Key Takeaways

- Renewable Energy: With India’s push towards clean energy, solar and wind power projects are gaining momentum. Government policies and global sustainability goals are driving long-term investment potential.

- Electric Vehicles (EVs): The EV sector is seeing rapid adoption backed by policy incentives, charging infrastructure growth, and increasing awareness. Battery tech and EV component makers also offer opportunities.

- Infrastructure Development: Focused government spending on roads, highways, railways, and smart cities makes this a growth-driven sector with multi-year visibility.

- Artificial Intelligence & Automation: Businesses across industries are adopting AI for efficiency, making this a future-ready and scalable sector for investment.

- Financial Technology (FinTech): With rising digital transactions and banking tech innovation, FinTech firms are expanding fast, especially in lending, insurance, and payment solutions.

In May 2024, S&P Global Ratings (formerly Standard & Poor’s) upgraded India’s sovereign credit rating outlook from ‘stable’ to ‘positive’ for the first time in its 14-year history. Despite the geopolitical turmoil, this shift reflects robust economic growth and a promising economic outlook for the upcoming years.

Even the government has set the target of becoming a 5 trillion dollar economy and developed nation by 2027. However, the question that usually comes to an investor’s mind is which are the best sectors to invest in and have the potential to drive growth and contribute to reaching the economic targets of our country.

In this blog, we will explore the best sectors to invest in India that are likely to perform well in the future.

Renewable Energy

Why renewable energy? The renewable energy sector is emerging as one of the best sectors to invest in and becoming more significant as the world highlights the urgent need to deal with climate change. According to the updated Nationally Determined Contributions (NDC), India is now committed to achieving about 50% cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030.

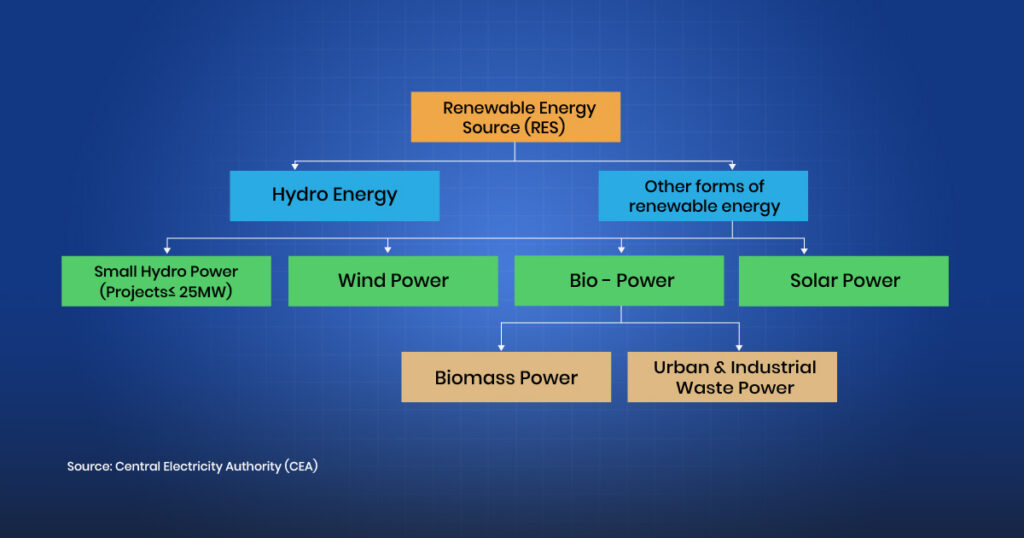

Before analyzing the renewable energy sector, let’s look at the different sources of energy in India. According to the Central Electricity Authority (CEA), renewable energy is divided into two categories:

- Hydro Energy: India has the fifth-largest hydropower production capacity in the world, with a total installed base of over 51.77 GW and is led by industry giants like Tata Power Ltd. and NHPC Ltd.

- Other Forms of Energy: There are different sources of energy, including electric generation due to wind, biomass power, solar power, urban and industrial wastes, and small hydro power that have less than or equal to 25 MW capacity. Companies included NTPC Ltd., KPI Green Energy Ltd, Borosil Renewables Ltd, and many others.

Let’s move ahead and understand how India’s energy transition could be an enormous economic opportunity for investors and why it is one of the best sectors to invest in.

