Table of Contents

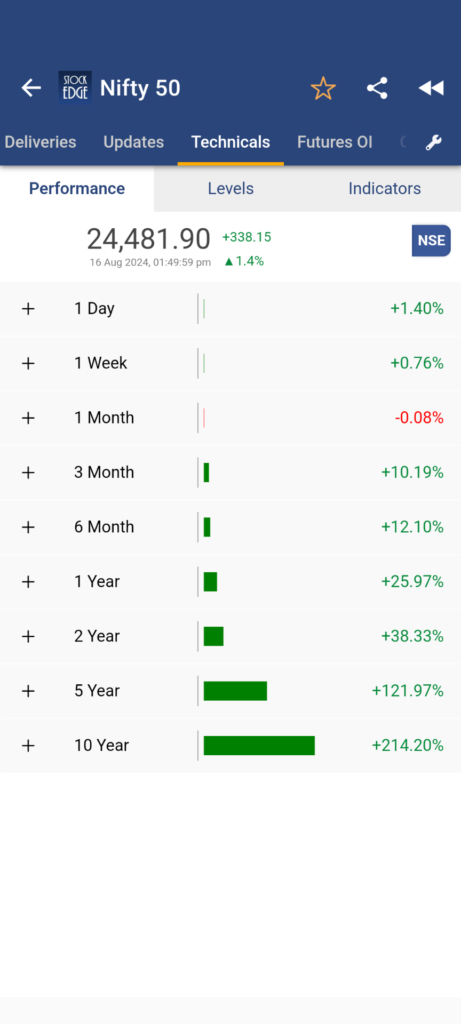

The Indian stock market is currently going through a difficult time. The volatility spiked due to several ongoing geopolitical risks. Although post-election results, the Indian benchmark indices witnessed strong growth with the Nifty 50 testing its all time high of 25,000. However, in the past month, Nifty 50 generated no return for the investors with the index losing -0.08% as of 16th Aug 2024. The Indian benchmark index Nifty 50 generated a staggering 10.19% and 12.10% in the last 3 months and 6 months respectively. Here is performance of Nifty 50:

It seems there is halt in growth of the Indian stock market due to prevailing geopolitical risk affecting the wealth of investors. So, in this blog let’s find out what are those geopolitical risks and whether they are short lived or may remain for a prolonged period which can eventually lead to a dent in investor’s wealth.

1. Global Economic Policies

The global economy is interconnected; the monetary policy of major economies like the U.S., Japan and the E.U. has a huge impact on emerging markets like India, but the biggest geopolitical risks in the Indian stock market are uncertainties related to global monetary policy, especially interest rates and monetary policy Recently, there have been fears of a recession in the US. and that has led to expectations that the U.S Federal Reserve may cut interest rates. A possible rate cut in the U.S. is likely to boost capital flows to emerging markets, including India, as investors seek higher yields. Well, that’s good for the Indian market, but this scenario also poses risks. So, what is that risk?

If there is a sudden change in the U.S. monetary policy, then it could cause significant volatility in the global financial markets. However, if the Federal Reserve delays or neglects to cut interest rates due to other economic concerns, there could be a large outflow of funds from India, putting pressure on the Indian rupee and stock markets.

The recent hike in interest rate by the Bank of Japan has strengthened the japanese yen, making exports more competitive. It is affecting the profitability of Japanese companies triggering domino effect in the global markets, and increased market volatility across Asia.

The impact for India is doubled. First, a strong Japanese yen makes Indian exports more competitive in global markets, potentially boosting industries such as IT and pharmaceuticals. However, higher volatility in Asian markets, especially Japan and South Korea, could affect the Indian stock market, creating more uncertainty in the short term.

Hence, global economic policies, especially those related to interest rates, can create significant geopolitical risks to the Indian stock market. The inter-relation of global markets means that any major policy shift in the U.S. or Japan could lead to increased volatility and uncertainty in India, affecting investor confidence and market performance.

