Table of Contents

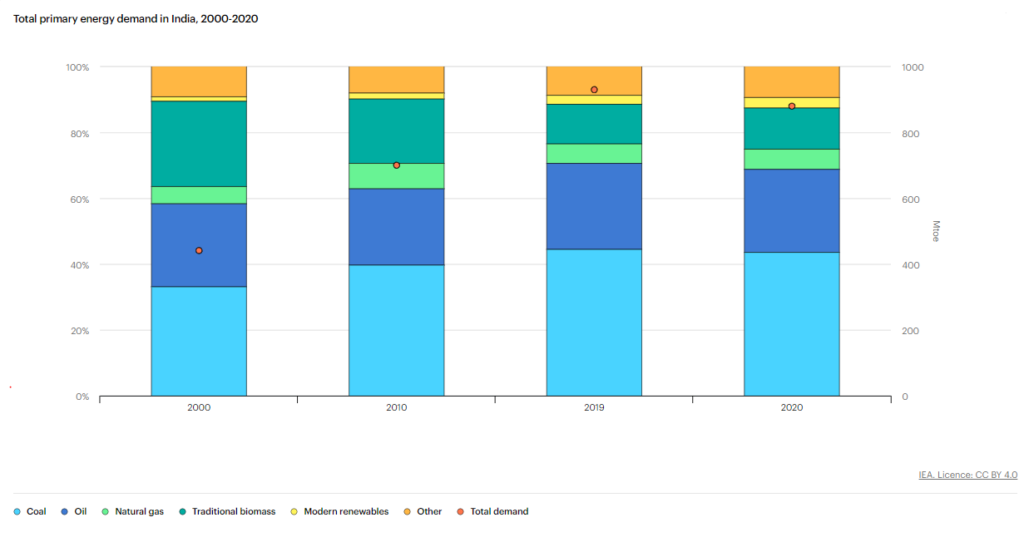

Did you know? In India, thermal power, predominantly fueled by coal, has consistently accounted for more than 70% of our total energy demands. Yes, despite the government promoting renewable energy sources, like solar, wind etc, the sheer growth in electricity demand has forced us to continue to rely on thermal power like coal.

Take a glimpse of India’s energy demands fulfilled by coal from 2000-2020:

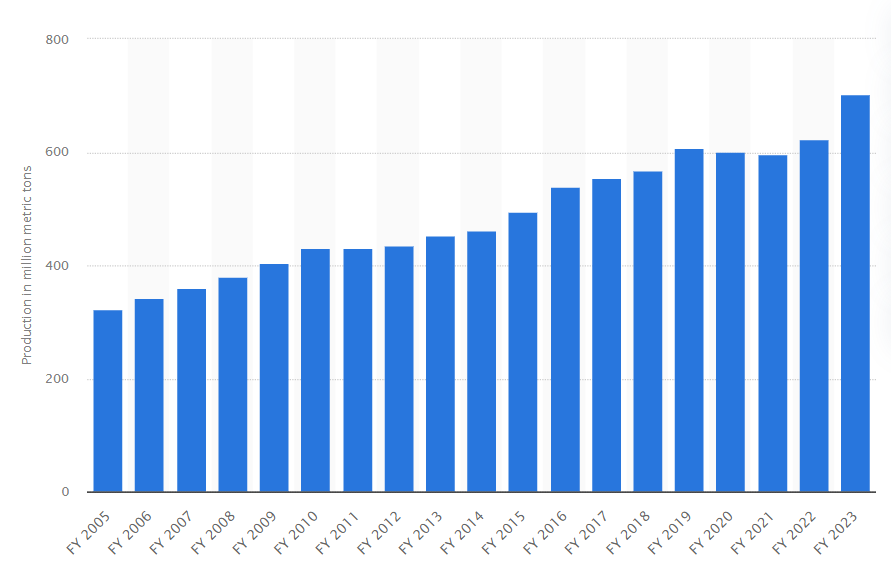

India is the second largest producer of coal, with a total coal reserve of 344.02 billion tonnes. The production volume of Coal India Ltd. has steadily increased from 2005-2023.

Production volume of coal from FY 2005-2023

As per the Ministry of Coal, the overall coal production is likely to cross 1 billion tonnes in the near future. So, should you invest in Coal India stock?

It is important to mention that Coal India stock is a part of Nifty 50, you can view the list of other stocks under the index and its contribution of weightage from the blog; All About NIFTY50, Components of NIFTY50, and How to Invest in it

If you see the share performance, Coal India stock has almost doubled in the past 1 year.