A Clean Energy Revolution

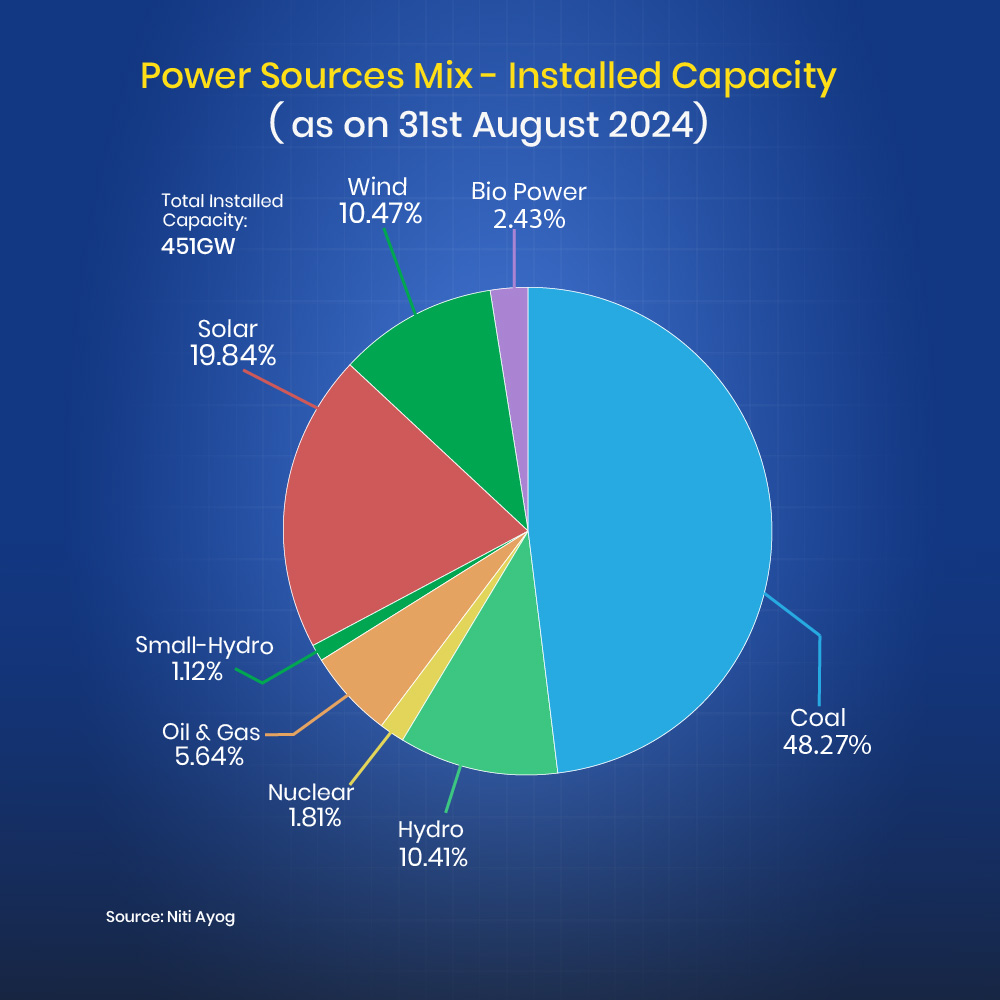

India’s installed renewable energy capacity has expanded by 165% over the last decade, growing from 76.38 gigawatts (GW) in 2014 to 203.1 GW in 2024. As of 31st August 2024, the coal-based thermal power generation capacity accounted for around 48% of Installed electricity generation capacity in India, while renewable energy sources (RES), nuclear and hydroelectric power accounted for 40%, 2% and 10%, respectively.

From 2008-2009 to 2023-24, thermal-based generation capacity declined from 63.3% to 56% of total installed capacity, and the share of hydro-based generation capacity also fell from 25% to 11%, but the capacity from renewables experienced a significant rise from 8.9% to 32%. This transformation reflects the rapid growth of clean and renewable energy sources. The government has set ambitious goals for renewable energy. Initially targeting 175 GW by 2030, the aim has now increased to 450 GW of renewable energy capacity.

Now, let’s look at the key growth drivers of renewable energy.

