Key Takeaways

- Strong Market Growth: India is the third-largest market for spirits, with a market size of $55 billion and a total liquor industry market capitalization of ₹2.28 lakh crore.

- Key Growth Drivers: Rising alcohol consumption due to changing lifestyles and urbanization. Increasing online sales and home delivery options. Growing middle-class population with higher disposable income.

- Investment Considerations: Understand the regulatory environment, as liquor policies vary by state. Also analyze company fundamentals and growth strategies before investing.

- Top Picks:

- United Spirits Ltd.

- Radico Khaitan Ltd.

- United Breweries Ltd.

- Sula Vineyards Ltd.

- Tilaknagar Industries Ltd.

“Alcohol consumption is injurious to health, but investing in liquor stocks in India can be favorable for your wealth.”

Liquor stocks in India have a total market capitalization of ₹228126.81 Crs and it is growing at an accelerated rate. As per the International Spirits & Wines Association of India (ISWAI); India is the third-largest market for spirits with an estimated market size of $55 bn. The alcohol and beverages sector play an integral role in the travel, tourism and hospitality industry and employ over 20 lakh people directly & indirectly.

The Indian liquor industry is growing thanks to an increasing population of young consumers, urbanization, rising disposable income, and, most importantly, ease of accessibility. Yes, accessibility plays a crucial role in today’s modern world.

Just with a click of a button on your smartphone, you can buy a pack of beer via Zomato or Swiggy! Although buying your favorite alcohol and beverages online is easy, investing in liquor stocks in India requires a thorough study of the overall market and carefully choosing the right liquor stocks for your portfolio.

In this blog, let’s explore investing opportunities among the top liquor stocks in India.

What are Liquor Stocks?

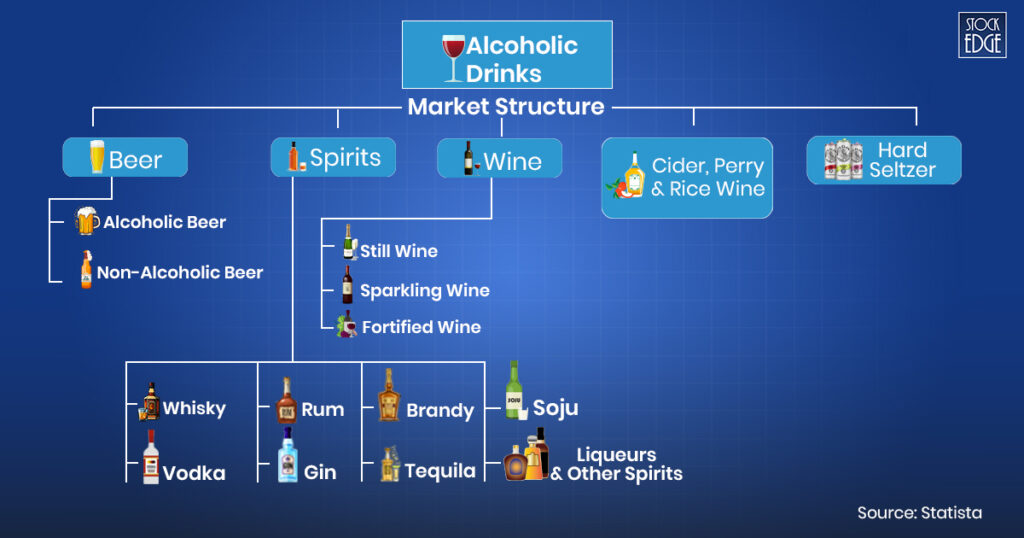

Liquor stocks in India refer to publicly listed shares of companies engaged in the manufacturing, distributing, and sale of alcoholic drinks. The market structure of alcoholic drinks in India is as follows:

Alcohol Sector Outlook: Breweries & Distilleries

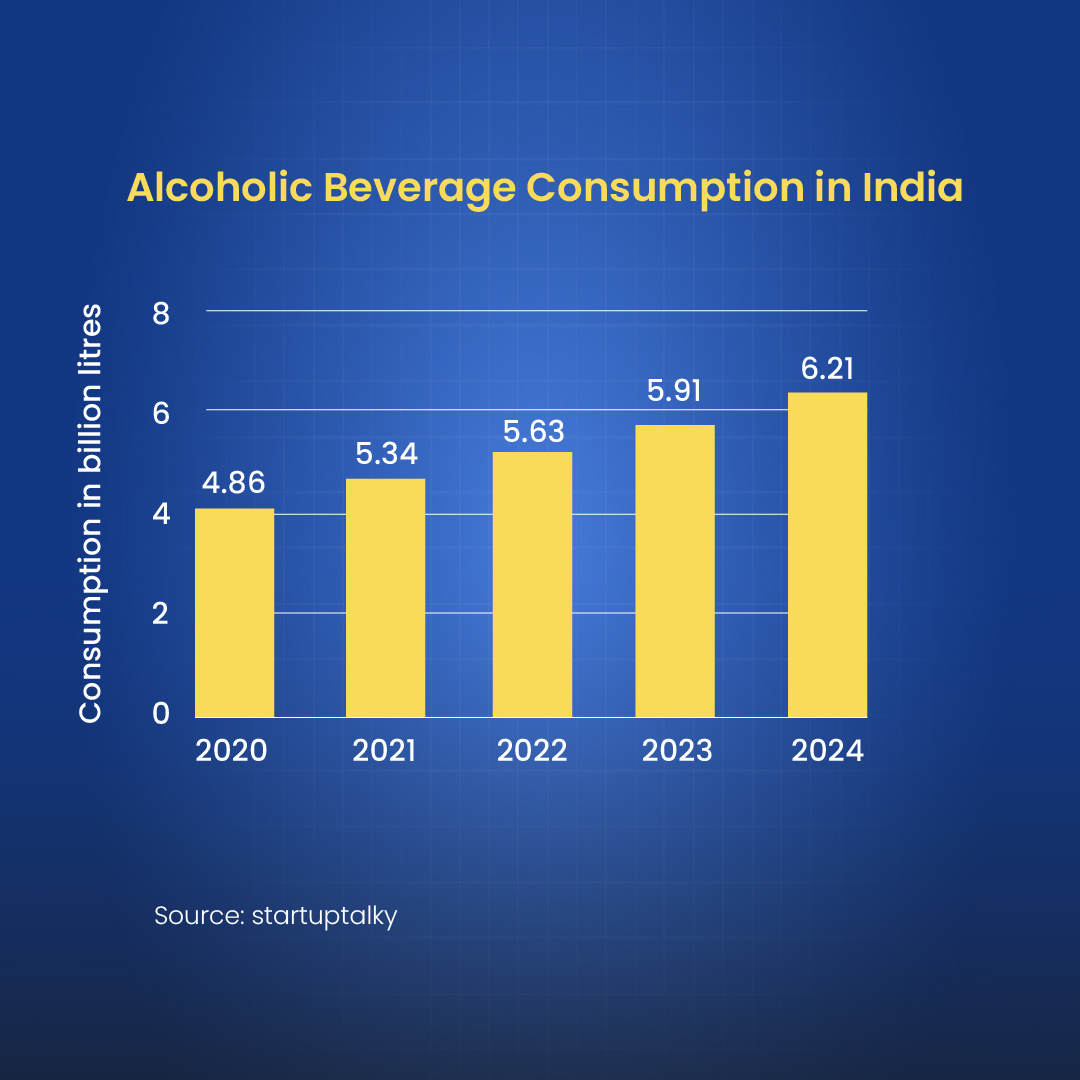

As per the report published by, IWSR which is a global leader in data, analytics and insights for the beverage alcohol industry state, “India is one of the few large beverage alcohol markets in the world to consistently display growth momentum, and this is expected to continue,” says Jason Holway, Senior Research Consultant at IWSR.

The upward growth trajectory is likely to remain due to the country’s population and its demographics. India has a median age below 30 which targets the youth and working population of the country. Drinking has become the new social norm and therefore a strong momentum has been noticed in the overall alcohol and beverage sector of India.

The liquor industry in India has strict government rules and regulations. Each state enforces its own policies, adding complexity. However despite these challenges, the industry has shown remarkable resilience and is expected to maintain strong growth in the growing Indian market. The rapid growth in the alcohol industry has led to companies in Indian liquor stocks from a number of investors.

Key Drivers in Liquor Stocks

- Rising Alcohol Consumption: India is experiencing a significant increase in alcohol consumption, driven by changing lifestyles, urbanization, and a growing middle-class population. This directly impacts alcohol companies’ stocks as they strive to meet the growing consumer base, with some even emerging as volume shockers on the NSE, indicating rising investor interest.

