Table of Contents

In the last year, Powergrid Corporation shares have given a staggering return of more than 50% as of 18th March 2024. Powergrid corporation shares have been listed in the stock market since 2007. It is an Indian state-owned electric utility company. Powergrid Corporation of India is a Public sector undertaking (PSU) with Maharatna status CPSEs in India. As of today, there are 13 Maharatnas CPSEs. It grants the status to companies that have achieved a net profit of over Rs 5000 crore for three consecutive years while maintaining an average annual net worth of ₹15000 crore for 3 years or an average annual turnover of Rs 25000 crore.

The company undertakes the transmission of electricity through the Inter-State Transmission System (ISTS). It ensures the development of an efficient, coordinated and economical system of inter-state transmission lines for efficient flow of electricity from generating stations to the load centers.

Our country is the world’s 3rd largest producer and consumer of electricity. The growing demand for electricity and increasing per capita electricity usage may trigger higher growth potential for India’s power sector. So, it’s possibly the right time to invest in the power sector of India.

In today’s blog, let’s analyze Powergrid corporation shares for investment. Is it worth adding to your portfolio? Let’s find out.

Company Overview

Power Grid Corporation Of India Ltd. stands as one of the world’s largest transmission companies, with a prominent presence in both inter-State and intra-State transmission sectors. Operating a vast network of Extra High Voltage (EHV) transmission lines and substations across India, Power Grid plays an essential role in ensuring reliable power supply throughout the country.

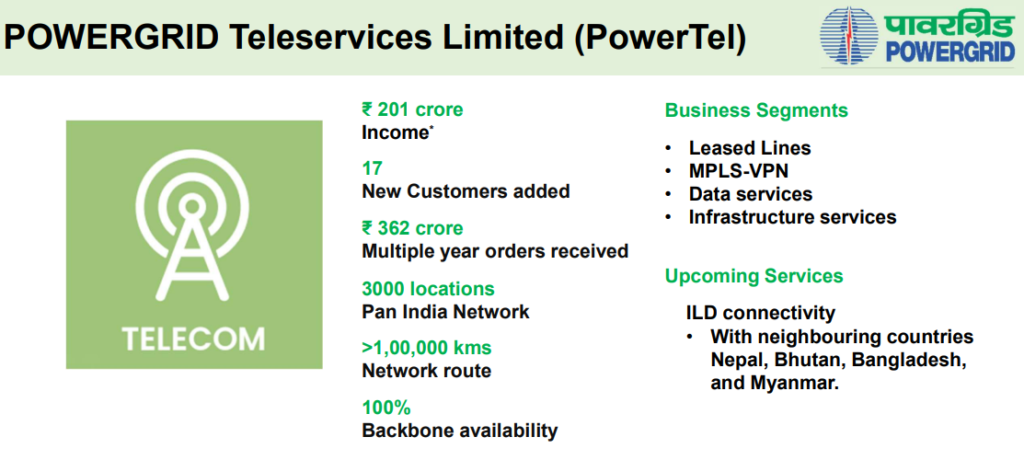

In addition to transmission, the company is actively involved in the telecom sector and offers consultancy services, demonstrating its diversified portfolio. Here is a snapshot of its newest venture in the telecom business:

Financial Highlights

Revenue for the year ended was recorded at ₹45,581.28 crores, which saw a growth of 9.51% YoY. EBITDA for the year ended was recorded at ₹39,478.13 crores, which saw a growth rate of 7.95% YoY. EBITDA margins were at 86.61%, which was a decline of 126 bps YoY. PAT for the year ended at ₹15,250.67 crores, which saw a decline of 11.72% YoY.

Financial statements can be easily analyzed using StockEdge; in the below image you can see the annual net sales growth of Powergrid corporation in the form of bar charts for easy interpretation of financial statements.

In H1FY24, Power Grid reported Revenue ₹11,267.1 crore, marking a modest increase of 1.0% on a YoY basis. Net profit showed a more substantial growth, rising by 6.9% to ₹3,941.5 crore.

In the latest quarter of Q3 FY24, net profit of Powergrid corporation jumped by 14.8% YoY, that you can visually interpret using StockEdge.

The company’s focus on operational efficiency is evident in its H1 FY24 capex of ₹4,246 crore, with ₹3,997 crore capitalized during the same period.

The telecom business exhibited a revenue growth of 8% YoY in Q1 FY24, and the creation of a new subsidiary, Power Grid Tele Services Ltd, is expected to expand into the data center business with an investment approval of ~₹713 crores.