Key Drivers

The government has played a significant role in advancing the wind energy sector by providing regulatory assistance as well as financial incentives. One of the key regulations includes Renewable Purchase Obligations (RPOs), which need a specific percentage of electricity to be generated from renewable sources. For 2024-25, this target is set at 29.91%, escalating annually to reach 43.33% by 2029-30. Furthermore, the government also provides fiscal incentives such as Accelerated Depreciation benefits, concessional customs duties on specific components of wind electric generators, and a waiver of Inter-State Transmission System (ISTS) charges for interstate wind power sales for the growth of this sector.

Investment in India’s renewable sector has been substantial, with $6.1 billion in foreign direct investment between April 2020 and September 2023. The solar energy sector alone received $3.8 billion over the last three years. Renewable energy investments reached $14.5 billion in FY22, and further investments in electric vehicles, green hydrogen, and solar manufacturing are expected to increase to $15 billion.

With increasing government support, renewable energy is among the best sectors to invest in for sustainable returns.

Investment Tip

While examining renewable energy companies, it is crucial to consider the financials, portfolio of renewable energy projects, track record of project execution, and strategic development and expansion plans. Furthermore, investors should consider the regulatory framework and government policies that may affect the renewable energy sector.

Overall, renewable energy stocks are the best sector to invest in, allowing you to participate in a sustainable and growing business while making substantial returns. You can read our blog to explore the Top Renewable Energy stocks in India.

Electric Vehicles (EVs)