- Online Sales: The alcohol sector is making more and more use of e-commerce to provide services for online sales and home delivery. The pandemic has accelerated this change, which has improved consumer convenience and created new revenue streams while also improving market liquidity.

- Government Regulation Shifts: In India, changes are being made to the licensing, price, and distribution of alcohol in order to increase efficiency of doing business. As liquor stocks in India are heavily regulated by the government, with ease of regulations can drive the growth of the overall industry.

- Canned Alcoholic Beverages: The segment for canned alcoholic beverages is rapidly growing in India and it’s surely a game changer. It is appealing to young Indians, especially the GenZs. It is expected that the market share of canned alcoholic beverages will increase and companies that specialize within this space are most likely witness long term growth.

- Digital Marketing and Engagement: The alcohol companies are also changing their marketing model at this time, by using digital platforms such as Facebook, Instagram and WhatsApp for reaching consumers, increasing consumer engagement and arranging virtual events. These strategies not only promote brand exposure, but build rapport with consumers that later translate to higher sales and profitability.

Why Should You Invest in Liquor Stocks?

Here is a toast to the likely better days ahead for India’s alcohol industry which can be seen having increasing potential because of economic factors and social trends development as they are the fundamental driver for liquor stocks in India.

- Steady Demand: Consumption of alcohol in India is driven by culture and social occasions which have been proven to be strong even during economic downturns. This enduring need serves as a borderline protection for investors, hence delivering stable return on their investments.

- Premium Offerings: Growth of the middle class and disposable incomes are resulting in a more pronounced shift towards premium products. As premium products have higher margins which can improve the company’s bottom line.

- Regulatory Boost: Although the alcohol industry’s regulatory environment remains intricate, recent reforms and a greater focus on responsible drinking practices could lead to a more favorable and streamlined system for investors.

Key Factors Before Investing in Liquor Stocks

- Company Fundamentals: Analyze a company’s financial performance, including its revenue growth, profitability, debt levels, and cash flow. Look for companies with a strong track record and sustainable growth prospects.

- Government Regulations: Alcohol and beverages are one of the highest revenue generators for the state governments. Any change in policies related to the liquor industry can impact the liquor stocks whose majority of revenue comes from that particular geography. Hence closely monitor the government rules and regulations.

- Product Portfolio: Analyze its line of product and its brand strength before making an investment decision in any liquor stocks. A company’s strong brand presence and diverse product portfolio suggest better positioned in the alcohol industry and help to navigate market fluctuations.

- Distribution Channel: A strong network of distribution channels is essential for any liquor company to penetrate new markets and create strong presence in existing ones. That’s because a wider consumer base will eventually convert into more sales that will generate more revenue for the company.

- Quality of Management: A poor management can destroy a good company whereas a strong management team can even turn a poor financial company into profitability.

Best Alcohol Stocks in India

United Spirits Ltd.