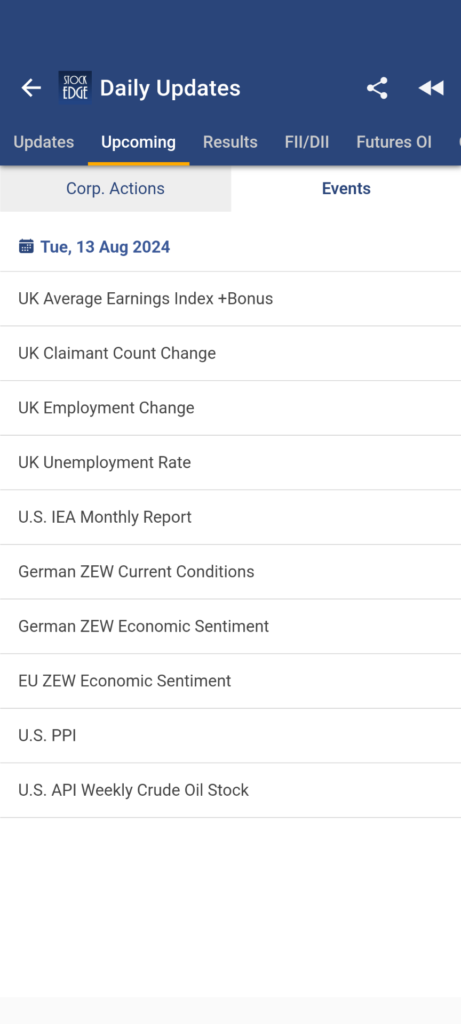

Therefore, you need to track important upcoming events that could affect the Indian stock market. You can track the major upcoming events in the market using StockEdge. Here is how?

Go to StockEdge’s News & Updates section and then click on Upcoming Events.

2. Border Security Concerns

The next geopolitical risk that could have a strong impact on the growth of the Indian stock market is the border security issue. Our country is located in an area that frequently experiences political unrest and security issues, especially when it comes to its neighbors. An increase in border tensions from political unrest, border conflicts, or terrorism may cause instability in the Indian market.

The continuous political and border conflicts between India-Pakistan are one of the biggest threats to geopolitical stability in India. Given the lengthy history of conflicts between the two nations, any escalation in border conflicts might cause a drop in investor confidence. For example, tensions between the two nations briefly increased after the Pulwama assault in February 2019, which caused a brief sell-off in the Indian stock market. Even though the matter was ultimately resolved, it brought attention to how susceptible the Indian economy is to geopolitical risks resulting from national security tensions.

India also has security issues along its border with China in addition to Pakistan. There is a chance that the ongoing border issues between the two nations—especially in the Ladakh region—may turn into a major war. In addition to having consequences for India’s national security, such a scenario would greatly increase market uncertainty and risk aversion among investors, which might result in capital outflow from the markets and a drop in market indices.

Moreover, India’s immediate neighbors are not the only ones with security worries in the region. Political instability is also a problem in the larger South Asian region; this is especially true in nations like Afghanistan, Sri Lanka, Myanmar, and, more recently, Bangladesh. The Indian market may be impacted by any increase in political upheaval or violence in these nations, especially if it causes disruptions to financial or trade movements.

3. International Trade Tensions

The growth of the Indian stock market may also be impacted by significant geopolitical risks, such as difficulties in international trade. Our country has a prominent position in the global economy. India is closely linked to global supply chains, and any disturbance in international trade can have significant effects on the country’s stock market as well as the economy.

The continuous trade tensions between the United States and China are one of India’s biggest trade-related threats. Global markets are extremely unsettled as a result of the trade war between the two biggest economies in the world, which has impacted supply chains and slowed down trade. This has both advantages and disadvantages for India.

India could benefit from the trade war on the one hand if it can establish itself as a substitute manufacturing base for businesses trying to diversify their supply chains away from China. However, the general slowdown in international trade may have an adverse impact on Indian exports, especially in industries that significantly rely on demand from around the world, such as electronics, automobiles, and textiles.

India encounters trade-related risks from its own trade policy in addition to the trade disputes between the US and China. Over the past few years, the Indian government has enacted a number of restrictive laws, such as increased import taxes and limitations on foreign investment in particular industries. Although the goal of these actions is to support domestic sectors, they also raise doubts in the minds of foreign investors and may provoke retaliation from other nations. A situation like this can cause foreign direct investment (FDI) to drop and have a negative effect on the Indian stock market.