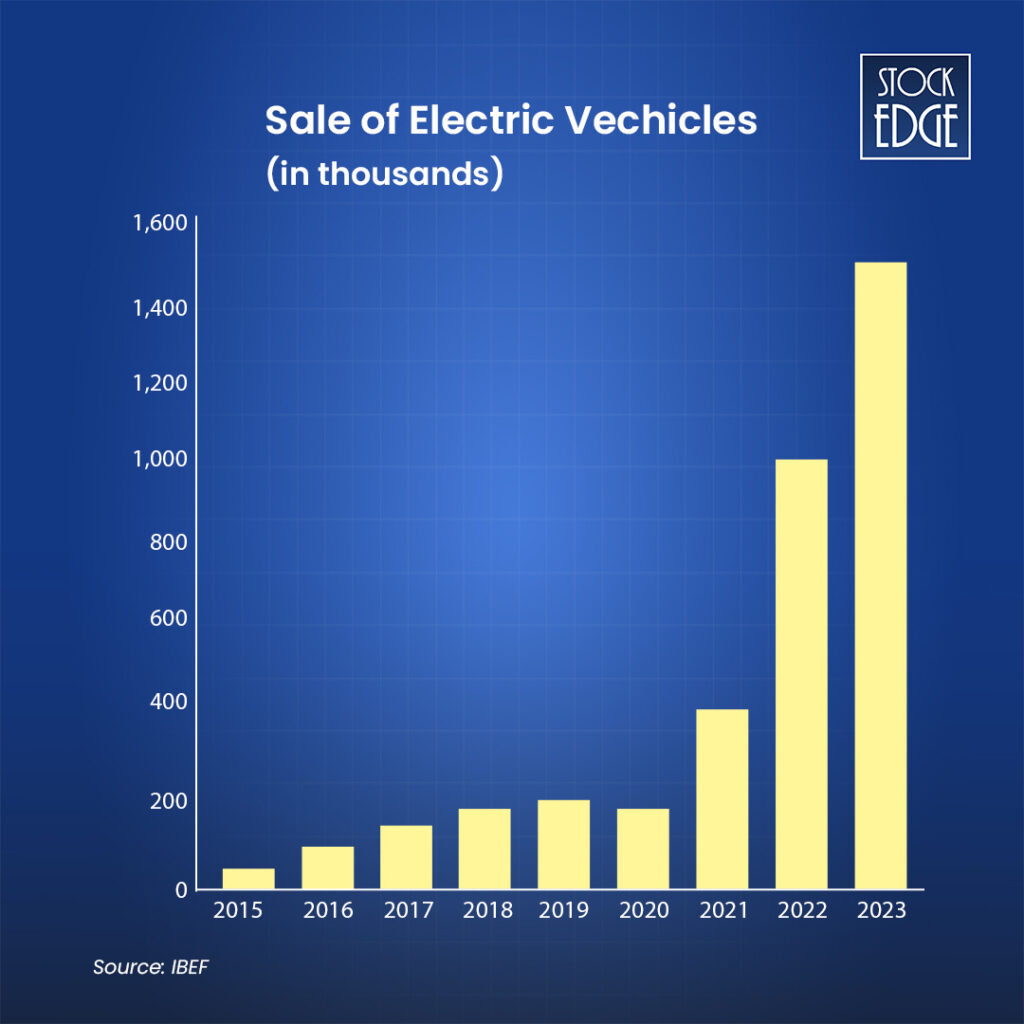

India’s electric vehicle (EV) sector is one of the best sectors to invest in as it has expanded rapidly, fueled by government incentives, rising environmental concerns, and technology advancements. India’s electric vehicle (EV) sales reached 1,752,406 units in FY24, showing a robust year-on-year growth of 40.31% compared to the previous year. The automotive industry’s transition to electric vehicles is picking up speed. The rise in electric vehicle registrations in recent years has been fueled by supportive government policies and a shared goal of reducing CO2 emissions. As per the Ministry of Road Transport and Highways data, EV registrations made up 6.4% of total vehicle sales in India.

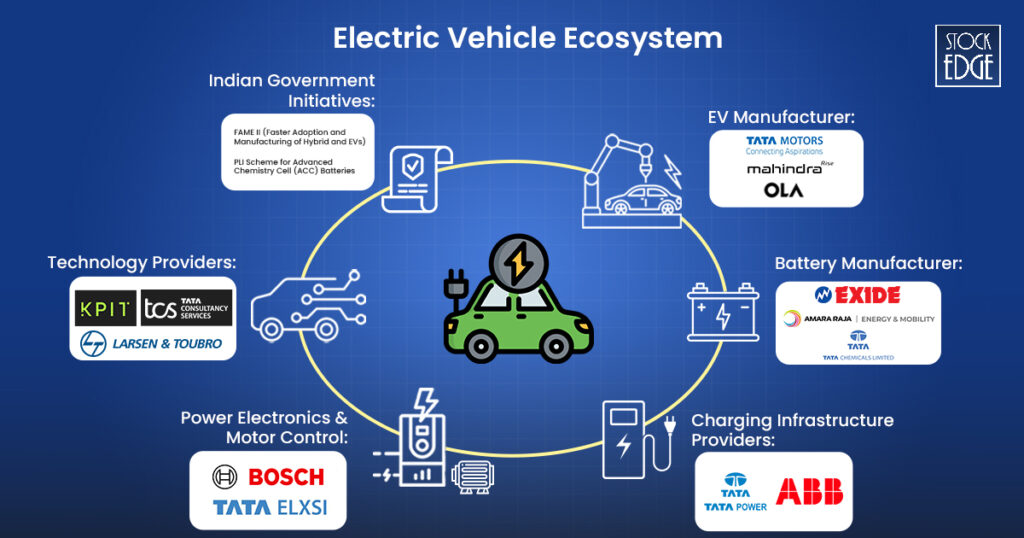

Let’s understand the Electric Vehicles Ecosystem first and which companies are involved in it.

- EV Manufacturer: This involves assembling fully electric (BEVs) or hybrid electric vehicles (HEVs). Companies include Tata Motor Ltd., Mahindra & Mahindra Ltd., OLA Electric Mobility Ltd. and many others.

- Battery Manufacturer: Batteries, particularly lithium-ion batteries, are the core of electric vehicles. They provide the stored energy required to run the motor. Key players include Exide Industries Ltd., Amara Raja Energy & Mobility Ltd., Tata Chemicals Ltd. and many more.

- Charging Infrastructure Providers: A network of charging stations that offer electricity to electric vehicles. This includes both public charging stations and home charging systems. Companies include Tata Power Company Ltd. and ABB India Ltd.

- Power Electronics & Motor Control: They help to manage the flow of electricity between the battery and the electric motor, enabling energy efficiency and smooth functioning of the vehicle. Key players include Bosch Ltd. and Tata Elxsi Ltd.

- Technology Providers: EVs require specific software to manage battery life, enhance driving range, and provide connected car services. Companies include KPIT Technologies Ltd., Larsen & Toubro Ltd., Tata Consultancy Services Ltd. and many more.

- Indian Government Initiatives: The government has taken various steps to promote the EV ecosystem, such as FAME II (Faster Adoption and Manufacturing of Hybrid and EVs), PLI Scheme for Advanced Chemistry Cell (ACC) Batteries and many more.