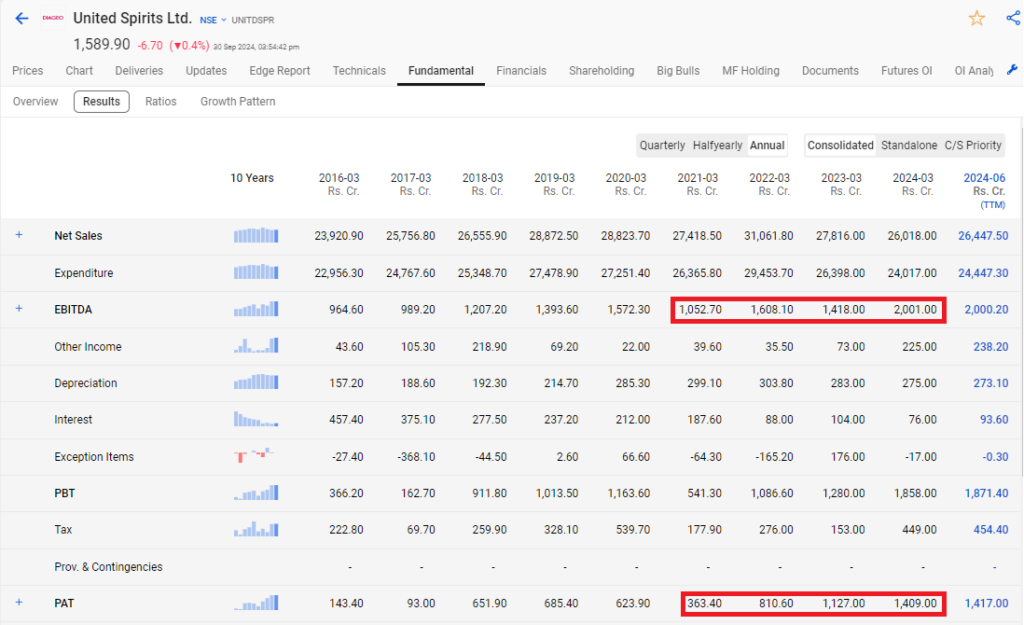

USL is the largest spirits company in India and a flagship entity of UB group. It manufactures a wide range of whisky, vodka, rum and other spirits. United Spirits is among the top three spirits companies in the world. USL has a global footprint with exports to over 37 countries. The company has the highest market capitalization of ₹1,16,729 Crores among other liquor stocks in India.

Financial Highlights

The revenue from operations of the company has been steady at 26,018 crores as of FY24. Despite flat sales, the company EBITDA and PAT margins have been steadily increasing. In FY21 EBITDA margin stood at 3.84 and PAT margin at 1.33 which is currently 7.69 and 5.42 respectively in FY24. This translates into doubling the EBITA margin and tripled PAT margin in a span of 4 years. At StockEdge, you can analyze profit and loss statements half yearly, quarterly and annually over 10 years. Here is the profit and loss statement of United Spirits Ltd.

In the latest quarter of Q1FY25, despite weaker demands, the company showed steady performance with revenue from operation increasing by 7.4% YoY. You can monitor a company’s business outlook every quarter from its con-call report. You can read its synopsis of it from the edge report section for any company in StockEdge.

Future Outlook

The company hopes rural demand recovery and a normal monsoon season would drive consumption revival going forward. The management expects revenue growth to be less than double digit in H1 FY25 and in double digits range in H2 FY25.

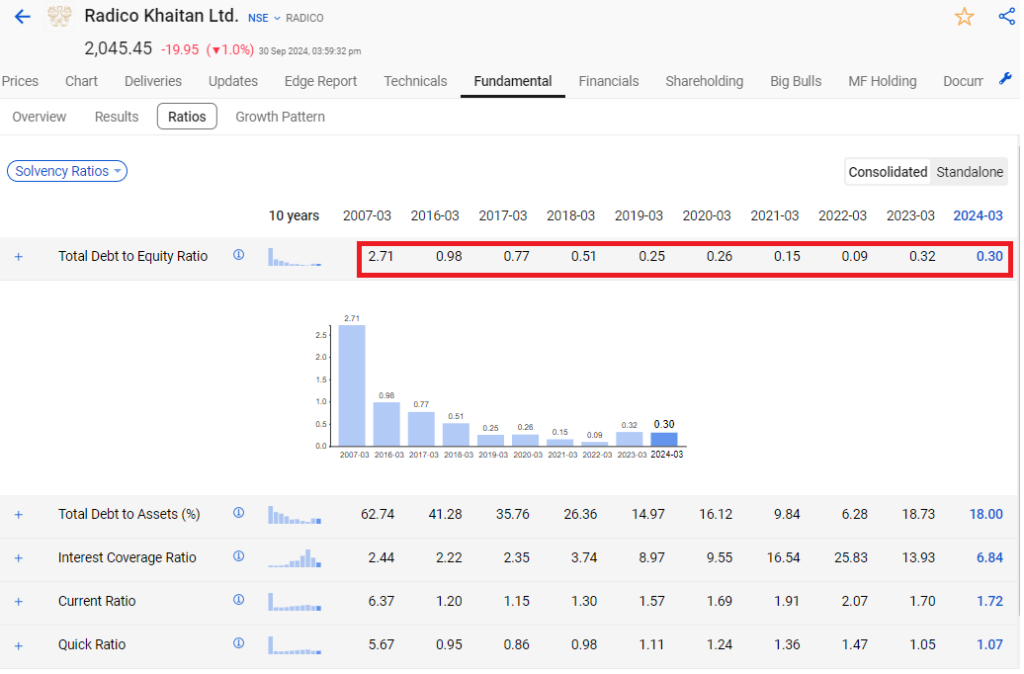

Radico Khaitan Ltd.