Financial Updates of Q3 FY24

- Revenue for the quarter stood at ₹11,549.79 crores, which saw a growth of 2.51% QoQ vs growth of 2.56% YoY.

- EBITDA for the quarter stood at ₹10,212.89 crores, which saw a growth of 3.07% QoQ vs growth of 3.23% YoY.

- EBITDA margins were at 88.42%, which saw a growth rate of 48 bps QoQ vs growth of 57 bps YoY.

- PAT was at ₹3,955.69 crores, which saw a decline of 0.61% QoQ vs growth of 15.89% YoY.

For quarterly updates on company financials, you may read our edge reports, where our analysts share concall analysis reports. You can read the concall analysis reports of Powergrid corporation shares from here.

SWOT analysis of Powergrid Corporation shares

Now, We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strengths

Power Grid’s pre-eminent position in the Indian transmission sector is a significant strength, underpinned by its extensive infrastructure and expertise. The company is well-positioned to capitalize on the large-scale opportunities in the inter-state transmission segment, including projects worth ₹75,248 crore recently approved for bidding.

Moreover, regulated tariff mechanisms offer strategic project implementation opportunities, including cross-border interconnections. Power Grid’s success in executing intra-state transmission systems in states like Uttar Pradesh (UP) and Madhya Pradesh highlights its commitment to last-mile connectivity. The company’s engagement with states for intra-state transmission development through various means further underscores its proactive approach.

Weaknesses

One potential weakness is the low promoter shareholding, which may influence investor perception and governance considerations. The consultancy business faced challenges in H1 FY24, impacting the segment on a YoY basis.

Notably, the company has encountered delays in receiving payments from certain Discoms, including major dues from Tamil Nadu, Jammu & Kashmir, Telangana, and Uttar Pradesh.

Opportunities

The growth of the telecom sector in India, driven by increasing affordability and government initiatives like Digital India, offers promising prospects. Power Grid’s significant presence in the telecom sector, boasting a robust pan-India optic fibre network, positions it as a preferred partner for telecom service providers. The expansion of 5G services further opens avenues for growth.

The company’s involvement in international transmission projects in Kenya, Tanzania, and other regions presents opportunities for global expansion. Additionally, Power Grid’s bid pipeline for new projects and the prospect of increasing revenue from its telecom business provide avenues for further growth.

Power Grid recognizes the importance of renewable energy sources in India’s energy mix. To support the expansion of renewable energy generation, the company is investing in infrastructure to facilitate the efficient transmission of power from renewable sources.

Power Grid envisions a promising future with approximately 45% of the nation’s power transmitted through its network. The company secured successful bids for multiple Inter State Transmission System projects. In Q2 FY24, it commissioned 9 projects, adding substantial transformation capacity, substations, and transmission lines.

Going forward, the management is keen on enhancing the telecom business, targeting a revenue of ₹800 crore in FY24. The capex guidance for FY24 has been revised upwards to ~₹10,000 crore, reflecting the company’s commitment to substantial investments. The estimated capex outlay by 2032 stands at ~₹1,88,000 crore, with the majority allocated to the transmission business, underlining a robust growth trajectory.

Threats

An ongoing Income Tax Department investigation and allegations of undisclosed income pose potential threats to the company’s reputation and financial stability. Moreover, capacity and manpower constraints, coupled with high global demand for HVDC technology, could affect Power Grid’s ability to meet tight project timelines.

The Bottom Line

Powergrid, a Nifty 50 constituent, plays a pivotal role in India’s transmission sector, transmitting 45% of the country’s power requirements and boasting a diversified portfolio that includes telecom and consultancy services.

Even after a rise in revenue, the margins have remained static as well as there is huge growth in the cash conversion cycle, which can be a dent in the margins in future as it’s into a very capital-intensive business. The growth thus is very weak, sometimes even negative. However the cash is king with the company which makes its liquidity & solvency strong.

Approximately 70% of the ₹77,700 crore in ongoing work is devoted to the evacuation of renewable energy. The expected expenditure up to 2032 is ₹2,07,500 crore, with an emphasis on diversified business categories such as renewable energy and transmission business.

The company’s strength lies in its proactive approach to seizing opportunities in inter-state and intra-state transmission, as well as its significant presence in the growing telecom sector.

We have another investment idea from the power sector of India, you may read this blog; In-Depth Analysis of NTPC Stock: Key Metrics and Growth Potential

Happy Investing!