According to Fortune Business Insights, the Indian EV market is forecasted to expand from US$ 3.21 billion in 2022 to US$ 113.99 billion by 2029, with a 66.52% CAGR. The EV battery market is projected to surge from US$ 16.77 billion in 2023 to a remarkable US$ 27.70 billion by 2028. The primary emphasis lies in establishing a robust and dependable infrastructure, alongside ensuring that home charging is both reliable and accessible at an affordable cost.

Now, let’s look at the key growth drivers of the electric vehicles (EVs) sector.

Key Growth Factors

- Government initiatives: The government have launched various policies and schemes to promote the adoption of EVs, including the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme. This scheme provides financial incentives to manufacturers, buyers, and suppliers of EVs, making them more affordable and accessible to consumers.

- Increased demand for sustainable transportation: Today, people have become more conscious of the environmental impact of traditional vehicles, and they are seeking cleaner and greener alternatives. So, EVs provide a sustainable transportation option that produces zero emissions and reduces the CO2.

- Decreasing battery costs: The cost of batteries is a higher cost and accounts for a substantial portion of the vehicle’s total price. However, the cost of batteries has fallen rapidly in recent years due to the enhancement of technology and increased production.

- Infrastructure development: One of the most significant barriers to the adoption of EVs is the need for charging infrastructure. To resolve this issue, the government has launched the National Electric Mobility Mission Plan (NEMMP), which intends to set up one charging station every 3 kilometres in cities and every 25 kilometres on highways.

The EV sector is a clear leader among the best sectors to invest in, driven by technology advancements and government backing.

Investment Tip

While analyzing Electric vehicles, it is important to consider their R&D investment, cash reserves, profit margins, debt levels, and revenue growth. Companies with strong R&D, substantial cash reserves, increasing profit margins and sales, and the potential to manage their debts are likely to be attractive investment opportunities in the electric vehicle market. At StockEdge, we developed an investment theme on electric vehicles, and we curated a list of EV stocks that can be a good long-term investment.

Click to get the list of the best EV stocks in India!

Infrastructure Development

Now, we will check out one of the best sectors to invest in, which is also the fastest-growing sector in India.

The infrastructure sector of India is vast, and therefore, in StockEdge, we have identified two significant sub-industries inside the infra sector stocks of India. You can check out the sector wise stocks using StockEdge.

The entire infrastructure sector is divided into two major industries. They are:

- Engineering- Construction that includes 143 stocks

- Transmission Towers/Equipment that consists of 2 stocks

The government has focused on enhancing connectivity and fostering economic growth. Key projects include the expansion of highways under the Bharatmala Pariyojana, the modernization of railway networks through the Dedicated Freight Corridor (DFC), and the development of smart cities equipped with cutting-edge technology. Additionally, initiatives like the UDAN scheme have improved regional air connectivity. These projects present ample investment opportunities, attracting both domestic and international investors to participate in India’s rapidly growing infrastructure landscape, thereby driving further economic development and integration.

In the 2024-25 union budget, capital investment outlay for infrastructure has been increased by 11.1% to Rs. 11.11 lakh crore (US$ 133.86 billion), which would be 3.4 % of GDP. Also, the government will provide 1.5 lakh crore as interest-free loans to the states to support resource allocation for infrastructure development.

Key Trends

The trend of infrastructure stocks can be done by tracking the Nifty Infrastructure Index. The index consists of 30 stocks related to telecom, power, port, air, roads, railways, shipping and other utility services providers.

The blue line reflects the Nifty Infrastructure Index & orange line represents the Nifty 50 stocks. It clearly shows that Nifty Infrastructure has outperformed the Nifty 50.