Did you know that one of India’s oldest and biggest producers of Indian Made Foreign Liquor (IMFL) is Radico Khaitan Limited (RKL).The company is present in several other international markets in addition to India. It is among the select few Indian businesses whose whole brand portfolio was created entirely through organic means that has more than 15 brands and their own variations.

Financial Highlights

The financial performance of the first quarter of FY25 was subdued because of weaker consumption fueled by ongoing food grain inflation and volatile commodity prices. However, despite the challenges, the net sales increased by 9% YoY. The EBITDA stood at ₹149 crore, up by 25% YoY. EBITDA margin was 3.49%, an expansion of 43 bps YoY. Margin expansion was impacted by grain price inflation. The company was highly leveraged more than a decade ago, where the debt-to-equity ratio was 2.71 in FY07, but over the years, it has lowered its debt ratio to just 0.30 as of FY24. You can check a company’s key financial ratios from the StockEdge app.

Future Outlook

The company is looking forward to enhancing its portfolio of brands through the implementation of focused marketing techniques, such as the launch of new brands in the luxury and premium markets. It anticipates that in the next time, the price of raw materials would stabilize, helping it increase its margins. The objective of the management is to enhance profitability, boost cash flow generation and manage working capital more efficiently. All of these factors will contribute to reducing debt. Further, they aim to become a debt-free company in the future.

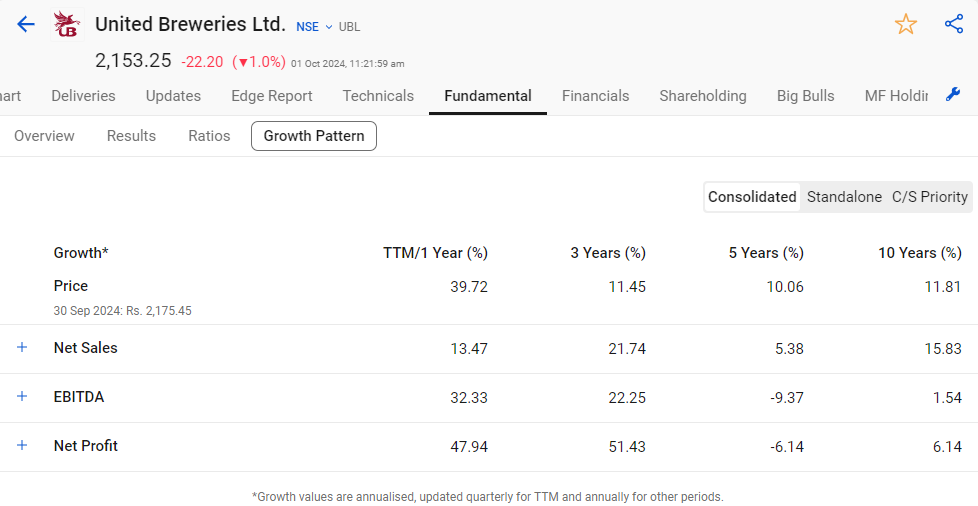

United Breweries Ltd.

Who doesn’t know about the company’s flagship brand ‘Kingfisher’, that has achieved international recognition consistently, and has won many awards at international beer festivals. In 1915, 5 breweries in South India came together to form United Breweries Ltd. Today the company owns the most popular beer, Kingfisher Premium Lager beer, is currently available in many countries and leads the way among Indian beers in the international market.

Financial Highlights

The company recorded a 10.8% YoY growth from revenue from operation which stands at 5811.28 crores in Q1FY25. The net profit increased by 27.5% YoY to 174 crores from 136 crores in previous years. In order to analyze a company’s growth pattern, you need to track both the top line and bottom line growth of a company which are basically Sales, EBITDA and net profit.

As you can see, the United Breweries stock has posted 13.47% sales growth, 32.23% EBITA growth and 47.94% growth in net profit. Using StocKEdge, you can view the growth pattern of any stock to analyze a company’s top-line and bottom-line growth.

Future Outlook

As the company has a strong brand presence of kingfisher in the beer segment, they are expecting in the next 9-12 months, the target for expansion in more than 4 states for production of beer. The company is looking forward to adding production capacity in West Bengal, Rajasthan, Telangana and additional regions along with increased production capacities of existing breweries. The management envisions to drive growth and gain market share in the premium segment, going forward. This will be done through revenue management, margin accretion, and cost initiatives.

