantri Jan-Dhan Yojana (PMJDY), which aimed to increase financial inclusion in the country by providing every household with a basic bank account.

Over million bank accounts were opened under this scheme, bringing the informal working class into the formal banking system. This has increased the customer base for banks, NBFCs, and insurance companies, leading to rise of savings and increasing demand for financial products. This initiative has helped flourish finance stocks in India by increasing the customer base, which leads to credit growth as well as an increase in deposits, bringing an inflow of capital into the formal banking system.

How to invest in Finance stocks?

There are essentially three ways to invest in finance stocks. One requires actively identifying opportunities to invest in finance stocks to get the best return and overcoming the risk involved in it. On the other hand, the other two ways require a passive approach to investing where the objective is to derive optimal returns with minimized risk. Let’s discover each method in brief:

1. Invest in Finance Stocks Directly

To invest in finance stocks, you can buy shares of financial service companies such as banks (e.g., HDFC Bank, ICICI Bank), NBFCs (e.g., Bajaj Finance), insurance companies (e.g., LIC, HDFC Life), and asset management companies (e.g., HDFC AMC).

This approach provides a control over your investment where you can invest in diversified finance stocks spanning across various industries like NBFCs, stock broking, insurance etc. You can choose stocks to invest based on your risk appetite.

However, direct stock investing requires a good understanding of fundamentals of the company, trend of the market, and especially risk management, as it can be more volatile and requires active monitoring.

If you wish to directly invest in finance stocks and given the risk appetite you are willing to actively participate in monitoring the stock, then the list of best finance stocks to invest in 2024 is coming right away in the next part of this blog.

2. Invest via Index Funds

Index funds track a broader market index, such as the Nifty Financial Services Index or Nifty Bank Index. These funds invest in a diversified set of finance stocks that mirror the performance of the financial sector index. It is a passive approach towards investing in finance stocks.

Index funds offer diversification, lower risk, and lower fees compared to actively managed funds. You benefit from exposure to multiple finance companies without having to pick individual stocks.

Since index funds simply track the market, they typically offer returns in line with the overall sector’s performance, meaning they won’t outperform the index but provide steady growth over time.

One such index fund which tracks India’s financial services index is Kotak Nifty Financial Service Fund that provided a healthy return of 31% in the past 1 year as on 3rd oct 2024.

3. Invest in Sectoral Funds to Invest in the Finance Theme

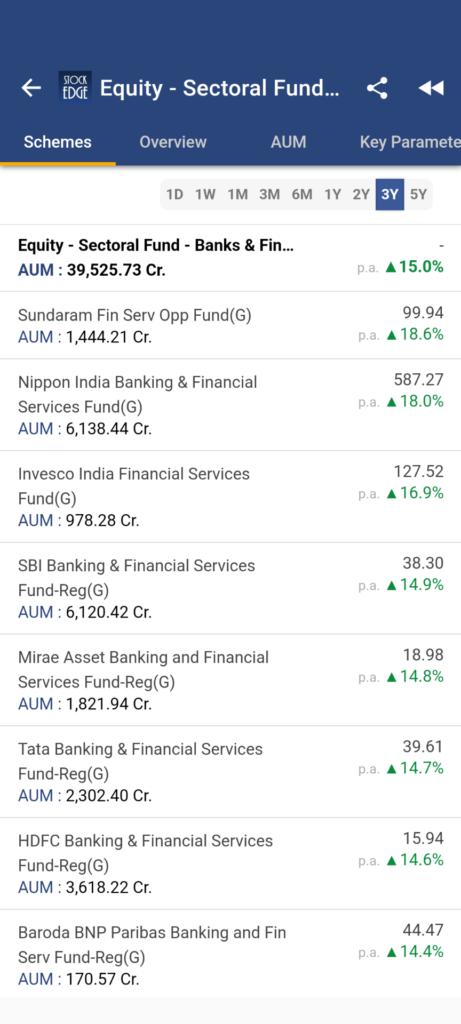

Sectoral mutual funds or popularly known as thematic funds focus on the financial services sector and invest in a wide range of finance stocks including banks, NBFCs, insurance, and asset management firms etc.

At StockEdge, we have a list of thematic funds based on banking and financial services from which you can select a sectoral fund as per your investment goal and risk appetite.

These funds are professionally managed, providing diversification within the finance theme, and offer exposure to high-growth sectors like banking, fintech, and insurance. They are suitable for investors with a high-risk appetite who want concentrated exposure to the financial sector.

Sectoral funds are riskier than diversified funds because they focus on a single sector. If the finance sector underperforms, the fund’s returns may be negatively affected.

Each method has its own risk-reward profile, and the choice depends on your financial goals and risk tolerance.