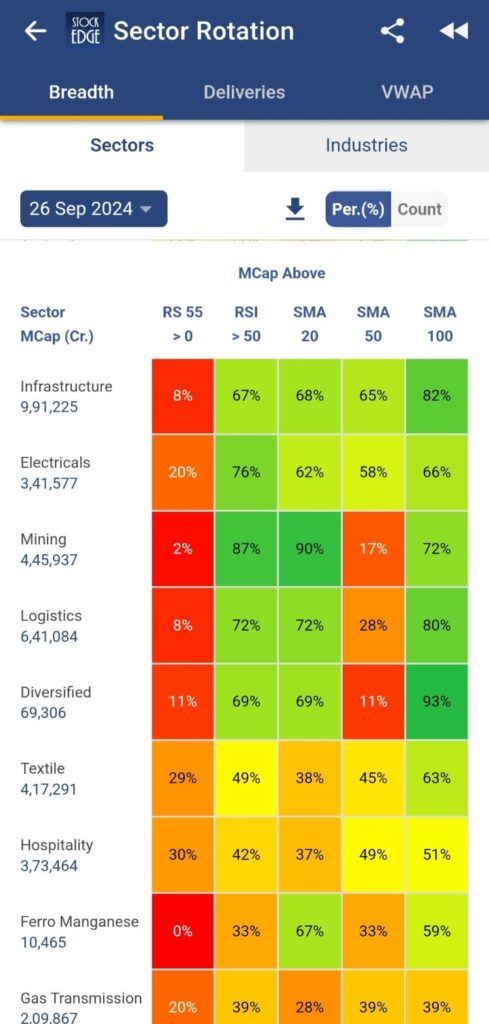

To analyze the trend of the market and which are the best sectors to invest in, you can use the Sector Rotation Tool, which reflects the sector wise performance, whether the sector is outperforming or underperforming. It is analyzed using three types of technical indicators, namely, Relative Strength (RS), Relative Strength Index (RSI) and Simple Moving Averages (20, 50 and 100).

When the overall sentiment is bullish, the indicators show a green colour, whereas a bearish trend is derived with shades of red. It signals short-term momentum in the sector. In the above screenshot, it is seen that on 25th Sep, the sector was bearish, but the long trend is bullish.

Investment Tip

To analyze the best infrastructure stocks, you have to deeply explore their quantitative and qualitative parameters. You have to track the financial performance, government contracts, and involvement in key projects. You can read our blog Top Infrastructure Stocks Should Be In Your Portfolio?

Artificial Intelligence and Automation

Artificial intelligence has become an integral part of our day-to-day, from the moment we wake up by checking our smartphones to the end of the day, by setting alarms using Amazon Alexa, Google Assistant, and Apple Siri, enhancing our experiences and making our lives more convenient.

AI is reshaping industries and becoming one of the best sectors to invest in. Today, the demand for AI has increased significantly. According to Capgemini’s research, 80% of organizations have increased their investment in generative AI from last year. Even the remaining 20% maintained the same investment level.

According to a recent International Data Corporation (IDC) analysis, the Indian AI market is poised for substantial growth, with a 33.7% CAGR over the next five years, exceeding USD 5.9 billion by 2027. This has the potential to become one of the best sectors to invest in. Now, let’s understand how companies use AI to generate their income.

Key Innovations

Let’s check out which companies are doing best using generative AI.

- Tech Mahindra Ltd.: Tech Mahindra and Google Cloud announced a partnership to help Mahindra & Mahindra (M&M) entities adopt generative AI and lead digital transformation. It enhances the engineering, supply chain, pre-sales, and after-sales services for Mahindra & Mahindra (M&M).

- Sun Pharmaceutical Industries Ltd.: Sun Pharma has adopted a range of technologies, including AI and ML, to enhance drug discovery and development, accelerating the research process.

- Easy Trip Planners Ltd.: They launched the 2.0 Self-Booking Tool for Corporates, in which they use the latest technologies like AI and Machine Learning to help business travellers and corporates efficiently book their travel with ease while simplifying the entire booking experience without involving a travel agency or a third party.

- PB Fintech Ltd: They leverage AI to enhance digital marketing and customer service efforts. With targeted campaigns and AI-powered chatbots for routine queries, they enhance customer experience and drive higher conversion rates, signalling positive prospects for future growth.

With increasing adoption across industries, companies utilizing AI for innovation and efficiency are positioned to provide excellent returns, making AI one of the best sectors to invest in for future growth.

Investment Tip

To analyze AI stocks, you have to understand their financials and explore the revenue growth from AI-driven products or services, research and development investments, and partnerships in the AI sector. Along with that, you have to track the industry trends, regulatory challenges, and overall demand for AI-driven solutions. You can read our blog, Best AI Stocks In India To Invest: Opportunities & Risks.

Financial Technology (FinTech)

Now, we will discuss the fastest-growing market, i.e., the Fintech Industry. Today, the Indian fintech industry is estimated to be around USD 110 billion in 2024, and it is projected to reach about USD 420 billion by 2029, which signifies that it is the best sectors to invest in.

India has approximately 9000 fintech entities, ranking third globally and accounting for 14% of startup investment in the country. India has a Fintech adoption rate of 87%, which is significantly higher than the global average of 67%.