Sula Vineyards Ltd.

Sula Vineyards is the largest producer and seller of wine in India. The company’s business is classified under two broad segments:

- production of wine, import and distribution of wines and spirits

- sale of services from ownership and operation of wine tourism venues, including vineyard resorts and tasting rooms

They have a portfolio of more than 50 domestic wine labels and over 25 imported alcoholic beverage labels comprising wines and spirits; Sula serves a large cross-section of customers, providing them with the widest range of choices at price points between ₹235 to ₹1,850. In FY 24, wine business contributed 87.8% of its revenue whereas wine tourism business and other business contributed – 9% and 3.2% respectively.

Financial Highlights

The company reported annual sales of 608.65 cr registering yearly growth by 10% in FY24. EBITDA at 175.85 cr higher by 11.67% YoY and EBITDA margin remained higher at 28.89%. The net Profit stood higher at Rs 93.31 cr registering growth by 11.02% YoY. whereas Profit margin remained elevated at 15.33%.

The company faced challenges like the national elections and dry days in several parts of India, which affected the movement for alcohol and beverages. Despite challenges, the company reported a 10% YoY growth in sales for the first quarter of FY25. However, the company is at its nascent stage and caters for a niche segment as the Indian wine market is relatively young, facing imminent challenges as consumption of alcohol and spirits, in particular, is highly prominent with regard to wine consumption. In addition, India does not have a wine-drinking culture, unlike in European countries where it is paired with meals. The drinking culture in India is an occasion-led event.

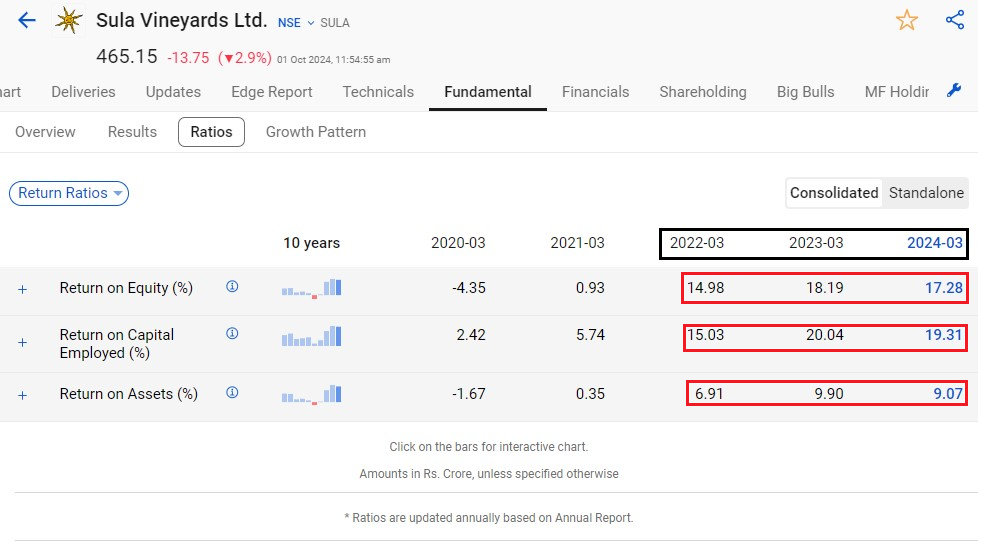

The return ratios like ROE, ROCE of the company are on an upward trajectory as you can view key financial ratios from StockEdge.

Future Outlook

The company is optimistic about the future, with wine tourism projects expected to boost performance in Q2FY25. It includes the opening of new facilities at Domaine Sula in Bangalore and Milestone Cellars near Nashik Airport. The company also plans to open a new resort near York Winery next year, increasing room capacity by 30% and adding conference facilities. Next year, in 2025, the grape harvest is expected to be healthy, and the company is set to continue its focus on the premiumization of its product portfolio.

Tilaknagar Industries Ltd.

The company is a leading manufacturer of liquor across the major categories – Whisky, Brandy, Rum, Vodka and Gin.with a market leading position in the southern and western parts of India. It is primarily involved in the manufacturing and sale of Indian Made Foreign Liquor (IMFL) and extra neutral alcohol.