Company Overview

Coal India Ltd.(CIL) was incorporated in 1973 as Coal Mines Authority Ltd after the nationalization of the coal sector. The company has 8 wholly owned Indian subsidiaries: Bharat Coking Coal Ltd, Central Coalfields Ltd, Eastern Coalfields Ltd, Western Coalfields Ltd, Northern Coalfields Ltd, Mahanadi Coalfields Ltd, South Eastern Coalfields Ltd, and Coal Mines Planning and Development Institute Ltd. It has a wholly-owned subsidiary in Mozambique, Coal India Africana Ltd.

Coal India is one of the largest coal producers in the world, with coal production of 602 mt in FY20 and a target of 1000 mt by FY23-24. Most of the coal produced (around 77%) is sold to power-generating companies to meet the country’s power needs. However, the company also sells coking coal primarily for use in steelmaking and metallurgical industries. The company also provides non-coking coal for use in cement, fertilizers and many other industries.

Financial Highlights of Coal India Stock

In the last 5 years, the company has delivered a compounded sales growth of 10% and profit growth of 32%. In FY23, the sales increased by 26.01% YoY.

EBITDA increased by 48.98% YoY, and net profit increased by 61.81% YoY. The EBITDA margin for the period was 26.63%, and the net profit margin was 20.35%.

You can analyze Coal India’s income statement or profit and loss statement from StockEdge. As you can see above, the company’s overall net sales growth can be visualized for easier interpretation of financial statements.

In Q1 FY24, despite a 14% YoY decline in EBITDA and 10.09% decline in net profit, revenue increased by a promising 2.5% YoY. This indicates potential for growth in the future.

EBITDA margin declined to 29.22% vs. 34.91% YoY, and net profit margin declined to 22.13% vs. 25.24% YoY, but these figures are still within a healthy range.

In Q2 FY24, Coal India’s performance was particularly strong. Revenue increased by an impressive 9.85% YoY, EBITDA increased by 11.77% YoY, and net profit increased by 8.70%.

This consistent growth demonstrates the company’s stability and potential for future success.

Despite the challenges, such as the increase in power demand during H1 FY24, Coal India demonstrated resilience and adaptability. The company’s robust performance was backed by improved average realizations, increased coal production, and higher dispatches, showcasing its ability to respond effectively to market dynamics.

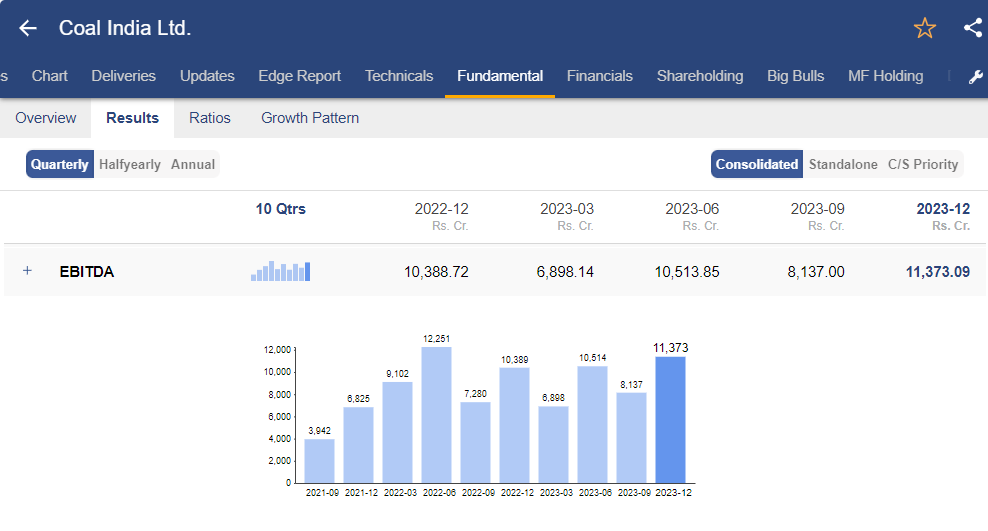

In Q3 FY24, revenue increased by 2.8% YoY, EBITDA margin stood at 37%, and net profit jumped by 17.8% YoY.

You can even check a company’s quarterly financial data using StockEdge. As for Coal India, you can view the EBITDA of Coal India stock.

Notably, in the latest quarter, Coal India’s net receivables as of 31st December 2023 showed a significant increase, standing at ₹17,044 crore compared to ₹13,060 crore as of 31st March 2023. This growth in net receivables reflects a positive trend in the company’s financial performance.