In StockEdge, you can check out the list of the sector wise stock list. Currently, there are 7 stocks, including PB Fintech Ltd, One97 Communication, Infibeam Avenues Ltd., Zaggle Prepaid Ocean Services Ltd., MOS Utility Ltd., RNFI Services Ltd. and Suvidhaa Infoserve Ltd.

Today, the fintech industry stands on four primary pillars, each representing a core area where technology has been applied to enhance traditional financial services.

- Payments and Transactions: This industry involves all types of payment processing, including peer-to-peer payments, mobile payments, and online transactions. Key Player includes One97 Communication.

- Lending and Financing: Fintech companies have revolutionized the way loans and financing are provided to individual and businesses, such as LendingKart.

- Wealth Management and Investment: It includes robo-advisors, online brokerages, and digital asset management such as Zerodha.

- Insurance: It involves all types of insurance, including health insurance, car insurance, life insurance, and many more, with companies like PB Fintech Ltd.

Key Areas of Growth

The transformation of India’s FinTech sector from an emerging market to a global powerhouse has been nothing short of extraordinary. Initiatives by way of Digital Public Infrastructure (such as UPI, JAM Trinity and now ULI), Institutional support, supporting policy framework from Government and regulators and Tech capabilities are helping drive a revolution in FinTech innovations and playing a crucial role in fostering an environment where FinTech and FinTech entities can thrive and continue to drive inclusive growth.

Application Programming Interface (API) and Cloud Computing are some of those new technologies that are already being used by a significant number of incumbent banks and FinTech entities. Artificial Intelligence (AI) and Machine Learning (ML) are already transforming the way financial services are delivered, offering personalized experiences, predictive analytics, and enhanced decision-making support capabilities.

Investment Tip

To analyze fintech stocks, you have to understand their financials and track the industry trends, regulatory challenges, and overall demand for AI-driven solutions.

Final Thoughts

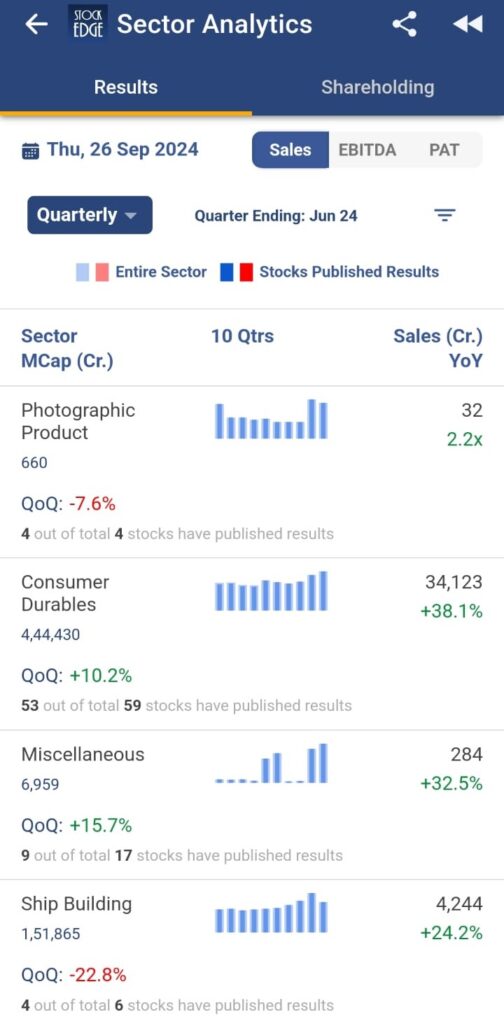

To identify & analyze the best sectors to invest in, you can check out our Sector Analytics tool. It provides a comprehensive sector analysis with its financial performance trends. It allows you to analyze key metrics such as Sales, EBITDA, and PAT, giving valuable insights into sectoral health and performance.

To find out the best sectors to invest in, you have to analyze the trend of the market. Today, India aims to become a $5 trillion economy by 2025 and to do so, it has to maintain an 8% real GDP growth rate. Investment, especially private investment, drives demand, creates capacity, increases labour productivity, introduces new technology, allows creative destruction, and generates jobs. Hence, the government continues to push for transformative reforms to attract more investments.

The Fed cut rates is favourable for emerging markets like India. With rates expected to drop by over 200 bps in the next two years, India will likely see an inflow of foreign capital as investors that help to robust economic growth.