Another concern is the ongoing trade talks between the European Union (EU) and India. Even though a good trade agreement would increase Indian exports to the EU, a breakdown or delay in the talks could cause market concern. One of India’s biggest trading partners is the EU, and any rift in trade may have a big impact on the country’s businesses, especially the pharmaceutical and IT sectors.

Strategies to Tackle Geopolitical Risks as an Investor

The geopolitical risks can significantly impact financial markets, leading to volatility and uncertainty. However, by adopting a strategic approach, investors can mitigate these risks and protect their portfolios.

Diversify using ETFs

ETFs are exchange-traded funds, where underlying instruments are usually benchmark indices or even sectoral indices as well. As then name suggest, Nifty 50 has 50 stocks in it, and investing in ETFs such as the Nifty 50 offers instant diversification to a wide range of sectors, reducing the impact of geopolitical events on any single company or industry. Therefore, ETFs offer diversification, which can minimize volatility and provide more stable returns over time.

The Nifty 50, in particular, represents the largest and most liquid companies in India, making it a solid choice during uncertain times. Despite the many shortcomings that are yet to affect the market, the benchmark index, over the long run, shall continue to rise. Therefore, disciplined investing in benchmark ETFs like Nifty 50 can deliver good returns in the long term.

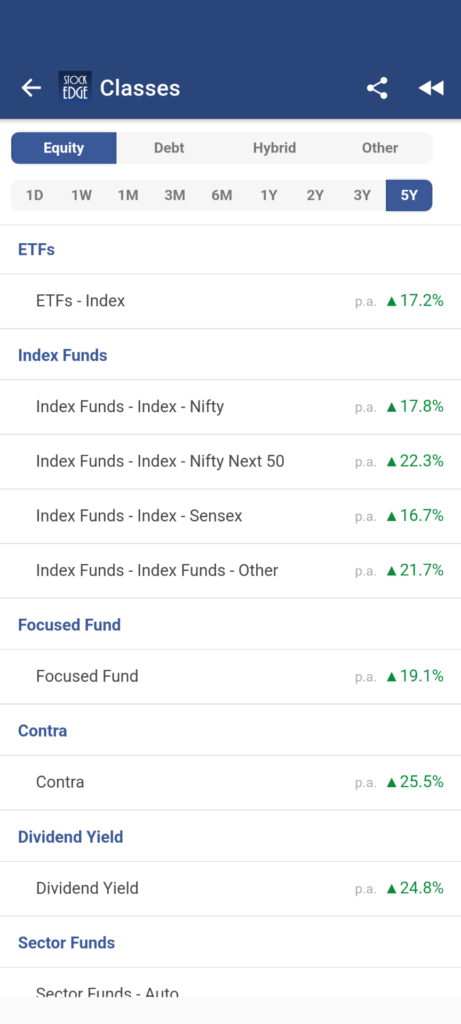

So, how to find which ETF to invest in? StockEdge can guide you to identify ETFs for your investment.

As you can see in the above screenshot, you can get the entire list of ETFs traded in the market. You can even get segregation of different benchmark indices as well.

Hedge with Precious Metals

Precious metals like gold and silver have long been considered a secured asset class in times of geopolitical turmoil. The prices of these assets tend to rise when equities are under pressure, making them an effective hedge against market fluctuations. By allocating a portion of your portfolio to gold or silver, you can reduce the overall risk and provide a hedge against sudden market downturns.