Financial Highlights

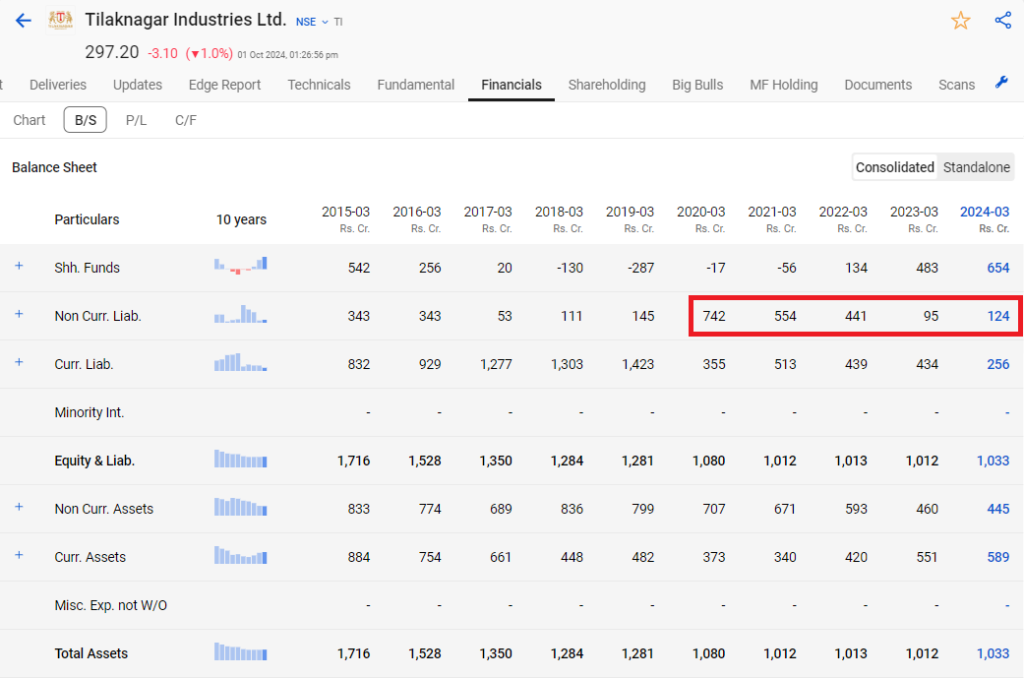

In FY24, company’s revenue for the year ended stood at ₹2958.28 crore which saw a growth rate of 19.80% YoY. EBITDA for the year ended stood at ₹185.45 crores, which saw a growth of 35.18% YoY. The company became highly leveraged during the Covid-19 pandemic where its debt climbed to 742 crores, but has managed to significantly reduce its debt on balance sheet to just 124 crores as of FY24. You can view the balance sheet of the company for further analysis of its financial position using StockEdge.

Future Outlook

Today, the company has positioned itself as a leader in India’s brandy segment. Going ahead it has a focus on increasing the share of premium products in its portfolio and as it can drive higher margins that could lead to sustained growth in the future. Keep a close eye on regulatory developments, as management anticipates favorable excise policy changes in key Southern states, which could enhance market growth opportunities. The company’s established leadership in these states positions it well to capitalize on these regulatory changes.

The Bottom Line

India’s booming alcohol market offers a great chance for investors, thanks to strong demand changing tastes, and positive market shifts. As more people move to cities, the young population grows, and folks have more money to spend, this industry is set to take off. The trend towards fancier cocktails, online sales, and new products like canned alcoholic beverages make it even more attractive. If you’re looking to invest for the long haul, India’s liquor industry gives you a mix of growth and stability that’s hard to beat with several all-time high stock in the middle of strong investor confidence.

To know more on what are sectors you can invest in other liquor stocks, you can read one or our previous blog: 5 Best Sectors to Invest in for Excellent Return in Future

Happy Investing!

Frequent Asked Questions (FAQ)

1. Which is India’s no. 1 alcohol company?

United Spirits Ltd, is the top liquor brand in India. It is a subsidiary of Diageo and leads the industry with popular names like McDowell’s No. 1, Royal Challenge, and Signature.

2. How to invest in liquor stocks?

To invest in liquor stocks, at first you need a trading account from a SEBI registered broker, research and identify the top players in this sector and then analyze the finances and risks of the companies in which you want to invest and buy shares from NSE/BSE.

3. Why are liquor stocks falling?

Liquor stocks are falling due to higher excise duties, weak demand due to government restrictions and increased competition from imported spirits under the India-UK Free Trade Agreement (FTA).