Now, coming to the interesting part of the blog, we have curated a list of the best finance stocks in India, where you may invest in the long term to enjoy growth and momentum in India’s financialization.

Best Finance Stocks in India

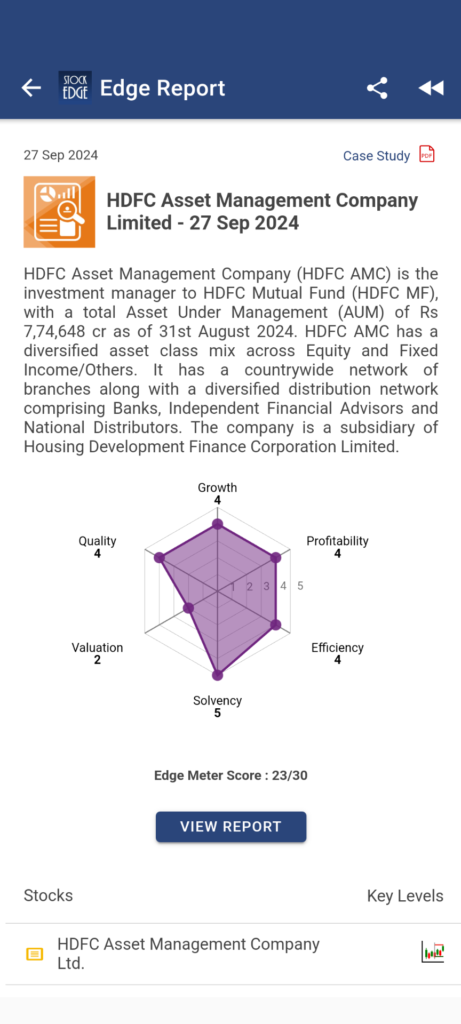

HDFC Asset Management Company Ltd.

It is one of the third largest mutual fund companies in terms of AUM with an asset under management of $74.15 billion as of the fourth quarter of FY 24. The financialization in India has spurred growth in the mutual fund industry.

The company offers a wide variety of savings and investment products across various asset classes, which provide wealth-creation opportunities to its customers. Now, with the introduction of a new asset class proposed by SEBI, where the minimum investment of ₹10 lakhs can cater to those individuals who could not otherwise afford to invest in PMS with a minimum investment of ₹50 lakhs.

Also, it aims to curb the rise of unregistered and unauthorized investment schemes that often promise unrealistic returns and exploit high-worth investors or individuals (HNIs). It will create more opportunities for business for Asset Management Companies (AUMs), and HDFC AMC, with its diversified portfolio of investment products, is at the forefront of riding the long-term growth in the mutual fund industry of India.

However, before you make any investment decision it is important to understand the company’s financial position and its performance over the years. Therefore, at StockEdge we have prepared a case study on HDFC AMC which involves analyzing the company based on 6 unique parameters which are; growth, profitability, efficiency, solvency, valuation and quality of the management.

Click to view the research report on HDFC Asset Management Company Ltd.

Central Depository Services (India) Ltd.