During the quarter, Coal India strategically invested ₹4,494 crore as capex. The overall capex target for FY24 is anticipated to be ₹16,500 crore, with a significant portion allocated towards land acquisition. This demonstrates the company’s forward-thinking approach and its commitment to future growth. The capital expenditure during 9M FY24 was ₹13,441 crore and ₹5,702 crore in Q3 FY24 (provisional).

During H1 FY24, Coal India successfully approved 4 coal mining projects with a total capacity of 59.5 MTY (million tonnes per year), supported by an incremental capacity of 32.7 MTY. This achievement underscores the company’s operational capabilities and its ability to secure future growth opportunities.

Business Highlights of Coal India

As of 30 September 2023, total coal production (raw coal) stood at ~333 million tons (MT), compared to 299 MT as of 30 September 2022.

In H1 FY24, total offtake (raw coal) increased by ~9% YoY to 361 MT as compared to 332 MT in H1 FY23. Also, the supplies to the power sector were ~80% during the same period.

Washed coal (coking) generated a revenue of ₹1,314 crore during H1 FY24, and the average realization per ton stood at ₹11,768.

SWOT analysis of Coal India

Now, We’ll conduct a SWOT analysis of the company to gauge its strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the company’s competitive position and potential risks, aiding in making informed investment decisions.

Strengths

Owing to India’s abundant coal reserves and the non-availability of other sustainable sources of fuel, coal will continue to play a dominant role in meeting the country’s energy requirement. CIL accounted for 80% of domestic coal production in fiscal 2023. The company recorded the highest ever production and offtake in fiscal 2023 at 703 million tonnes (MT) and 695 MT, respectively (623 MT and 662 MT, respectively, in fiscal 2022), out of which around 85% of supply was to the power sector.

CIL, with 48% of India’s proven reserves in its command area, stands as the cornerstone of domestic coal production. Despite the Government’s initiation of auctions for commercial mining by private sector players, a process that has seen 92 coal mines auctioned until August 2023 under seven tranches since November 2020, the implementation is expected to be a lengthy one. This ensures that CIL will maintain its monopoly over the medium term, providing a stable and secure investment opportunity.

CIL’s financial strength is a testament to its stability. With a net cash and cash equivalents of approximately Rs 37.078 crores, the company’s debt profile is robust, instilling confidence in potential investors.

The company has a high dividend yield of around 7.29%.

Weaknesses

CIL plays an important role in ensuring the country’s energy security and is strategically important to the Government of India. Therefore, this exposes the company to a number of regulatory and political risks to serve the national interest. Moreover, the coal offered to the power plants and domestic coal has a discounted price compared to imported coal.

Evacuation infrastructure bottleneck in certain areas due to land, statutory clearance and law & order issues.

Indigenous coal has an inherent inferior quality due to its high ash content.

Opportunities

CIL will undertake a capex to increase mining and coal-washing capacity and improve rail infrastructure. The company plans to set up solar power and thermal power plants and revive fertilizer plants. While the investments in these sectors have been low till now since the projects are in the preliminary stages, it may increase with the progress of the projects. Any larger-than-expected capex, adversely impacting cash position, will remain a key monitorable.

Threats

Despite improving productivity, CIL’s coal output has been constrained by delays in obtaining environmental and forest approvals, especially in greenfield projects and a lack of adequate logistic infrastructure. Flexibility is also restricted by sociopolitical factors, which mandate development activities in coal mining areas, impacting the cost structure.

The company plays an important role in ensuring the country’s energy security and domestic coal has a discounted price compared with imported coal. Private players entering the business under the commercial mining route will take time to start production, keeping CIL’s near-monopoly status and strategic importance to the government.

Operational flexibility has improved in the past few years with environmental and forest clearances enabling faster implementation of stuck projects for coal evacuation. Any change in the regulatory regime or sociopolitical factors will impact the business.

Conclusion

Going forward, the company expects demand from the power and steel sectors to be a significant growth driver. Also, it expects a substantial reduction in costs on evacuation & transportation charges.

The railway lines for coal evacuation across different regions are under construction. In Chhattisgarh, the construction for evacuating ~65 MTPA of coal is underway, with a progress of ~45% as of date. The same is anticipated to be commissioned by December 2024. Also, the Shivpur coal evacuation is on track with progress of ~55%, anticipated to get commissioned by March 2025.

All in all, the macro prospects for CIL look promising. Considering the high dividend yield, we believe the company does offer a decent margin of safety.

Happy Investing!