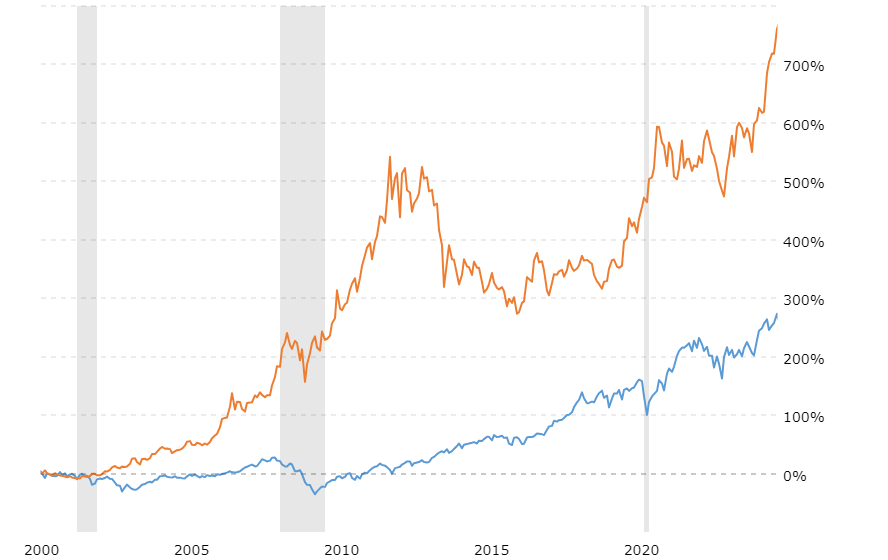

Gold has been the choice of Indian investors that have always created a good hedge against the equity portfolio of stocks. Here is demonstration how gold has performed against US benchmark index Dow Jones Industrial Average (DJIA) since 2000s and how the shining metal has performed during times of recessions (marked as gray areas)

Gold Price vs Stock Market

In the above image, orange line represent return of Gold and blue line represents DJIA index. During times of recessions or geopolitical risks where the Dow Jones declined sharply, Gold price shoots up creating a hedge. Therefore, to hedge your portfolio of stocks, investing in Gold ETFs, Gold mutual funds is a great way. But if you are a believer of God’s currency- “Gold” as mentioned by Robert Kiyosaki. Then you may invest in a proxy theme of Gold. You can find an investment idea of Gold in the StockEdge app.

Moreover, investing in silver can also get you good returns over the years and also act as similar hedge in case of geopolitical risks or uncertainties. To know more about investing in silver, you can read this blog: Invest in Silver to Diversify your Portfolio Beyond Gold

Utilize Liquid Funds

Parking your excess money in liquid funds is another smart strategy during times where there are geopolitical risks. Liquid funds invest in short-term, low-risk debt instruments, providing liquidity and relatively stable returns. They offer a safe place to park cash while earning a decent return, making them ideal for preserving capital during volatile periods.

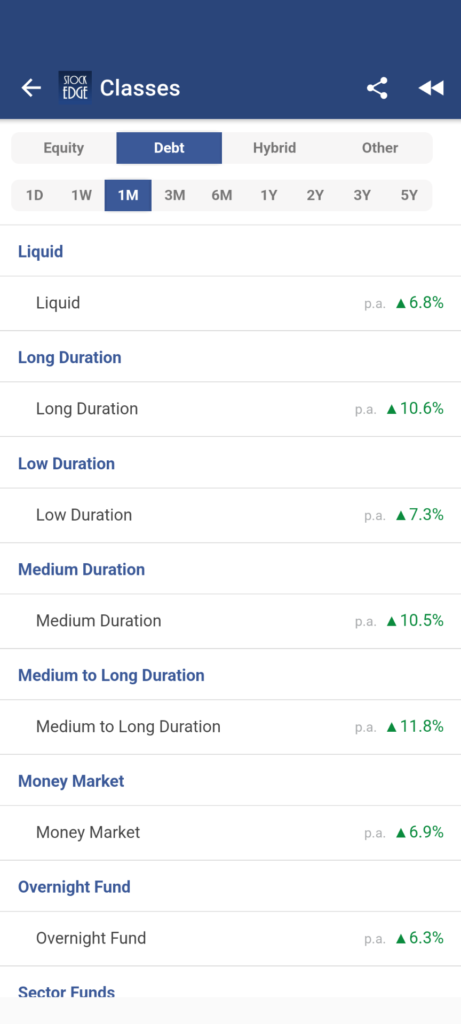

On an average Debt-Liquid funds delivered a healthy return of 6.8% in the last one month, whereas the benchmark index Nifty 50 in the last one month delivered -0.08% as of 16th Aug 2024. Hence, during high market volatility and ongoing geopolitical risks, it is better to park some portion of your capital in liquid funds.

The Bottom Line

In conclusion, navigating geopolitical risks requires a thoughtful and diversified approach to investing. By strategically allocating investments across ETFs like Nifty 50, hedging with precious metals such as gold and silver, and parking funds in liquid investments, investors can mitigate the impact of global uncertainties. These strategies not only help preserve capital during volatile times but also position investors to capitalize on growth opportunities as market conditions stabilize. By staying informed and flexible, investors can effectively manage geopolitical risks and continue to build wealth over the long term.

Happy Investing!