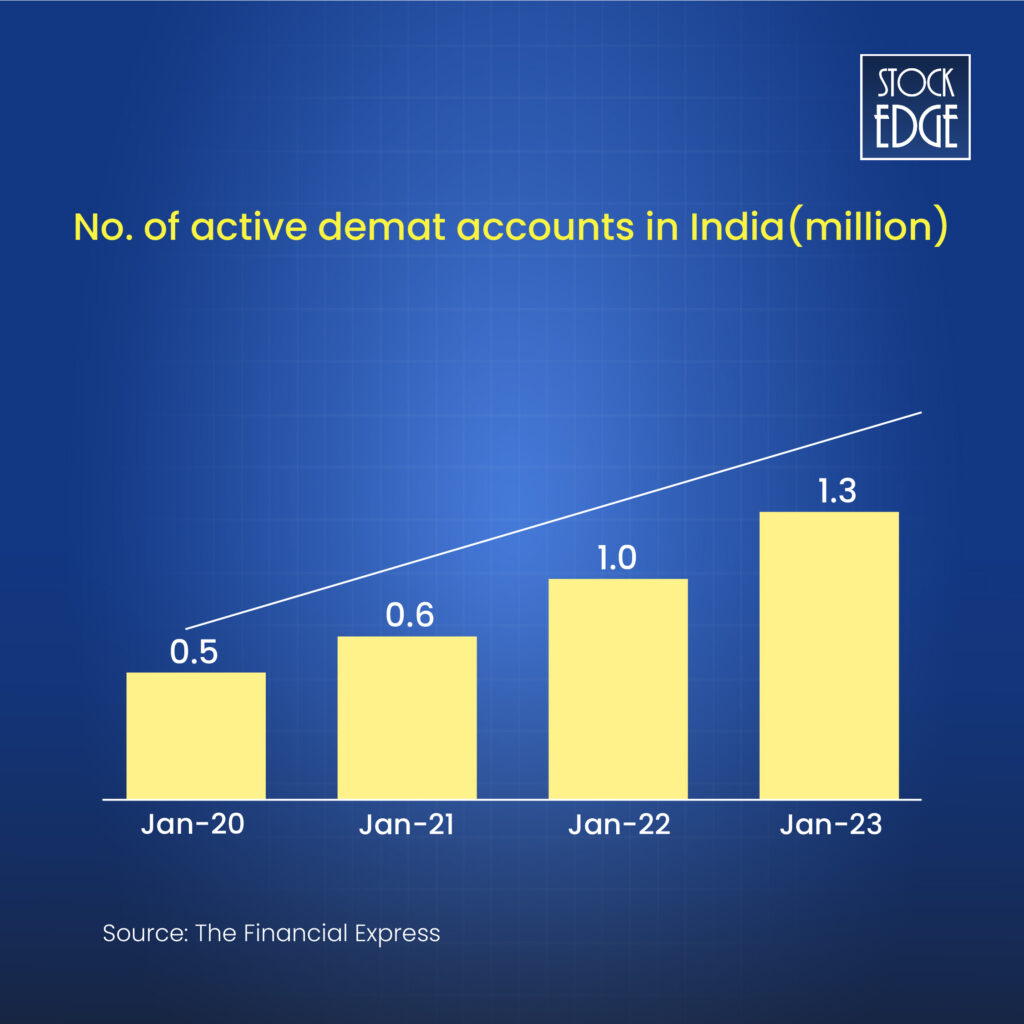

It is one of the leading security depositories in India. In recent years, there has been increased participation in equity markets, especially after Covid 19 pandemic. The total number of active demat accounts has increased by 3.6x from Jan 2020 to Jan 2024.

Therefore, CDSL may see a sharp rise in new account additions and increased transactions in demat accounts leading to increase in its revenues. India has only two security depositories which are NSDL and CDSL and CDSL being the only listed entity in the Indian stock market where you have the opportunity to invest in this finance stock for the long term.

Similar to the case study on HDFC AMC Ltd, we have prepared a detailed research report on Central Depository Services (India) Ltd., which you can refer to before making an investment decision.

BSE Ltd.

Last but not least, the finance stock from our list is India’s oldest and fastest stock exchange, which is the Bombay Stock Exchange (BSE) Ltd. The increase in participation by retail investors in the stock market will lead to increased transaction volumes, leading to an increase in its revenues. The growth in BSE is staggering, as the number of companies listed on the BSE increased from 135 in 1995 to 5,357 as of March 2024. Additionally, the recent addition of SME companies to the platform has also increased transaction volume in the exchange.

According to Goldman Sachs, investors have been pouring money into India’s stock market, which is likely to reach >US$ 5 trillion, surpassing the UK, and become the fifth-largest stock market worldwide by 2024. A growing number of participants in the stock market will eventually lead to increased revenue for stock exchanges. In India, there are two stock exchanges namely the Bombay stock exchange (BSE) and the National Stock Exchange (NSE) where BSE Ltd. being the listed entity offers you the opportunity to invest in a growing stock market.

To know the company’s financial performance in the last few quarters, you can refer to the case study report available at StockEdge.

Further, if you wish to diversify your portfolio into more finance stocks, then you can check out one of our investment themes: Financialisation of Savings

In this investment theme, we have added more finance stocks where you can invest. The list of finance stocks selected for the theme is based on the financialization of savings. But what does it mean? As mentioned earlier, the majority of us have parked our savings in physical assets like Gold and silver or real estate, etc. However, due to financialisation, there is a shift from physical assets to savings in financial assets, which has given importance to India’s financial service sector. Therefore, in this investment theme, we have provided you with a list of finance stocks that are to benefit from the financialization of savings in India over the long term.

We have other investment themes, to learn the basics of thematic investment, read: Thematic Investing: A Comprehensive Guide

The Bottomline

As our economy expands, driven by increasing financial inclusion, digital transformation, and government reforms, the demand for credit, insurance, and investment services is expected to rise significantly. The finance sector is pivotal to this growth, playing a key role in capital allocation, wealth creation, and infrastructure development. With a rise in income among the middle class, rapid adoption of fintech, and supportive regulatory frameworks, finance stocks are well-positioned to deliver sustainable long-term returns, making them an attractive investment option for wealth accumulation.

Happy Investing!